Free Finance Budget Feasibility Study

I. Executive Summary

For [Your Company Name], the proposed budget for the upcoming fiscal year is crafted to enhance operational efficiency and drive strategic growth. Key components include substantial investments in technology and infrastructure, increased allocations for research and development, and a robust plan for marketing and sales expansion.

Key Objectives and Outcomes

The core goal of this feasibility study for [Your Company Name] is to rigorously evaluate whether the proposed budget is practical and sustainable, considering our current financial status. The expected outcome is to ascertain the budget’s alignment with [Your Company Name]'s long-term financial goals and its operational capabilities. A successful outcome would be a budget that not only addresses immediate operational needs but also strategically positions [Your Company Name] for future growth and stability in the market industry.

II. Current Financial Assessment

By analyzing recent financial statements and dissecting income and expenses, we establish a baseline understanding of the company's financial capacity and readiness for budget implementation.

A. Financial Status Analysis

A thorough review of the organization’s current financial status, including an examination of the latest income statements, balance sheets, and cash flow statements.

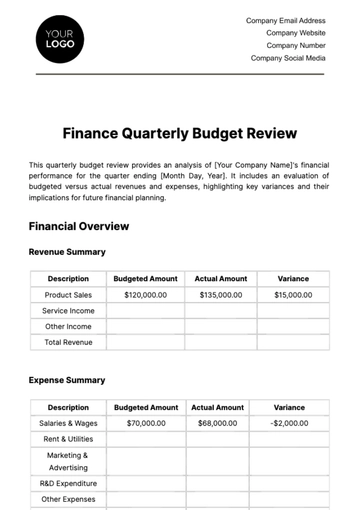

Financial Statement | Key Components | Details | Percent/Amount |

Income Statement | Revenue, Cost of Goods Sold, Gross Profit, Operating Expenses, Net Income | Analysis of revenue sources and profitability | Gross Margin: 40% |

Balance Sheet | Assets, Liabilities, Shareholder's Equity | Evaluation of financial stability and asset management | Debt-to-Equity Ratio: 0.5 |

Cash Flow Statement | Operating Activities, Investing Activities, Financing Activities | Assessment of cash inflows and outflows | Operating Cash Flow: $[amount] |

B. Review of Income and Expenses

Detailed scrutiny of existing revenue streams and expenditure patterns. This review helps in identifying areas of financial strength and weakness, which are crucial in determining the feasibility of the proposed budget.

Category | Income/Expense Source | Amount (Annual) | Percentage of Total |

Revenue Streams | Product Sales | $[1,000,000], | [60%] |

Fixed Expenses | |||

Variable Expenses |

III. Budget Proposal Analysis

This section critically examines the proposed budget for [Your Company Name], focusing on the distribution and allocation of funds. It evaluates how the budget aligns with the organization's strategic objectives and whether the allocations are justified and effective in meeting the company's financial goals.

A. Examination of Proposed Budget

In-depth analysis of the proposed budget, focusing on its structure, allocation of funds, and projected expenses. This includes evaluating how the budget addresses key organizational objectives and how funds are distributed among various departments or projects.

Budget Category | Allocation | Percentage of Total Budget | Alignment with Objectives |

Operational Expenditures | $[10,000] | [40%] | Supports day-to-day operational efficiency |

B. Assessment of Budget Allocations

Critical evaluation of the rationale behind the budget allocations and their alignment with strategic priorities. This assessment aims to ensure that each allocation is justified and contributes to the overall financial goals of the organization.

Allocation Category | Rationale | Contribution to Goals | Percentage of Allocation |

Technology Upgrades | To modernize and enhance operational efficiency | Increases productivity and cost savings | [20%] |

IV. Risk Assessment and Contingency Planning

In this vital section, we evaluate potential financial risks associated with the proposed budget for [Your Company Name] and develop comprehensive contingency plans to mitigate these risks. This proactive approach ensures preparedness for unforeseen financial challenges.

A. Identification of Potential Risks

This segment identifies potential financial risks that may impact the execution of the proposed budget. Risks could include market volatility, unexpected expenditure increases, or revenue shortfalls.

Risk Category | Description | Potential Impact | Likelihood |

Market Volatility | Fluctuations in market conditions | Affects investment returns, revenue generation | Medium |

Unanticipated Expenditures | Unexpected increases in operational costs | Strains budget allocations, reduces profitability | High |

Revenue Shortfalls | Lower than projected sales or revenue | Leads to funding gaps for planned projects | Low |

Regulatory Changes | New laws or regulations affecting operations | Compliance costs, operational adjustments | Medium |

Technological Disruptions | Emergence of new technologies impacting operations | Requirement for unplanned tech upgrades | Medium |

B. Development of Contingency Plans

Formulation of strategies to mitigate identified risks. This includes creating financial buffers, diversifying income sources, or developing plans to reduce non-essential expenditures in case of financial setbacks.

Risk Mitigation Strategy | Plan Description | Implementation Method | Expected Outcome |

Financial Buffer Creation | Setting aside a portion of the budget as a reserve | Allocating a percentage of monthly revenue to contingency funds | Readiness for unforeseen expenses |

Income Diversification | Exploring and developing alternative revenue streams | Identifying new markets, products, or services | Reduced dependence on single income source |

Cost Reduction Initiatives | Plans to reduce non-essential spending | Regular review of expenditures, implementing cost-saving measures | Improved financial stability during setbacks |

Compliance Readiness | Staying updated with regulatory changes | Regular legal consultations, training for staff | Swift adaptation to regulatory changes |

Technological Adaptability | Investing in technology for operational efficiency | Researching emerging tech trends, allocating funds for tech upgrades | Ensuring competitive edge in market |

V. Feasibility and Recommendations

We present an evaluation of [Your Company Name]'s proposed budget, assessing its feasibility against the company's financial standing and risk profile. Based on the findings, we provide targeted recommendations to refine and enhance the budget, aligning it more closely with strategic and operational objectives.

A. Evaluation of Feasibility

Upon thorough examination, the feasibility of [Your Company Name]'s proposed budget reveals several key insights. The budget's allocation towards new technological investments, while ambitious, aligns well with the company's long-term growth strategy. However, the analysis indicates potential strain in operational cash flow due to these high upfront costs. The risk assessment highlights market volatility as a significant concern, particularly regarding the company's reliance on a limited number of revenue streams. While the overall budget demonstrates a forward-looking approach, it requires careful balancing to ensure financial stability in the face of potential market uncertainties.

B. Recommendations

Based on the feasibility study, we recommend the following adjustments to [Your Company Name]'s budget:

Reallocate Funds for Cash Flow Stability: A portion of the budget earmarked for technology upgrades should be redirected to bolster the operating cash reserve, ensuring liquidity and operational resilience.

Gradual Investment in Technology: Rather than a large upfront investment in new technologies, we suggest a phased approach to spread out the expenditure over multiple fiscal periods.

Diversification of Revenue Streams: To mitigate risks associated with market volatility, exploring new markets or product lines is recommended to diversify income sources.

Enhanced Risk Management Measures: Increase the contingency fund allocation by [5%] of the total budget to prepare for unforeseen financial setbacks.

Cost Optimization in Non-Essential Areas: Identify and reduce expenditures in non-critical areas by [10%], reallocating these funds to areas with higher returns or strategic importance.

These recommendations aim to refine [Your Company Name]'s budget, enhancing its feasibility and alignment with both immediate operational needs and long-term strategic goals. They provide a blueprint for balanced financial planning.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Unlock financial success with Template.net's Finance Budget Feasibility Study template. Carefully designed for maximum efficacy, this editable, customizable tool empowers decision-making. Editable in our Ai Editor Tool, this invaluable resource will enable you to plan effectively and efficiently. Discover the power of strategized financial planning with Template.net today.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising