Free Financial Cost Crisis Management Protocol

Management Protocol

Introduction

The purpose of this protocol is to establish a structured framework for effectively managing a financial crisis while safeguarding our organization's financial health and sustainability. It serves as a guide for proactive decision-making and coordinated actions to mitigate the impact of the crisis.

Scope

This protocol encompasses a wide range of financial, operational, and communication strategies aimed at addressing the financial crisis. It covers the identification and assessment of the crisis, the formation of a crisis management team, stakeholder communication, cash flow management, cost reduction initiatives, revenue protection, debt management, asset review, and various operational measures.

Target Audience

This document is intended for use by our organization's leadership team, including executives, department heads, and key decision-makers responsible for managing the financial crisis. It is also a valuable resource for employees involved in crisis response and external stakeholders such as investors, creditors, customers, and suppliers seeking insights into our crisis management approach.

Revision History

Version | Date | Author | Description of Changes |

1.0 | [Date] | [Author Name] | Initial Draft |

1.1 | [Date] | [Author Name] | Added section: "Stakeholder Communication Plan" |

Crisis Identification and Assessment

In this critical phase of our Financial Cost Crisis Management Protocol, we focus on the timely identification and thorough assessment of a financial crisis. This proactive approach is vital for understanding the severity and impact of the crisis on our operations and financial health.

Procedures

Continuous Financial Monitoring: Regular review of financial statements, cash flow projections, and key financial ratios.

Market and Industry Analysis: Ongoing analysis of market trends and industry factors that may impact our financial stability.

Internal Audits: Frequent internal audits to identify any potential financial irregularities or inefficiencies.

Stakeholder Feedback: Gathering insights from employees, customers, suppliers, and investors to gain a broader perspective on our financial status.

Risk Assessment Meetings: Regular meetings with department heads to discuss potential risks and their financial implications.

Expert Consultation: Engaging with financial experts and advisors for an independent assessment of our financial situation.

Early Warning Indicators and Threshold Levels

Indicator | Threshold Level | Notes |

Cash Flow Shortages | Cash balance below a 3-month operational cost requirement | Indicates immediate liquidity concerns and potential inability to meet short-term obligations. |

Decline in Revenue | More than 10% decline YoY | Reflects a significant downturn in business, warranting a deeper investigation. |

Rapid Increase in Debt Levels | Debt-to-Equity ratio exceeding 2:1 | High leverage may indicate over-reliance on borrowing, increasing financial risk. |

Decrease in Profit Margins | Gross margin falling below 15% | Suggests decreasing operational efficiency or pricing pressures. |

Extended Accounts Receivable Period | Average collection period over 60 days | Indicates potential cash flow issues due to delayed payments from customers. |

Increased Inventory Holding | Inventory turnover ratio below industry average | Sign of potential overstocking or reduced demand. |

Market Share Reduction | Decrease in market share by 5% within a fiscal year | Impacts revenue and competitive position. |

Credit Rating Downgrade | Drop by two or more rating categories | Reflects worsening creditworthiness and financial stability. |

Regulatory or Legal Compliance Issues | Any non-compliance event | Could lead to financial penalties and reputational damage. |

Significant Economic or Industry Downturn | Macro-economic indicators showing negative trends | External factors that could impact our business significantly. |

Crisis Management Team Formation

The formation of a dedicated crisis management team is a critical step in our protocol. This team, comprised of key personnel from various departments, is tasked with strategic decision-making, coordination, and execution of our crisis management efforts.

Team Member Role | Responsibilities |

Chief Financial Officer (CFO) | Lead the team, oversee financial assessments, manage budgeting and cash flow, coordinate with external financial entities. |

Chief Operating Officer (COO) | Implement operational changes, ensure continuity of critical operations, manage supply chain and logistics. |

Legal Counsel | Advise on legal and compliance matters, manage contractual risks, handle litigation issues. |

Head of Communications | Manage internal and external communications, maintain stakeholder relations, oversee media interactions. |

Chief Human Resources Officer (CHRO) | Address workforce-related concerns, plan staffing changes, oversee employee communication and welfare programs. |

Head of Information Technology (IT) | Ensure the reliability and security of IT systems, support remote operations, manage technological solutions. |

Risk Management Officer | Identify and assess ongoing risks, develop risk mitigation strategies, conduct regular risk reviews. |

Stakeholder Communication Plan

Effective communication is crucial in managing a financial crisis, ensuring that all stakeholders are informed and engaged. Our plan outlines strategies for transparent and timely communication with our key stakeholders - employees, investors, creditors, customers, and suppliers - along with regular updates and feedback mechanisms to maintain trust and confidence.

Stakeholder | Strategy | Frequency & Method |

Employees | Detailed briefings on the current situation and ongoing changes; open Q&A sessions to address concerns. | Weekly updates via email, intranet, and town hall meetings. |

Investors | Comprehensive updates on financial status, restructuring efforts, and future outlook; dedicated investor calls. | Quarterly reports and conference calls; immediate notifications for major developments. |

Creditors | Direct communication on debt restructuring plans, repayment strategies, and financial health. | Monthly updates via email and conference calls; immediate notification of critical changes. |

Customers | Regular updates on how the crisis may impact service delivery; reassurances on quality and continuity. | Bi-weekly via email newsletters, company website, and direct communications for key clients. |

Suppliers | Notifications about changes in procurement strategies, payment terms, and ongoing requirements. | Monthly updates via email and dedicated supplier portal; ad-hoc communications for critical changes. |

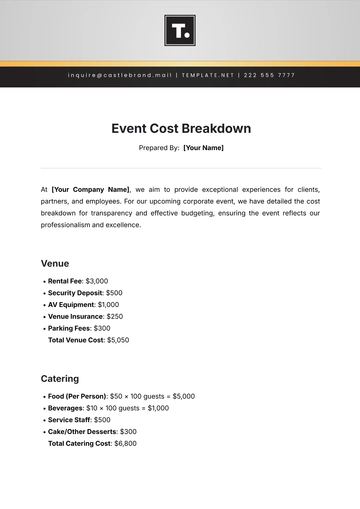

Cash Flow Management

In the face of a financial crisis, managing and preserving cash flow is of paramount importance. We are implementing immediate measures to control our cash flow effectively, including stringent reviews of our expenditures and the suspension of non-essential spending.

Immediate Measures

Expenditure Review and Control: Conduct a comprehensive audit of all current expenditures. Identify and eliminate or reduce non-essential and discretionary spending. Freeze hiring for non-critical roles and defer salary increases.

Optimization of Operational Expenses: Negotiate reduced operational costs, including utility expenses and lease payments. Implement energy-saving measures to lower utility costs. Review and optimize supply chain expenses.

Capital Expenditure (CapEx) Review: Postpone or cancel non-critical capital projects. Reassess ongoing capital expenditures for potential cost savings.

Inventory Management: Reduce inventory levels to free up cash, focusing on high-turnover items. Implement just-in-time inventory practices to minimize holding costs.

Strategies for Accelerating Receivables

Accounts Receivable Management: Implement stricter credit control policies to minimize overdue accounts. Offer incentives for early payment to customers. Expedite the invoicing process to ensure timely billing.

Negotiations with Customers: Engage with key customers to discuss and potentially renegotiate payment terms. Explore options for partial payments or installment plans where necessary.

Supplier and Creditor Payment Terms: Communicate with suppliers and creditors to renegotiate payment terms, extending payment cycles where possible. Prioritize payments based on the criticality of the supplier and potential for supply disruptions.

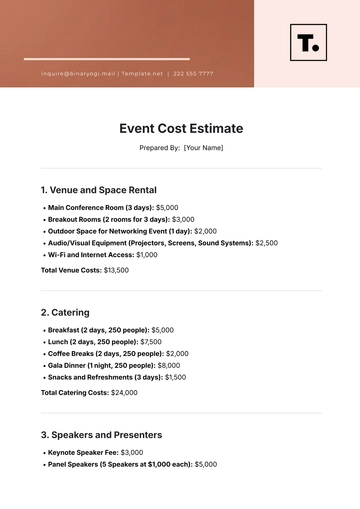

Cost Reduction Initiatives

In response to the financial crisis, we are prioritizing rapid cost-cutting measures that aim to reduce expenses without jeopardizing our critical business operations. These initiatives are designed to streamline our operations and reduce overheads, ensuring we remain financially resilient.

Area | Initiative | Expected Impact |

Workforce Adjustments | Implement a temporary hiring freeze. Reduction in part-time and contract staff. | Reduce payroll expenses while retaining essential personnel. |

Salary and Wage Management | Temporary salary reductions for executive team. Delayed bonuses and pay raises. | Lower immediate payroll costs, with minimal impact on core workforce. |

Non-Essential Spending | Suspend all non-essential travel and entertainment expenses. | Immediate reduction in discretionary spending. |

Marketing and Advertising | Reduce marketing and advertising budgets, focusing on cost-effective strategies. | Maintain market presence while significantly reducing costs. |

Operational Efficiencies | Consolidate office spaces, reduce utility costs, and optimize supply chain management. | Decrease operational overheads without impacting productivity. |

Outsourcing and Contract Services | Review and potentially reduce outsourced services and contracts. | Cut down on external spending where internal capabilities exist. |

Revenue Projection and Enhancement

As part of our strategy to navigate through the financial crisis, it's essential to not only protect our existing revenue streams but also to explore avenues for revenue enhancement. This includes implementing customer retention strategies and identifying new opportunities for growth, all while ensuring we prioritize our most profitable product lines and services.

Strategies

Enhance Customer Engagement and Retention: Strengthen relationships with existing customers through personalized communication and loyalty programs. Implement feedback mechanisms to understand customer needs and improve satisfaction.

Expand Online and Digital Sales Platforms: Leverage e-commerce and digital channels to increase sales, especially in response to changing consumer behaviors.

Diversify into New Markets or Segments: Identify and enter new market segments where our products or services could meet untapped demand.

Innovate Product Offerings: Develop new products or enhance existing ones to meet evolving market needs and generate new revenue streams.

Evaluation and Prioritization

Line | Evaluation Criteria | Strategic Action |

Core Product Line A | High profitability, strong market demand | Increase investment and marketing efforts. |

Service Line B | Moderate profitability, loyal customer base | Enhance service offerings, focus on customer retention. |

Product Line C | Low profitability, declining demand | Consider discontinuing or restructuring for cost savings. |

Emerging Product D | Growing demand, potential for high profitability | Allocate resources for development and market penetration. |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Financial Cost Crisis Management Protocol Template from Template.net is designed to navigate financial emergencies effectively. Editable and customizable in our AI Editor tool, this template serves as a guide for establishing protocols during financial crises. It ensures preparedness and strategic response, providing a structured approach to managing and mitigating financial challenges. Essential for maintaining stability in turbulent financial periods.