Free Nursing Home Insurance Proposal

A. Introduction and Overview

Welcome to [Your Company Name], where we pride ourselves on being a premier insurance provider dedicated to safeguarding the well-being of nursing homes across [location/region]. With a profound understanding of the unique challenges and responsibilities faced by nursing home facilities, we have meticulously crafted insurance policies tailored to meet their specific needs. Our mission is to offer comprehensive coverage and exceptional service, ensuring peace of mind for nursing home administrators, staff, and residents alike.

In this proposal, we invite you to explore the depth and breadth of our insurance solutions, meticulously designed to address the complexities inherent in running a nursing home. From general liability to professional malpractice coverage, property insurance, and beyond, we offer a range of options to suit various operational requirements and budgets. With [Your Company Name], nursing homes can rest assured knowing they have a trusted partner committed to their protection and success.

At [Your Company Name], we understand that each nursing home is unique, with its own set of challenges and priorities. That's why our team of experienced professionals is dedicated to working closely with you to customize insurance solutions that align perfectly with your specific needs and risk profile. As you delve into this proposal, we hope you'll see why countless nursing homes trust [Your Company Name] to provide the comprehensive coverage and peace of mind they deserve.

B. Coverage Details

Ensuring comprehensive protection for nursing homes is our top priority. Our policy encompasses a range of vital areas crucial for safeguarding your facility, staff, and residents. Below, we outline the key coverage options included in our insurance policy, designed to address the diverse risks and challenges faced by nursing homes.

Our policy provides coverage in several key areas:

General Liability

Professional Liability (Malpractice Insurance)

Property Insurance

Workers' Compensation

Cyber Liability

C. Policy Limits and Deductibles

At [Your Company Name], we understand that every nursing home has its own set of financial considerations and coverage requirements. That's why we offer flexible policy limits and unique deductible options, allowing you to tailor your insurance coverage to align perfectly with your budget and specific needs.

Flexible Policy Limits: Our insurance policies are designed to accommodate a wide range of coverage limits, ensuring that you have the protection you need without overextending your budget. Whether you're seeking comprehensive coverage or prefer to focus on specific areas of risk, our flexible policy limits can be adjusted to suit your preferences.

Unique Deductible Options: We recognize that choosing the right deductible is a crucial decision that can impact your premiums and financial stability. That's why we offer a variety of deductible options, allowing you to select the amount that best fits your financial situation and risk tolerance. Whether you prefer a higher deductible to lower your premiums or a lower deductible for greater peace of mind, we have options to suit your needs.

By offering customizable policy limits and deductible options, we empower nursing home administrators to take control of their insurance coverage and make informed decisions that align with their financial goals and risk management strategies. With [Your Company Name], you can trust that you're getting the coverage you need at a price that works for you.

D. Premiums and Payment Options

At [Your Company Name], we understand the importance of providing transparent pricing and flexible payment options to ensure that nursing homes can access the coverage they need without undue financial strain. Our approach to premiums and payment plans is designed to prioritize affordability and convenience for our valued clients.

Transparent Pricing

Customized Quotes: We provide personalized quotes tailored to your specific coverage needs and budgetary constraints, ensuring transparency in pricing.

Clear Breakdown: Our quotes offer a clear breakdown of the costs associated with each coverage option, empowering you to make informed decisions about your insurance policy.

Flexible Payment Plans

Annual Payments: Opt for an annual payment plan to streamline your budget and minimize administrative hassle.

Semi-Annual Payments: Spread your payments out with semi-annual options, providing flexibility while maintaining financial stability.

Monthly Payments: Choose monthly payment plans for ultimate convenience, allowing you to manage your cash flow more effectively.

By offering transparent pricing and flexible payment options, we strive to remove barriers to accessing essential insurance coverage for nursing homes. With [Your Company Name], you can trust that you're getting fair, competitive pricing and convenient payment options that align with your financial goals and operational needs. We're committed to providing exceptional service and support every step of the way, so you can focus on what matters most – providing quality care to your residents.

E. Exclusions and Limitations

While our insurance policy offers comprehensive coverage for a wide range of risks, it's important to note that there are certain situations and scenarios where coverage may not apply. We believe in transparency and want our clients to have a clear understanding of the limitations of their insurance coverage.

Exclusions: Our policy may not provide coverage for pre-existing conditions or specific types of incidents that fall outside the scope of the coverage. These exclusions are outlined in detail in the policy documentation, ensuring that you are fully informed about the circumstances in which coverage may not be available.

Limitations: In addition to specific exclusions, there may be limitations on coverage for certain types of claims or expenses. These limitations are designed to manage risk and ensure the long-term sustainability of our insurance offerings while still providing valuable protection for nursing homes.

While exclusions and limitations are a standard part of insurance policies, we strive to minimize their impact by offering clear and comprehensive coverage options. Our team is available to answer any questions you may have about exclusions and limitations, providing peace of mind and confidence in your insurance coverage. With [Your Company Name], you can trust that you're receiving straightforward and reliable protection for your nursing home facility, staff, and residents.

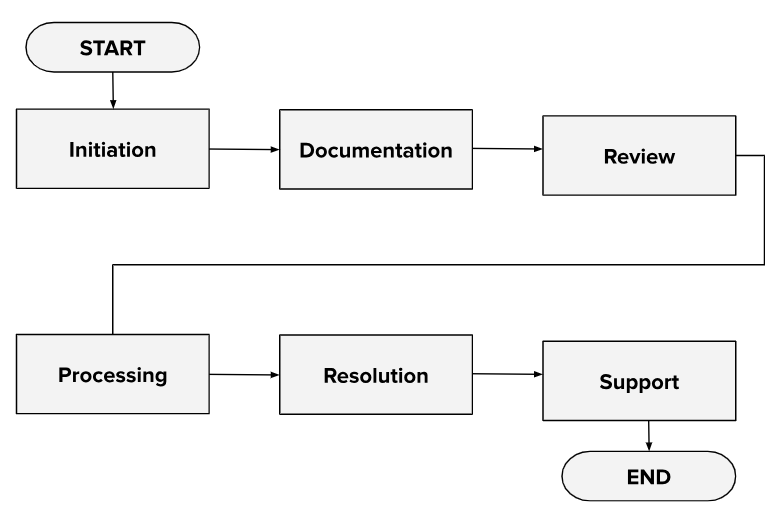

F. Claims Process and Support

At [Your Company Name], we understand that navigating the claims process can be daunting, especially during challenging times. That's why we're committed to providing a seamless and supportive experience for our clients. Our claims process is designed to be straightforward and intuitive, backed by exceptional support services to guide you every step of the way.

Initiation: Contact our claims department to initiate the process and report the incident.

Documentation: Gather and submit all necessary documentation related to the claim.

Review: Our team will review the submitted documentation and assess the validity of the claim.

Processing: Once approved, we'll process the claim promptly and efficiently.

Resolution: We'll work diligently to resolve the claim and provide timely updates on its status.

Support: Throughout the process, our dedicated support team is available to provide guidance, assist with form processing, and address any queries or concerns you may have.

With [Your Company Name], you can trust that we'll be with you every step of the way, providing the support and assistance you need to navigate the claims process with confidence.

G. Additional Services and Benefits

At [Your Company Name], we believe in going above and beyond to support the success and resilience of nursing homes beyond just providing insurance coverage. That's why we're proud to offer a range of additional services and benefits designed to empower our clients and enhance their risk management efforts

Risk Management Resources |

As part of our commitment to proactive risk management, we provide access to a wealth of resources to help nursing homes identify, assess, and mitigate potential risks. From best practices guides to industry-specific articles and risk assessment tools, our resources are invaluable in helping you safeguard your facility and residents. |

Training Programs |

Education is key to effective risk management, which is why we offer comprehensive training programs tailored to the unique needs of nursing homes. Whether it's staff training on safety protocols, compliance requirements, or emergency preparedness drills, our programs are designed to empower your team with the knowledge and skills they need to create a safe and secure environment for residents. |

Access to Industry Experts |

Our policy benefits include access to a network of industry experts who can provide valuable insights and guidance on a wide range of topics, from regulatory compliance to crisis management. Whether you have questions about changing regulations, emerging risks, or best practices in nursing home management, our team of experts is here to help. |

H. Budget

Ensuring that insurance coverage aligns with your budget is essential for maintaining financial stability while safeguarding your nursing home. To facilitate this, we provide a breakdown of estimated premiums for each coverage option, along with deductible options, to help you make informed decisions about your insurance budget.

Coverage Option | Estimated Premiums (per annum) | Deductible Options |

|---|---|---|

General Liability | $2,500 | $1,500 - $3,000 |

Professional Liability | $1,800 | $2,000 - $7,000 |

Property Insurance | $3,200 | $3,000 - $10,000 |

Workers' Compensation | $4,500 | $1,200 - $4,000 |

Cyber Liability | $1,600 | $1,500 - $3,000 |

I. Timeline

Understanding the timeline for implementing your insurance coverage is crucial for effective planning and risk management. Below, we outline the timeline for key milestones, from initial inquiry to policy activation, to ensure a smooth and timely process.

Milestone | Timeline |

|---|---|

Initial Inquiry | Month, Day, Year |

Customized Quote | Within 1-2 Business Days |

Policy Review | Within 3-5 Business Days |

Policy Activation | Upon Acceptance |

Note: Timelines may vary based on specific requirements, complexity of coverage, and responsiveness of involved parties. Please contact us for personalized assistance and to expedite the process as needed.

J. Summary and Conclusion

In conclusion, our nursing home insurance proposal is crafted with your needs in mind, offering comprehensive coverage and flexible options to protect your facility, staff, and residents. We are confident that our insurance solutions can provide the security and peace of mind you seek in safeguarding your esteemed organization.

At [Your Company Name], our commitment goes beyond just providing an insurance policy. We strive to build long-lasting partnerships with our clients, working collaboratively to navigate the complexities of risk management and ensure a secure future for your nursing home. We look forward to the opportunity to discuss further how our services can benefit your organization and provide tailored solutions to meet your unique needs. Together, let's create a safer and more resilient environment for your nursing home, where you can focus on what truly matters – delivering exceptional care to your residents.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Protect your facility with the Nursing Home Insurance Proposal Template from Template.net. This editable and customizable template details your nursing home's insurance needs, covering potential risks and proposing optimal coverage solutions. Editable in our Ai Editor Tool, it's crucial for negotiating comprehensive insurance policies, safeguarding against unforeseen events, and ensuring the continuity of care and operations.

You may also like

- Research Proposal

- Proposal Request

- Project Proposal

- Grant Proposal

- Photography Proposal

- Job Proposal

- Budget Proposal

- Marketing Proposal

- Branding Proposal

- Advertising Proposal

- Sales Proposal

- Startup Proposal

- Event Proposal

- Creative Proposal

- Restaurant Proposal

- Blank Proposal

- One Page Proposal

- Proposal Report

- IT Proposal

- Non Profit Proposal

- Training Proposal

- Construction Proposal

- School Proposal

- Cleaning Proposal

- Contract Proposal

- HR Proposal

- Travel Agency Proposal

- Small Business Proposal

- Investment Proposal

- Bid Proposal

- Retail Business Proposal

- Sponsorship Proposal

- Academic Proposal

- Partnership Proposal

- Work Proposal

- Agency Proposal

- University Proposal

- Accounting Proposal

- Real Estate Proposal

- Hotel Proposal

- Product Proposal

- Advertising Agency Proposal

- Development Proposal

- Loan Proposal

- Website Proposal

- Nursing Home Proposal

- Financial Proposal

- Salon Proposal

- Freelancer Proposal

- Funding Proposal

- Work from Home Proposal

- Company Proposal

- Consulting Proposal

- Educational Proposal

- Construction Bid Proposal

- Interior Design Proposal

- New Product Proposal

- Sports Proposal

- Corporate Proposal

- Food Proposal

- Property Proposal

- Maintenance Proposal

- Purchase Proposal

- Rental Proposal

- Recruitment Proposal

- Social Media Proposal

- Travel Proposal

- Trip Proposal

- Software Proposal

- Conference Proposal

- Graphic Design Proposal

- Law Firm Proposal

- Medical Proposal

- Music Proposal

- Pricing Proposal

- SEO Proposal

- Strategy Proposal

- Technical Proposal

- Coaching Proposal

- Ecommerce Proposal

- Fundraising Proposal

- Landscaping Proposal

- Charity Proposal

- Contractor Proposal

- Exhibition Proposal

- Art Proposal

- Mobile Proposal

- Equipment Proposal

- Student Proposal

- Engineering Proposal

- Business Proposal