Free Accounting Asset Accounting Guide

Accounting Asset Accounting For [Your Company Name]

This comprehensive guide will enlighten you on all the essential facets of accounting asset management within your company. By adopting this integrated approach, not only will you streamline your accounting process, but undeniably enhance the robust nature of your brand.

Table of Contents

1. Introduction to Asset Accounting for [Your Company Name]

Overview of Asset Accounting at [Your Company Name]

Importance and Role in [Your Company Name]'s Financial Reporting

Legal and Regulatory Framework for [Your Company Name]

2. Types of Assets at [Your Company Name]

A. Definition and Classification of Assets in [Your Company Name]

B. Understanding Depreciation and Amortization at [Your Company Name]

C. Special Considerations for [Your Company Name]'s Asset Types

3. Asset Valuation and Recording for [Your Company Name]

A. Initial Recognition of Assets at [Your Company Name]

B. Subsequent Measurement and Impairment of Assets at [Your Company Name]

C. Accounting for Asset Disposals and Write-offs at [Your Company Name]

4. Depreciation Methods and Policies at [Your Company Name]

A. Straight-Line Depreciation at [Your Company Name]

B. Declining Balance Depreciation at [Your Company Name]

C. Reviewing and Changing Depreciation Methods at [Your Company Name]

5. Asset Management and Internal Controls at [Your Company Name]

A. Asset Tracking and Inventory Management at [Your Company Name]

B. Safeguarding Assets at [Your Company Name]

C. Internal Control Procedures for Asset Management at [Your Company Name]

6. Financial Reporting and Disclosure Requirements for [Your Company Name]

A. Preparing Asset-related Financial Statements for [Your Company Name]

B. Notes to Financial Statements for [Your Company Name]

C. Compliance with IFRS and GAAP at [Your Company Name]

7. Conclusion

1. Introduction to Asset Accounting for [Your Company Name]

Overview of Asset Accounting at [Your Company Name]

At [Your Company Name], asset accounting stands as a pivotal component of our financial management system. We meticulously track and manage our assets, encompassing acquisition, valuation, depreciation, and disposal processes. Our approach integrates industry-specific practices and adheres to global standards, ensuring precision in financial records. This meticulous attention to detail supports strategic planning, optimizes resource allocation, and fortifies our financial foundation, positioning [Your Company Name] for sustained growth and stability in the dynamic business landscape.

Importance and Role in [Your Company Name]'s Financial Reporting

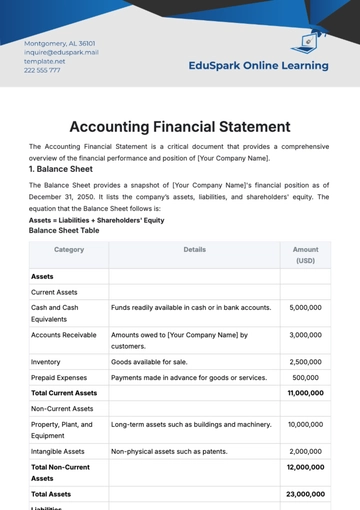

Asset accounting is the bedrock of [Your Company Name]'s financial integrity and reporting accuracy. Our methodical approach to asset management profoundly influences our balance sheets, income statements, and cash flow reports. These practices are pivotal in guiding key business decisions, managing risk, and optimizing operational efficiency. Through rigorous asset accounting, [Your Company Name] not only adheres to compliance standards but also harnesses financial data to drive strategic initiatives, bolster financial health, and secure competitive advantages in our industry.

Legal and Regulatory Framework for [Your Company Name]

At [Your Company Name], we navigate the complexities of the legal and regulatory framework governing asset accounting with a focus on compliance and strategic alignment. Adhering to IFRS and GAAP standards, we ensure our asset reporting, valuation, and disclosure practices are not only compliant but also strategically positioned to enhance financial transparency and investor confidence. This commitment to adhering to international standards is more than a regulatory mandate; it's a strategic approach that strengthens [Your Company Name]'s financial reporting, bolsters market credibility, and fosters trust among stakeholders.

2. Types of Assets at [Your Company Name]

In this essential section, we meticulously classify and manage the diverse assets of [Your Company Name], ensuring compliance and strategic alignment with our financial objectives. From tangible machinery to intangible intellectual property, each asset type receives bespoke treatment, reflecting its unique role in our financial ecosystem. We focus on the nuanced aspects of asset accounting, including depreciation, amortization, and special considerations, tailoring our approach to fit the distinct needs of our business operations.

A. Definition and Classification of Assets in [Your Company Name]

In [Your Company Name], asset classification is pivotal for accurate financial reporting and strategic decision-making. This section offers a detailed categorization of assets, distinguishing between current and non-current, tangible and intangible. Each type is meticulously defined with examples and specific accounting treatments, aligning perfectly with our business operations and regulatory requirements.

Asset Type | Classification | Examples | Accounting Treatment |

|---|---|---|---|

Current Assets | Short-term | Cash, Inventory | Recorded at lower of cost or net realizable value |

Non-Current Assets | Long-term | Real Estate, Machinery | Capitalized and depreciated/amortized over useful life |

Tangible Assets | Physical form | Buildings, Vehicles | Depreciated over useful life |

Intangible Assets | Non-physical form | Patents, Trademarks | Amortized over the period of benefit |

B. Understanding Depreciation and Amortization at [Your Company Name]

Depreciation and amortization play a critical role in the lifecycle management of [Your Company Name]'s assets. This segment explains our methods for tangible assets like machinery and intangible assets such as patents. It includes a comprehensive guide on selecting and applying appropriate depreciation and amortization techniques, ensuring our financial statements accurately reflect asset values and productivity.

Asset Category | Depreciation/Amortization Method | Use Case | Benefit |

|---|---|---|---|

Tangible Assets | Straight-Line Depreciation | Uniform usage, e.g., Furniture | Simple, consistent expense allocation |

Tangible Assets | Declining Balance Depreciation | High initial usage, e.g., Machinery | Higher expenses initially, decreasing over time |

Intangible Assets | Amortization | Software, Patents | Expense allocation over the period of economic benefit |

C. Special Considerations for [Your Company Name]'s Asset Types

[Your Company Name] recognizes the unique nature of certain assets that require specialized accounting treatments. This section focuses on such assets, including leased assets, goodwill, and intellectual properties, and outlines industry-specific valuation and depreciation methods. This approach is tailored to effectively manage our diverse asset portfolio, ensuring compliance and strategic alignment with [Your Company Name]'s business goals.

Special Asset Category | Consideration | Valuation Approach | Depreciation/Amortization Method |

|---|---|---|---|

Leased Assets | Lease type (Operating/Finance) | Based on lease agreement | Depreciate over the shorter of lease term or asset life |

Goodwill | Intangible, not amortized | Purchase Price - Fair Value of Net Assets | Impairment tests, not amortized |

Intellectual Properties | Varied economic benefits | Estimated future revenue | Amortize over estimated useful life |

3. Asset Valuation and Recording for [Your Company Name]

In this essential section, we delve into the processes of asset valuation and recording at [Your Company Name], encompassing initial recognition, subsequent measurement, and the intricacies of asset disposals and write-offs. Each aspect is tailored to align with our business practices and accounting standards, ensuring that our asset management is not only compliant but also strategically sound and reflective of our operational reality.

A. Initial Recognition of Assets at [Your Company Name]

At [Your Company Name], initial asset recognition is more than a mere entry into our books; it's the start of an asset's financial journey. We evaluate each asset for its expected contribution to our operations, considering factors like usability, location, and expected life span. This initial assessment is not just about cost but also about understanding how the asset fits into our broader financial strategy. Additionally, we consider any potential future obligations associated with the asset, such as maintenance costs, to ensure a comprehensive evaluation of its overall impact on our financial statements.

Furthermore, our approach to initial recognition also involves a detailed examination of purchase agreements and other acquisition-related documents. This scrutiny helps us identify any hidden costs or liabilities that might affect the asset's value. By adopting this rigorous methodology, we ensure that each asset is not only recorded accurately but also reflects its true value to [Your Company Name], thereby fortifying our financial reporting and strategic planning.

B. Subsequent Measurement and Impairment of Assets at [Your Company Name]

In the dynamic environment of [Your Company Name], we recognize that the value of an asset can fluctuate due to various factors such as market conditions, technological advancements, or changes in use. Therefore, our process for subsequent measurement involves regular reviews of asset values, adjusting for depreciation, and reassessing the remaining useful life. This ongoing evaluation ensures that our financial statements accurately reflect the current status of our assets, allowing for more informed financial planning and analysis.

Moreover, our impairment testing process is thorough and proactive. We monitor market trends and internal usage data to identify early signs of asset impairment. If an asset’s recoverable amount falls below its carrying amount, we promptly recognize an impairment loss, ensuring that our financial statements do not overstate the value of our assets. This proactive approach to asset valuation safeguards [Your Company Name] against financial misrepresentation and aligns our accounting practices with the reality of our operational environment.

C. Accounting for Asset Disposals and Write-offs at [Your Company Name]

When it comes to disposing of or writing off assets, [Your Company Name] follows a structured approach to ensure financial accuracy and transparency. We meticulously document the rationale for disposal or write-off, considering factors like obsolescence, damage, or strategic realignment. This detailed record-keeping aids in understanding the asset lifecycle and informs future asset acquisition decisions.

Additionally, our team collaborates closely with other departments to synchronize asset disposal with operational changes. This collaboration ensures that the disposal or write-off of an asset is not just an accounting exercise but a strategic decision aligned with our overall business objectives. We also engage in post-disposal analysis to assess the financial impact and glean insights for future asset management strategies. Through this holistic approach, [Your Company Name] ensures that asset disposals and write-offs are not only compliant with accounting standards but also add value to our business operations and long-term strategic goals.

4. Depreciation Methods and Policies at [Your Company Name]

In this crucial section, [Your Company Name] delves into the various depreciation methods and policies that govern the accounting of our tangible assets. Understanding and applying the right depreciation method - be it straight-line or declining balance - is vital for accurate financial reporting and asset management. Additionally, we address the considerations and procedures involved in reviewing and potentially changing these methods, ensuring our practices remain aligned with our business's evolving needs.

A. Straight-Line Depreciation at [Your Company Name]

At [Your Company Name], the straight-line depreciation method is integral to our asset management. It offers a consistent, predictable annual expense, ideal for assets with uniform usage over their lifespan. This section presents a detailed breakdown of our straight-line depreciation approach, including computation formulas and illustrative examples for different asset types.

Asset Type | Initial Cost | Residual Value | Useful Life (Years) | Annual Depreciation Expense |

|---|---|---|---|---|

Office Furniture | $10,000 | $1,000 | 10 | $900 |

Company Building | $500,000 | $50,000 | 30 | $15,000 |

Computers | $5,000 | $500 | 5 | $900 |

Key Points:

Consistent expense allocation over the asset's useful life.

Simplifies financial planning and budgeting.

Ideal for assets with steady usage patterns.

B. Declining Balance Depreciation at [Your Company Name]

The declining balance method at [Your Company Name] is tailored for assets that incur higher wear and tear initially. This section elucidates how we apply this method, providing details on depreciation rates and examples for relevant assets, ensuring accurate reflection of their usage and value.

Asset Type | Initial Cost | Depreciation Rate | Year 1 Expense | Year 2 Expense | Year 3 Expense |

|---|---|---|---|---|---|

High-Tech Machinery | $20,000 | 30% | $6,000 | $4,200 | $2,940 |

Vehicles | $25,000 | 25% | $6,250 | $4,687.5 | $3,515.63 |

Key Points:

Accelerated depreciation in initial years.

Suited for assets with higher early use or technological obsolescence.

Adjusts expense to match asset productivity.

C. Reviewing and Changing Depreciation Methods at [Your Company Name]

[Your Company Name] embraces flexibility in its depreciation strategies. This segment discusses when and how we review and potentially modify depreciation methods, ensuring they stay relevant and compliant.

Reason for Review | Procedure | Implications | Example |

|---|---|---|---|

Change in Asset Usage | Assess new usage patterns, calculate revised depreciation | Update financial statements, communicate changes to stakeholders | Machinery repurposed for different production line |

Technological Advancements | Evaluate impact on asset's useful life and productivity | Adjust depreciation rates, reassess asset value | Upgraded software reducing the utility of older hardware |

Market Condition Shifts | Monitor market trends, reassess asset value | Reflect current asset value, align with market realities | Real estate depreciation in a depreciating market area |

Key Points:

Reviews triggered by changes in asset usage, technology, or market conditions.

Comprehensive procedure ensures compliance and accuracy.

Ensures asset values in financial statements reflect current realities.

5. Asset Management and Internal Controls at [Your Company Name]

In this comprehensive section, [Your Company Name] explores the multifaceted aspects of asset management and internal controls. Focusing on asset tracking, safeguarding, and internal controls, we provide an in-depth view of our sophisticated methods and systems. These practices are crucial for ensuring the security, accuracy, and efficiency of our asset management processes, aligning with our commitment to excellence and financial integrity.

A. Asset Tracking and Inventory Management at [Your Company Name]

At [Your Company Name], asset tracking and inventory management are pivotal for operational efficiency and financial accuracy. We employ advanced tracking systems that integrate RFID technology and cloud-based inventory management software. This approach enables real-time monitoring of asset location, status, and performance. Our robust system facilitates regular audits, ensuring discrepancies are identified and addressed promptly. Additionally, this system supports strategic decision-making by providing accurate data on asset utilization, lifespan, and replacement needs, thereby optimizing asset management and budget allocation.

Tracking System | Technology Used | Functionality | Benefits |

|---|---|---|---|

RFID Tracking System | RFID Tags | Tracks real-time location and movement of assets | Reduces loss, improves inventory accuracy |

Cloud-Based Inventory System | Cloud Computing | Manages inventory levels, orders, and asset records | Enhances accessibility, scalability |

Barcode Scanning System | Barcode Technology | Quick scanning for inventory check-ins and check-outs | Speeds up operations, improves record-keeping |

GPS Asset Tracking | GPS Technology | Monitors location of mobile assets | Ensures asset security, optimizes usage |

IoT Monitoring System | IoT Sensors | Provides data on asset condition and usage patterns | Enables predictive maintenance, reduces downtime |

B. Safeguarding Assets at [Your Company Name]

Safeguarding assets is a top priority at [Your Company Name]. Our comprehensive approach includes a mix of physical security measures, such as surveillance systems and secure storage facilities, and digital protections, like cybersecurity protocols and data encryption. We also implement stringent access controls and regular security audits to prevent unauthorized access or misuse of assets. Insurance coverage plays a crucial role, offering financial protection against theft, damage, or loss, ensuring that our assets are protected not just physically but also financially.

Asset | Security Measures | Access Control |

|---|---|---|

Office Buildings | Surveillance Cameras | Keycard Access Control |

High-Value Equipment | Alarmed Secure Storage | Biometric Authentication |

Company Vehicles | GPS Tracking | Authorized User Log |

Data Servers | Cybersecurity Protocols | Password Protection |

Intellectual Property | Data Encryption | Limited Access Permissions |

C. Internal Control Procedures for Asset Management at [Your Company Name]

At [Your Company Name], internal control procedures are the backbone of our asset management system. We adhere to a strict set of controls, including segregation of duties, to prevent errors and fraud. Our process involves distinct roles for asset acquisition, maintenance, and disposal, ensuring checks and balances at every step. Regular internal audits and compliance checks are conducted to assess the effectiveness of these controls. Furthermore, we emphasize thorough documentation and authorization processes for all asset-related transactions, fostering transparency and accountability in our asset management practices.

Procedure | Purpose | Implementation |

|---|---|---|

Segregation of Duties | Prevents errors and fraud | Separate roles for acquisition, maintenance, disposal |

Regular Internal Audits | Assesses control effectiveness | Scheduled audits of asset management practices |

Compliance Checks | Ensures adherence to laws and policies | Regular reviews of legal and regulatory compliance |

Documentation & Authorization | Maintains transparency and accountability | Thorough record-keeping, required approvals for transactions |

Role-based Access Control | Secures sensitive information | Access to financial systems based on job function |

6. Financial Reporting and Disclosure Requirements for [Your Company Name]

In this vital section, [Your Company Name] addresses the intricacies of financial reporting and disclosure requirements related to asset management. We cover everything from the preparation of asset-related financial statements to comprehensive notes and adherence to international standards like IFRS and GAAP. These practices are crucial for ensuring transparency, compliance, and accuracy in our financial communications.

A. Preparing Asset-related Financial Statements for [Your Company Name]

At [Your Company Name], preparing asset-related financial statements is a task that demands precision and clarity. Our finance team is equipped to detail every aspect of our assets, from their initial valuation to accumulated depreciation and impairment losses. We ensure that these statements provide a clear, accurate representation of our assets' current value and their contribution to our overall financial position. This accuracy not only aids in internal decision-making but also ensures that stakeholders and investors have a reliable picture of our company's financial health.

B. Notes to Financial Statements for [Your Company Name]

The notes accompanying our financial statements at [Your Company Name] are not just addendums; they are integral to understanding our financial narrative. These notes provide crucial details about our asset management policies, including depreciation methods, valuation techniques, and any changes in accounting policies. They also shed light on contingencies and commitments related to our assets, ensuring a comprehensive understanding of their impact on our financial position. These disclosures are key to maintaining transparency and fostering trust among our stakeholders.

C. Compliance with IFRS and GAAP at [Your Company Name]

Adhering to IFRS and GAAP standards is a cornerstone of our financial reporting strategy at [Your Company Name]. Our accounting team stays abreast of the latest updates and interpretations of these standards, ensuring our asset accounting practices are fully compliant. We understand that these standards are not static; they evolve with changing financial landscapes, and our adherence reflects our commitment to best practices and international compliance. This diligence not only safeguards us from regulatory risks but also reinforces our reputation for financial integrity in the global marketplace.

7. Conclusion

We underscore the importance of meticulous asset management and robust internal controls in driving our company's financial stability and growth. Through the detailed exploration of asset classification, valuation, depreciation methods, and financial reporting requirements, this guide serves as a comprehensive resource for managing our extensive asset portfolio.

Our journey through this guide has highlighted the dynamic nature of asset accounting, emphasizing the need for adaptive strategies that align with evolving business landscapes and regulatory environments. The practices outlined here are not merely compliance obligations; they represent strategic tools for enhancing the transparency and accuracy of our financial reporting, thus bolstering stakeholder trust and investment confidence.

At [Your Company Name], the approach to asset management and accounting is integral to our broader financial strategy. By applying the principles and procedures detailed in this guide, we ensure that our asset reporting is reflective of our operational reality, thereby supporting informed decision-making and strategic planning. This guide, therefore, is not just a set of instructions; it's a roadmap to financial prudence and strategic asset management.

As we look forward, [Your Company Name] remains committed to continuous improvement and adaptation in our asset management practices. We recognize that the financial landscape is ever-changing, and staying abreast of these changes is crucial for our ongoing success. This guide will be periodically reviewed and updated to reflect new insights, technological advancements, and regulatory changes, ensuring that our asset management strategies remain cutting-edge and effective.

In summary, this Asset Accounting Guide stands as a testament to [Your Company Name]'s dedication to excellence in financial management. By adhering to the principles and practices outlined herein, we reinforce our commitment to operational efficiency, financial integrity, and strategic growth.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Enhance your asset accounting practices with Template.net's editable Accounting Asset Accounting Guide Template. This guide streamlines your accounting processes, ensuring professional and efficient asset management. Unlock the potential of precise and systematic asset accounting. Optimize your accounting practices with this tool, ensuring accuracy and strategic management of company assets.