Free Annual Financial Statement Report

Executive Summary

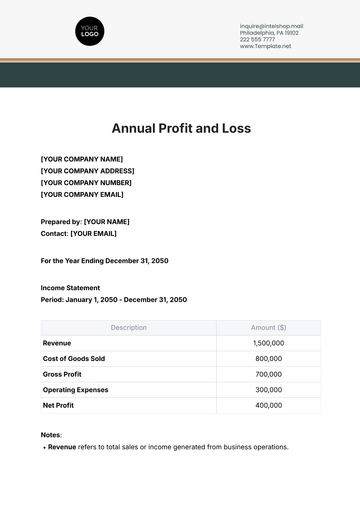

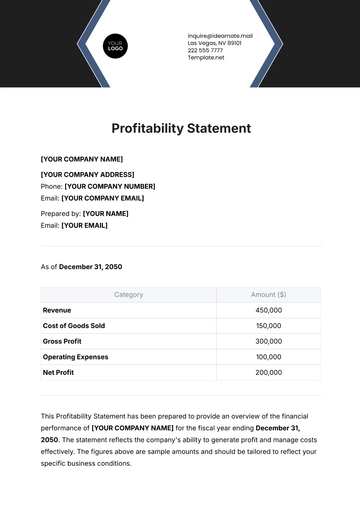

For the fiscal year ended [Date], our organization has demonstrated solid financial performance and stability. The company's total revenue for the year was $120 million, an increase of 15% compared to the previous year. This growth is attributed to the successful launch of new products and expansion into new markets, contributing an additional $20 million to the revenue stream.

The gross profit margin improved from 45% to 50%, thanks to enhanced operational efficiencies and cost reduction strategies. Our net income saw a substantial increase, closing the year at $30 million, compared to $22 million in the previous year.

Total assets grew by 20%, reaching $200 million, with significant investments in technology and infrastructure that are expected to drive future growth. The company maintained a healthy liquidity position, ending the year with a cash balance of $40 million.

Liabilities increased marginally to $60 million, primarily due to long-term investments in business expansion. The debt-to-equity ratio remained stable at 0.3, reflecting a strong balance sheet and prudent financial management.

The year also saw a 10% increase in shareholder equity, which now stands at $140 million, demonstrating confidence in the company's financial health and growth prospects.

In summary, our financial results for [Year] reflect a robust and growing business, with strong revenue growth, improved profitability, and a solid financial position. The company is well-positioned for continued success in the upcoming fiscal year.

Balance Sheet as of [Year-End Date]

Assets | Amount ($) | Liabilities and Equity | Amount ($) | |

Cash and Cash Equivalents | 0 | Accounts Payable | 0 | |

Accounts Receivable | 0 | Short-term Loans | 0 | |

Inventory | 0 | Other Current Liabilities | 0 | |

Other Current Assets | 0 | |||

Total Current Assets | 0 | Total Current Liabilities | 0 | |

Property, Plant & Equipment | 0 | Long-term Loans | 0 | |

Intangible Assets | 0 | Deferred Tax Liabilities | 0 | |

Investments | 0 | Other Non-Current Liabilities | 0 | |

Other Non-Current Assets | 0 | |||

Total Non-Current Assets | 0 | Total Non-Current Liabilities | 0 | |

Total Assets | 0 | Total Liabilities | 0 | |

Common Stock | 0 | |||

Retained Earnings | 0 | |||

Other Equity | 0 | |||

Total Equity | 0 | |||

Total Liabilities and Equity | 0 |

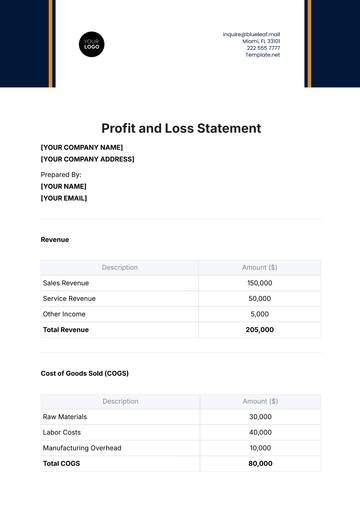

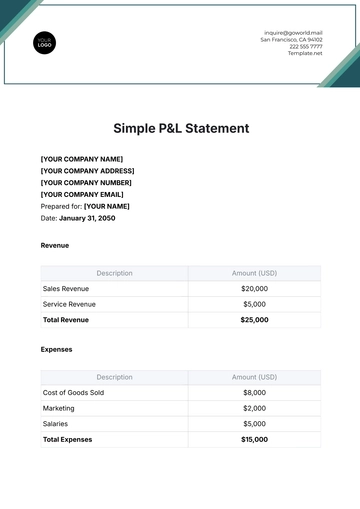

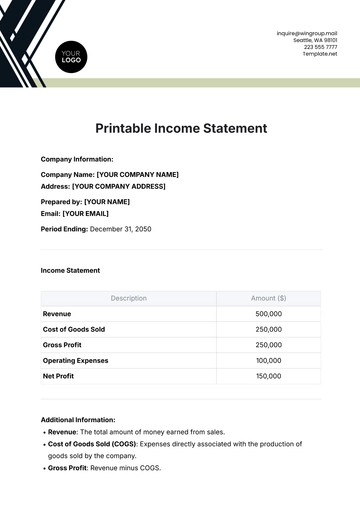

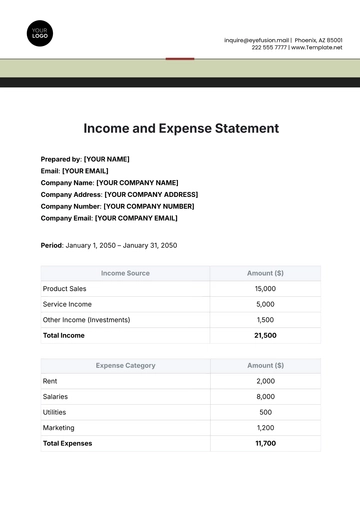

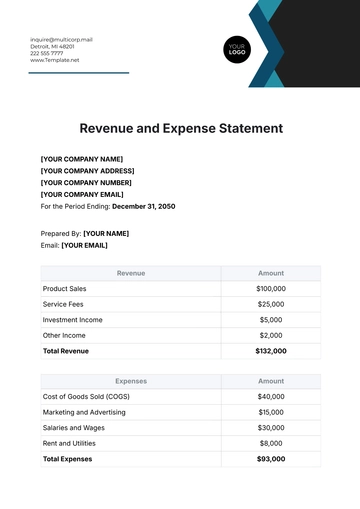

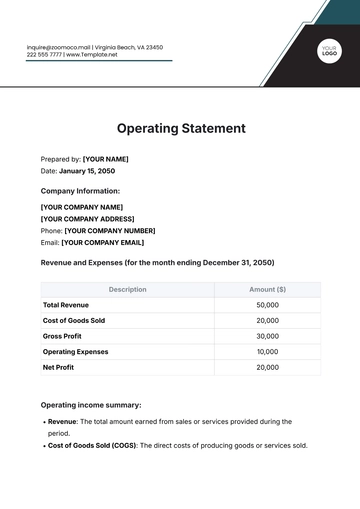

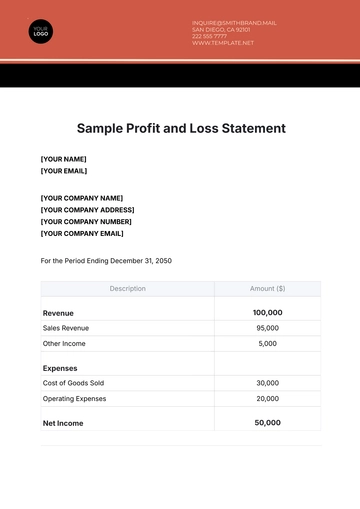

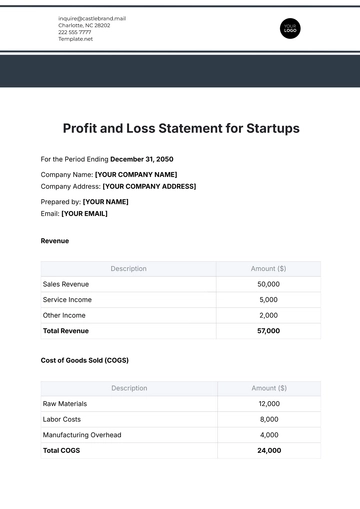

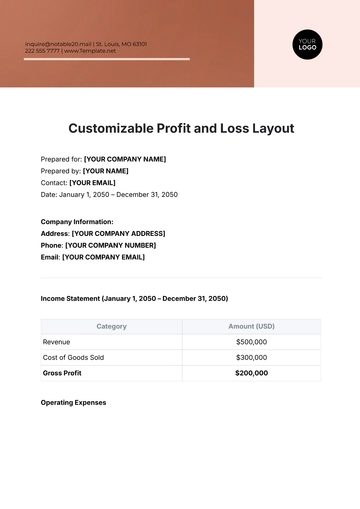

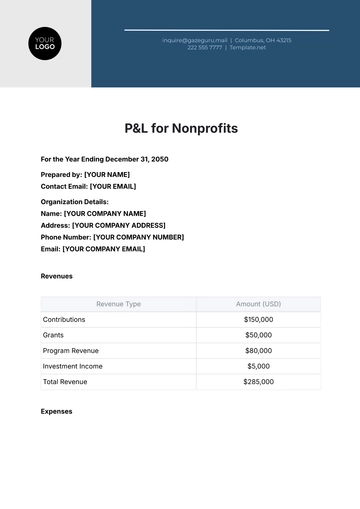

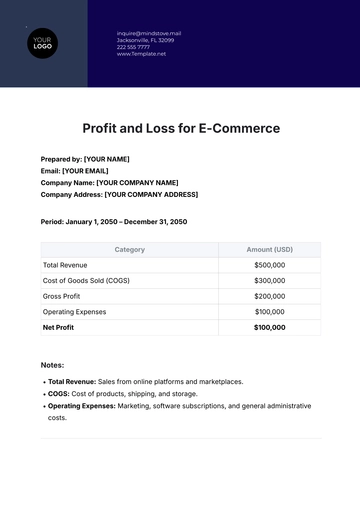

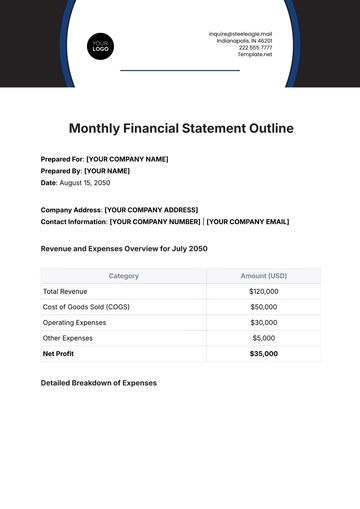

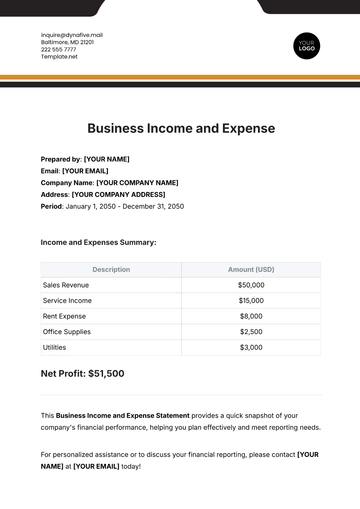

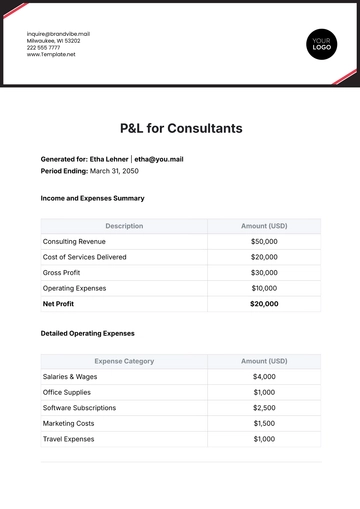

Income Statement as of [Year-End Date]

Description | Amount ($) |

Revenue | 0 |

Cost of Goods Sold | 0 |

Gross Profit | 0 |

Operating Expenses | 0 |

Selling, General and Administrative Expenses | 0 |

Depreciation and Amortization | 0 |

Operating Income | 0 |

Interest Expense | 0 |

Other Income/Expense | 0 |

Pre-Tax Income | 0 |

Income Tax Expense | 0 |

Net Income | 0 |

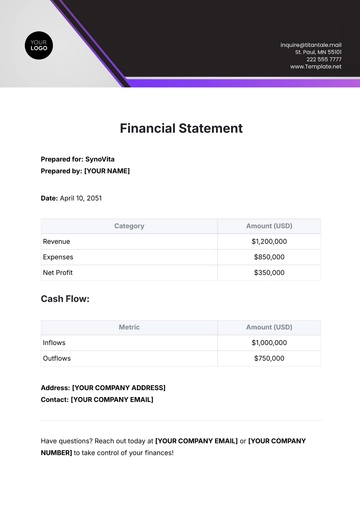

Cash Flow Statement as of [Year-End Date]

Activity | Amount ($) |

Operating Activities | |

Net Income | 0 |

Adjustments for Non-Cash Items | 0 |

Changes in Working Capital | 0 |

Net Cash from Operating Activities | 0 |

Investing Activities | |

Capital Expenditures | 0 |

Investments | 0 |

Net Cash Used in Investing Activities | 0 |

Financing Activities | |

Proceeds from Issuance of Stock | 0 |

Proceeds from Loans | 0 |

Dividends Paid | 0 |

Net Cash from (Used in) Financing Activities | 0 |

Net Increase (Decrease) in Cash | 0 |

Beginning Cash Balance | 0 |

Ending Cash Balance | 0 |

Statement of Changes in Equity [Year-End Date]

Component | Beginning Balance | Additions | Deductions | Ending Balance |

Common Stock | 0 | 0 | 0 | 0 |

Retained Earnings | 0 | 0 | 0 | 0 |

Other Equity | 0 | 0 | 0 | 0 |

Total Equity | 0 | 0 | 0 | 0 |

Auditor's Report

To the Shareholders of Our Organization:

We have audited the accompanying financial statements of our organization, which comprise the balance sheet as of [Date], and the income statement, cash flow statement, and statement of changes in equity for the year then ended, and a summary of significant accounting policies and other explanatory information.

In our opinion, the financial statements present fairly, in all material respects, our financial position as of [Date], and its financial performance and cash flows for the year then ended in accordance with generally accepted accounting principles.

Basic of Opinion: Our audit was conducted in accordance with auditing standards. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Financial Statements: Management is responsible for the preparation and fair presentation of these financial statements in accordance with generally accepted accounting principles; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibilities: Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our opinion.

Management Discussion and Analysis (MD&A)

This MD&A provides an overview of the financial condition and operating results of our organization for the fiscal year ended [Date].

Financial Performance: The company’s revenue grew to $120 million, a 15% increase from the previous year. This growth is primarily attributed to the successful introduction of new product lines and expansion into new geographical markets. Our profit margin improvements are a result of strategic cost management and operational efficiencies.

Market and Operations: [Year] was marked by significant investment in technology and infrastructure, setting the stage for future growth. These investments contributed to a 20% increase in our total assets, now valued at $200 million. The company successfully penetrated new markets, which is expected to be a continued source of revenue growth.

Financial Position: Our balance sheet remains strong with a stable debt-to-equity ratio of 0.3. The increase in total liabilities to $60 million is a strategic move to fuel further expansion. The company’s liquidity position is robust, ending the year with a cash balance of $40 million, ensuring sufficient capital for upcoming initiatives.

Future Outlook: Looking forward, we are poised for sustained growth. Our focus will be on leveraging our new technological capabilities and further expanding our market presence. We are committed to enhancing shareholder value through continued financial health and strategic investments.

Risk Management: We are aware of the risks associated with our expansion and are committed to managing these through prudent financial practices and robust market analysis. We believe our current risk management strategies are well-aligned with our growth objectives.

We remain dedicated to delivering strong financial performance and building a sustainable future for our shareholders.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

The Annual Financial Statement Report Template from Template.net is a comprehensive tool for annual financial reporting. Editable and customizable in our AI tool, it provides a structured format for presenting annual financial data clearly and accurately. Ideal for businesses and financial professionals, this template is essential for compiling thorough annual financial statements, critical for financial analysis and decision-making.