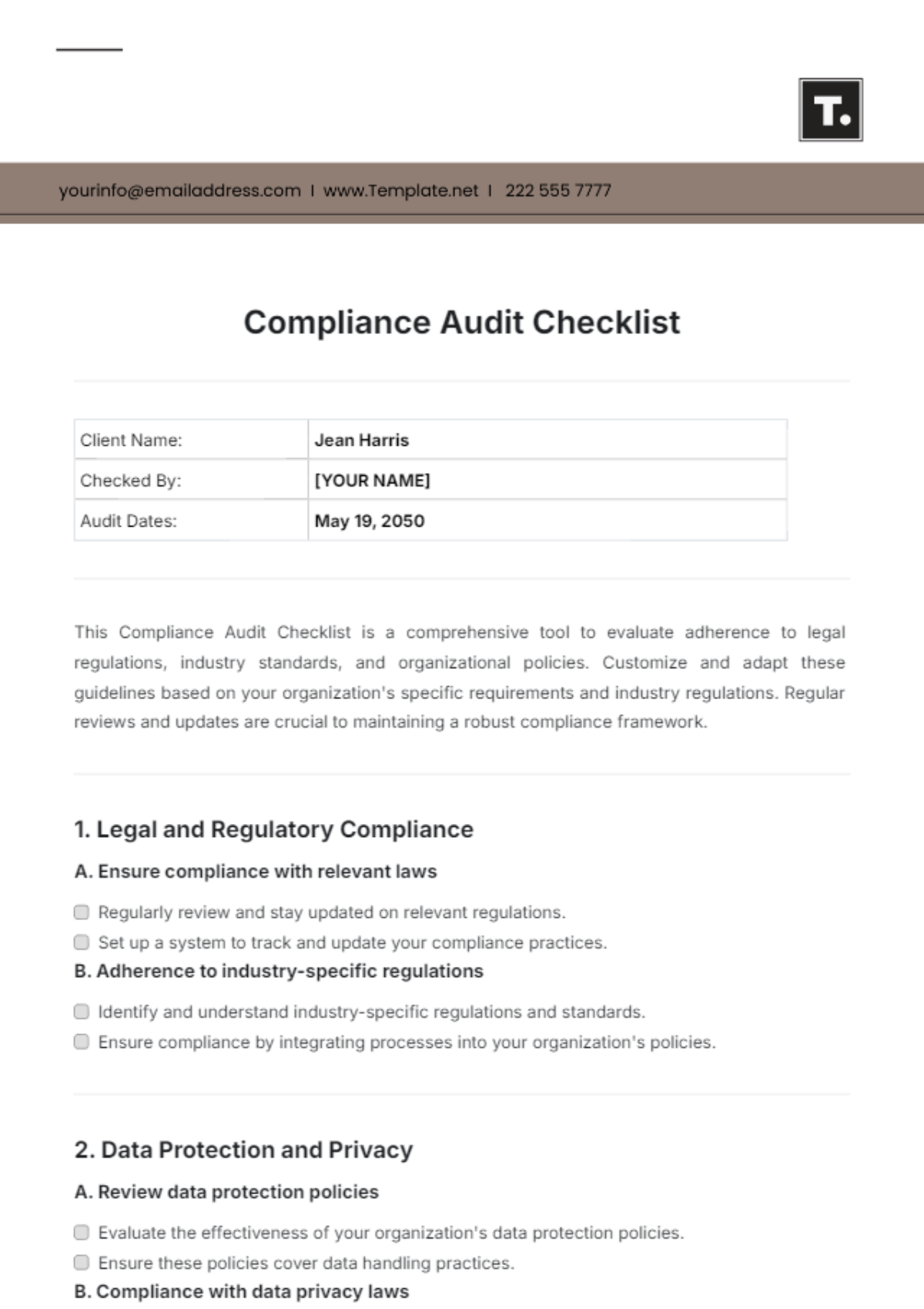

Free Compliance Audit Checklist

Client Name: | Jean Harris |

Checked By: | [YOUR NAME] |

Audit Dates: | May 19, 2050 |

This Compliance Audit Checklist is a comprehensive tool to evaluate adherence to legal regulations, industry standards, and organizational policies. Customize and adapt these guidelines based on your organization's specific requirements and industry regulations. Regular reviews and updates are crucial to maintaining a robust compliance framework.

1. Legal and Regulatory Compliance

A. Ensure compliance with relevant laws

Regularly review and stay updated on relevant regulations.

Set up a system to track and update your compliance practices.

B. Adherence to industry-specific regulations

Identify and understand industry-specific regulations and standards.

Ensure compliance by integrating processes into your organization's policies.

2. Data Protection and Privacy

A. Review data protection policies

Evaluate the effectiveness of your organization's data protection policies.

Ensure these policies cover data handling practices.

B. Compliance with data privacy laws

Comply with relevant data privacy laws like GDPR and HIPAA.

Regularly update data protection measures to align with regulations.

C. Data access controls and encryption

Use strong access controls and encryption to protect sensitive data.

Regularly audit and update access permissions to minimize unauthorized data access.

3. Financial Compliance

A. Verify accurate financial reporting

Establish procedures to ensure accurate and transparent financial reporting

Regularly review finances and controls to comply with industry standards.

B. Adherence to tax regulations

Stay informed about tax regulations affecting your organization.

Regularly audit for tax law compliance and accurate reporting.

C. Audit internal controls:

Periodically assess and strengthen internal controls related to financial transactions.

Includes duties segregation, authorization, and monitoring.

4. Employment and Labor Laws

A. Compliance with employment laws

Regularly update and communicate policies to align with employment laws.

Track labor regulation changes and update HR practices.

B. Review employee documentation

Regularly audit employee contracts, handbooks, and documents for compliance.

5. Health and Safety

A. Assess workplace safety protocols

Regularly review and update workplace safety protocols and procedures.

Conduct thorough safety assessments to identify and address potential hazards.

B. Compliance with occupational health and safety regulation

Ensure your organization follows safety regulations.

Implement training programs and conduct drills to enhance employee awareness.

6. Information Security:

A. Review information security policies

Regularly update and communicate information security policies.

Train employees on best practices for security and data protection.

B. Assess cybersecurity measures

Regularly update firewalls, antivirus, and intrusion detection systems.

Conduct penetration testing to identify and address vulnerabilities.

C. Compliance with relevant standards

Ensure compliance with industry-specific info security standards, such as ISO 27001.

Regularly audit and update security practices to align with these standards.

7. Ethics and Code of Conduct:

A. Review the organization's code of conduct

Regularly update the code of conduct to maintain ethical standards.

Communicate the code of conduct effectively to all employees.

B. Confirm adherence to ethical standards

Establish mechanisms for reporting ethical concerns and violations.

Regularly review adherence to the code of conduct.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Ensure thorough compliance in your audits with Template.net's Compliance Audit Checklist Template. This resource is fully editable and customizable, allowing you to tailor each aspect to meet specific regulatory needs. Crafted for simplicity and efficiency, it's easily adjustable in our AI Editor Tool, making compliance management more streamlined and effective.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

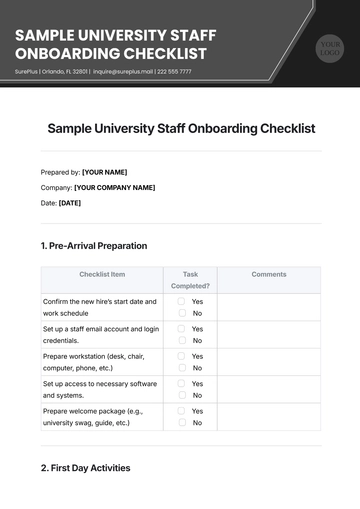

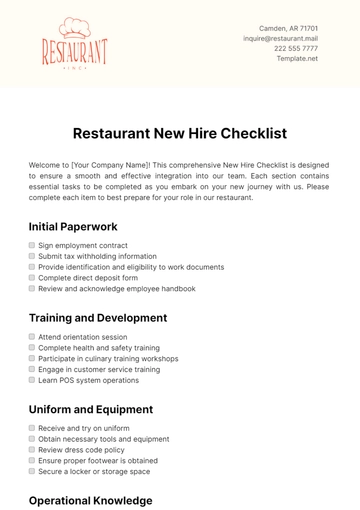

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

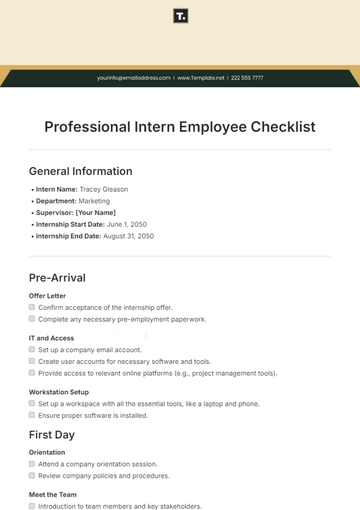

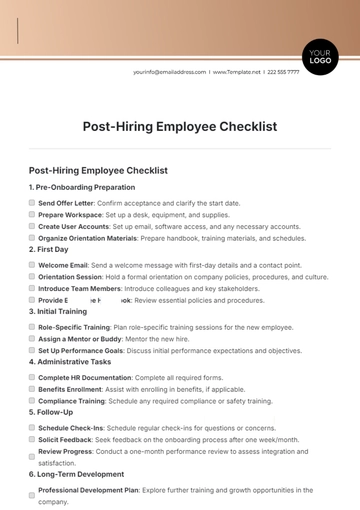

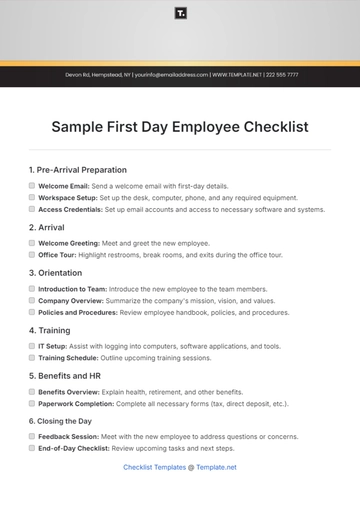

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

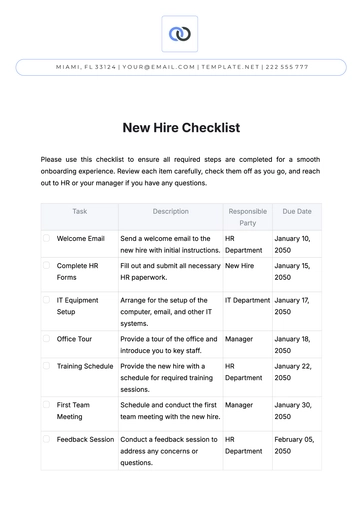

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

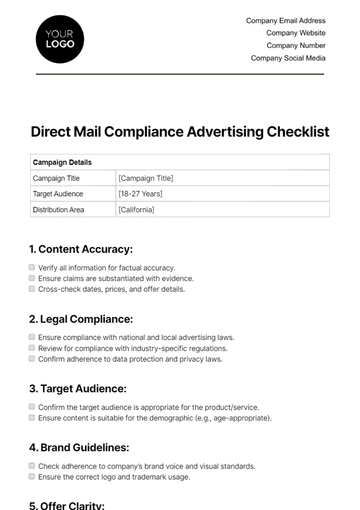

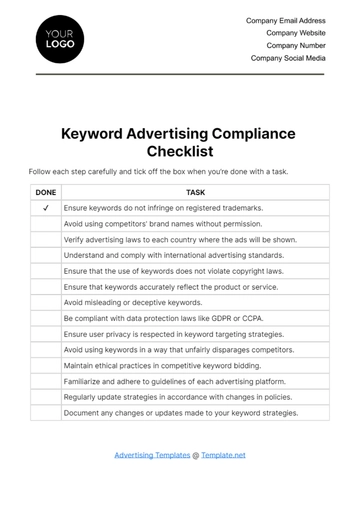

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

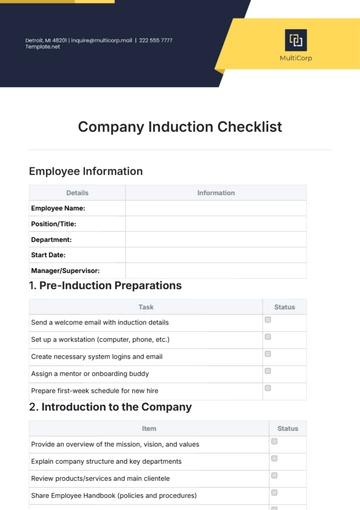

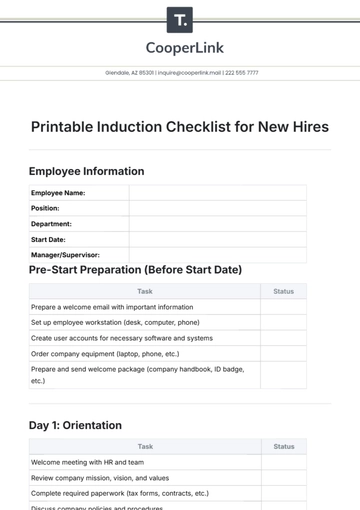

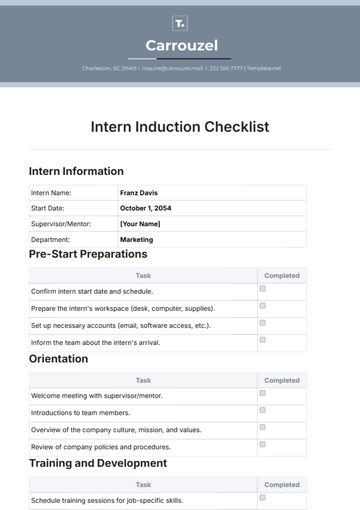

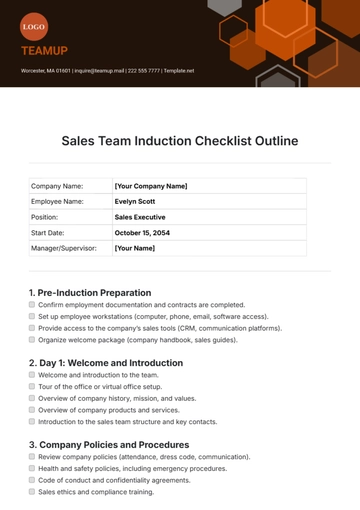

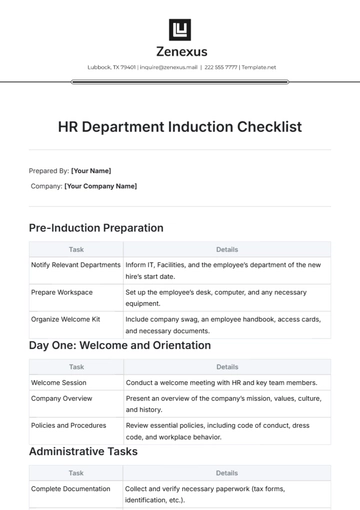

- Induction Checklist

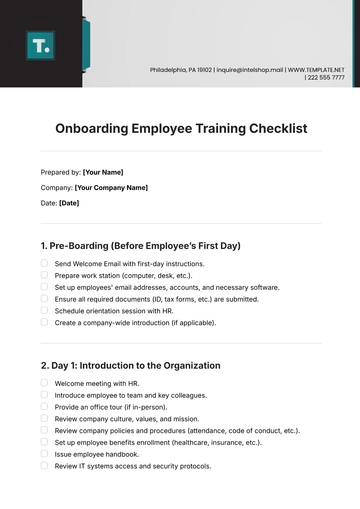

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

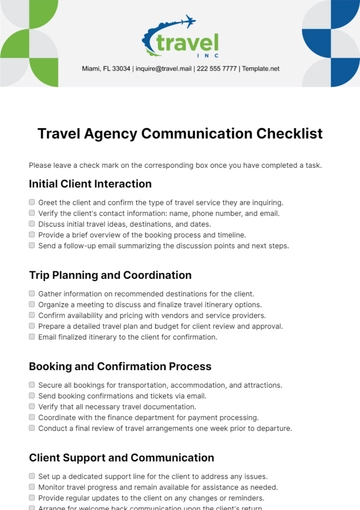

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

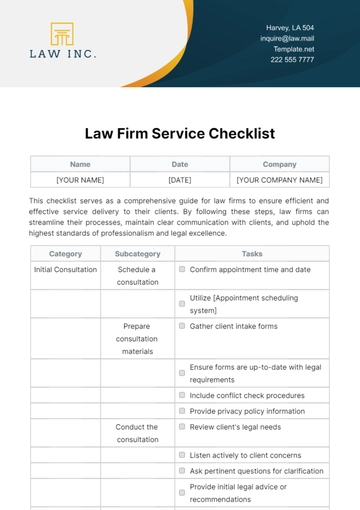

- Legal Checklist

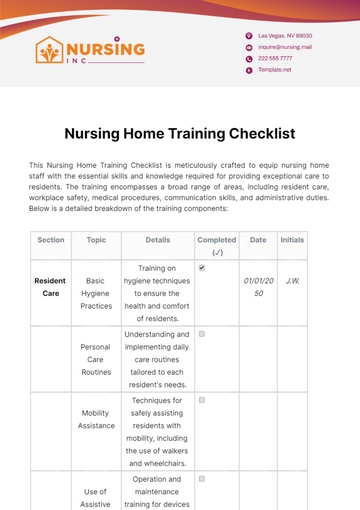

- Nursing Home Checklist

- Weekly Checklist

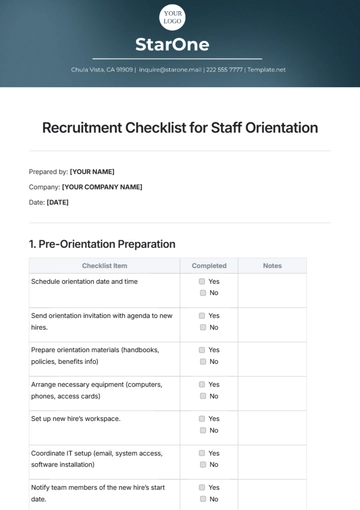

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

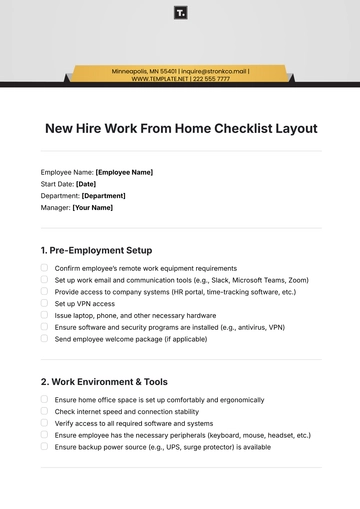

- Work From Home Checklist

- Student Checklist

- Application Checklist