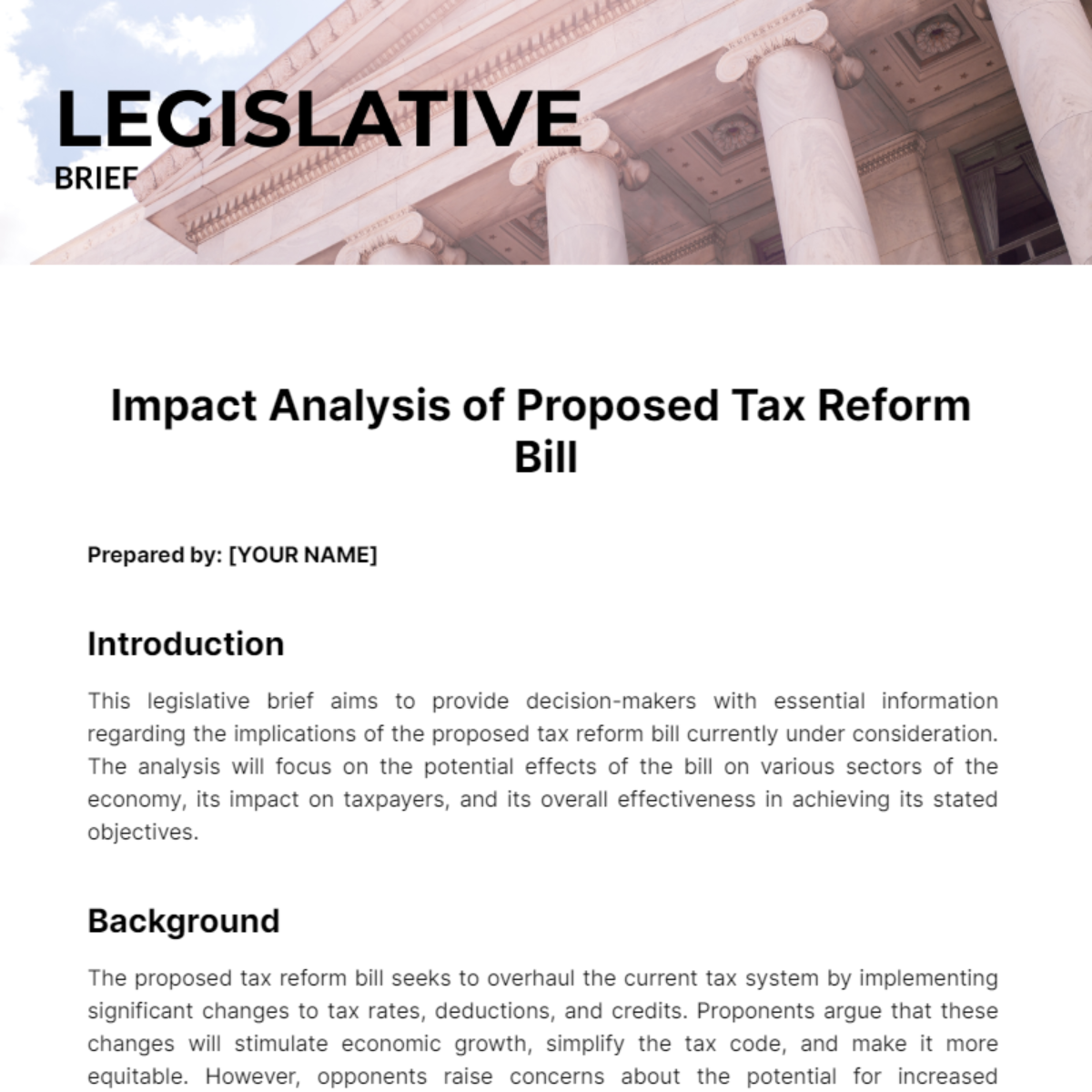

Free Legislative Brief

Prepared by: [YOUR NAME]

Introduction

This legislative brief aims to provide decision-makers with essential information regarding the implications of the proposed tax reform bill currently under consideration. The analysis will focus on the potential effects of the bill on various sectors of the economy, its impact on taxpayers, and its overall effectiveness in achieving its stated objectives.

Background

The proposed tax reform bill seeks to overhaul the current tax system by implementing significant changes to tax rates, deductions, and credits. Proponents argue that these changes will stimulate economic growth, simplify the tax code, and make it more equitable. However, opponents raise concerns about the potential for increased inequality, the impact on government revenue, and the distributional effects across different income groups.

Key Implications

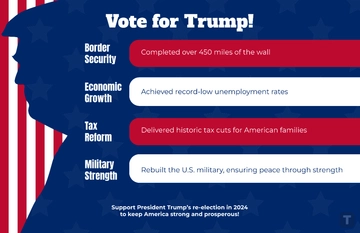

Economic Growth: The bill's proponents argue that lowering tax rates will incentivize investment and spur economic growth. However, empirical evidence suggests that the relationship between tax rates and economic growth is complex and may not lead to the anticipated outcomes.

Income Inequality: Critics of the bill warn that the proposed changes could exacerbate income inequality by disproportionately benefiting high-income earners. Analyses of similar tax reforms in the past have shown that they often result in a redistribution of wealth towards the top income brackets.

Government Revenue: The proposed tax cuts are expected to reduce government revenue, potentially leading to budget deficits or cuts in public services. Decision-makers must carefully consider the trade-offs between stimulating economic growth and maintaining fiscal sustainability.

Taxpayer Impact: The bill's impact on individual taxpayers will vary depending on their income level, filing status, and specific deductions and credits they currently claim. Decision-makers should assess how different provisions of the bill will affect different segments of the population.

Administrative Complexity: Simplifying the tax code is a stated objective of the bill, but implementing such changes may introduce new complexities and challenges for taxpayers, businesses, and government agencies tasked with tax administration.

Conclusion

In conclusion, the proposed tax reform bill has significant implications for the economy, taxpayers, and government finances. Decision-makers must carefully weigh the potential benefits and trade-offs of the proposed changes to ensure that the legislation effectively achieves its objectives while minimizing unintended consequences. Additionally, ongoing monitoring and evaluation will be essential to assess the effectiveness of the bill once implemented and to make any necessary adjustments to address emerging issues.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing Template.net's Legislative Brief Template, your essential tool for concise legal analysis. This editable and customizable template simplifies outlining key legislation, arguments, and proposed solutions. Tailor it effortlessly to your case strategy and requirements, ensuring clarity and effectiveness. Plus, it's editable in our Ai Editor Tool, offering seamless adjustments for personalized briefs. Streamline your legislative advocacy with this indispensable resource.