Free Financial Risk Management Meeting Minute

Meeting Minute

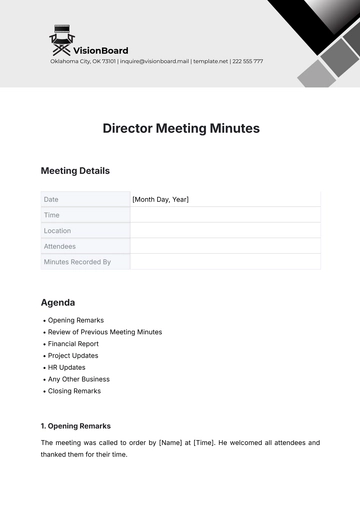

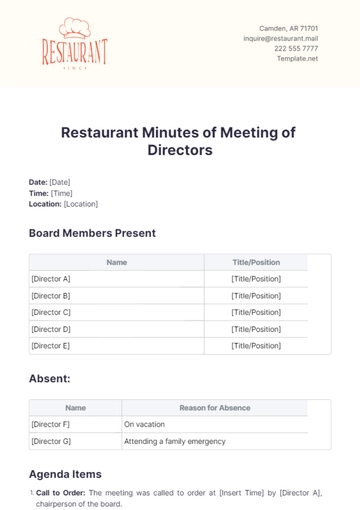

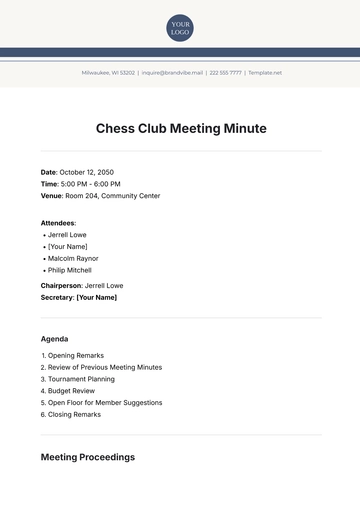

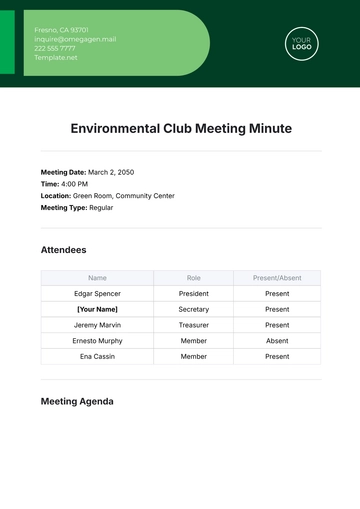

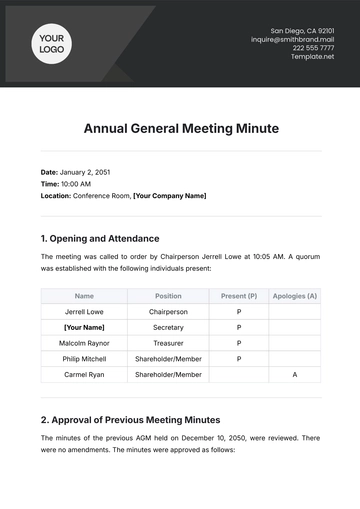

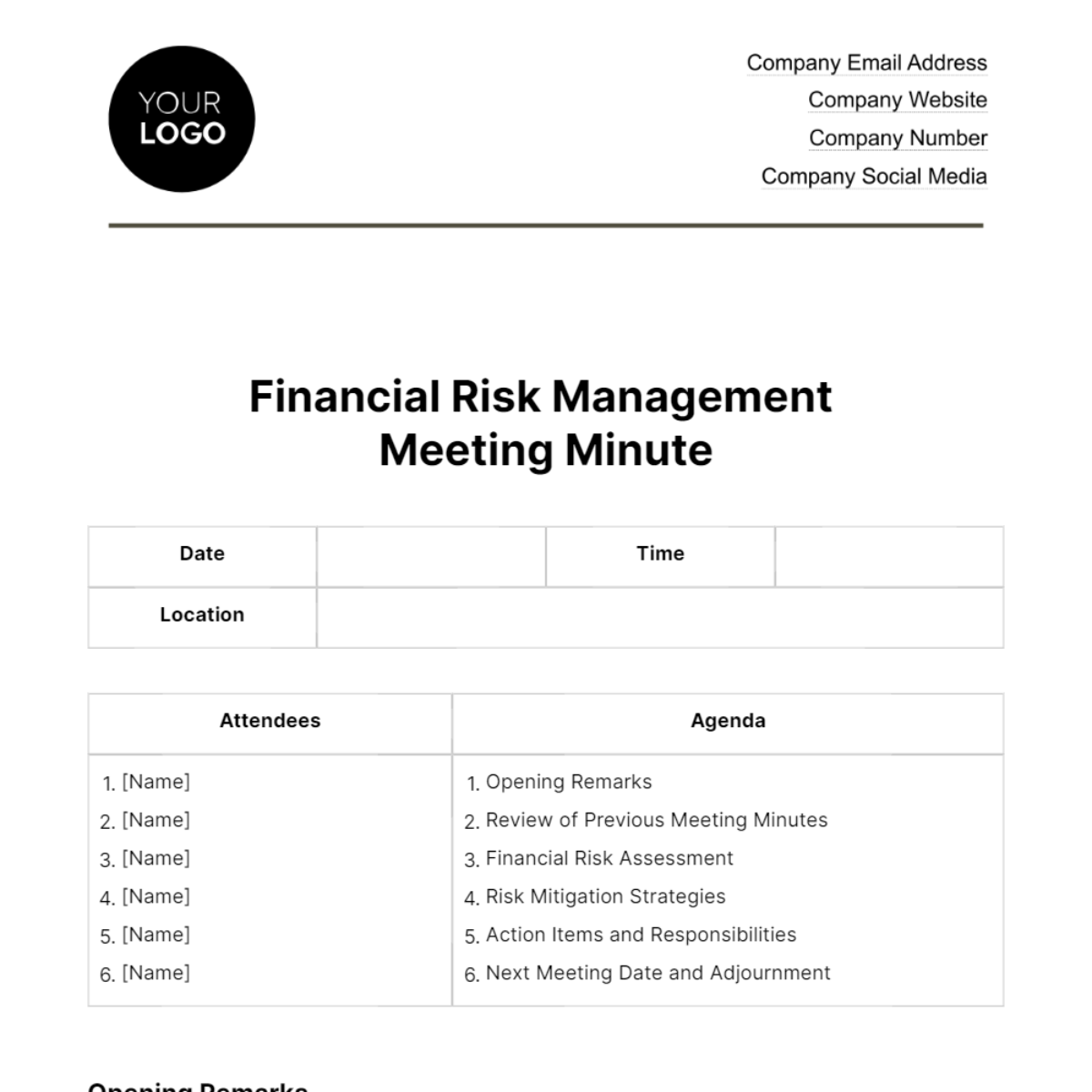

Date | Time | ||

Location | |||

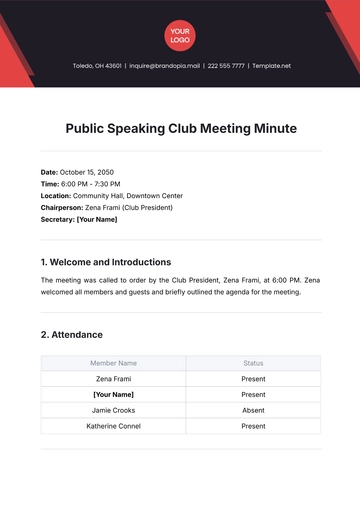

Attendees | Agenda |

|

|

Opening Remarks

The meeting was called to order by [Chairperson's Name] at [Time]. [Chairperson's Name] welcomed all attendees and provided an overview of the meeting agenda.

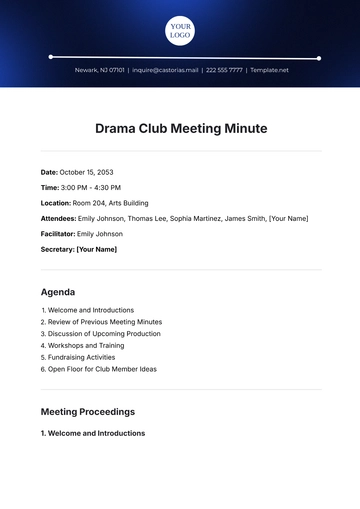

Review of Previous Meeting Minutes

The minutes of the previous Financial Risk Management meeting held on [Date] were reviewed. The minutes were approved without any changes.

Financial Risk Assessment

The following urgent financial risks were identified and discussed:

Currency Risk: There is an urgent concern regarding fluctuations in currency exchange rates, which could have a significant impact on our international operations and financial performance.

Counterparty Default Risk: The increased likelihood of counterparty default poses an immediate risk to our financial stability, particularly with certain business partners.

IT System Risk: The vulnerability of our IT systems to failures and cybersecurity threats is an urgent concern that requires immediate attention.

Regulatory Compliance: Non-compliance with certain regulatory requirements has been identified as an urgent risk that may result in penalties and reputational damage.

Risk Mitigation Strategies

Based on the urgent financial risks highlighted above, the following risk mitigation strategies have been recommended:

Currency Risk Mitigation: Implement currency hedging strategies to minimize the impact of currency fluctuations. Monitor foreign exchange markets regularly.

Counterparty Default Risk Mitigation: Review and assess the creditworthiness of high-risk counterparties and consider reducing exposure or implementing stricter credit terms.

IT System Risk Mitigation: Enhance cybersecurity measures, conduct a comprehensive IT risk assessment, and implement necessary upgrades and safeguards.

Regulatory Compliance Mitigation: Conduct an immediate review of compliance policies and procedures, address identified gaps, and ensure timely reporting and adherence to regulatory requirements.

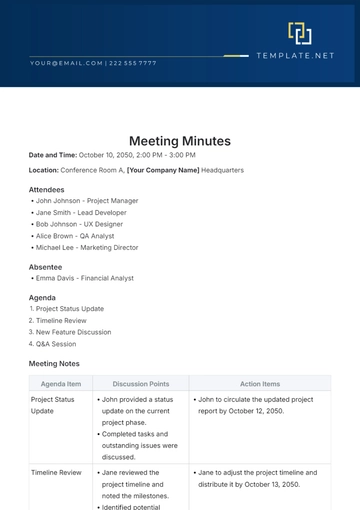

Action Items and Responsibilities

Action Item | Responsible Person(s) | Deadline |

Implement currency hedging | [Date] | |

Review credit exposure | [Date] | |

Enhance cybersecurity | [Date] | |

Update compliance policies | [Date] |

Next Meeting Date and Adjournment

The next Financial Risk Management meeting is scheduled for [Date] at [Time] in [Location]. The meeting was adjourned at [Time].

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Maximize the efficiency of your risk management meetings with the Financial Risk Management Meeting Minute Template from Template.net. This template is expertly crafted to be fully editable and customizable in our AI Editor tool, enabling you to accurately record and track financial risk management decisions and actions. Essential for ensuring detailed and effective minute-taking during critical financial risk discussions.