Free Payroll Accounting Report

I. Introduction

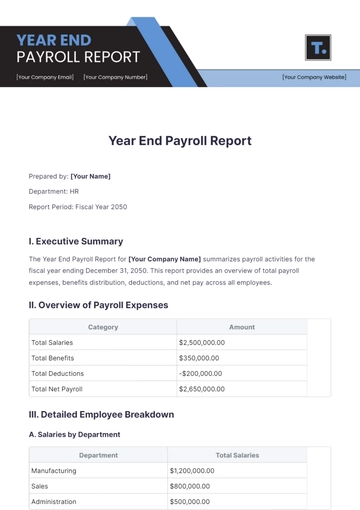

This comprehensive Payroll Accounting Report presents an in-depth evaluation of our company's payroll activities for the year 2050. The intent is to deliver transparency, display the efficiency of our financial operations, and disclose critical payment details. The report scrutinizes the management of salaries, wages, bonuses, and deductions within the company, while also addressing compliance with various tax laws. Our goal is to ensure that each stakeholder has comprehensive insight into the payroll process and its outcomes. By doing so, we believe it will aid in better decision-making and promote an environment of fiscal responsibility within the company.

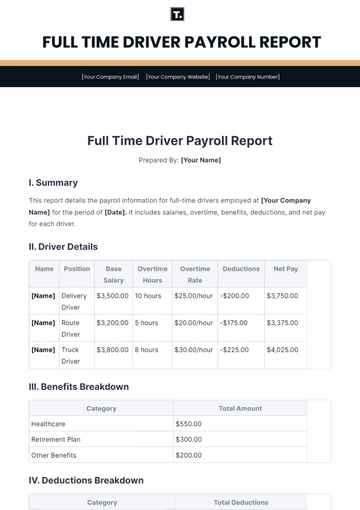

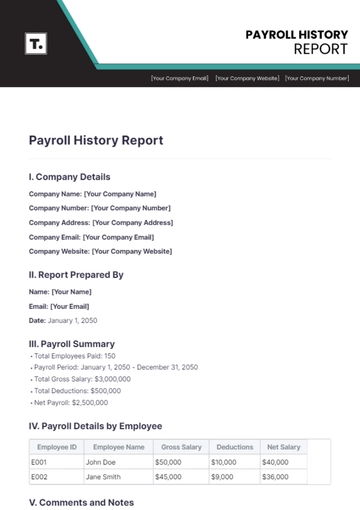

II. Employee Compensation

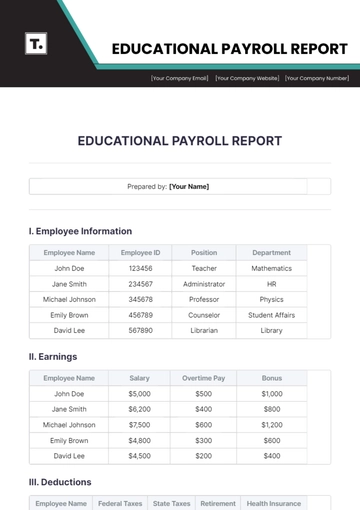

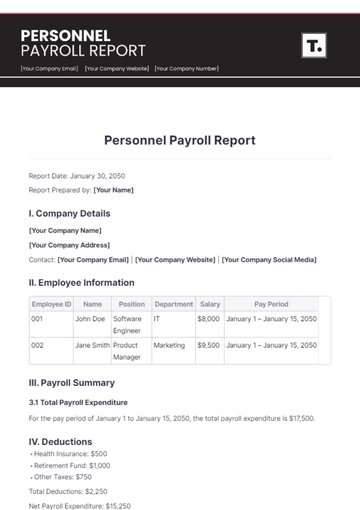

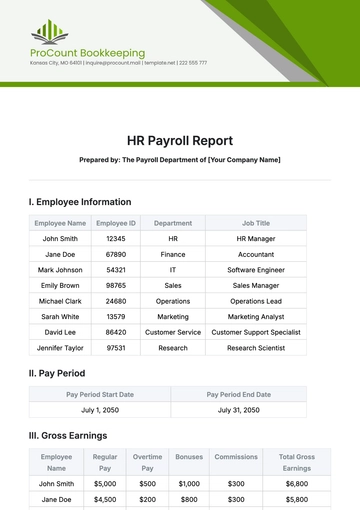

The table below provides details of our employees' compensation:

Name | Employee ID | Salary | Benefits |

|---|---|---|---|

Taylor Rogers | 12-15893 | $80,000 | $20,000 |

Employee compensation is an essential part of our payroll accounting system. It shows the company's responsibility and commitment to providing remuneration packages that are transparent and fair. It also reflects the company's appreciation for its employees' efforts and contribution toward achieving the company's goals. The detail presented here depicts the total compensation for employee 12-15893, an integral member of our establishment, for the year 2050. The employee's remuneration package is allocated into two sections; his yearly salary of $80,000 plus benefits totaling $20,000 making her total remuneration package hit $100,000.

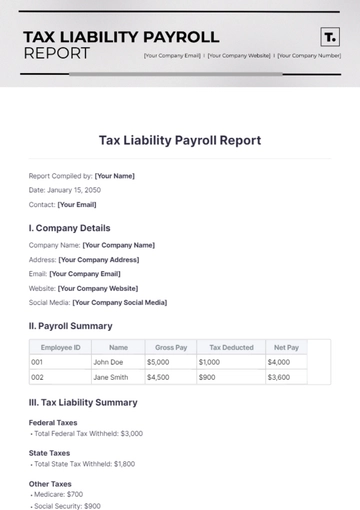

III. Payroll Taxes

The table below provides the details of payroll taxes:

Employee Name | Employee ID | Federal Tax | State Tax |

|---|---|---|---|

Taylor Rogers | 12-15893 | $16,000 | $4,000 |

Accurate calculation and timely payment of payroll taxes bear significant implications for our company. They ensure our legal compliance with tax statutes, reduce the risk of penalties, and affirm our commitment to filing and remitting our employees' taxes as a part of responsible corporate citizenship. The detail presented here demonstrates the total payroll tax deductions for employee 12-15893 for the year 2050. The payroll tax of the employee includes both federal and state amounts which come to $16,000 and $4,000 respectively.

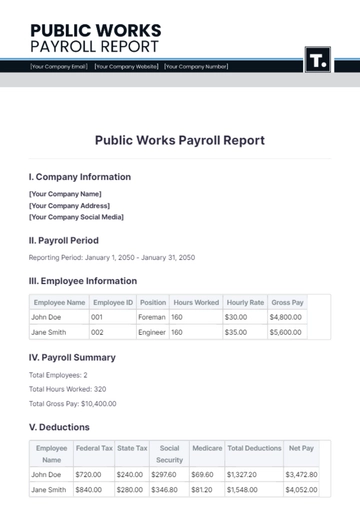

IV. Deductions

The table below provides detail of deductions:

Employee Name | Employee ID | Health Insurance | Retirement Plan |

|---|---|---|---|

Taylor Rogers | 12-15893 | $2,500 | $3,000 |

Payroll deductions are a key feature in the company's payroll accounting system. They are not only a requirement by certain laws but also an effective method for sowing into our employee's future security. This serves to guarantee employees maintain their wellbeing and have a secure future post-retirement. The captured details here express the deductions for retirement plan and health insurance contributions for employee 12-15893 for the year 2050. The employee has $2,500 deducted for health insurance and $3,000 for her retirement plan annually.

V. Conclusion

In conclusion, our payroll accounting report for [2050] attests to our commitment to transparent, fair, and responsible financial operations in the company. It demonstrates our dedication to employee compensation, legal compliance via accurate payroll taxes, and future security via significant payroll deductions for health and retirement benefits. With a total compensation package with salaries and benefits and mindful deductions for federal and state taxes as well as health and retirement plans, we maintain a beneficial and regulatory abiding payroll structure. Moving forward, the company will continue to be consistent with these principles so that we continue promoting an environment of fiscal responsibility. The transparency and the data provided will serve as a valuable reference point for better decision-making in the future.

Prepared by: [YOUR NAME]

For and under: [YOUR COMPANY NAME]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Unlock actionable insights easily with the Payroll Accounting Report Template from Template.net! This comprehensive and customizable report empowers effective payroll data analysis. Leverage our AI Editor Tool for modifications, ensuring a report that aligns with your analytical needs. Enhance decision-making with this versatile and editable resource. Get your ally now!

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report