Free Account Compliance Assessment

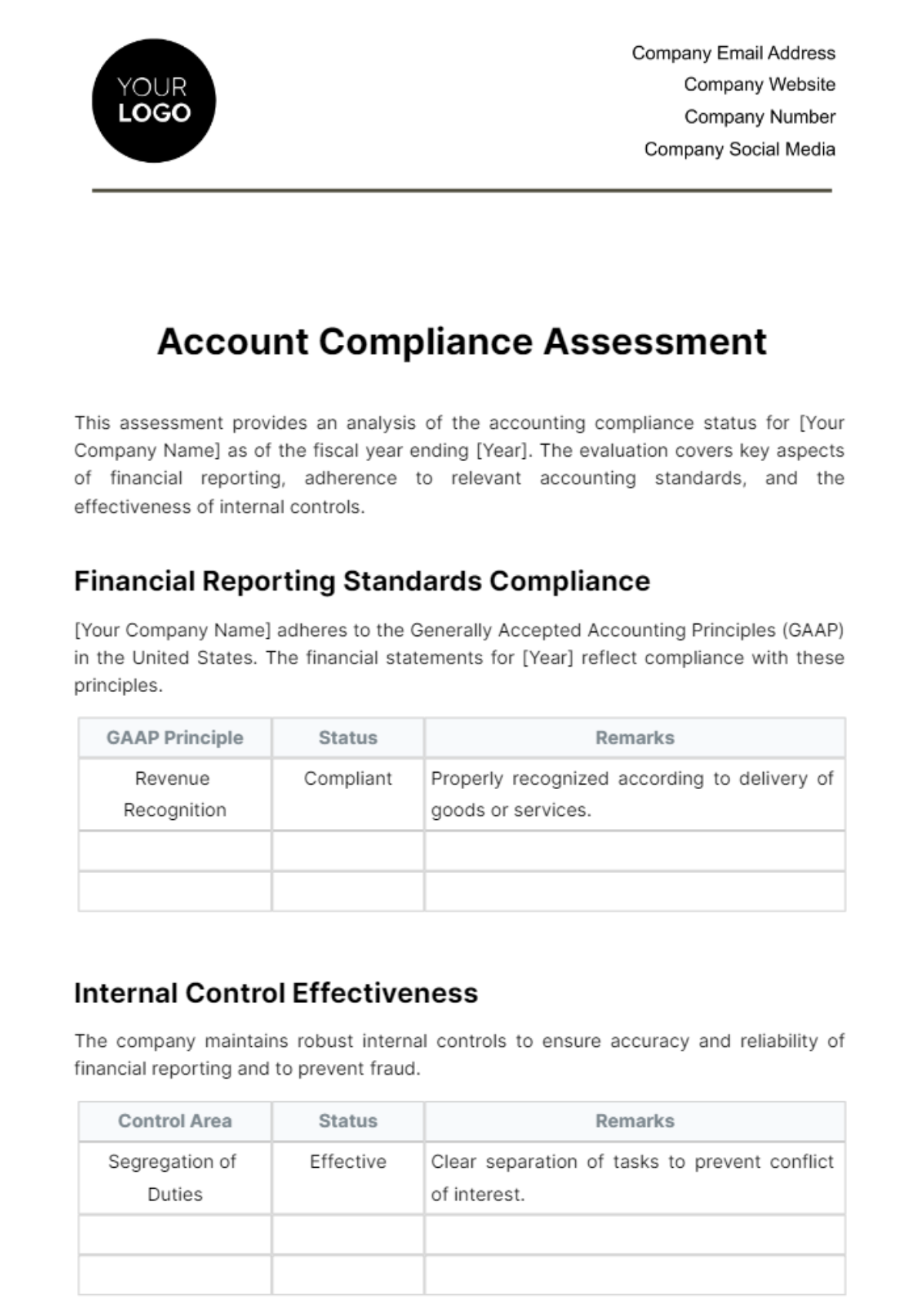

This assessment provides an analysis of the accounting compliance status for [Your Company Name] as of the fiscal year ending [Year]. The evaluation covers key aspects of financial reporting, adherence to relevant accounting standards, and the effectiveness of internal controls.

Financial Reporting Standards Compliance

[Your Company Name] adheres to the Generally Accepted Accounting Principles (GAAP) in the United States. The financial statements for [Year] reflect compliance with these principles.

GAAP Principle | Status | Remarks |

|---|---|---|

Revenue Recognition | Compliant | Properly recognized according to delivery of goods or services. |

Internal Control Effectiveness

The company maintains robust internal controls to ensure accuracy and reliability of financial reporting and to prevent fraud.

Control Area | Status | Remarks |

|---|---|---|

Segregation of Duties | Effective | Clear separation of tasks to prevent conflict of interest. |

Adherence to Tax Compliance

[Your Company Name] has consistently complied with tax laws and regulations. The company's tax filings for [Year] are accurate and timely.

Tax Requirement | Status | Remarks |

|---|---|---|

Federal Income Tax | Compliant | Filed and paid accurately and on time. |

[Your Company Name] demonstrates strong compliance with accounting standards, effective internal controls, and adherence to tax requirements as of the [Year]. The company is well-positioned to maintain its financial integrity and meet its reporting obligations in future periods.

Prepared By: [Your Name]

Date of Assessment: [Month Day, Year]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Experience seamless and efficient business documentation with Template.net's Account Compliance Assessment Template. The fully editable and customizable graphics add value to your assessment process. Easily adjust this template's layout in our advanced Ai Editor Tool—improving your compliance work has never been this simple. Download our template today!