Free Financial Reporting Impact Analysis

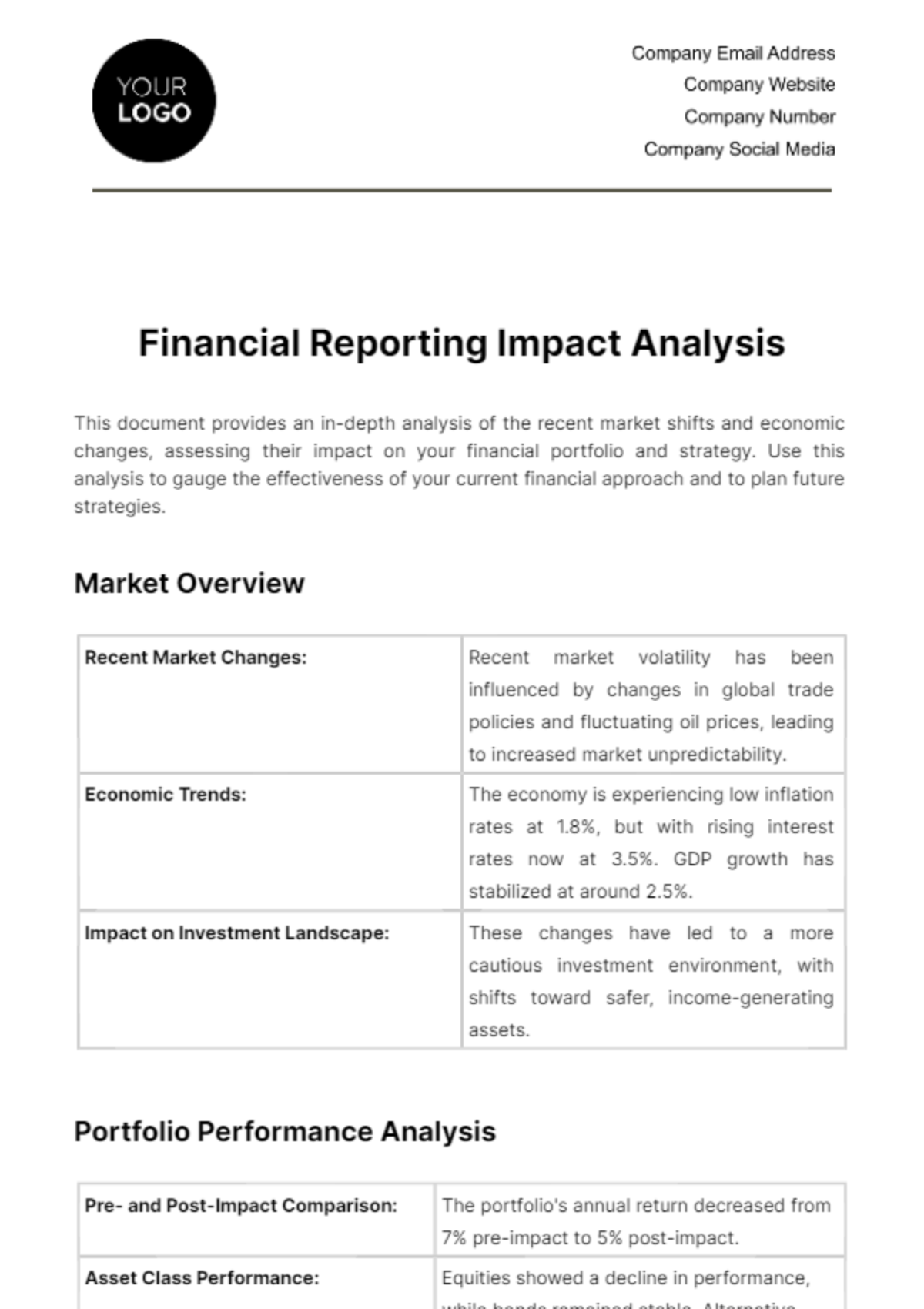

This document provides an in-depth analysis of the recent market shifts and economic changes, assessing their impact on your financial portfolio and strategy. Use this analysis to gauge the effectiveness of your current financial approach and to plan future strategies.

Market Overview

Recent Market Changes: | Recent market volatility has been influenced by changes in global trade policies and fluctuating oil prices, leading to increased market unpredictability. |

Economic Trends: | The economy is experiencing low inflation rates at 1.8%, but with rising interest rates now at 3.5%. GDP growth has stabilized at around 2.5%. |

Impact on Investment Landscape: | These changes have led to a more cautious investment environment, with shifts toward safer, income-generating assets. |

Portfolio Performance Analysis

Pre- and Post-Impact Comparison: | The portfolio's annual return decreased from 7% pre-impact to 5% post-impact. |

Asset Class Performance: | Equities showed a decline in performance, while bonds remained stable. Alternative investments provided a slight buffer against the market downturn. |

Performance Deviations: | The most significant deviations were observed in international equities due to global trade uncertainties. |

Risk Exposure and Management

Risk Profile Changes: | The portfolio's risk profile has shifted from 'moderate' to 'moderately high' due to increased market volatility. |

Risk Management Effectiveness: | Current risk mitigation strategies have partially cushioned the impact but need strengthening in the face of heightened market uncertainty. |

Recommendations for Risk Adjustment: | Suggest diversifying further into fixed-income assets and considering more conservative investment options. |

Financial Strategy Impact

Strategic Goals Review: | The shift in market conditions has delayed the achievement of certain long-term growth targets. |

Adjustments Needed: | Rebalancing the portfolio to align with a more conservative risk profile is recommended. |

Long-term Strategy Recommendations: | Consider increasing the portfolio’s liquidity to capitalize on future market corrections. |

Future Outlook and Projections

Market Projections: | Anticipated gradual market recovery with continued volatility in the short term. |

Impact on Future Performance: | Expected slower portfolio growth in the next fiscal year, with potential for recovery in the following years. |

Strategic Adjustments for Future Readiness: | Advised to adjust asset allocation to include more defensive stocks and high-quality bonds. |

Prepared by:

[Your Name]

[Your Job Title]

[Date]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Access comprehensive financial insights with Template.net's Financial Reporting Impact Analysis. This editable, customizable template is easily manipulated with our AI Editor Tool for precision tailoring. Enhance business intelligence, make strategically effective decisions, and elevate your financial standing. Experience an engaging, professional interface designed for optimum results. Elevate your business strategy today.