Free Internal Audit Accounting Evaluation Manual

Overview

This manual provides comprehensive guidance for conducting internal audit procedures and accounting evaluations to ensure accurate financial reporting, regulatory compliance, and efficient business operations. We, at [YOUR COMPANY NAME], encourage you to maintain compliance with this manual to foster a culture of transparency, integrity, and accountability within the organization.

1. Introduction

The cornerstone of a robust corporate governance framework in any organization lies in its internal auditing function. It serves as a critical tool for evaluating and enhancing the effectiveness, efficiency, and alignment of risk management, control, and governance processes with the organization's strategic objectives. The essence of internal auditing extends beyond mere compliance checks and financial scrutiny; it encompasses a holistic examination of operational integrity, ethical conduct, and procedural adherence within the framework of accepted accounting standards and internal policies.

In essence, the internal audit function acts as an independent and objective assurance and consulting activity designed to add value and improve an organization's operations. It aids an organization in accomplishing its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes. By identifying potential gaps and inefficiencies, internal auditors provide management and the board with insights and recommendations based on analyses and assessments of data and business processes. Through this meticulous evaluation, internal auditing facilitates a culture of transparency, accountability, and continuous improvement, thereby enhancing the organization's resilience, operational efficiency, and public trust.

2. Scope of Internal Audit

The scope of internal audit within an organization is extensive and encompasses various areas critical to the organization's success and compliance. This broad spectrum ensures a comprehensive evaluation of the organization's diverse operations, systems, and controls. The internal audit charter, a formal document that outlines the purpose, authority, and responsibility of the internal audit activity, provides the foundation for this broad scope.

Financial Auditing: This is the cornerstone of internal auditing, focusing on the reliability and integrity of financial and operational information. It involves examining accounting records and financial reports against established standards, policies, and regulations to ensure accuracy, completeness, and compliance.

Operational Auditing: Beyond financial records, internal auditors assess the efficiency and effectiveness of operational processes. This includes evaluating the use of resources, safeguarding of assets, and the achievement of business objectives. Operational audits identify process improvements and efficiencies that can enhance the organization's performance and strategic alignment.

Compliance Auditing: With the ever-evolving regulatory landscape, organizations must ensure adherence to laws, regulations, standards, and contractual obligations. Compliance audits assess the organization's conformity with external legal requirements and internal policies, thereby mitigating legal and regulatory risks.

Information Systems Auditing: In an age dominated by information technology, safeguarding digital assets and ensuring the reliability of IT systems and processes is paramount. This audit area focuses on the organization's IT infrastructure, evaluating the effectiveness of IT controls, data security, information processing, and the alignment of IT strategy with organizational goals.

Risk Management Auditing: Identifying and mitigating risks is fundamental to the internal audit function. This involves a systematic evaluation of the effectiveness of the organization's risk management processes, ensuring that significant risks are identified, assessed, and managed appropriately.

The internal audit's scope is dynamic and should be adaptable to changes in the organization's business environment, operations, and risk profile. The internal audit charter should be regularly reviewed and updated to reflect these changes and ensure that the internal audit function remains aligned with the organization's objectives and capable of addressing emerging challenges.

3. Key Roles and Responsibilities

The internal audit function is a collaborative effort involving various stakeholders, each with distinct but complementary roles and responsibilities. These roles are defined to ensure clarity, efficiency, and effectiveness in the internal audit process.

Internal Auditors: Internal auditors are at the heart of the audit process, responsible for conducting audits in accordance with professional standards. They must maintain objectivity and independence in their work, systematically evaluating and improving the effectiveness of risk management, control, and governance processes. Their responsibilities include planning audits, conducting fieldwork, identifying issues, and recommending improvements.

Audit Committee: The audit committee, typically a subcommittee of the board of directors, provides oversight of the internal audit function. It is responsible for ensuring the independence of the internal audit, reviewing and approving the internal audit plan, and ensuring that significant findings and recommendations are addressed by management. The committee also reviews the effectiveness of the internal audit function and ensures that it has the necessary resources and support.

Management: Management's role is to ensure that internal controls are in place and functioning effectively. They are responsible for addressing findings and recommendations from internal audits and implementing corrective actions to mitigate risks and improve processes. Management also supports the internal audit function by providing access to information, resources, and personnel necessary for the conduct of audits.

Board of Directors: The board of directors has the ultimate responsibility for oversight of the organization's governance, risk management, and internal control frameworks. The board ensures that internal auditing activities are aligned with the organization's strategic objectives and that the audit committee and internal auditors have the necessary authority and resources.

The collaborative interplay among these stakeholders fosters a culture of accountability, transparency, and continuous improvement within the organization. By clearly defining and adhering to these roles and responsibilities, organizations can ensure the effectiveness of their internal audit function and its contribution to the organization's overall governance and performance.

4. Internal Audit Procedures

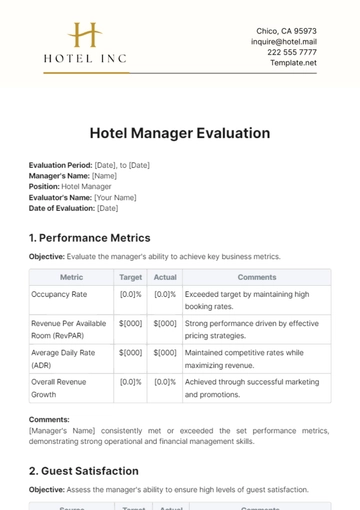

Fig 1: Aim of Accounting Internal Audits

The internal audit procedures are structured to provide a systematic and disciplined approach to the audit process, ensuring comprehensiveness and effectiveness. These procedures are divided into distinct phases, each critical to the audit's success.

Planning Phase: The foundation of a successful audit lies in thorough planning. This phase involves understanding the audit area's scope, objectives, and significance within the organization's overall framework. Auditors assess the risks associated with the audit area and determine the resources and time required. Key activities include defining the audit's scope, setting objectives, identifying key controls, and developing an audit program that outlines the nature, timing, and extent of audit procedures.

Execution Phase: During execution, auditors carry out the planned procedures to gather audit evidence. This involves detailed testing of controls, transactions, and balances using various audit techniques such as inquiry, observation, inspection, and confirmation. Auditors evaluate the effectiveness of internal controls and the reliability of financial reporting, identifying any deviations, inefficiencies, or areas of risk.

Reporting Phase: The culmination of the audit process is the preparation and dissemination of the audit report. This report provides a clear, concise, and objective account of the audit findings, including any deficiencies or areas for improvement. Recommendations for corrective actions are also included, aimed at enhancing controls and processes.

Follow-up Phase: Post-audit, auditors engage in follow-up activities to assess the implementation of audit recommendations. This ensures that corrective actions are taken and that identified issues are resolved.

Throughout these phases, auditors adhere to a predefined schedule, ensuring that audits are conducted at regular intervals. This regularity ensures ongoing oversight and timely identification of issues, fostering continuous improvement in the organization's control environment and operational effectiveness.

5. Auditing Standards and Principles

The integrity, reliability, and consistency of the internal audit process are underpinned by adherence to established auditing standards and principles. These standards ensure that audits are conducted with professionalism, objectivity, and transparency, providing stakeholders with confidence in the audit process and its outcomes.

Generally Accepted Auditing Standards (GAAS): These are a set of systematic guidelines used by auditors when conducting audits on companies' financial statements. GAAS covers three categories: general standards, standards of fieldwork, and standards of reporting, ensuring audits are performed with competence, due diligence, and with an objective state of mind.

Generally Accepted Accounting Principles (GAAP): This set of principles provides the framework for financial accounting and reporting in the United States. GAAP ensures that financial statements are consistent, comparable, and reliable, facilitating clear communication of financial information and decisions.

International Financial Reporting Standards (IFRS): As a global counterpart to GAAP, IFRS provides a common language for business affairs so that company accounts are understandable and comparable across international boundaries, enhancing the transparency and comparability of financial statements on a global scale.

International Standards for the Professional Practice of Internal Auditing (IIA Standards): Issued by the Institute of Internal Auditors, these standards provide a framework for the practice and evaluation of internal auditing. They cover aspects such as independence, objectivity, proficiency, and performance criteria, guiding the ethical and professional conduct of auditors.

Adherence to these standards ensures that internal audits are conducted in a manner that is consistent with best practices and international norms. It promotes the credibility and effectiveness of the audit function, contributing to the reliability and integrity of financial reporting and governance processes within the organization.

6. Accounting Evaluation

Accounting evaluation is a critical aspect of the internal audit function, focusing on the assessment and improvement of financial reporting and accounting practices. This process involves a detailed examination of financial transactions, records, and reports to ensure their accuracy, completeness, and compliance with accepted accounting standards and principles.

The goal of accounting evaluations is to identify and mitigate areas of financial risk and inefficiency. This involves benchmarking the organization's financial practices against industry standards and best practices to identify discrepancies, inefficiencies, or areas for improvement. Auditors assess the appropriateness of accounting policies, the accuracy of financial statements, and the effectiveness of financial controls.

Various techniques and tools are employed in accounting evaluations, including:

Analytical Procedures: These involve the analysis of significant ratios and trends, comparing financial data across periods, and benchmarking against industry norms to identify unusual transactions or variances that may indicate potential issues.

Substantive Testing: This includes detailed testing of transactions and balances to verify the accuracy and completeness of accounting records.

Risk Assessment: Auditors assess the risk of material misstatement in financial reports, considering both internal and external factors that could impact financial accuracy.

The outcome of accounting evaluations is a comprehensive understanding of the organization's financial health and the effectiveness of its accounting practices. Recommendations for improvements are made to enhance the reliability of financial reporting, ensuring that stakeholders can make informed decisions based on accurate and timely financial information.

By systematically assessing financial transactions and processes against accepted standards, accounting evaluations play a crucial role in safeguarding the organization's financial integrity and supporting its overall governance and risk management framework.

7. Report Generation and Review

The audit report is the culmination of the audit process, encapsulating the findings, conclusions, and recommendations derived from the audit. The effectiveness of an audit is significantly influenced by the clarity, precision, and actionable nature of its reporting. Therefore, a structured approach to report generation and review is critical.

Report Preparation: The preparation of the audit report begins with the consolidation of audit findings, observations, and evidentiary support gathered during the audit. It's imperative that the report is written in clear, concise language that is easily understood by stakeholders across the organization. The report should include an executive summary for high-level insights, detailed findings, and recommendations for improvement.

Content and Format: The content should be organized systematically, starting with the audit scope and objectives, followed by detailed findings categorized by area or process, the implications of these findings, and suggested recommendations. The format of the report should facilitate ease of reading and understanding, with the use of headings, subheadings, bullet points, and, where necessary, charts or tables to illustrate key points.

Dissemination: The dissemination process involves distributing the audit report to relevant stakeholders, including management, the audit committee, and, where appropriate, the board of directors. The distribution list should be determined based on the audit's scope and the impact of the findings.

Frequency and Review: Audit reports are typically generated at the conclusion of each audit. However, the frequency can vary based on the organization's size, nature, and risk profile. Each report should be subject to a review process, typically by senior auditors or the audit committee, to ensure accuracy, completeness, and relevance of the findings and recommendations. The review process also provides an opportunity for auditors to discuss the findings with management and gain their insights and responses to the recommendations made.

8. Follow-up Procedures

Follow-up procedures are critical to ensuring that the recommendations made in audit reports are effectively implemented. These procedures are designed to verify the actions taken by management in response to audit findings and to assess the impact of those actions on addressing the identified issues.

Timing of Follow-up Audits: The timing for follow-up audits should be determined based on the significance of the audit findings and the expected time required for corrective actions to be implemented. Typically, a follow-up is scheduled several months after the initial report is issued, allowing sufficient time for corrective measures to be taken.

Conducting Follow-up Audits: The process involves re-examining the areas where deficiencies were identified to assess whether corrective actions have been implemented and are functioning as intended. This may involve reviewing documentation, retesting controls, and conducting interviews with relevant personnel.

Reporting on Follow-up: The results of the follow-up audit are documented in a follow-up report, which outlines the actions taken by management in response to the original audit recommendations, the current status of those recommendations, and any remaining issues or additional findings. This report is then communicated to the relevant stakeholders, similar to the original audit report.

Tracking and Documentation: Effective tracking systems are essential for monitoring the status of audit recommendations and management's corrective actions. Such systems enable auditors to manage follow-up activities efficiently and ensure accountability and transparency in the implementation process.

Follow-up procedures reinforce the value of the audit process by ensuring that findings are addressed, thereby contributing to the continuous improvement of the organization's operations and control environment.

9. Updating Audit Procedures

The landscape in which organizations operate is constantly evolving, driven by changes in technology, regulation, and market dynamics. Consequently, the internal audit function must remain dynamic, continuously enhancing its methodologies, tools, and procedures to stay relevant and effective.

Review and Assessment: Regular reviews of audit procedures and methodologies should be conducted to assess their effectiveness and efficiency in achieving audit objectives. This includes evaluating the audit scope, techniques, risk assessment methodologies, and reporting formats.

Incorporating Feedback: Feedback from auditors, audit committees, management, and external reviewers can provide valuable insights into areas for improvement. This feedback should be systematically collected and analyzed to inform updates to audit procedures.

Adapting to Changes: Changes in the business environment, such as new regulatory requirements, technological advancements, and shifts in business strategy, necessitate updates to audit procedures to ensure they remain aligned with the organization's objectives and risks.

Training and Development: Updating audit procedures may also involve investing in the training and development of audit staff to equip them with the skills and knowledge required to implement new methodologies or technologies effectively.

Documentation and Communication: Any changes to audit procedures should be thoroughly documented in the audit manual and communicated to all relevant parties within the audit function. This ensures consistency in the application of the updated procedures across the organization.

By fostering a culture of continuous improvement, the internal audit function can enhance its value to the organization, ensuring that it remains a key pillar in the governance and risk management framework.

10. Contact Information

For any inquiries related to the internal audit and accounting evaluations, please reach out to [YOUR COMPANY EMAIL] or at [PHONE NUMBER]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Template.net's Internal Audit Accounting Evaluation Manual Template is the ultimate solution for streamlining your audit processes. Our editable and customizable template, powered by our AI editor tool, simplifies internal audits. Effortlessly assess financial systems, controls, and compliance. With this comprehensive manual, you'll enhance your company's financial integrity and decision-making. Upgrade your auditing experience today!