Free Finance Investment Policy Statement

This Finance Investment Policy Statement provides a structured framework for managing your investment portfolio. Use this document as a blueprint to align your investment decisions with your financial goals and risk tolerance.

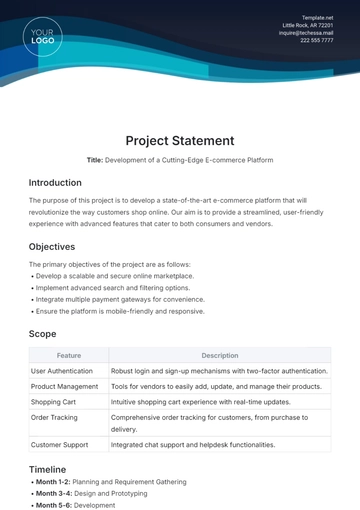

1. Investment Philosophy and Objectives

Philosophy: Our investment philosophy is grounded in achieving long-term financial growth through market diversification and disciplined risk management. We believe in a balanced approach, combining both active and passive investment strategies to capitalize on market opportunities.

Objectives: The primary objective is to grow the principal over a 20-year horizon while generating moderate annual returns. We aim to balance the growth with risk mitigation, targeting an annual return of 6-8%.

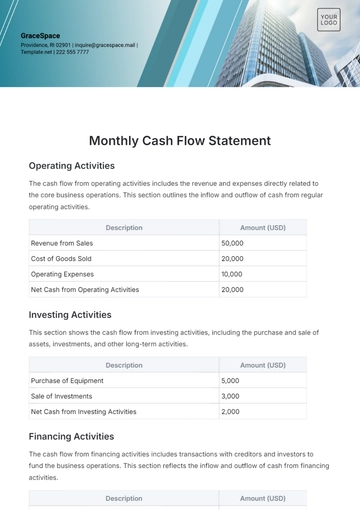

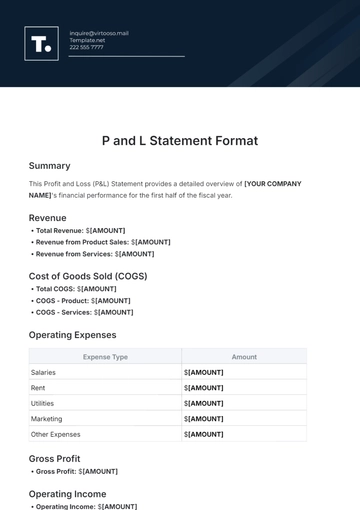

2. Asset Allocation and Diversification

Asset Allocation: The portfolio will maintain a diversified mix of 60% equities, 30% fixed income, and 10% alternative investments. This allocation aims to balance the potential for higher returns with the stability of income-generating assets.

Diversification Strategy: Investments will be diversified across various sectors and geographies to minimize risk. The equity portion will be spread across different market capitalizations and styles, while the fixed income allocation will include government and high-grade corporate bonds.

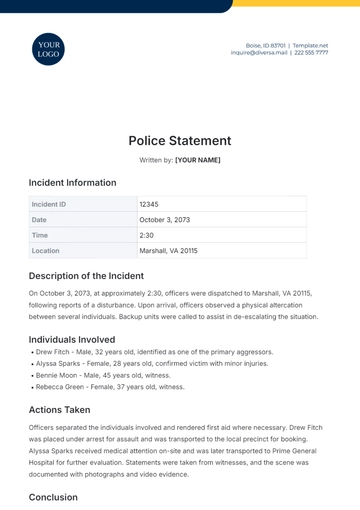

3. Risk Management Strategies

Risk Tolerance Assessment: The investor profile is characterized as moderately aggressive, and willing to accept moderate levels of volatility for potentially higher returns.

Risk Mitigation Measures: To manage risks, the portfolio will undergo semi-annual rebalancing to maintain the target asset allocation. Additionally, we will employ dollar-cost averaging to mitigate the impact of market volatility.

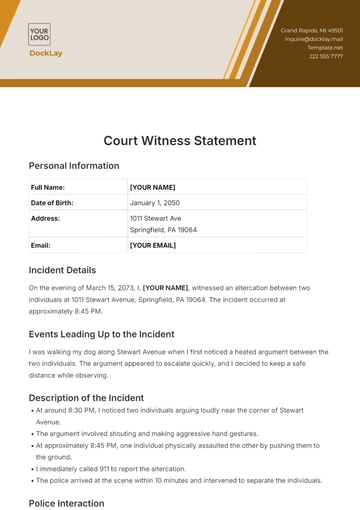

4. Investment Selection Criteria

Selection Process: Investments will be selected based on a rigorous analysis that includes historical performance, cost efficiency (like low expense ratios for funds), manager track record, and alignment with our strategic allocation. Regular due diligence will be conducted to assess the continuing suitability of chosen investments.

Monitoring and Review: The portfolio will be reviewed quarterly to evaluate performance against benchmarks like the S&P 500 for equities and the Bloomberg Barclays US Aggregate Bond Index for fixed income.

5. Performance Monitoring and Reporting

Performance Benchmarks: The portfolio’s performance will be benchmarked against a composite index reflecting its diversified asset allocation.

Reporting Frequency and Format: A comprehensive performance report will be provided semi-annually, detailing portfolio holdings, transaction history, performance metrics, and a comparative analysis against the benchmarks.

Prepared by:

[Your Name]

[Your Company Name]

[Your Email]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Experience transformative financial planning with Template.net's Finance Investment Policy Statement. This editable, customizable template allows seamless composition with our exclusive Ai Editor Tool. Make effective, impactful decisions with this user-friendly guide. Evoke action and interest, streamline your operations and watch your performance excel. Engage with Template.net for your financial growth.