Free Financial Investment Feasibility Study

Executive Summary

Overview of the Investment Opportunity

In the year 2050, our company is presented with a unique financial investment opportunity in the emerging technology sector. The investment involves the development and management of a portfolio of innovative tech startups that have shown substantial growth potential. This feasibility study assesses the viability of this investment opportunity and provides valuable insights for decision-making.

Key Findings and Recommendations

The analysis indicates that the investment opportunity is promising, with strong potential for significant returns. Key findings include:

The technology sector is projected to experience robust growth in the coming years.

The selected startups demonstrate innovative solutions and a solid track record.

The initial investment cost is estimated at $50 million.

Revenue projections indicate a potential annual return of 20%.

Based on these findings, we recommend proceeding with the investment while implementing a comprehensive risk mitigation strategy.

Introduction

Background and Context

The year 2050 is marked by rapid technological advancements and changing market dynamics. Our company aims to leverage these opportunities by strategically investing in promising tech startups to diversify its portfolio and enhance long-term financial stability.

Purpose of the Feasibility Study

The primary purpose of this feasibility study is to evaluate the financial investment opportunity and provide a comprehensive analysis of its feasibility, risks, and potential rewards. The study will assist stakeholders in making informed decisions regarding the investment.

Scope and Objectives

The study will focus on the following key objectives:

Assess the market conditions and trends in the technology sector.

Evaluate the financial feasibility of the investment, including cost estimates and revenue projections.

Identify and mitigate potential risks associated with the investment.

Ensure compliance with legal and regulatory requirements.

Develop an operational plan for the successful implementation of the investment.

Market Analysis

Market Overview

The technology sector in 2050 is characterized by rapid innovation, driven by advancements in artificial intelligence, renewable energy, and biotechnology. Market size is projected to reach $10 trillion, presenting substantial growth opportunities for investors.

Market Trends

Key market trends include:

Increased focus on sustainability and renewable energy solutions.

Integration of AI and automation in various industries.

Growth of the biotechnology sector, with breakthroughs in healthcare and agriculture.

Expansion of the Internet of Things (IoT) ecosystem.

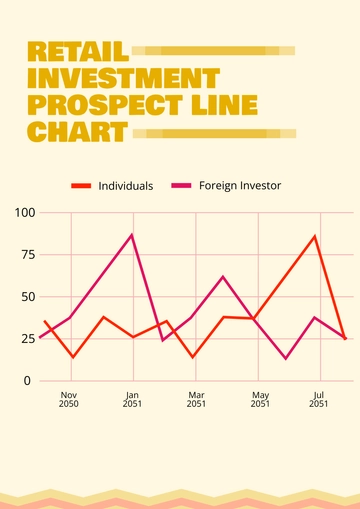

Target Audience Analysis

Our target audience includes high-net-worth individuals, institutional investors, and corporate partners seeking exposure to innovative technology startups. We aim to diversify our investor base for this opportunity.

Competitor Analysis

Competitors in the investment landscape include venture capital firms and tech-focused investment groups. Our competitive advantage lies in our strategic approach and industry connections.

SWOT Analysis

Strengths | Weaknesses |

Strong financial backing | Initial high investment cost |

Established industry reputation | Market volatility |

Access to a network of startups | Limited expertise in some tech subsectors |

Diversification of the portfolio | Regulatory compliance challenges |

Growth potential of tech startups |

Opportunities | Threats |

High market growth potential | Economic downturns |

Innovative startup opportunities | Technological disruptions |

Strategic partnerships | Competition from other investors |

Long-term profitability | Legal and regulatory changes |

Sustainable technology trends | Cybersecurity risks |

Financial Analysis

Investment Cost Estimation

The initial investment cost is estimated at $50 million, including capital injections into selected startups, operational expenses, and contingency reserves.

Revenue Projections

Based on market analysis and startup performance, revenue projections indicate an annual return of 20% on the investment. This includes dividends, capital gains, and exit strategies.

Cost Projections

Cost projections encompass operational expenses, management fees, and potential losses. A detailed cost breakdown is provided in Table 1 below.

Profitability Analysis

The projected profitability of the investment indicates a positive net present value (NPV) and internal rate of return (IRR), demonstrating its financial viability.

Break-Even Analysis

The break-even analysis estimates the point at which the investment begins generating positive returns. This is expected to occur within the third year of the investment.

(Table 1: Cost Projections)

Expense Category | Year 1 ($M) | Year 2 ($M) | Year 3 ($M) |

Startup Investments | 25 | 15 | 10 |

Operational Expenses | 5 | 5 | 5 |

Contingency Reserves | 5 | 5 | 5 |

Management Fees | 2.5 | 2.5 | 2.5 |

Total Expenses | 37.5 | 27.5 | 22.5 |

Risk Assessment

Identification of Investment Risks

Key risks include market volatility, startup failure, regulatory changes, and technological disruptions. Detailed risk assessments and mitigation strategies are outlined in Section 5 of this study.

Risk Mitigation Strategies

To mitigate risks, we propose diversifying the startup portfolio, conducting thorough due diligence, and staying updated on regulatory changes. These strategies aim to reduce potential losses and ensure long-term sustainability.

Sensitivity Analysis

Sensitivity analysis explores the impact of varying assumptions on investment outcomes. It helps assess the robustness of the investment model under different scenarios.

Legal and Regulatory Compliance

Regulatory Framework

The investment will comply with all relevant financial regulations, including reporting, transparency, and investor protection requirements.

Compliance Requirements

To ensure compliance, we will establish a dedicated legal and compliance team responsible for monitoring regulatory changes and implementing necessary adjustments.

Legal Considerations

Legal considerations include contractual agreements with startups, investor agreements, and intellectual property protection. A legal framework will be established to address these aspects.

Operational Plan

Investment Implementation Timeline

The investment will be implemented over a three-year period, with a phased approach to portfolio development and risk management.

Resource Allocation

Resource allocation includes human capital, technology infrastructure, and strategic partnerships. These resources will be allocated efficiently to support the investment's success.

Projected Cash Flow

A detailed cash flow projection is provided in Table 2, outlining expected inflows and outflows over the investment period.

Key Performance Indicators (KPIs)

KPIs will be established to track and measure the investment's performance, including ROI, portfolio diversification, and risk-adjusted returns.

(Table 2: Projected Cash Flow)

Year | Inflows ($M) | Outflows ($M) | Net Cash Flow ($M) |

Year 1 | 60 | 37.5 | 22.5 |

Year 2 | 70 | 27.5 | 42.5 |

Year 3 | 80 | 22.5 | 57.5 |

Conclusions and Recommendations

Summary of Key Findings

In conclusion, the feasibility study indicates that the financial investment opportunity in the technology sector for the year 2050 is promising. The investment is financially viable, with a positive NPV and IRR. However, it is not without risks, and a comprehensive risk mitigation strategy is recommended.

Investment Viability Assessment

Based on the analysis, the investment is considered viable and aligned with our company's long-term growth objectives. It offers the potential for significant financial returns and portfolio diversification.

Recommendations for Decision-Making

We recommend proceeding with the investment, subject to thorough due diligence, risk mitigation, and compliance measures. Continuous monitoring and adaptation to market dynamics will be essential for success.

This feasibility study serves as a valuable resource for stakeholders to make informed decisions regarding the financial investment opportunity in the technology sector for the year 2050.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Optimize your investment portfolio with Template.net's Finance Portfolio Diversification Survey Template. This editable, customizable survey assesses investment diversification. It's an important tool for financial advisors and investors to evaluate portfolio spread across various assets, ensuring risk is managed effectively and investment strategies align with diversification principles.