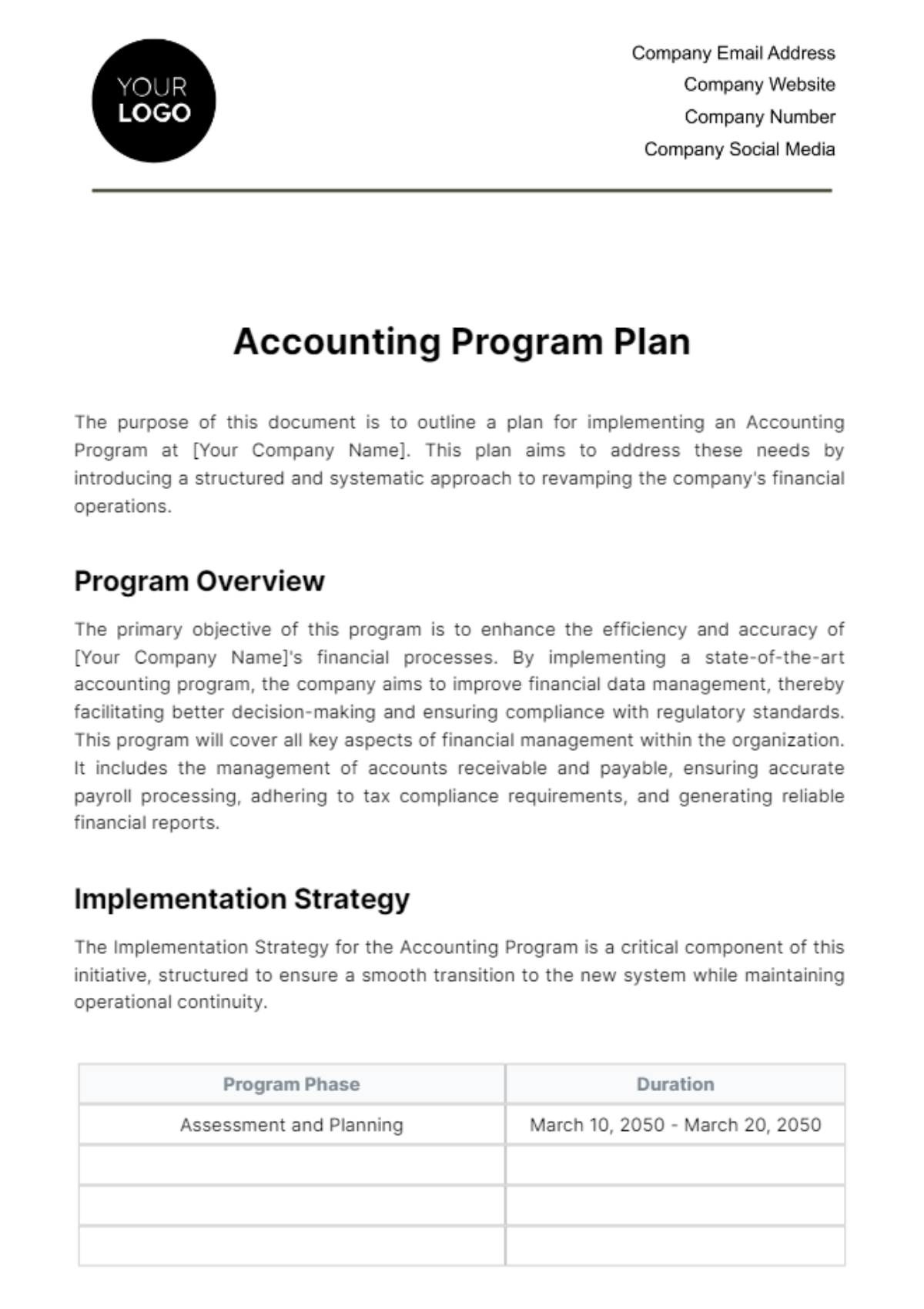

Free Accounting Program Plan

The purpose of this document is to outline a plan for implementing an Accounting Program at [Your Company Name]. This plan aims to address these needs by introducing a structured and systematic approach to revamping the company's financial operations.

Program Overview

The primary objective of this program is to enhance the efficiency and accuracy of [Your Company Name]'s financial processes. By implementing a state-of-the-art accounting program, the company aims to improve financial data management, thereby facilitating better decision-making and ensuring compliance with regulatory standards. This program will cover all key aspects of financial management within the organization. It includes the management of accounts receivable and payable, ensuring accurate payroll processing, adhering to tax compliance requirements, and generating reliable financial reports.

Implementation Strategy

The Implementation Strategy for the Accounting Program is a critical component of this initiative, structured to ensure a smooth transition to the new system while maintaining operational continuity.

Program Phase | Duration |

|---|---|

Assessment and Planning | March 10, 2050 - March 20, 2050 |

Each phase of the implementation is carefully planned to address specific aspects of the program. The strategy emphasizes the importance of thorough preparation, customized system selection, data integrity during migration, effective training, and continuous improvement.

Budget Estimation

The budget estimation for the Accounting Program has been crafted to ensure a comprehensive allocation of resources, covering all critical aspects of the program's implementation.

Program Phase | Estimated Cost |

|---|---|

Assessment and Planning | $50,000 |

This budget estimation reflects a strategic investment in [Your Company Name]'s financial infrastructure. It is designed to be both cost-effective and value-driven, ensuring that the Accounting Program provides long-term benefits to the company.

Key Performance Indicators (KPIs)

These KPIs serve as benchmarks to evaluate the effectiveness of the new system and ensure that it aligns with our organizational goals. They provide quantifiable metrics to assess the impact of the program on our financial operations and overall organizational efficiency.

Precision in Financial Reporting: This KPI focuses on the accuracy and reliability of financial statements and reports generated by the new system. Regular audits will be conducted to ensure the correctness of financial data.

Transaction Processing Efficiency: This indicator measures the effectiveness of the accounting system in processing financial transactions. Metrics include transaction processing time, error rates, and automation levels.

Regulatory Compliance: This KPI assesses adherence to tax laws and accounting standards. It involves regular reviews of the system's compliance features and updates in response to changing regulations.

Employee Engagement and System Proficiency: This indicator evaluates employee satisfaction with the new accounting system and their proficiency in using it. It will be measured through surveys and performance assessments.

Risk Management Plan

Recognizing and planning for potential risks ensures that the program is resilient and capable of adapting to challenges. This outlines a proactive approach to identifying possible risks associated with the new accounting system and details the strategies for mitigating these risks. By addressing these concerns upfront, we aim to minimize disruptions and maintain a high standard of operational continuity throughout the transition to the new system.

Risk Identification:

Data Migration Errors: Recognizing the potential for errors during data transfer to the new system.

System Downtime: Preparing for any unexpected interruptions in system availability.

Over-dependence on Technology: Acknowledging the risks associated with reliance on the new system.

Risk Mitigation Strategies:

Regular Data Backups: Implementing a routine backup protocol to safeguard against data loss.

Phased Implementation Approach: Gradually rolling out the system to manage the transition effectively and reduce the impact of potential issues.

Comprehensive Employee Training: Providing extensive training to ensure staff are proficient and can effectively utilize the new system, thereby reducing over-dependence on a narrow set of users or technical staff.

The proposed Accounting Program for [Your Company Name] is designed to optimize financial operations, enhance compliance, and promote efficiency. Regular reviews and updates will ensure the system remains effective and aligned with the company's evolving needs.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Create systematic accounting plans with Template.net's Accounting Program Plan Template. Our template is fully editable and customizable via our Ai Editor Tool, designed for flexibility and ease of use. Streamline your accounting processes with our premium, user-friendly template. Download a copy of template today!