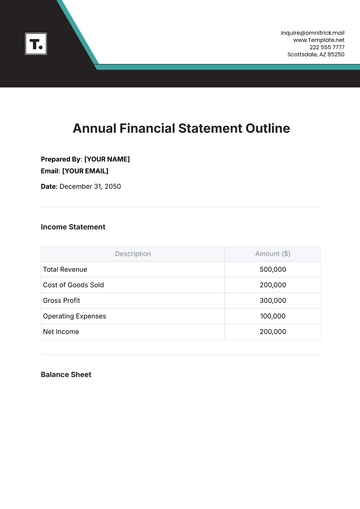

Free Annual Finance Internal Control Report

A. Executive Summary

This report offers a detailed evaluation of [Your Company Name]'s internal controls over financial reporting for the past fiscal year. It assesses the suitability and efficiency of these controls, identifies key risk areas, and outlines corrective action plans. The primary finding is that while effective internal controls are established, certain mechanisms require refinement for optimal efficiency and compliance. This enhancement is vital for ensuring the robustness and reliability of our financial reporting processes.

B. Management's Responsibility for Financial Reporting

The leadership of [Your Company Name] bears the fundamental responsibility for the preparation and fair presentation of the annual financial statements. Bound by legal and ethical obligations, our management ensures that these statements are accurate, consistent, and timely, reflecting the company's financial position with the utmost integrity. This responsibility is a cornerstone of our commitment to transparency and accountability in all aspects of our financial reporting.

In addition to financial statement preparation, our management is dedicated to establishing and maintaining efficient internal controls. These controls are designed to safeguard assets, prevent and detect fraud, and ensure the reliability of financial reporting. Regular reviews and updates to these systems are a testament to our proactive approach in adapting to changing financial landscapes and regulatory requirements, thereby upholding our high standards of fiscal stewardship.

C. Scope of the Report

This report lays emphasis on the company’s financial performance for the fiscal year. It encapsulates financial activities across all departments and operating processes, providing insights into income statements, cash flow statement, balance sheet, and statement of changes in equity.

D. Assessment of Internal Control Framework

In alignment with the COSO (Committee of Sponsoring Organizations of the Treadway Commission) framework, our assessment of [Your Company Name]'s internal control systems was comprehensive, focusing on five critical components. This structured approach ensures a holistic evaluation of our internal control mechanisms.

Component | Assessment Summary | Improvement Recommendations |

|---|---|---|

Control Environment | Strong ethical framework and leadership commitment. | Enhance staff training in ethical conduct. |

Risk Assessment | Effective identification and management of risks. | Implement more dynamic risk assessment tools. |

Control Activities | Well-defined control activities in place. | Regular review and update of control procedures. |

Information & Communication | Adequate system for information dissemination and feedback. | Streamline communication channels for efficiency. |

Monitoring | Consistent monitoring processes established. | Introduce more frequent internal audits. |

E. Risk Assessment and Management

Our risk assessment process rigorously focuses on areas crucial to financial reporting. Identified key risk areas include receivables, inventory management, and investment evaluation. To mitigate these, we've implemented stringent controls, emphasizing routine checks, database enhancements, and advanced analytics.

Risk Area | Identified Risks | Mitigation Strategies |

|---|---|---|

Receivables | Delayed payments and credit risks. | Implement stricter credit policies and follow-ups. |

Inventory Management | Overstocking and obsolescence. | Optimize inventory levels using predictive analytics. |

Investment Evaluation | Market volatility and investment performance risks. | Strengthen investment review process and diversification strategies. |

Data Management | Inaccuracies and data breaches in financial reporting. | Upgrade database management systems and enhance cybersecurity measures. |

F. Control Activities and Processes

Our control activities and processes are vital for maintaining the integrity of financial reporting. They include reconciliations, duty segregation, and authorization protocols. While effective, enhancements in period-end reporting procedures are identified as necessary for continued improvement.

Control Activity | Evaluation and Improvement Suggestions |

|---|---|

Reconciliation Processes | Robust but require more frequent execution for real-time accuracy. |

Separation of Duties | Effective in reducing errors, but needs regular review for evolving roles. |

Authorization Protocols | Strong controls, but update needed to align with current technologies. |

Period-End Financial Reporting | Efficient, yet advancements in automated tools can further streamline the process. |

G. Information and Communication

[Your Company Name] employs a structured and efficient process for managing financial information, ensuring its accuracy, accessibility, and timely distribution. Our six-step process is designed to optimize the flow of financial data, promoting transparency and informed decision-making across all organizational levels. Upgrading our ERP system is a key recommendation to enhance this process further.

Step-by-step Information and Communication Process

Identification of Information Needs

Data Collection and Recording

Information Processing

Accessibility and Distribution

Feedback Mechanisms

Periodic Review and Update

H. Monitoring Activities

Our approach to monitoring the internal control framework is dynamic and comprehensive, ensuring continuous oversight and evaluation of its effectiveness. We conduct several key activities to maintain high standards of financial integrity and operational efficiency.

Periodic Internal Audits: Regular audits are conducted to scrutinize financial transactions and controls. These audits help in identifying any irregularities or weaknesses, facilitating timely corrective actions.

Control Self-Assessments: Departments conduct self-assessments of their controls, providing a frontline perspective on operational effectiveness and areas for improvement.

Management Reviews: Senior management routinely reviews financial reports and control processes. These reviews are crucial for gaining insights into the performance of various control mechanisms and ensuring alignment with organizational objectives.

Discrepancy Management: Discrepancies identified through audits, assessments, or reviews are documented and addressed. This includes immediate corrective actions for minor issues and developing remediation plans for more significant findings.

I. Deficiencies and Remediation Plans

Our analysis has identified certain deficiencies within our internal control system, particularly in period-end financial reporting and ERP functionalities. We are committed to addressing these through targeted training and policy enforcement, alongside technological upgrades.

Deficiency Area | Identified Issues | Remediation Plans |

|---|---|---|

Period-End Financial Reporting | Inefficiencies in closing processes. | Implement more streamlined procedures and staff training. |

ERP System | Limitations in current functionalities. | Upgrade to a more advanced system with enhanced features. |

Training and Policy Adherence | Inconsistencies in application of policies. | Reinforce training programs and regular policy reviews. |

Communication Channels | Delays in information dissemination. | Optimize internal communication channels for efficiency. |

J. Conclusion and Sign-Off

In conclusion, the company’s internal control over financial reporting is considerably effective. The strengths of the control systems highly outweigh the deficiencies, with the latter already undergoing the necessary remediation process. The undersigned Management members attest to the validity of this Internal Control Report.

Signed,

CEO | CFO |

John Doe | Jane Doe |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Craft your Annual Finance Internal Control Reports with ease using Template.net's customizable template. This user-friendly, editable template streamlines your reporting process. Perfectly adaptable to your specific needs, it's also editable in our Ai Editor Tool, ensuring precision and professionalism in your financial documentation.

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report