Free Financial Expense Review

Executive Summary

A. Overview

The Financial Expense Review provides a comprehensive analysis of [Your Company Name]'s financial health over Q2 2050, revealing a concerning increase in operating expenses, particularly in the salaries and utilities categories, with operating expenses totaling [$5,000,000]. This calls for strategic measures to maintain fiscal stability.

Introduction

A. Purpose

The primary goal of this review is to assess the financial performance, identify areas of concern, and propose strategies for cost reduction and operational efficiency improvement. The insights gained will guide [Your Company Name] in making informed financial decisions.

B. Scope

This review encompasses Q2 2050, focusing on operating and capital expenses across all departments, with operating expenses representing a [15]% increase from the previous quarter. A detailed examination of these areas will provide a holistic understanding of the financial landscape.

Methodology

A. Data Collection

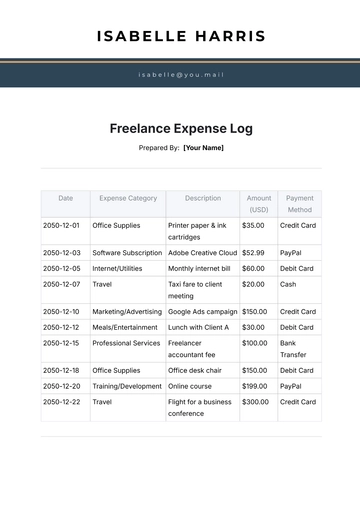

Financial data, including income statements and expense reports, was collected from internal accounting records. External sources, such as market trends, were also considered for a comprehensive analysis. Rigorous data collection methods ensure the accuracy of our findings.

B. Analysis

Statistical tools and financial ratios were employed to analyze the data, comparing Q2 2050 with the previous quarter. This approach unveiled trends and potential areas for improvement, allowing for data-driven decision-making.

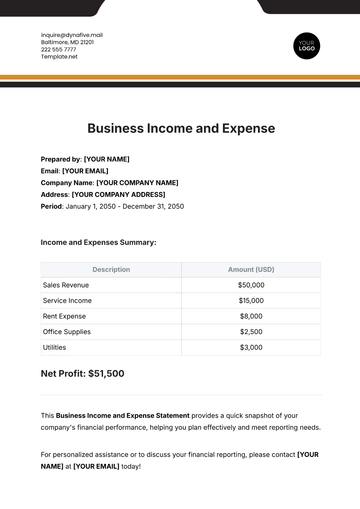

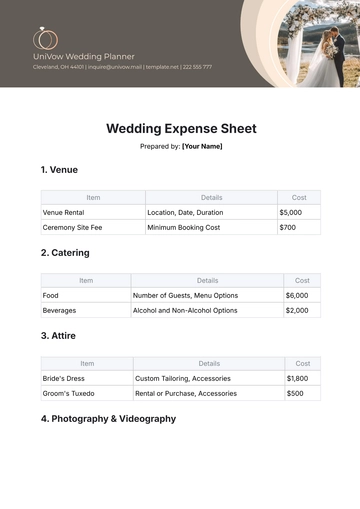

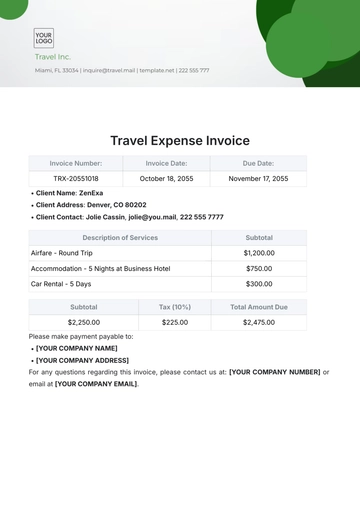

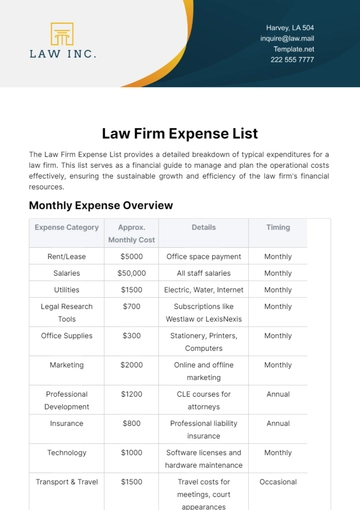

Expense Categories

A. Operating Expenses

Operating expenses during Q2 2050 amounted to [$6,500,000], marking a [20]% increase from Q1 2050. The surge is mainly attributed to increased project demands, resulting in additional staff hires and higher utility costs.

B. Salaries

Salaries accounted for [$3,000,000] of the operating expenses, reflecting a [15]% increase. This rise is primarily due to the hiring of additional staff members to meet increased project demands, indicating a need for strategic workforce planning.

C. Utilities

Utility expenses increased by [25]% due to a spike in energy prices. This section explores potential energy-saving initiatives for cost reduction, such as investing in renewable energy sources or optimizing energy consumption.

D. Capital Expenses

Capital expenditures totaled [$2,000,000], mainly driven by the acquisition of new machinery. This section evaluates the Return on Investment (ROI) of these investments and their impact on future capital budgets.

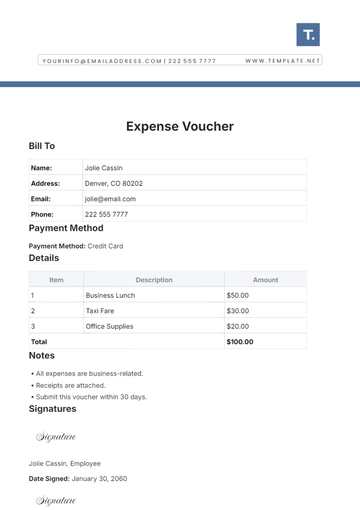

Budget vs. Actual

A. Budget Overview

The budgeted amounts for operating and capital expenses were [$5,800,000] and [$2,100,000], respectively. This budget overview provides a baseline for evaluating financial performance.

B. Variance Analysis

Actual operating expenses exceeded the budget by [10]%, primarily due to unforeseen salary increases. Capital expenses aligned closely with the budget, signaling effective cost management in this area. Variance analysis is crucial for identifying areas requiring immediate attention.

Recommendations

A. Cost Reduction Strategies

To address the increased operating expenses, we recommend renegotiating supplier contracts and implementing a hiring freeze until project demands stabilize. These strategies aim to bring operating costs in line with budgeted amounts.

B. Efficiency Improvements

Proposed improvements include streamlining internal processes and investing in energy-efficient technologies to mitigate utility cost increases. Implementing these efficiency improvements will contribute to long-term cost savings and sustainability.

Future Projections

A. Forecast

Based on the current trends and proposed changes, we forecast operating expenses to decrease by [8]% in Q3 2050, resulting in substantial cost savings. Accurate forecasting ensures proactive financial management.

Conclusion

The Financial Expense Review outlines key areas of concern and provides actionable recommendations for cost reduction and operational efficiency improvement. It serves as a valuable guide for [Your Company Name] in navigating the financial landscape in the upcoming quarters. Continuous monitoring and implementation of recommendations will contribute to sustained financial health.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Efficiently review expenses with the Financial Expense Review Template on Template.net. This editable and customizable template simplifies the review process. Tailor content effortlessly using our Ai Editor Tool, ensuring adaptability and precision. Elevate your financial insights with this user-friendly template, offering a comprehensive approach to crafting personalized expense reviews for informed decision-making and strategic financial planning.