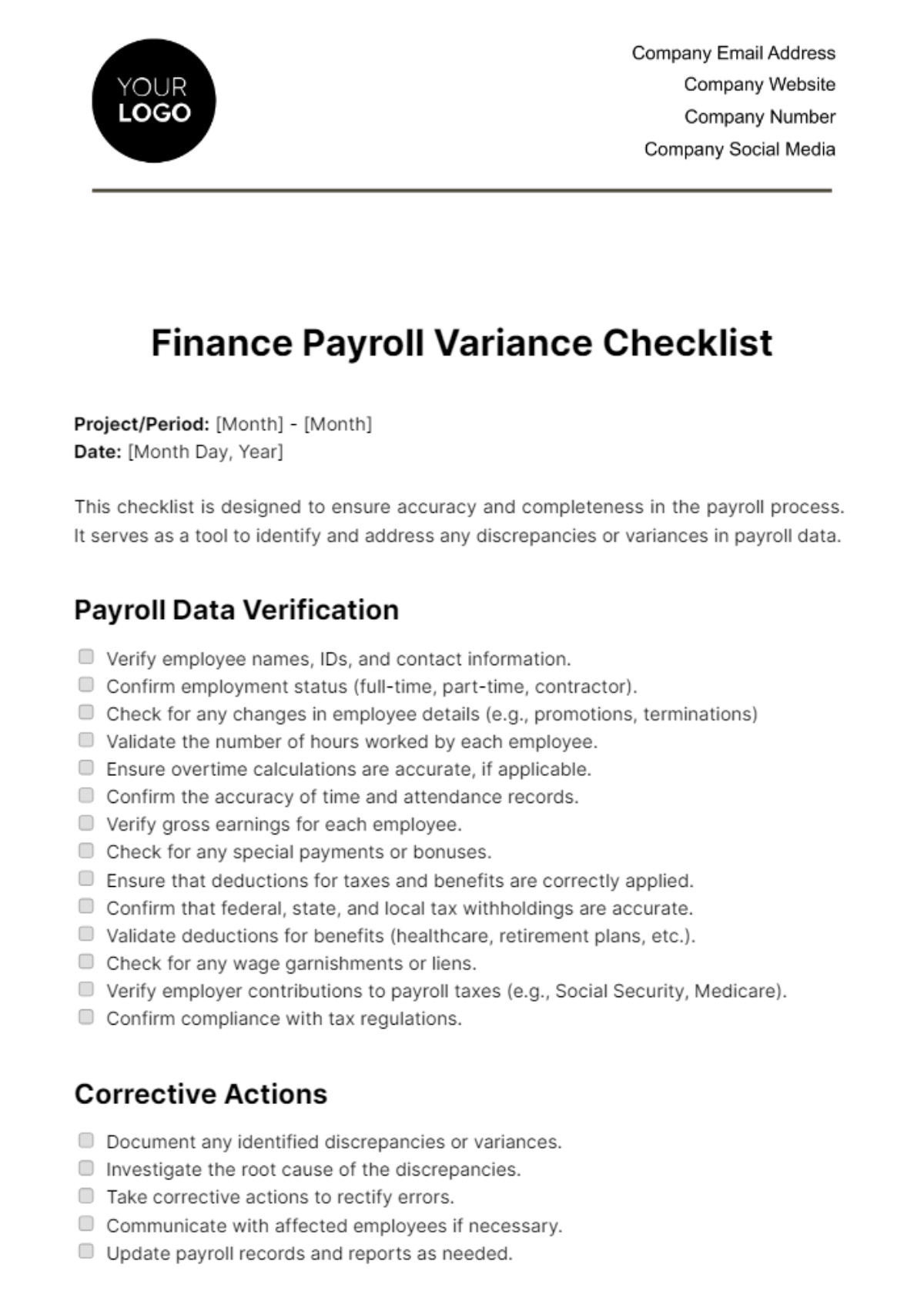

Free Finance Payroll Variance Checklist

Project/Period: [Month] - [Month]

Date: [Month Day, Year]

This checklist is designed to ensure accuracy and completeness in the payroll process. It serves as a tool to identify and address any discrepancies or variances in payroll data.

Payroll Data Verification

Verify employee names, IDs, and contact information.

Confirm employment status (full-time, part-time, contractor).

Check for any changes in employee details (e.g., promotions, terminations)

Validate the number of hours worked by each employee.

Ensure overtime calculations are accurate, if applicable.

Confirm the accuracy of time and attendance records.

Verify gross earnings for each employee.

Check for any special payments or bonuses.

Ensure that deductions for taxes and benefits are correctly applied.

Confirm that federal, state, and local tax withholdings are accurate.

Validate deductions for benefits (healthcare, retirement plans, etc.).

Check for any wage garnishments or liens.

Verify employer contributions to payroll taxes (e.g., Social Security, Medicare).

Confirm compliance with tax regulations.

Corrective Actions

Document any identified discrepancies or variances.

Investigate the root cause of the discrepancies.

Take corrective actions to rectify errors.

Communicate with affected employees if necessary.

Update payroll records and reports as needed.

Notes

Reviewed By: [Name]

Date: [Month Day, Year]

Approved By: [Name]

Date: [Month Day, Year]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Maintain payroll accuracy with the Finance Payroll Variance Checklist Template from Template.net. Editable and customizable in our AI Editor tool, this template offers a systematic approach to identify and address payroll discrepancies. It's an indispensable tool for finance teams to ensure payroll accuracy, facilitating smooth payroll processing and enhancing overall financial management efficiency.

You may also like

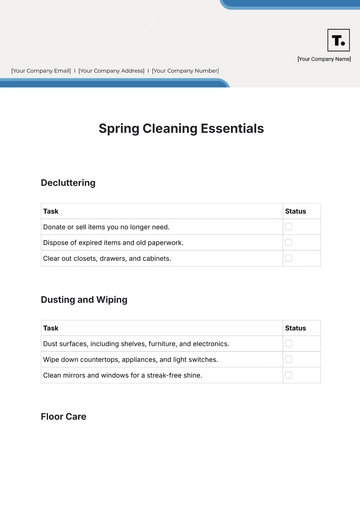

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

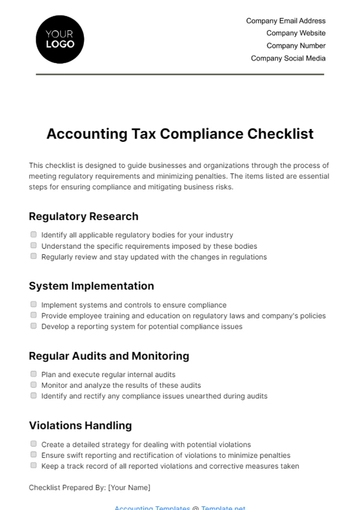

- Compliance Checklist

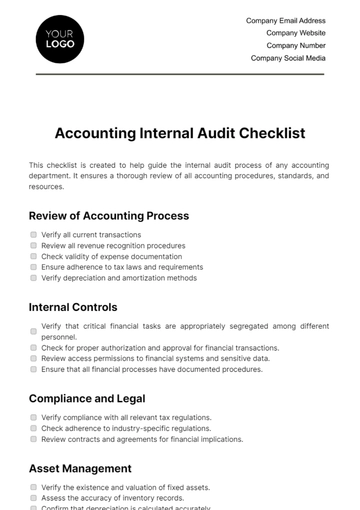

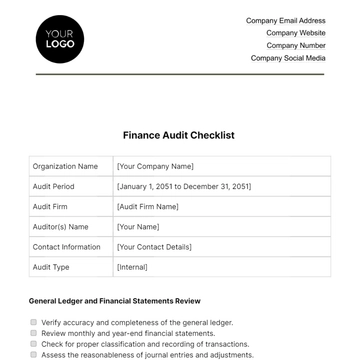

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

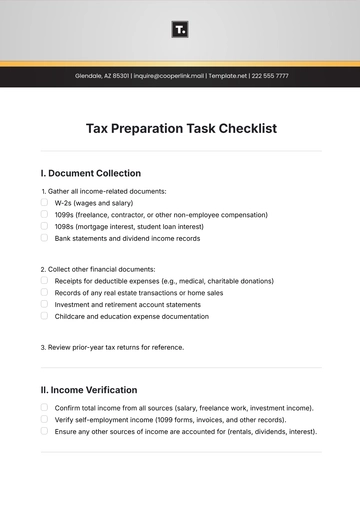

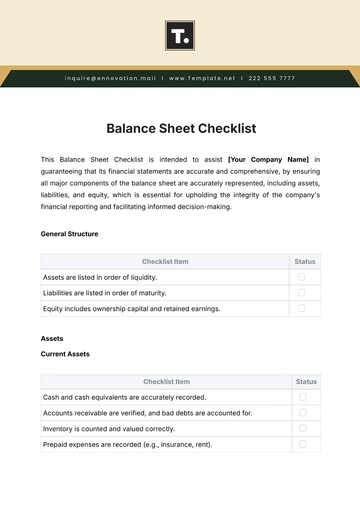

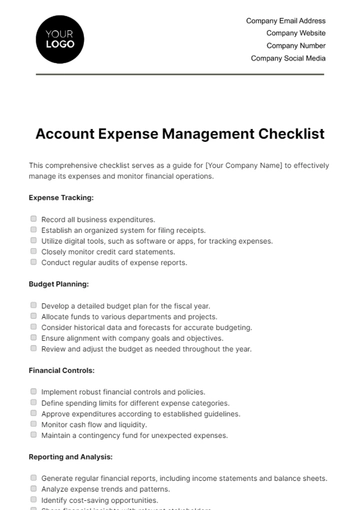

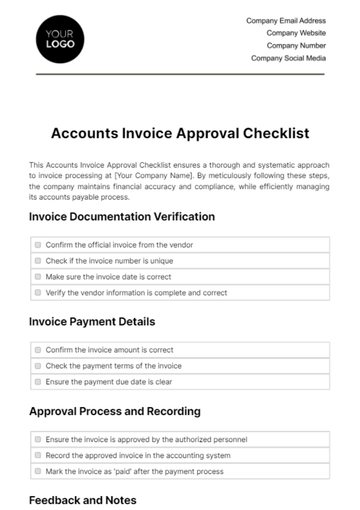

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

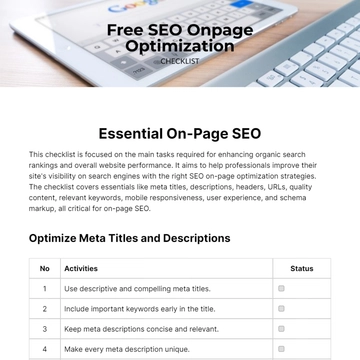

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

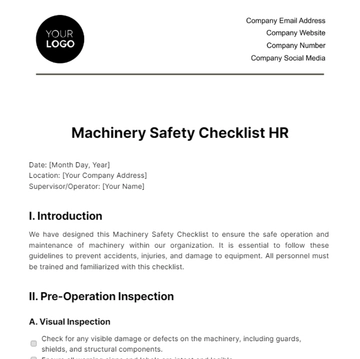

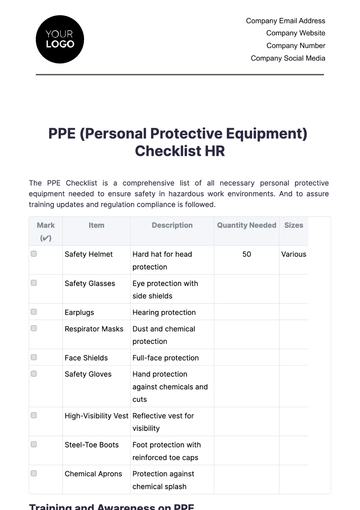

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist