Free Investment Case Study

I. Introduction

Purpose of the Case Study:

This case study intends to assess both the feasibility of investment opportunities in the solar power industry as well as the potential profits that could be yielded from such investments.

Importance of Supporting Investment Decision-Making:

Investors rely on thorough analysis to make informed decisions regarding where to allocate capital for maximum returns and minimal risks.

Overview of the Investment Opportunity:

Solar energy presents a compelling investment opportunity due to its sustainability, cost-effectiveness, and growing demand amidst global efforts to combat climate change.

II. Objectives

Assess the feasibility of investment opportunities in the solar power industry by analyzing market trends, growth potential, and competitive landscape.

Assess the financial feasibility of a California solar power project using past financial data, forecasts, and key metrics like LCOE, IRR, and NPV.

Implement strong risk management strategies to manage potential risks, like market, regulatory, and operational, associated with solar power investments.

III. Industry and Market Analysis

Overview of the Industry:

The solar power industry has experienced rapid growth driven by declining costs, technological advancements, and supportive government policies worldwide.

Market Trends and Dynamics:

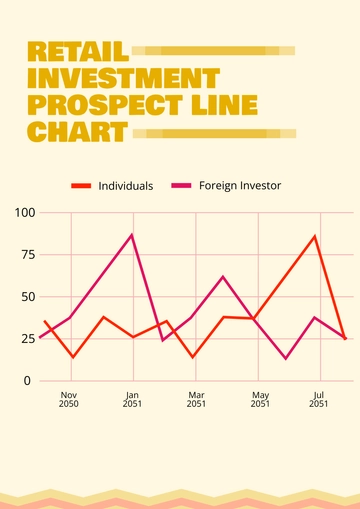

Increasing adoption of renewable energy, growing awareness of environmental issues, and the shift towards clean energy sources are driving market demand.

Market Size and Growth Potential:

The global solar energy market is projected to reach $223.3 billion by 2050, with a compound annual growth rate (CAGR) of 20.5% from 2050 to 2051.

Competitive Landscape:

Key players in the solar industry include SunPower Corporation, First Solar, Inc., and Canadian Solar Inc., among others, with intense competition driving innovation and market penetration.

IV. Investment Opportunity Analysis:

Description of the Investment Opportunity:

This case study focuses on a solar power project in California, comprising the development of a utility-scale solar farm with a capacity of 100 megawatts.

Product/Service Offerings:

The project aims to generate clean electricity to meet the energy needs of approximately 30,000 households, contributing to carbon emission reductions and environmental sustainability.

Target Market and Customer Segments:

The target market includes residential, commercial, and industrial customers seeking affordable and environmentally friendly energy solutions.

Unique Value Proposition:

The project leverages advanced solar technologies, favorable regulatory frameworks, and strategic partnerships to deliver competitive electricity prices and long-term financial returns.

V. Financial Analysis

Historical Financial Performance:

Analysis of historical financial data demonstrates the project's feasibility and potential for revenue generation based on comparable solar energy projects.

Projections and Forecasts:

Forward-looking financial projections indicate steady revenue growth, positive cash flows, and attractive returns on investment over the project's lifecycle.

Key Financial Metrics:

Metrics such as levelized cost of energy (LCOE), internal rate of return (IRR), and net present value (NPV) highlight the project's financial viability and attractiveness to investors.

Valuation Assessment:

Valuation models incorporating discounted cash flow (DCF) analysis and peer comparison support the project's valuation and investment potential.

VI. Risks Assessment

Identification of Potential Risks:

Risks include fluctuations in energy prices, regulatory changes, technological obsolescence, and project execution challenges.

Market Risks:

Market volatility and competition may impact electricity prices and market demand for solar energy.

Regulatory Risks:

Changes in government policies, subsidies, and incentives could affect project economics and investor returns.

Operational Risks:

Construction delays, equipment failures, and performance variability may impact the project's operational efficiency and financial performance.

Mitigation Strategies:

Risk mitigation strategies include diversification of revenue streams, robust contractual agreements, insurance coverage, and proactive project management practices.

VII. Investment Thesis

Reasons for Investment:

Solar power investments offer attractive returns driven by long-term revenue visibility, environmental benefits, and alignment with sustainable investment objectives.

Competitive Advantages:

The project benefits from favorable solar irradiance levels, scalable infrastructure, and established industry partnerships, enhancing its competitiveness and market positioning.

Growth Potential:

Continued advancements in solar technology, expanding market opportunities, and supportive regulatory environments present opportunities for future growth and expansion.

Catalysts for Value Creation: Strategic alliances, technological innovation, and market penetration strategies are key drivers for value creation and investor returns.

VIII. Recommendation

Investment Decision:

Based on the comprehensive analysis conducted, it is recommended to proceed with the investment in the solar power project.

The rationale for the Recommendation:

The project demonstrates strong financial fundamentals, mitigates identified risks effectively, and aligns with the investor's objectives of achieving attractive risk-adjusted returns and contributing to sustainable development goals.

Consideration of Risk-Return Tradeoff:

While risks exist, the potential rewards outweigh them, considering the project's solid financial performance, growth prospects, and strategic advantages.

IX. Conclusion

Summary of Key Findings:

The case study highlights the compelling investment opportunity in solar power, supported by favorable market dynamics, robust financial metrics, and effective risk management strategies.

Final Thoughts on Investment Opportunity:

Investing in solar energy not only offers financial returns but also contributes to environmental sustainability and energy independence, making it a desirable investment choice for informed investors.

X. Appendix

Additional Charts, Tables, and Data

Supporting Documents and References

Prepared By:

[Your Name]

[Your Company Name][Date]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Craft compelling investment narratives effortlessly with Template.net's Investment Case Study Template. Tailored for financial analysts and investors, this editable and customizable template, available on Template.net, streamlines your data presentation. Utilize our Ai Editor Tool to refine your content seamlessly, ensuring your investment strategies stand out with clarity and professionalism.