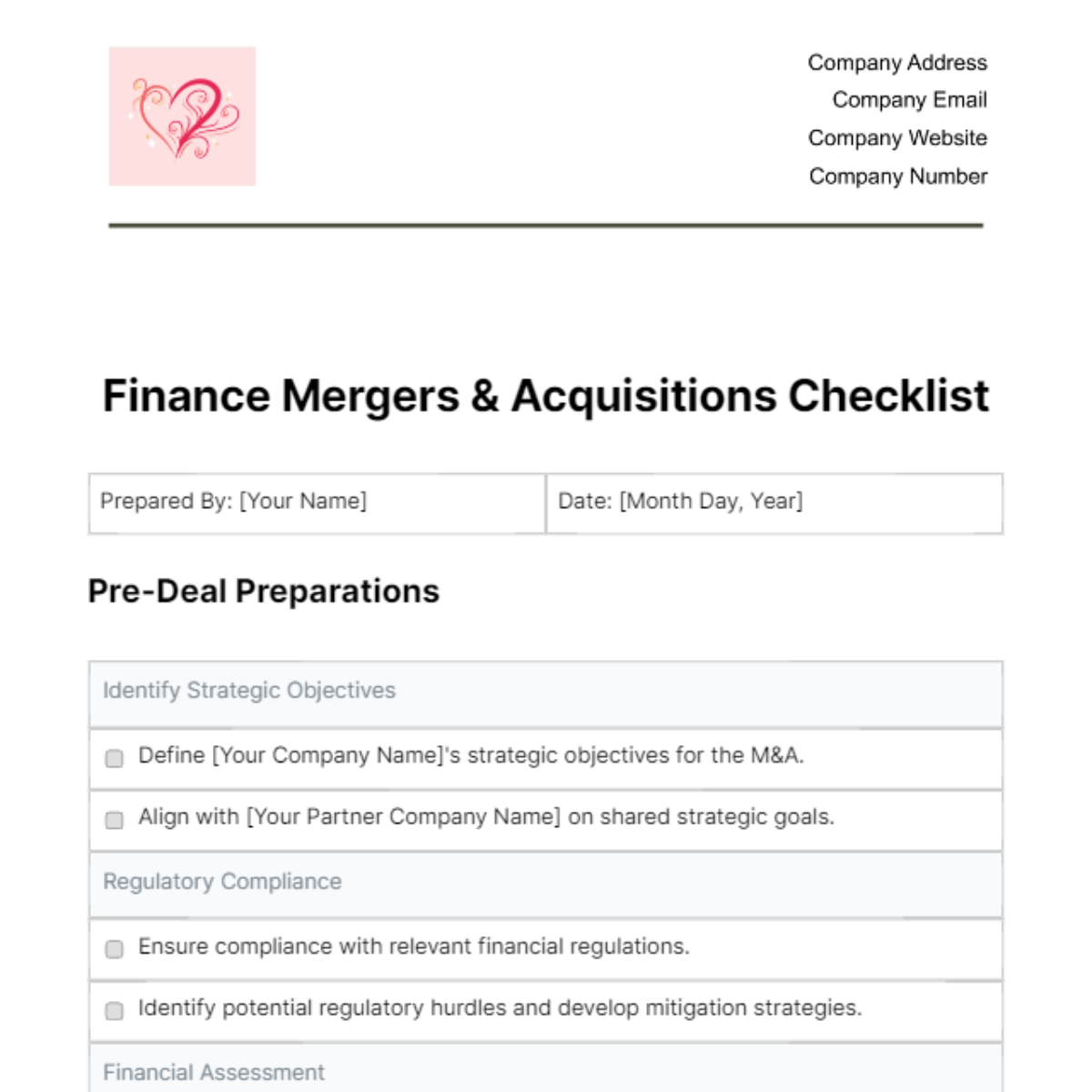

Free Finance Mergers & Acquisitions Checklist

Prepared By: [Your Name] | Date: [Month Day, Year] |

Pre-Deal Preparations

Identify Strategic Objectives |

|---|

|

|

Regulatory Compliance |

|

|

Financial Assessment |

|

Due Diligence

Legal Due Diligence |

|---|

|

|

Financial Due Diligence |

|

|

Operational Due Diligence |

|

|

Negotiation

Valuation |

|---|

|

|

Deal Structure |

|

|

Legal Documentation |

|

|

Post-Merger Integration

Integration Planning |

|---|

|

|

Financial Consolidation |

|

|

Stakeholder Communication |

|

|

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Finance Mergers & Acquisitions Checklist Template from Template.net. Providing a comprehensive guide to streamline your financial merge or acquisition process. This easy-to-use checklist ensures you don't overlook any key factors during the transition. Simplify your M&A operation with this expertly designed tool. Head to Template.net now to download and elevate your finance strategies.

You may also like

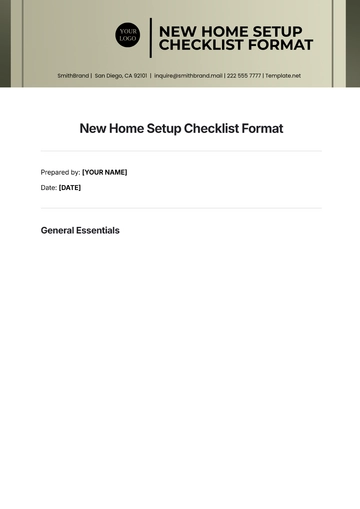

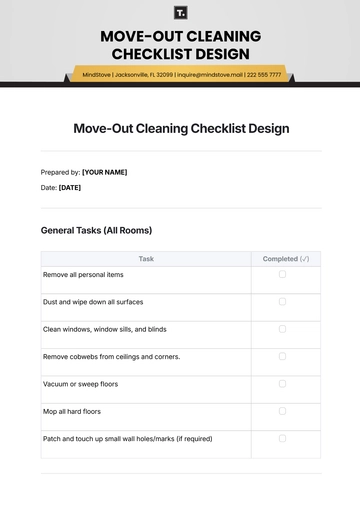

- Cleaning Checklist

- Daily Checklist

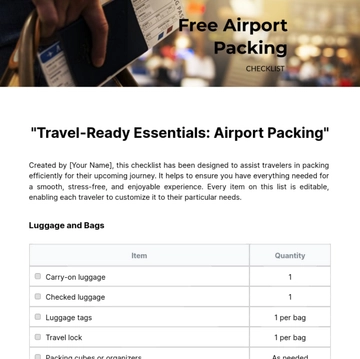

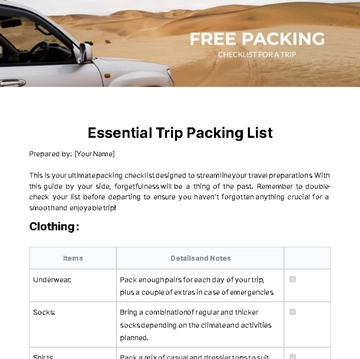

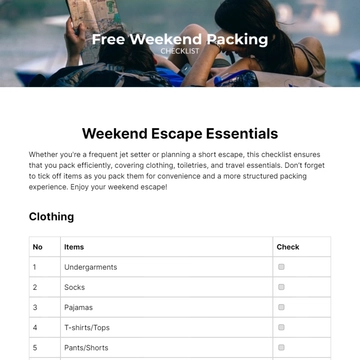

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

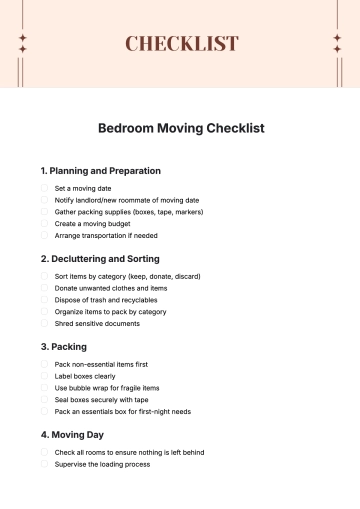

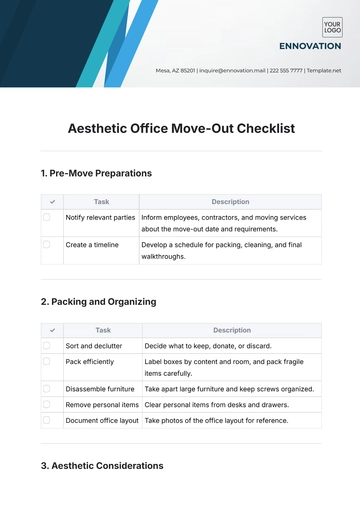

- Moving Checklist

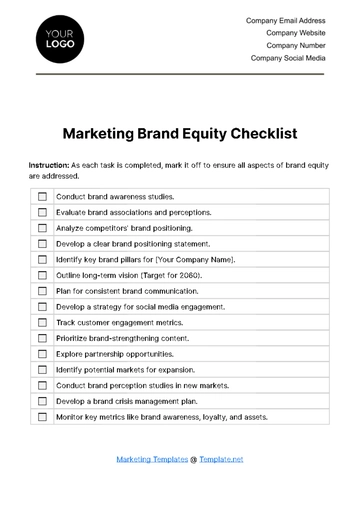

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

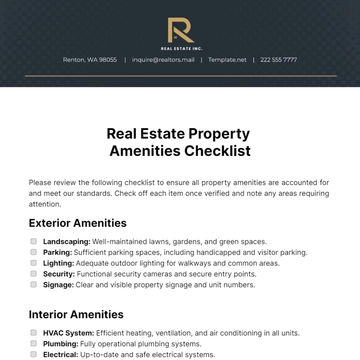

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

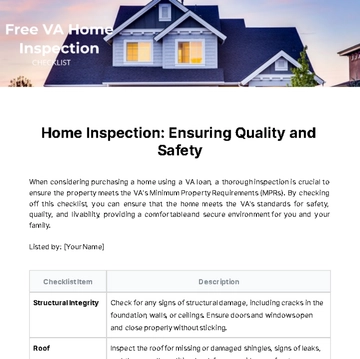

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

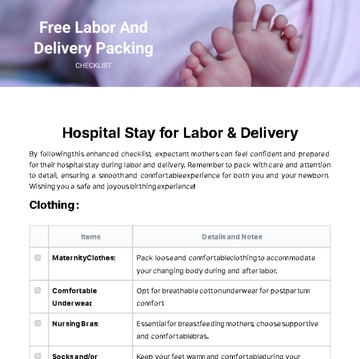

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

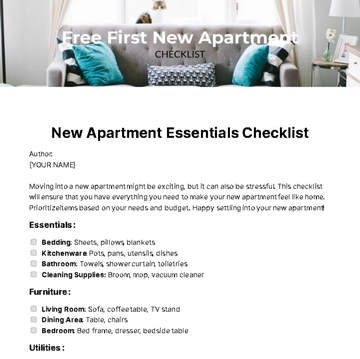

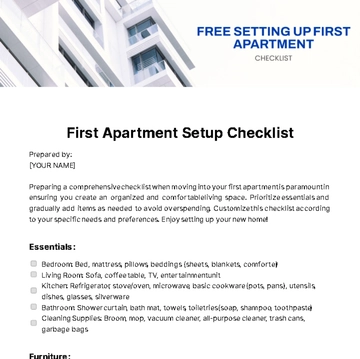

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

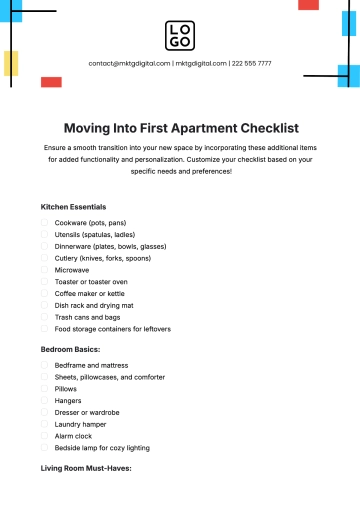

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

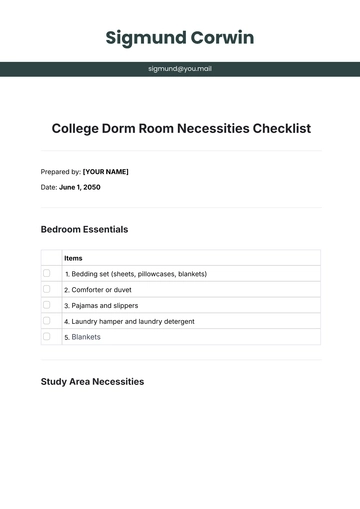

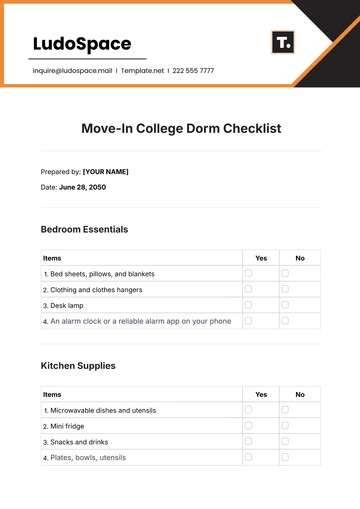

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist