Free Financial Literacy Fact Sheet

Created by: [YOUR NAME]

Company: [YOUR COMPANY NAME]

Department: [YOUR DEPARTMENT]

Introduction

Financial literacy is key to managing money effectively and securing financial stability. This fact sheet provides essential information on budgeting, saving strategies, investing basics, debt management, understanding credit scores, and making informed financial decisions. By mastering these concepts, individuals can establish strong financial foundations and achieve their goals. Implementing these practices will empower individuals to take control of their finances and build a secure financial future.

1. Budgeting Basics

Budgeting is a fundamental tool for managing your finances effectively. It involves tracking your income and expenses to ensure you are living within your means and saving for your goals.

Key Steps:

Step | Description |

|---|---|

Track Your Income | Record all sources of income (e.g., salary, allowances). |

List Your Expenses | Identify and categorize all expenses (e.g., rent, groceries, utilities). |

Set Financial Goals | Define short-term (e.g., monthly savings) and long-term goals (e.g., retirement). |

Create a Budget | Allocate your income to cover expenses and savings. |

Review and Adjust | Regularly review your budget and make necessary adjustments. |

2. Saving Strategies

Saving money is crucial for financial security and achieving your goals. Establishing good saving habits early can lead to long-term financial stability.

Effective Strategies:

Automate Savings: Set up automatic transfers to a savings account each payday.

Emergency Fund: Aim to save 3-6 months' worth of expenses for unexpected costs.

Pay Yourself First: Prioritize savings by setting aside a portion of your income before spending.

3. Investing Basics

Investing allows your money to grow over time. Understanding basic investment concepts is essential for building wealth.

Key Points:

Diversification: Spread investments across different asset classes (e.g., stocks, bonds, real estate).

Risk vs. Return: Higher returns often come with higher risk.

Long-Term Perspective: Invest with a focus on long-term growth and weathering market fluctuations.

4. Debt Management Techniques

Managing debt responsibly is critical for maintaining financial health and avoiding excessive interest payments.

Strategies to Manage Debt:

Prioritize High-Interest Debt: Pay off debts with the highest interest rates first.

Debt Consolidation: Combine multiple debts into a single loan with a lower interest rate.

Negotiate with Creditors: Contact creditors to discuss repayment options if struggling to make payments.

5. Understanding Credit Scores

Your credit score impacts your ability to borrow money and obtain favorable interest rates. Understanding how credit scores work is essential.

Credit Score Basics:

Factors Affecting Scores: Payment history, amounts owed, length of credit history, new credit, types of credit used.

Importance of Good Credit: A higher credit score can lead to better loan terms and lower interest rates.

6. Tips for Informed Financial Decisions

Making informed financial decisions is key to achieving financial goals and avoiding pitfalls.

Tips for Financial Success:

Educate Yourself: Stay informed about personal finance topics.

Seek Professional Advice: Consult with financial advisors for complex matters.

Avoid Impulse Spending: Think carefully before making large purchases.

VIII. Conclusion

In conclusion, financial literacy is a vital life skill that empowers individuals to make informed financial decisions and achieve their goals. By understanding budgeting, saving, investing, debt management, credit scores, and responsible decision-making, individuals can take control of their financial well-being. It's never too late to start improving your financial literacy—educate yourself, apply these principles, and pave the way for a more secure and prosperous future. Remember, financial knowledge is the key to financial freedom and stability.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Explore the Financial Literacy Fact Sheet Template on Template.net, a crucial resource for promoting financial education and empowerment. This editable and customizable template simplifies information dissemination, allowing tailored content creation. Compatible with our Ai Editor Tool, personalize your fact sheets effortlessly. Empower individuals with this user-friendly template, ensuring clear and accessible education on financial literacy and money management.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

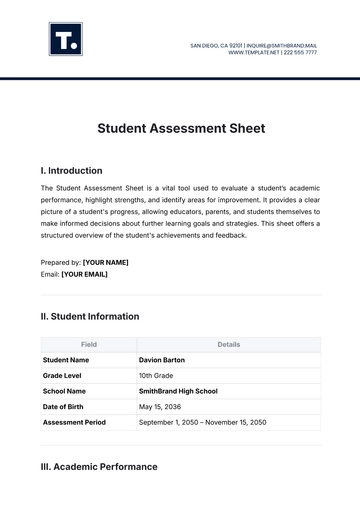

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

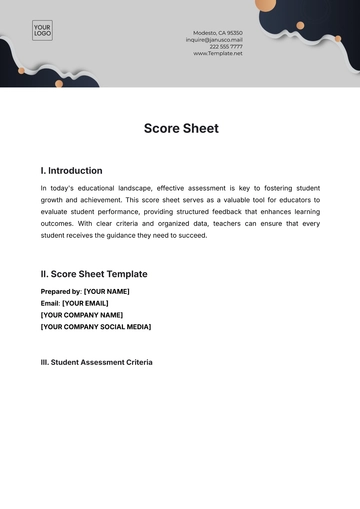

- Score Sheet

- Estimate Sheet

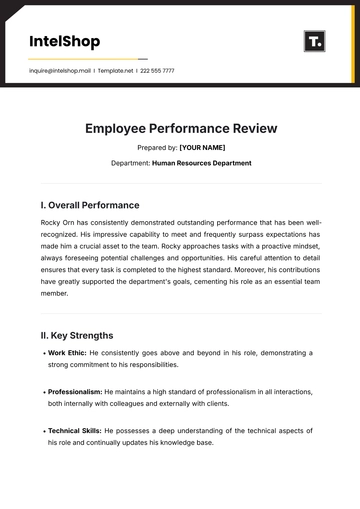

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

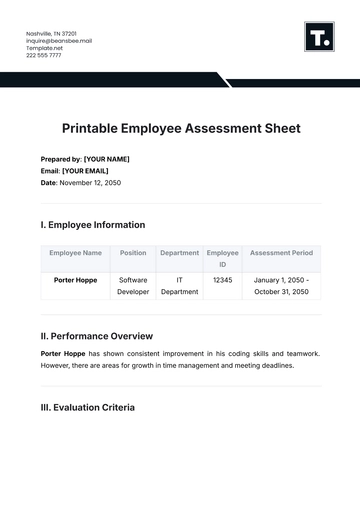

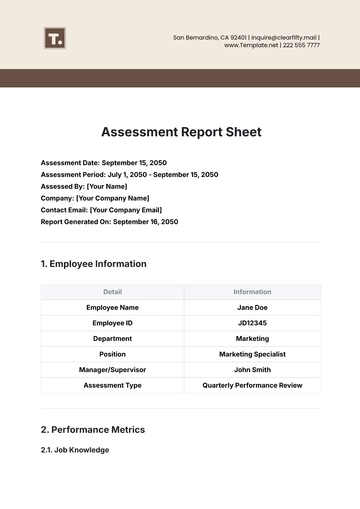

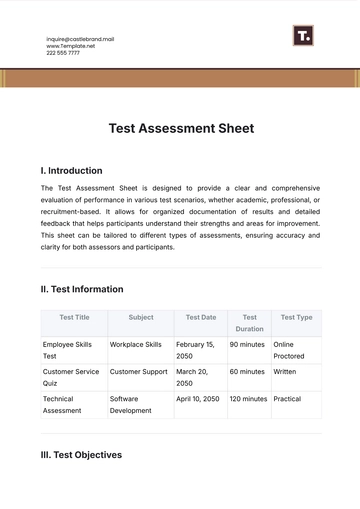

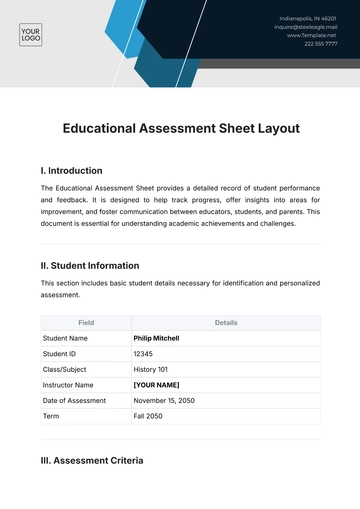

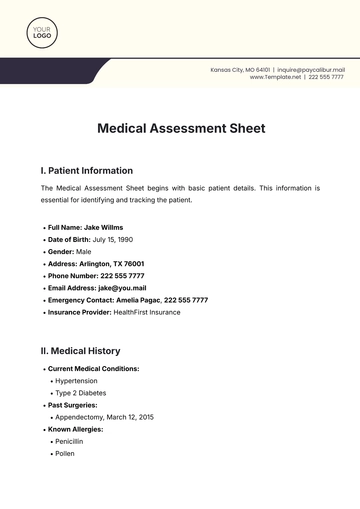

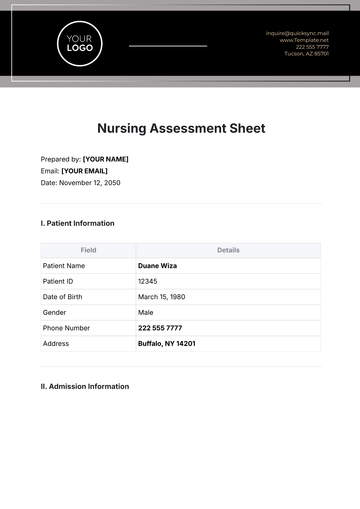

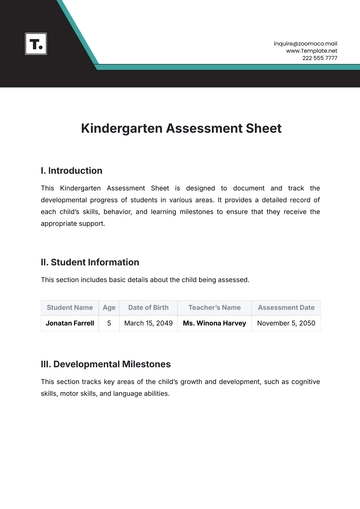

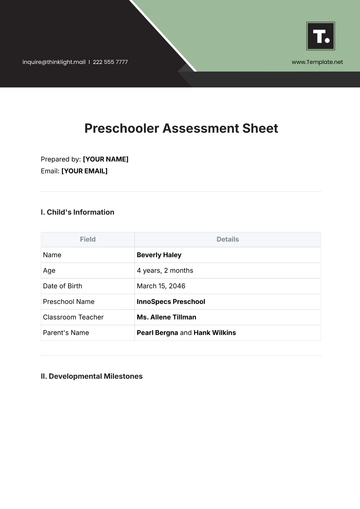

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet