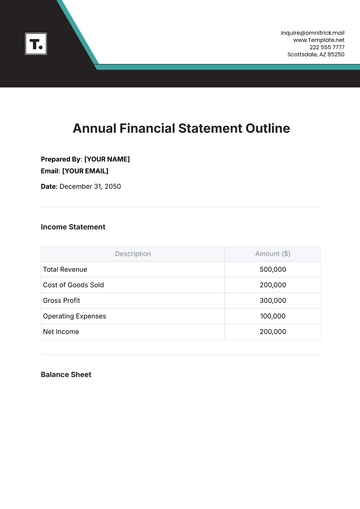

Free Annual Financial Investment Report

I. Executive Summary

In the fiscal year spanning from [April 1, 2050] to [MM/DD/YYYY] our financial investment portfolio demonstrated robust performance amid a dynamic economic landscape. With a diversified approach spanning equities, fixed income, and alternative investments, we achieved commendable returns, exceeding benchmarks and showcasing the effectiveness of our strategic decision-making. The careful allocation of assets, coupled with active risk management, contributed to a positive net income, reflecting our commitment to optimizing returns while prudently managing risks. Our realized and unrealized gains and losses further underscored our ability to capitalize on market opportunities and navigate valuation fluctuations. Importantly, transparency remained a core tenet, with comprehensive disclosures on income, expenses, risks, and compliance, fostering trust and accountability among stakeholders.

Looking ahead, our outlook remains forward-thinking, informed by a commitment to innovation, sustainability, and technological integration. Future strategies include exploring innovative investment vehicles, integrating ESG principles, and leveraging advanced risk analytics to navigate evolving market dynamics. Contingency planning and stakeholder engagement initiatives underscore our dedication to resilience and transparent communication. As we embrace the challenges and opportunities ahead, our vision is centered on sustained growth, responsible financial practices, and delivering enduring value to our esteemed investors.

II. Investment Objectives and Strategy

A. Overview

At the core of our organization's investment philosophy lies a commitment to sustained growth, rigorous risk mitigation, and the optimization of value. We embrace a dynamic and comprehensive approach to investments, geared towards navigating the intricacies of the market and consistently delivering enduring value to our diverse stakeholder base.

B. Investment Objectives

Capital Preservation

A fundamental pillar of our investment objectives is the unwavering commitment to capital preservation. We prioritize this objective through a multifaceted approach, employing diligent risk management practices and strategic asset allocation to fortify the financial foundation of our stakeholders. Our goal is not merely to generate returns, but to ensure the enduring security and resilience of invested capital.

Risk-Adjusted Returns

A paramount focus on achieving superior risk-adjusted returns underscores our commitment to maintaining a balanced and resilient portfolio. Rigorous assessment and dynamic adjustments to our investment mix form the bedrock of our strategy, allowing us to optimize returns while judiciously managing risks. This approach ensures that our stakeholders not only benefit from positive returns but do so in a manner that aligns with their risk tolerance and financial objectives.

Long-Term Growth

Central to our investment strategy is the cultivation of sustained, long-term growth. We position ourselves at the forefront of emerging market trends, embracing a forward-looking approach that anticipates and adapts to evolving economic landscapes. By aligning our investments with future opportunities, we seek to provide stakeholders with lasting value and growth potential.

C. Investment Strategy

Diversification

Our commitment to robust risk management manifests through a deliberate and well-rounded diversification strategy. Beyond the conventional triad of equities, fixed income, and alternative assets, we explore innovative avenues to further enhance the resilience of our portfolio against market volatility. Diversification not only mitigates risk but also positions us to capitalize on a broad spectrum of market opportunities.

Active Portfolio Management

Integral to our investment approach is active portfolio management, a dynamic process that enables us to proactively respond to market dynamics. Through continuous monitoring, in-depth analysis, and timely adjustments, we maximize the performance potential of our investment portfolio. This active management approach allows us to capitalize on emerging opportunities and swiftly navigate challenges, ensuring optimal performance.

Evaluating ESG Factors

We proudly integrate Environmental, Social, and Governance (ESG) factors into our investment decisions, thereby aligning our portfolio with sustainable and responsible practices. This commitment goes beyond mere financial considerations, reflecting our dedication to ethical and socially conscious investment strategies. By assessing the impact of our investments on the environment, society, and governance structures, we contribute to a more sustainable and equitable future while simultaneously enhancing the long-term value of our portfolio.

III. Market Overview and Economic Landscape

A. Macro-Economic Trends

Economic Recovery

Signs of economic recovery were evident, marked by increased GDP growth rates in major economies. This recovery provided a foundation for our investment decisions, aligning our strategies with evolving economic conditions.

Inflationary Pressures

Inflationary pressures were observed, driven by supply chain disruptions and heightened demand. Our investment approach carefully considered these pressures, navigating the implications for our portfolio.

Global Trade Dynamics

We monitored geopolitical shifts and trade policy changes, ensuring our investments were well-positioned in the face of evolving international trade landscapes.

B. Financial Market Conditions

Equity Markets

Robust performance characterized equity markets during the reporting period. Positive earnings reports and accommodative monetary policies contributed to favorable conditions, impacting our investment strategies.

Fixed Income Markets

Fluctuations in fixed income markets were observed, influenced by changing interest rate expectations and central bank actions. These market dynamics prompted careful evaluation and adjustment of our fixed income investments.

Alternative Investments

Alternative investments, including real estate and private equity, presented unique opportunities. Our investment team conducted thorough analyses to leverage these opportunities within the broader investment landscape.

C. Emerging Risks and Opportunities

Climate-Related Risks

The emergence of climate-related risks prompted a strategic evaluation. Our investment decisions incorporated comprehensive climate risk assessments, aligning our portfolio with sustainable and responsible investment practices.

Technological Innovations

Opportunities arising from technological innovations were explored with a forward-looking perspective. We assessed investments in sectors at the forefront of disruptive technologies, positioning our portfolio for future growth.

IV. Portfolio Performance

A. Financial Highlights

Returns on Investment

Our portfolio delivered commendable returns, exceeding benchmarks and reflecting the effectiveness of our investment strategies. The calculated risk and reward balance contributed to the positive performance observed throughout the period.

Yield Analysis

In-depth yield analysis demonstrated the effectiveness of our income-generating investments. We maintained a focus on optimizing yield while preserving capital, resulting in a well-balanced and sustainable income stream.

B. Equities Performance

Market Dynamics

Our ability to understand and adapt to market dynamics allowed us to capitalize on opportunities within the equity space. Proactive strategies ensured that our equity investments contributed significantly to the overall financial highlights.

Volatility Management

Successfully navigating equity market volatility was a testament to our risk management approach. Diversification and active portfolio management enhanced our ability to capture opportunities while mitigating the impact of market fluctuations.

V. Asset Allocation

The table below provides a breakdown of our asset allocation during the reporting period, offering insights into the distribution of resources across key asset classes:

Asset Class | Allocation |

Equities | 45% |

Fixed Income | |

Alternative Investments | |

Cash and Equivalents |

Strategic asset allocation is pivotal for various reasons. Firstly, it facilitates effective risk management by diversifying investments, mitigating vulnerability to the fluctuations of any single asset class. Secondly, it aligns with our overarching goal of optimizing returns by identifying opportunities across different market segments. Lastly, this dynamic approach enhances the overall resilience of our investment strategy, fostering long-term sustainability and value creation.

VI. Income and Expenses

The table below presents a breakdown of our income and expenses:

Category | Amount |

Investment Income | $1,200,000 |

Dividends | |

Interest Income | |

Management Fees | |

Operating Expenses | |

Net Income |

This detailed breakdown serves a crucial purpose in our financial reporting. It provides a transparent account of the various income streams contributing to our financial health. Positive net income reflects our ability to generate returns exceeding costs, indicating effective financial stewardship. Moreover, understanding the sources of income and the nature of expenses is crucial for strategic decision-making. It informs future investment strategies, expense management measures, and allows us to align financial activities with organizational goals.

VII. Realized and Unrealized Gains/Losses

The following table presents a breakdown of realized and unrealized gains and losses, offering insights into the financial impact of our investment decisions and the market valuation of our portfolio:

Category | Amount |

Realized Gains | $800,000 |

Realized Losses | |

Unrealized Gains | |

Unrealized Losses | |

Net Gains/Losses |

Realized gains and losses reflect the actual profits or losses resulting from the sale of investments, providing tangible evidence of our ability to capitalize on market opportunities and make prudent selling decisions. Unrealized gains and losses, on the other hand, represent the fluctuations in the value of our current holdings, offering insights into the potential future financial performance of our portfolio. Furthermore, the net gains/losses figure provides a comprehensive view of the overall financial impact, combining both realized and unrealized elements. The positive net gains demonstrate the effectiveness of our investment decisions.

VIII. Risks and Mitigations

A. Identified Risks

Market Volatility

Market fluctuations pose inherent risks to our portfolio. Rapid changes in market conditions can impact the valuation of our investments, potentially resulting in financial losses.

Interest Rate Risk

Fluctuations in interest rates can affect the performance of fixed-income securities. A rise in interest rates may lead to a decrease in the market value of existing bonds.

Liquidity Risk

The risk of illiquidity in certain investments can impede our ability to buy or sell assets swiftly. This can be exacerbated during periods of market stress.

B. Mitigation Strategies

Diversification

A diversified portfolio across asset classes helps mitigate the impact of market volatility. This strategy allows us to spread risk and minimize the impact of adverse movements in any single investment.

Interest Rate Hedging

Utilizing interest rate hedging instruments helps mitigate the impact of interest rate fluctuations on fixed-income investments, providing a level of protection against potential losses.

Liquidity Management

Active liquidity management ensures we maintain sufficient cash reserves to navigate periods of market illiquidity. This approach enhances our ability to meet financial obligations promptly.

IX. Compliance and Regulatory Disclosures

A. Compliance Commitments

Regulatory Framework

A commitment to complying with the regulatory framework governing financial investments is fundamental to our operations. Adherence to relevant laws and regulations ensures ethical and lawful financial practices.

Internal Compliance Policies

Implementing robust internal compliance policies and procedures is integral. These measures are designed to align with regulatory requirements and industry best practices, fostering a culture of accountability and transparency.

B. Regulatory Disclosures

Regulatory Changes

Any significant changes in regulatory requirements that may impact our financial investments are disclosed. Staying informed about regulatory developments is essential for timely and compliant decision-making.

Legal Proceedings

Full disclosure of any legal proceedings or regulatory investigations involving our financial investments is provided. Transparency about such matters is crucial for maintaining trust with stakeholders.

Compliance Audits

Regular compliance audits are conducted to assess adherence to regulatory requirements. Any findings or corrective actions are transparently communicated to stakeholders, demonstrating our commitment to accountability.

X. Outlook and Future Strategies

A. Economic and Market Outlook

Global Economic Trends

Our outlook considers global economic trends, including GDP growth, inflationary pressures, and trade dynamics. This analysis informs our macroeconomic approach to positioning the portfolio for sustained growth.

Sectoral Opportunities

Identifying sectoral opportunities is integral to our outlook. We assess emerging trends and disruptive technologies, aligning our investments with sectors poised for growth in the coming years.

B. Future Investment Strategies

Innovative Investment Vehicles

We are exploring innovative investment vehicles to diversify our portfolio and tap into new opportunities. This includes evaluating emerging financial instruments and adapting our strategies accordingly.

Sustainability and ESG Integration

Integrating sustainability and Environmental, Social, and Governance (ESG) factors further defines our future strategies. This commitment aligns with evolving investor preferences and promotes responsible financial practices.

Technological Integration

Leveraging technological advancements is a key pillar of our future strategies. This includes adopting cutting-edge analytics, artificial intelligence, and other technologies to enhance investment decision-making and risk management.

C. Risk Mitigation and Contingency Planning

Advanced Risk Analytics

We plan to enhance our risk management capabilities through advanced analytics. This involves leveraging data-driven insights to identify and mitigate risks in real-time, ensuring a proactive risk management approach.

Contingency Planning

Developing comprehensive contingency plans is essential. We will outline strategies to navigate potential market shocks or unexpected events, ensuring the portfolio remains resilient in the face of uncertainties.

XI. Conclusion

In conclusion, this comprehensive report for the fiscal year serves as a testament to our unwavering commitment to financial stewardship and excellence in investment management. The exceptional performance of our diversified portfolio, guided by strategic risk management, underscores our steadfast dedication to delivering optimal returns for our valued stakeholders. Our proactive stance in identifying and mitigating risks, complemented by robust compliance and transparency initiatives, reaffirms our pledge to uphold responsible financial practices.

As we navigate the intricacies of an ever-evolving financial landscape, our forward-thinking outlook and innovative future strategies uniquely position us for sustained growth and resilience. Embracing change as an opportunity for progress, we remain poised to adapt to emerging market dynamics, ensuring that we not only meet but exceed the expectations of our esteemed investors. This report encapsulates not just a snapshot of the past fiscal year but serves as a beacon guiding our commitment to enduring success and the creation of lasting value in the years to come.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Craft your financial narrative with the Annual Financial Investment Report Template from Template.net! This editable and customizable tool, empowered by the intuitive AI Editor Tool, lets you shape your report dynamically. Begin your journey to financial clarity, delivering insights tailored to your unique investment landscape by trying it out today!

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report