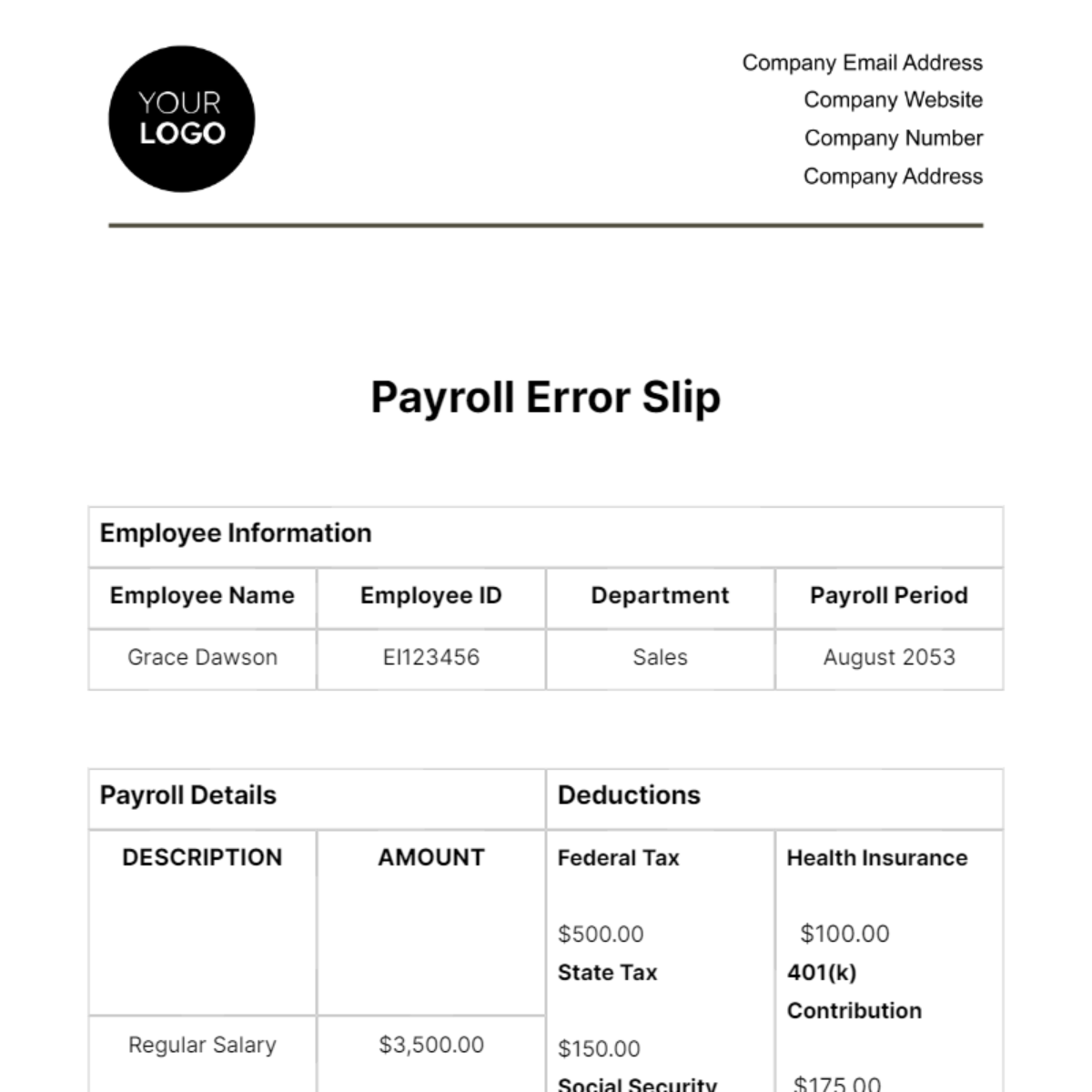

Free Payroll Error Slip HR

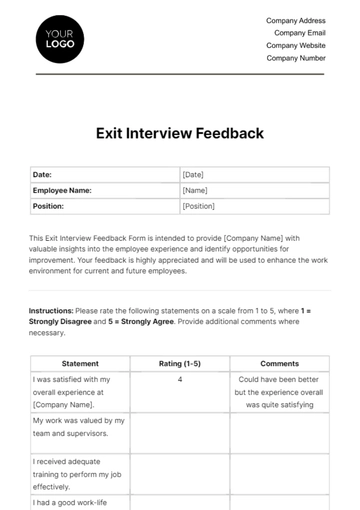

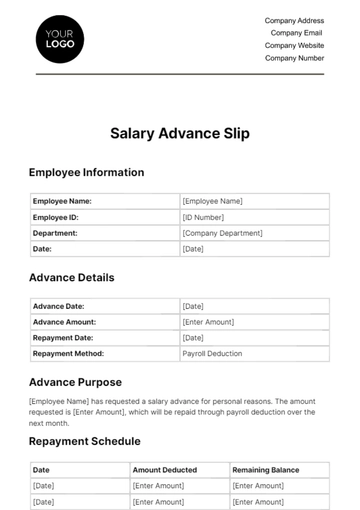

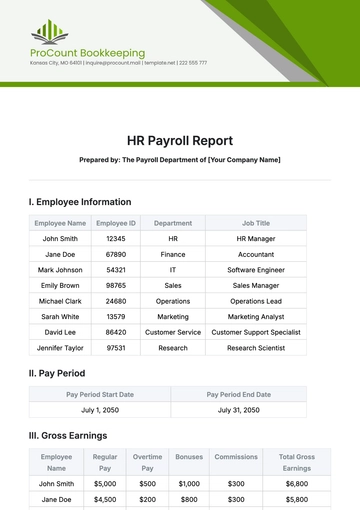

Employee Information | |||

Employee Name | Employee ID | Department | Payroll Period |

Grace Dawson | EI123456 | Sales | August 2053 |

Payroll Details | Deductions | ||

DESCRIPTION | AMOUNT | Federal Tax $500.00 State Tax $150.00 Social Security $210.00 Medicare $49.00 | Health Insurance $100.00 401(k) Contribution $175.00 Gross Pay $3,850.00 Net Pay (After Deduction) $2,566.00 |

Regular Salary | $3,500.00 | ||

Overtime Pay | $200.00 | ||

Error Details

The Health Insurance deduction for Grace Dawson was incorrectly calculated for this payroll period. It should have been $125.00 instead of $100.00.

Corrected Payroll Details | Deductions | ||

DESCRIPTION | AMOUNT | Federal Tax $500.00 State Tax $150.00 Social Security $210.00 Medicare $49.00 | Health Insurance $125.00 401(k) Contribution $175.00 Gross Pay $3,850.00 Net Pay (After Deduction) $2,566.00 |

Regular Salary | $3,500.00 | ||

Overtime Pay | $200.00 | ||

We apologize for the error in the calculation of Grace Dawson's Health Insurance deduction for the August 2053 payroll. The corrected deduction amount has been reflected above. This adjustment will be made in the next payroll cycle to ensure John Doe receives the correct amount.

[Your Name]

Payroll Manager

Finance and Human Resources Department

[Date]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

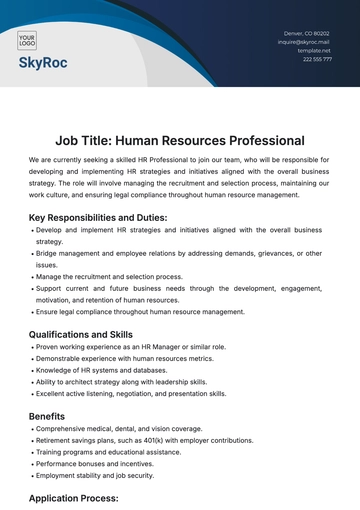

Tackle payroll issues efficiently with our Payroll Error Slip HR Template. Accurate and straightforward, this template helps you document and communicate payroll discrepancies to employees. Minimize confusion and ensure swift resolution, keeping your payroll process error-free and transparent.