Free Financial Cost Efficiency Feasibility Study

Executive Summary

A. Key Findings

After a meticulous analysis of our financial landscape, several key findings have emerged:

Current revenue streams are primarily driven by product sales, contributing [$5 million] and services, contributing [$3 million].

Operating expenses, including direct and indirect costs, total [$8 million], necessitating a closer examination for potential optimization.

Process inefficiencies, particularly in manufacturing operations, have been identified as major cost contributors.

B. Recommendations

Based on the findings, the following recommendations are proposed:

Implement process optimization measures in manufacturing operations to reduce operational costs by [$1.5 million].

Integrate advanced technology solutions to automate order processing, resulting in an estimated annual savings of [$2 million].

Explore strategic partnerships with suppliers to leverage synergies and reduce procurement costs by [$1 million].

C. Potential Benefits

The implementation of these recommendations is anticipated to yield the following benefits:

A projected increase in annual profitability by [$2.5 million].

Enhanced operational efficiency leading to a reduction in overall costs by [$3.5 million].

Improved financial stability, positioning [Your Company Name] for sustained growth in the dynamic industry market.

D. Executive Decision Summary

To realize the potential benefits outlined, executive decisions should prioritize the following actions:

Allocate resources for immediate implementation of process optimization measures in manufacturing operations.

Initiate discussions with identified supplier partners to explore collaboration opportunities and negotiate better terms.

Allocate a budget of [$1.5 million] for the acquisition and integration of technology solutions to automate order processing.

Introduction

A. Background

Our company, [Your Company Name], operates in the manufacturing sector, facing challenges in maintaining optimal cost efficiency amidst the evolving business landscape. The need for this feasibility study arises from increased competition, rising operational costs, and the imperative to adapt to industry trends. This study aims to provide a comprehensive assessment of our financial processes to identify potential areas for improvement.

B. Objectives

This study is designed to achieve the following objectives:

Assess the existing revenue and expenditure landscape to identify key financial drivers.

Pinpoint areas for potential cost savings and efficiency improvements.

Propose actionable recommendations for process optimization and technology integration.

Project the financial impact of implementing recommended measures on our company's overall performance and sustainability.

By addressing these objectives, we aim to enhance our financial sustainability and maintain a competitive edge in the dynamic manufacturing market.

Methodology

A. Data Collection

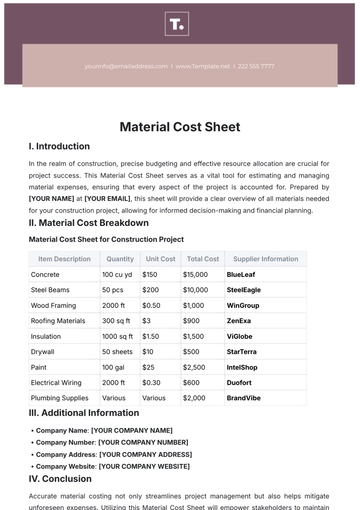

The data collection process involved a comprehensive approach to ensure a holistic understanding of the financial landscape. Internal financial records were gathered, including income statements, balance sheets, and cash flow statements from the last three fiscal years. Supplier invoices and procurement records were scrutinized to identify patterns and potential areas for cost optimization. Operational reports detailing production efficiency and resource utilization were also examined. To supplement internal data, external market research was conducted to benchmark our financial performance against industry standards.

Interviews were conducted with key stakeholders across departments to gain qualitative insights into the current financial processes and identify pain points. Department heads, procurement managers, and financial analysts were actively involved in providing valuable perspectives on existing challenges and opportunities.

B. Analysis Techniques

A combination of quantitative and qualitative analysis techniques was employed to derive meaningful insights.

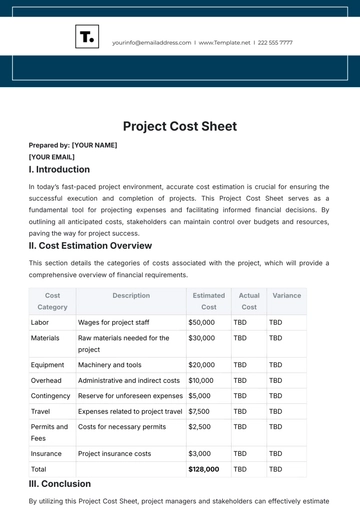

Cost-Benefit Analysis: This method was used to evaluate the potential benefits of proposed initiatives against their associated costs. It helped in prioritizing recommendations based on their anticipated return on investment.

Break-Even Analysis: By determining the point at which total revenue equals total costs, break-even analysis was instrumental in identifying thresholds for cost efficiency measures. This allowed for a clearer understanding of when initiatives would start generating positive returns.

Financial Modeling: Advanced financial modeling tools were utilized to simulate the impact of proposed measures on our company's financial performance over a specified timeframe. Sensitivity analysis was conducted to account for different scenarios and uncertainties.

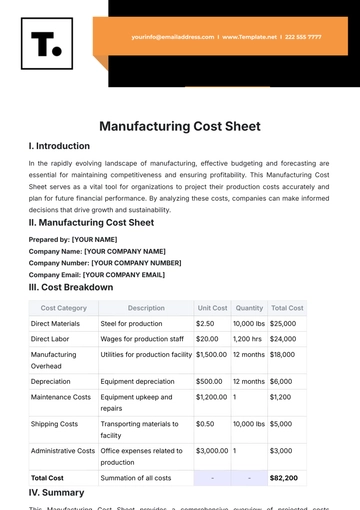

Current Financial Landscape

A. Revenue and Expenditure Analysis

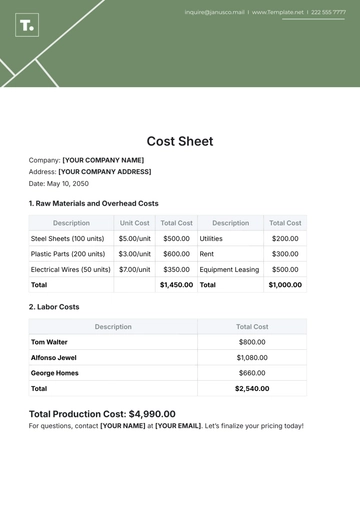

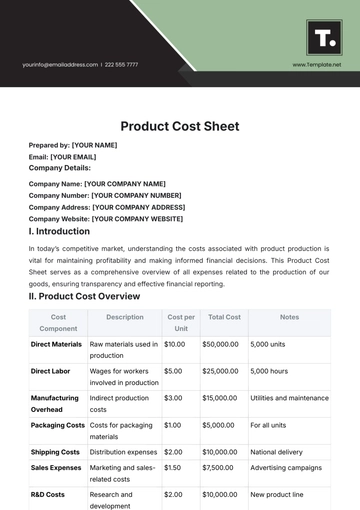

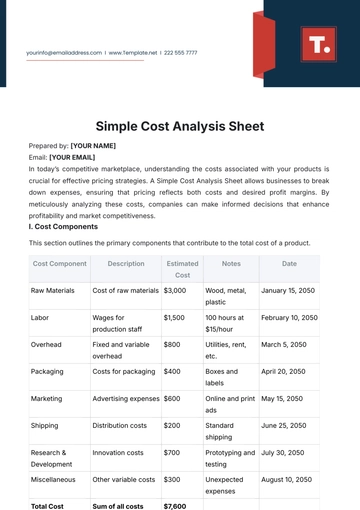

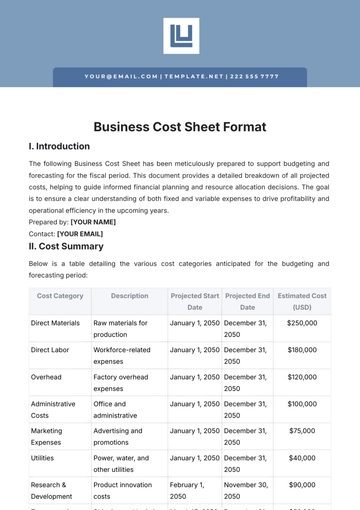

In the last fiscal year, our revenue composition demonstrated diversification. Product sales contributed [$5 million], services contributed [$3 million], and other income sources added [$1 million]. This breakdown provided a nuanced understanding of the revenue mix, allowing for strategic planning based on the performance of each segment.

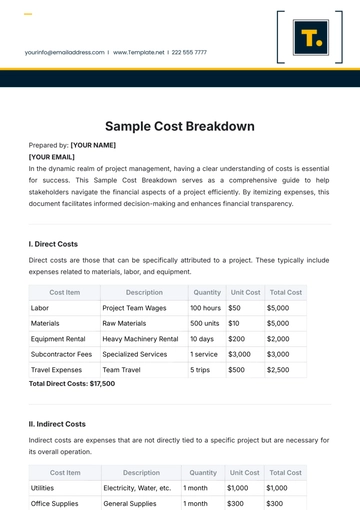

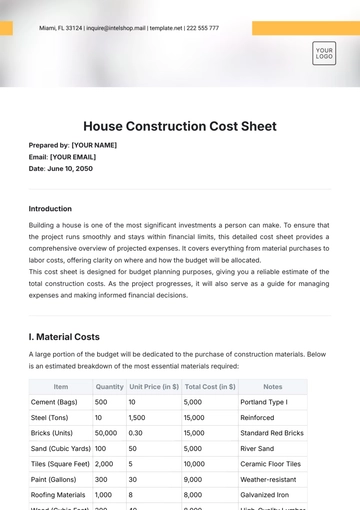

On the expenditure side, a detailed analysis was conducted to categorize costs effectively. Direct costs associated with production materials amounted to [$2 million], highlighting the financial impact of raw material expenses. Indirect costs, covering marketing and administrative expenses, totaled [$2 million]. Operating expenses, which encompass utilities and maintenance, accounted for [$2 million]. This granular breakdown facilitated a precise identification of cost drivers within each category.

Revenue Source | Amount |

|---|---|

Product Sales | [$5 million] |

B. Cost Structure

Understanding the detailed cost structure was pivotal in identifying areas for potential savings and efficiency gains. Direct costs, mainly comprising production materials, were scrutinized to evaluate opportunities for cost optimization. Indirect costs, spanning marketing and administrative expenses, were analyzed for potential streamlining. Operating expenses, including utilities and maintenance, were assessed for possible efficiency improvements.

Cost Category | Amount |

|---|---|

Direct Costs | [$2 million] |

The granularity of this analysis sets the foundation for targeted recommendations and interventions in subsequent sections of the study.

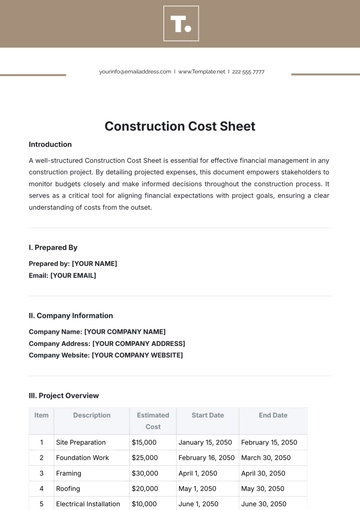

Cost Efficiency Opportunities

A. Process Optimization

After a thorough analysis of our current processes, specific opportunities for optimization within manufacturing operations have been identified.

Supply Chain Streamlining: By implementing just-in-time inventory management and negotiating favorable terms with key suppliers identified during the supplier partnership exploration, we estimate potential savings of [$1 million]. This involves reducing excess inventory holding costs and minimizing stockouts.

Production Line Automation: Investing [$1.5 million] in advanced automation technologies for certain production processes will not only enhance efficiency but also reduce labor costs over time. The estimated annual savings from this initiative are projected to be [$0.8 million].

Energy Efficiency Initiatives: Implementing energy-efficient technologies and practices in our manufacturing facilities is anticipated to result in annual cost savings of [$0.7 million]. This involves upgrading equipment, optimizing energy consumption, and potentially exploring renewable energy sources.

B. Technology Integration

The integration of advanced technologies plays a pivotal role in achieving cost efficiency across various functions.

Automated Order Processing System: Implementing an automated order processing system is projected to reduce manual processing time by 50%, leading to an estimated annual savings of [$1.5 million]. This involves the adoption of a sophisticated software solution that streamlines order management from placement to fulfillment.

Data Analytics for Decision-Making: Investing [$1 million] in data analytics tools will enhance our ability to make data-driven decisions, optimizing resource allocation and identifying additional cost-saving opportunities. The estimated annual savings from improved decision-making are projected to be [$0.5 million].

Financial Projections

A. Cost Savings Forecast

The projected cost savings resulting from the recommended measures are as follows:

Process Optimization: | [$1 million] |

Technology Integration: | [$2.5 million] |

These figures represent the anticipated annual savings after the full implementation of the proposed measures. The cumulative impact on our operating costs is estimated to be [$3.5 million] annually.

B. Return on Investment (ROI)

To assess the viability of proposed investments, the following ROI calculations have been made:

Automated Order Processing System: With an initial investment of [$1.5 million], the projected annual savings of [$1.5 million] result in a 100% ROI within the first year.

Production Line Automation: The initial investment of [$1.5 million] is expected to yield annual savings of [$0.8 million], resulting in an ROI of 53.3% in the first year.

Data Analytics Implementation: An investment of [$1 million] is estimated to bring annual savings of [$0.5 million], resulting in an ROI of 50% in the first year.

These calculations emphasize the financial feasibility and attractiveness of the proposed initiatives.

Recommendations

Based on the comprehensive analysis and projections, the following recommendations are presented for executive consideration:

A. Prioritize Process Optimization Initiatives

Implement Supply Chain Streamlining: Initiate discussions with identified suppliers to negotiate favorable terms and implement just-in-time inventory management. Allocate resources for this initiative, with an estimated investment of [$0.5 million], targeting a swift implementation within the next fiscal quarter.

Production Line Automation: Allocate [$1.5 million] for the phased implementation of advanced automation technologies within manufacturing operations. This includes upgrading specific production processes to enhance efficiency and reduce labor costs. Initiate this initiative within the next six months, with a projected completion timeline of 18 months.

Energy Efficiency Initiatives: Form a dedicated task force to identify and implement energy-efficient technologies within our manufacturing facilities. Allocate [$0.7 million] for equipment upgrades and the adoption of sustainable practices. Commence this initiative within the next quarter, with ongoing efforts to continually optimize energy consumption.

B. Accelerate Technology Integration

Automated Order Processing System: Allocate [$1.5 million] for the acquisition and integration of a sophisticated order processing system. Collaborate with a reputable technology vendor to ensure a seamless implementation within the next nine months.

Data Analytics Implementation: Allocate [$1 million] for the implementation of data analytics tools. Establish a cross-functional team to oversee the integration process and ensure alignment with our strategic objectives. Initiate this initiative within the next fiscal year.

Conclusion

In conclusion, the Financial Cost Efficiency Feasibility Study highlights significant opportunities for cost reduction and operational enhancement. The proposed recommendations, when implemented strategically, are projected to yield annual cost savings of [$3.5 million]. The return on investment for the proposed initiatives is compelling, with key projects demonstrating rapid payback periods.

These recommendations align with our company's objectives to enhance financial sustainability, improve operational efficiency, and position [Your Company Name] for sustained growth in the dynamic manufacturing market.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Evaluate cost efficiency effortlessly with the Financial Cost Efficiency Feasibility Study Template on Template.net. This editable and customizable template simplifies the study process. Tailor content effortlessly using our Ai Editor Tool, ensuring adaptability and precision. Elevate your financial decision-making with this user-friendly template, offering a comprehensive approach to crafting personalized feasibility studies for effective cost management assessment.