Free Financial Cost Sustainability Study

Introduction

The primary objective of this study is to comprehensively evaluate and analyze our organization's current financial practices with an emphasis on long-term sustainability. The scope includes assessing our revenue streams, cost structures, funding strategies, and overall financial health. The intention is to identify opportunities for improvement, mitigate risks, and ensure that our financial operations are aligned with our strategic goals for sustainable growth and resilience in the face of market fluctuations and economic changes.

Background Information

We are an organization that has been operational for over a decade, primarily engaged in the technology sector with a focus on developing innovative software solutions. Over the years, we have expanded our operations across multiple countries and diversified our product offerings to cater to a growing global customer base. Last fiscal year, our reported revenue was $150 million, with a net profit margin of approximately 12%. Our operational model has been heavily reliant on both direct sales and subscription-based services, contributing 60% and 40% to our revenue respectively.

Historically, our investment in research and development (R&D) has been substantial, accounting for about 15% of our annual revenue, which has been pivotal in maintaining our competitive edge. However, this has also led to significant operational costs, with R&D and personnel expenses comprising the largest portions of our expenditures.

In recent years, we have observed shifts in the market and technological advancements that necessitate a re-evaluation of our financial strategies to ensure sustainability. The evolving landscape of digital technology, increasing competition, and changing consumer preferences are driving us to scrutinize our financial practices more closely. This study aims to address these challenges and chart a course for a financially sustainable future that aligns with our core values and business objectives.

Financial Analysis

In this section, we provide a thorough analysis of our financial situation, focusing on our revenue streams, cost structure, and break-even analysis.

Revenue Streams

Our revenue is primarily generated from four key streams: Direct Sales, Subscription Services, Licensing, and Consulting Services. The following table presents last year's revenue from each stream along with the projected growth.

Revenue Stream | Last Year Revenue | Projected Growth |

Direct Sales | $90 million | 5% |

Subscription Services | $60 million | 10% |

Licensing | $10 million | 15% |

Consulting Services | $5 million | 20% |

Our largest revenue source is Direct Sales, contributing significantly to our financial strength. However, the fastest-growing segment is Consulting Services, expected to grow by 20% due to increasing demand for specialized expertise. Subscription Services, offering a recurring revenue model, is anticipated to grow by 10%, underlining the shift towards sustainable income streams.

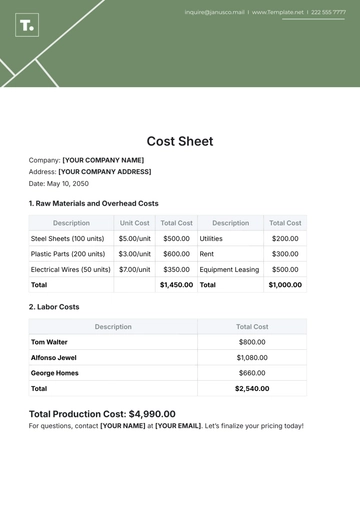

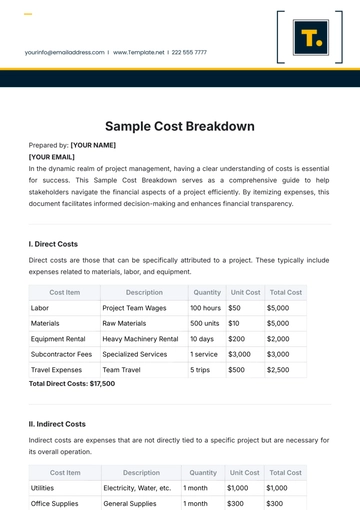

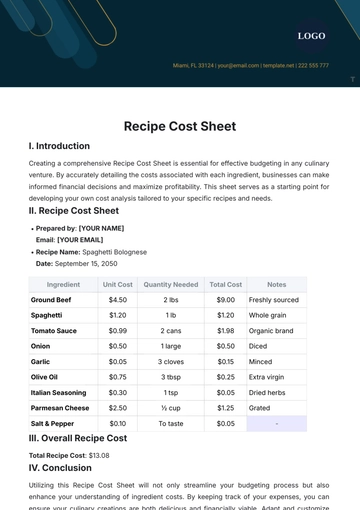

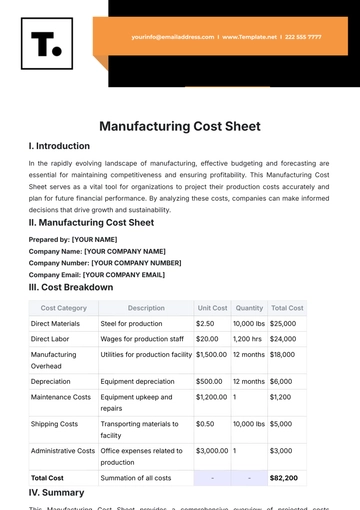

Cost Analysis

Our expenses are categorized into five major areas: R&D, Personnel, Marketing, Operational, and Administrative. The table below outlines the costs incurred last year and the projected changes for the upcoming year.

Cost Category | Last Year Costs | Projected Change |

R&D | $22.5 million | +10% |

Personnel | $45 million | +5% |

Marketing | $15 million | +8% |

Operational | $30 million | +3% |

Administrative | $10 million | +2% |

The largest expenditure is in Personnel, accounting for a significant portion of our costs. R&D expenses, crucial for our growth and innovation, are projected to increase by 10%, reflecting our commitment to staying at the forefront of technology. Operational costs, being a considerable part of our expenses, are managed efficiently with a modest increase of 3%.

Break-even Analysis

Our break-even point is calculated based on the above revenue and cost projections. Last year, our break-even point was achieved at $122.5 million in revenue, which accounted for the majority of our fixed and variable costs. With the projected increase in both revenue and expenses, our new break-even point for the upcoming year is estimated to be around $130 million. This figure represents the minimum revenue required to cover all costs, beyond which we start generating profit.

This financial analysis indicates a positive trajectory in revenue growth, especially in the areas of Subscription Services and Consulting. However, the increase in R&D and Personnel costs will require careful management to maintain profitability. Our break-even analysis suggests that we are well-positioned to not only cover our costs but also to generate substantial profit, provided we continue to manage our resources effectively.

Sustainability Assessment

In this crucial section, we assess the long-term viability of our organization, examining the potential risks we face and exploring various financial scenarios to ensure our operations and services are sustainable over time.

Long-term Viability

Our long-term viability hinges on maintaining a balance between continuous innovation, market adaptability, and prudent financial management. With our current revenue streams showing positive growth trends and our cost management strategies in place, we are well-positioned to sustain and expand our operations. Ongoing investments in R&D and market expansion initiatives are key to adapting to changing technological and market landscapes, ensuring our relevance and competitiveness.

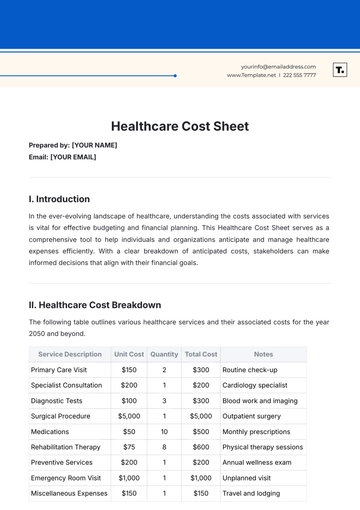

Risk Analysis

We have identified several key financial risks and their potential impacts, along with strategies to mitigate them. The following table outlines these risks:

Risk Factor | Potential Impact | Mitigation Strategies |

Market Volatility | High | Diversifying product offerings |

Technological Disruption | Medium | Continual investment in R&D |

Regulatory Changes | Medium | Regular compliance audits |

Economic Downturn | High | Building a strong financial reserve |

Competitive Pressure | High | Market analysis and agile strategy adaptation |

Market volatility and competitive pressure are identified as high-impact risks. We plan to mitigate these through product diversification and agile strategic adaptations. Technological disruptions and regulatory changes, though with medium impact, are addressed through continual R&D investment and compliance audits. Preparing for economic downturns involves building a robust financial reserve to cushion against unforeseen financial challenges.

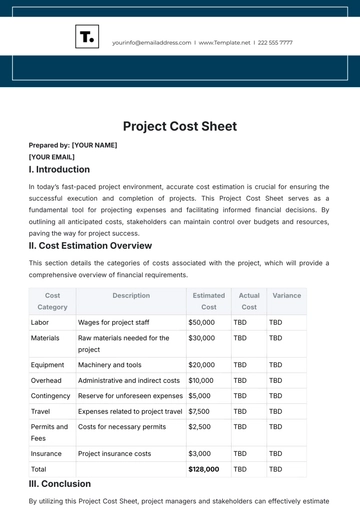

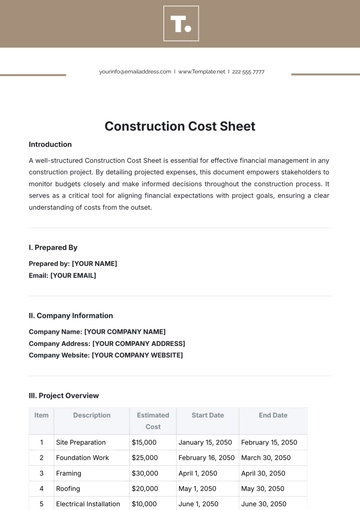

Scenario Planning

To further assess our financial resilience, we have developed three financial scenarios - Optimistic, Realistic, and Pessimistic. Each scenario includes projected revenue, expenses, and net profit or loss.

Scenario | Revenue Forecast | Expense Forecast | Net Profit/Loss |

Optimistic | $250 million | $180 million | +$70 million |

Realistic | $220 million | $200 million | +$20 million |

Pessimistic | $190 million | $220 million | -$30 million |

In the Optimistic scenario, we project significant growth in revenue with controlled expenses, resulting in a substantial profit. The Realistic scenario, likely the most probable, shows moderate growth with manageable expenses. The Pessimistic scenario, while unlikely, prepares us for a situation of reduced revenue and increased expenses, leading to a potential loss. These scenarios help us in planning for diverse financial situations, ensuring preparedness for various market conditions.

Funding Strategies

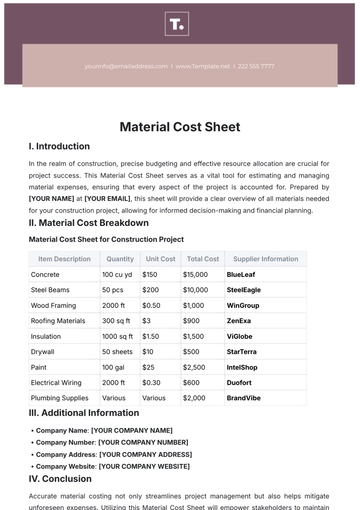

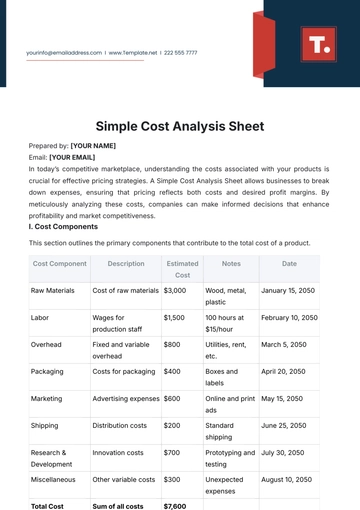

This section of our Financial Cost Sustainability Study is dedicated to analyzing our funding strategies, which are critical for ensuring the financial health and sustainability of our operations.

Current Funding Sources

Our organization's existing funding sources vary in terms of amount and stability. The following table presents a summary of these sources:

Funding Source | Amount | Stability |

Equity Financing | $50 million | High |

Bank Loans | $30 million | Medium |

Venture Capital | $20 million | Medium |

Government Grants | $5 million | Low |

Equity financing forms the backbone of our funding, offering high stability with significant funding. Bank loans and venture capital provide substantial financial support but with moderate stability due to their contingent nature and potential fluctuations in terms. Government grants, while beneficial, offer limited funding with low stability, largely dependent on policy changes.

Potential Funding Opportunities

In exploring new or additional sources of funding, we have identified several potential opportunities, each with varying levels of accessibility and potential amounts. The table below outlines these opportunities:

Funding Opportunity | Potential Amount | Accessibility |

Crowdfunding | $5-10 million | Medium |

Angel Investors | $10-15 million | High |

Strategic Alliances | $15-20 million | Medium |

Public Offerings | $50+ million | High |

Crowdfunding and strategic alliances offer moderate levels of accessibility with significant potential amounts. Angel investors and public offerings, while more accessible, can provide higher amounts of funding. These opportunities can diversify our funding sources and provide financial leverage for future growth.

Investment Strategies

To support our financial sustainability, we recommend the following investment strategies:

Diversified Portfolio: Investing in a mix of stocks, bonds, and other securities to spread risk.

Technology Sector Investments: Allocating funds to emerging technology sectors that align with our business model.

Real Estate Investments: Investing in commercial real estate to generate steady rental income.

Sustainable and Responsible Investments (SRI): Focusing on investments that are socially and environmentally responsible.

Strategic Acquisitions: Acquiring smaller companies or startups to expand our market reach and capabilities.

Emergency Fund: Maintaining a reserve fund for unforeseen expenses and market downturns.

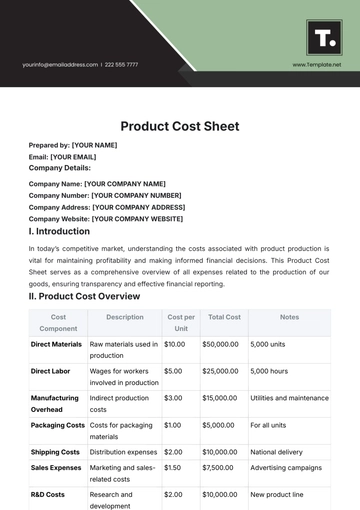

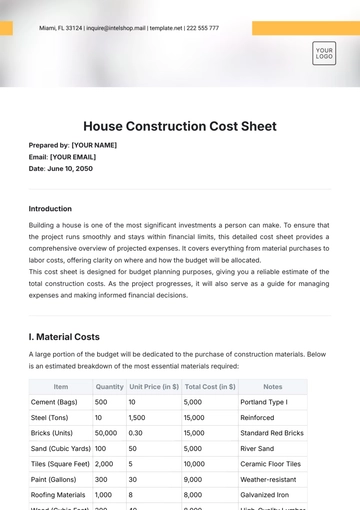

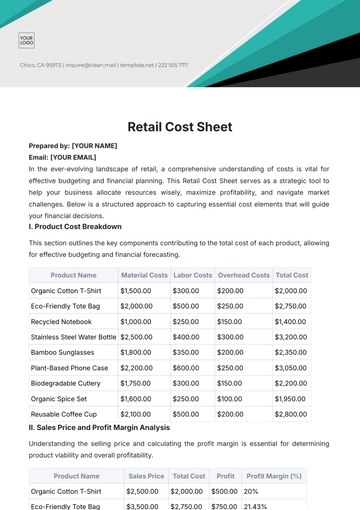

Cost Reduction Strategies

In this section, we focus on identifying and implementing strategies to reduce costs, which is a crucial aspect of our financial sustainability. These strategies are centered around efficiency measures and negotiation opportunities, both aimed at reducing operational expenses.

Efficiency Measures

We have identified several key areas where implementing efficiency measures can lead to significant cost savings. The table below details these measures, the expected savings, and the implementation timeframe:

Measure | Expected Savings | Implementation Timeframe |

Process Automation | $2 million annually | 1 year |

Energy Efficiency | $500,000 annually | 6 months |

Supply Chain Optimization | $1.5 million annually | 2 years |

Remote Work Policy | $750,000 annually | Immediate |

Process automation stands out as a major area for cost savings, with an expected reduction of $2 million annually, though it requires a year to implement fully. Energy efficiency measures and the implementation of a remote work policy can provide immediate to short-term cost benefits. Supply chain optimization, while taking longer to implement, can result in substantial savings.

Negotiation Opportunities

We also see potential for cost reductions through renegotiation of various contracts and terms. The following table summarizes these opportunities:

Negotiation Area | Potential Savings | Likelihood of Success |

Supplier Contracts | $1 million annually | High |

Lease Agreements | $300,000 annually | Medium |

Service Provider Contracts | $200,000 annually | Medium |

Technology Licensing | $400,000 annually | High |

Renegotiating supplier contracts and technology licensing agreements presents a high likelihood of success and can lead to significant annual savings. While renegotiating lease and service provider contracts may offer moderate savings, these are also important areas to explore for cost reduction.

Compliance and Regulatory Standards

In this section, we examine the various financial regulations and compliance requirements that are relevant to our operations. Adherence to these regulations is vital for maintaining legal and ethical standards, and for ensuring the long-term sustainability of our financial practices.

Relevant Financial Regulations and Compliance Requirements

Data Protection and Privacy Laws: Compliance with global data protection regulations like GDPR and CCPA.

Environmental Regulations: Adherence to environmental laws and standards, especially in operations that have a significant environmental impact.

Labor Laws: Ensuring fair labor practices and compliance with national and international labor standards.

Taxation and Financial Reporting Standards: Following accurate and ethical financial reporting and tax compliance practices.

Anti-Money Laundering (AML) and Anti-Corruption Laws: Compliance with AML regulations and anti-corruption practices.

Impact of Regulatory Changes

Regulatory landscapes are constantly evolving, and changes in these regulations can significantly impact our financial sustainability. The following table outlines this impact:

Regulation | Current Impact | Potential Changes Impact |

Data Protection Laws | Moderate | High |

Environmental Regulations | High | Very High |

Labor Laws | Moderate | High |

Taxation Policies | High | Moderate |

Changes in environmental regulations and data protection laws are likely to have the highest impact on our operations. Environmental regulations are becoming increasingly stringent, requiring greater investment in sustainable practices. Similarly, evolving data protection laws may necessitate significant updates to our data handling and security protocols.

ESG Considerations

We recognize the growing importance of Environmental, Social, and Governance (ESG) factors in determining our organization's long-term success and sustainability. In this context, we analyze how ESG factors impact our financial sustainability and provide recommendations for integrating sustainable practices.

ESG Impact

The impact of ESG factors on our financial sustainability is summarized in the table below:

ESG Factor | Current Impact | Future Impact Projection |

Environmental Sustainability | Moderate | High |

Social Responsibility | High | Very High |

Corporate Governance | High | High |

Social responsibility and corporate governance currently have a high impact on our financial sustainability, and this is projected to increase in the future. Environmental sustainability, while currently having a moderate impact, is expected to become more significant. These factors are crucial in shaping our reputation, customer relationships, and operational efficiency.

Sustainable Practices Recommendations

Green Operations: Implementing energy-efficient technologies and reducing carbon footprint in our operations.

Community Engagement: Actively participating in community development and social welfare projects.

Ethical Business Practices: Upholding high standards of ethics and integrity in all business dealings.

Transparent Reporting: Maintaining transparency in financial and operational reporting.

Stakeholder Involvement: Engaging with stakeholders to understand and address their concerns related to ESG.

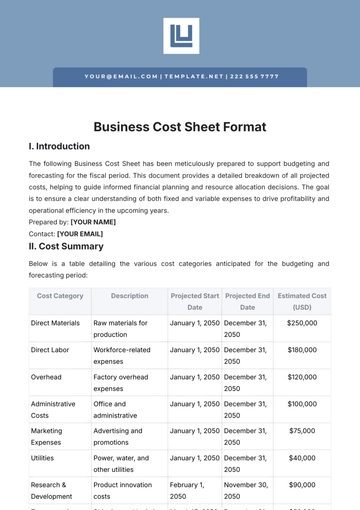

Recommendations and Action Plan

This section outlines specific recommendations for enhancing our financial sustainability, followed by a detailed action plan with timelines for implementing these recommendations.

Recommendations

Adopt Advanced Process Automation: To increase operational efficiency and reduce costs.

Strategic Market Expansion: To tap into new revenue streams and diversify our market presence.

Investment in Renewable Energy: To reduce energy costs and support environmental sustainability.

Strengthen Data Security Protocols: To safeguard against data breaches and comply with data protection regulations.

Innovation in Product Development: To stay competitive and meet evolving market demands.

Promote Remote Work Options: To reduce overhead costs and enhance employee productivity.

Action Plan

The following table provides a roadmap with timelines for implementing these recommendations, specifying the responsible departments:

Recommendation | Implementation Timeline | Responsible Department |

Implement Process Automation | Q2-Q4 2084 | Operations |

Expand into New Markets | Q3 2084 - Q2 2085 | Sales and Marketing |

Invest in Renewable Energy | Q1-Q3 2085 | Facilities |

Enhance Data Security Measures | Q4 2084 | IT |

Develop New Product Lines | Q2 2085 - Q1 2086 | R&D |

Increase Remote Work Options | Immediate - Q1 2085 | Human Resources |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Financial Cost Sustainability Study Template from Template.net is essential for assessing long-term financial viability. Editable and customizable in our AI Editor tool, this template aids in conducting thorough studies on cost sustainability, providing insights into financial practices and their future impact. It is ideal for businesses seeking to balance profitability with sustainable financial management, fostering responsible and enduring financial strategies.