Free Payroll Accounting Case Study

I. Introduction

A. Overview

Our organization, a medium-sized manufacturing company, is the subject of this case study. With a workforce exceeding 500 employees, our operations fall within a highly regulated industry, necessitating meticulous attention to the intricacies of payroll management. This case study meticulously explores a specific payroll challenge we encountered, shedding light on the complexities inherent in our compensation and benefits administration systems.

B. Purpose

The primary aim of this case study is to conduct an in-depth analysis of the identified payroll challenge, providing valuable insights into our organization's payroll practices and their broader implications. Through the dissection of this real-world scenario, our study seeks to contribute to a comprehensive understanding of payroll accounting complexities, particularly within the context of compliance, decision-making, and risk management.

C. Objectives

Evaluate Legal Compliance

Assess our organization's compliance with federal and state labor laws, tax regulations, and other pertinent legal requirements within the payroll domain. This objective aims to uncover potential areas of non-compliance and their implications for our operations.

Analyze Decision-Making Processes

Investigate the decision-making mechanisms employed within our organization for payroll management. By scrutinizing these processes, we aim to identify key considerations, challenges, and effective strategies.

Enhance Risk Management

Explore how we manage risks associated with payroll processes, identifying areas for improvement and showcasing effective risk mitigation strategies. This objective aims to strengthen our overall risk management framework within the payroll domain.

II. Background

A. Historical Evolution

Manual Systems Era

In the early stages of our operations, payroll management was characterized by manual processes. Extensive paperwork and manual calculations were the norm, demanding meticulous attention to detail.

Technological Integration

As technology advanced, we underwent a significant transformation by integrating automated payroll systems. This marked a pivotal shift, enhancing the accuracy and efficiency of our financial processes.

B. Employee Dynamics Specialized Roles

Our workforce is structured into various specialized roles, each playing a distinctive part in our organizational success. The diversity in roles contributes to the complexity of our payroll structures.

Performance-Based Compensation

To align with our commitment to excellence, compensation structures incorporate performance-based incentives. This approach motivates our employees and fosters a culture of continuous improvement.

C. Technological Advancements

Cloud-Based Payroll Systems

Embracing modern trends, we transitioned to cloud-based payroll systems. This move not only ensures real-time accessibility but also enhances data security, reflecting our dedication to staying at the forefront of technological advancements.

Integration of AI

Artificial Intelligence (AI) has become an integral part of our payroll processes. The integration of AI elements automates routine tasks, reducing manual workload and positioning us at the forefront of efficiency in payroll management.

D. Past Hurdles and Solutions

Compliance Challenges

In our journey, we encountered challenges related to compliance with changing tax regulations and labor laws. Navigating these complexities required strategic solutions.

Implementation of Compliance Training

To address compliance challenges, we implemented comprehensive training programs. These initiatives not only enhanced our team's understanding of regulations but also fortified our commitment to legal and ethical payroll practices.

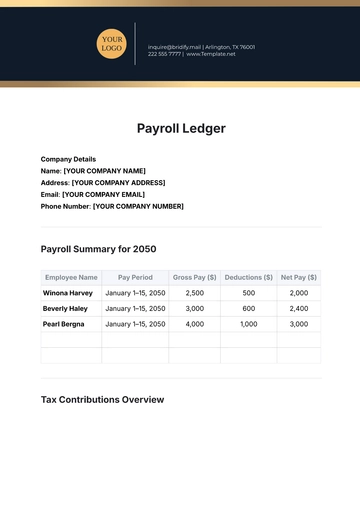

III. Payroll Structure

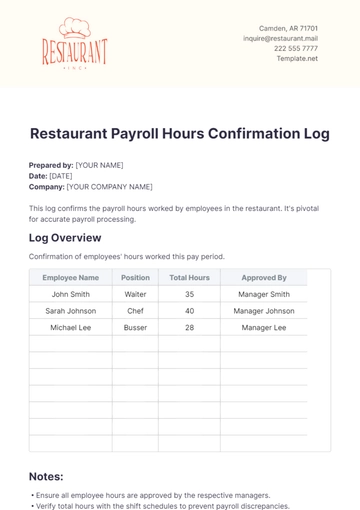

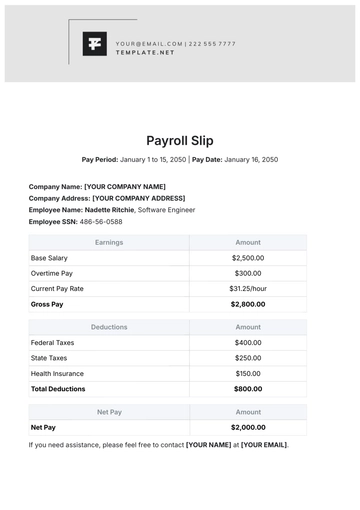

The table below outlines key elements shaping our payroll, providing a snapshot of our workforce categorization, compensation components, and benefits distribution":

Employee Category | Compensation Components | Benefits |

|---|---|---|

Full-Time | Base Salary, Bonuses | Health Insurance, Retirement Plans |

In examining the Full-Time category, employees receive a base salary complemented by bonuses tied to performance metrics. This dual-component compensation structure aligns with our commitment to recognizing and rewarding sustained effort and exceptional achievements. Furthermore, benefits for full-time employees extend to comprehensive health insurance coverage and retirement plans, fostering a holistic approach to employee well-being.

This employee category's compensation structure signifies a blend of fixed and variable elements, providing stability through the base salary while incentivizing high performance through bonuses. By categorizing employees based on their roles and responsibilities, delineating compensation components, and outlining benefits, we establish a clear and equitable framework. This clarity is vital not only for employee satisfaction but also for internal consistency and compliance with regulatory standards. A well-defined payroll structure contributes to organizational success by fostering a positive work culture, attracting top talent, and promoting financial stability among our workforce. Additionally, it reinforces our commitment to employee well-being and aligns our compensation practices with broader industry trends, positioning us competitively in the talent market.

IV. Legal and Regulatory Framework

Ensuring compliance with legal and regulatory requirements is integral to our payroll management. The table below outlines key aspects of adherence to federal and other statutory obligations:

Regulatory Aspect | Compliance Status | Action Steps Taken |

|---|---|---|

Federal Labor Laws | Fully Compliant | Regular audits conducted to ensure adherence |

Current compliance status with federal labor laws, indicates that we are fully compliant. Our approach involves regular audits to ensure strict adherence to federal labor laws. Through comprehensive reviews of employee classifications, wage and hour practices, and workplace safety standards, we proactively prioritize legal compliance. This not only mitigates the risk of legal disputes but also fosters a work environment that upholds employees' rights and well-being.

Focusing on legal and regulatory adherence is critical as it establishes the foundation for ethical and lawful payroll practices. Compliance with federal and state regulations is non-negotiable, safeguarding both the organization and its employees. The meticulous tracking and assessment of compliance status, as outlined in the table, demonstrate our commitment to upholding the highest standards. This not only ensures that our payroll practices align with the latest legal requirements but also serves as a proactive measure to prevent potential legal challenges. By staying informed about evolving regulations and implementing necessary actions, we fortify our organizational resilience, build trust with our workforce, and contribute to the overall integrity of our business operations.

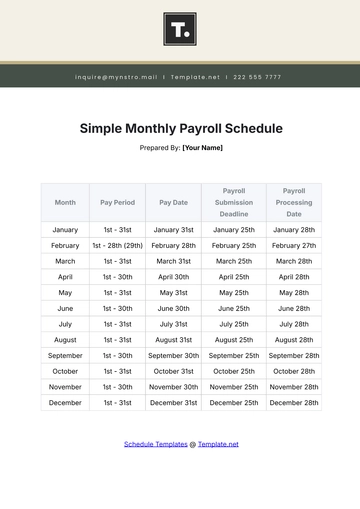

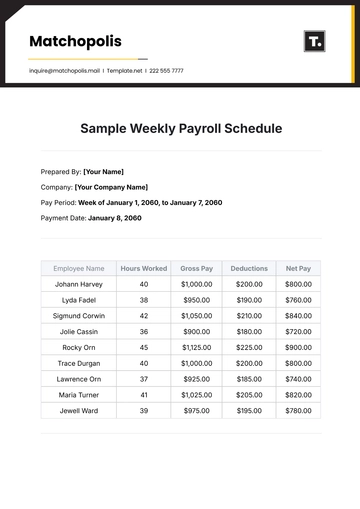

V. Technology and Tools

Efficient payroll processing is contingent upon the implementation of robust technology and tools. The table below provides a snapshot of the software and technology in use, evaluating their effectiveness, and examining their impact on enhancing overall efficiency.

Technology/Software Used | Evaluation of Effectiveness | Impact on Efficiency |

|---|---|---|

Xero Payroll | Highly Effective | Streamlined Payroll Processing |

Xero Payroll, our primary payroll software, stands out as highly effective. Its user-friendly interface, extensive features, and seamless integration capabilities have significantly streamlined our payroll processing. Xero automates routine tasks, from calculating wages to generating tax forms, reducing manual effort and minimizing errors. Real-time reporting features provide valuable insights, contributing to enhanced accuracy and efficiency in our financial processes. Evaluating the effectiveness and impact of these tools, particularly the highly effective Xero Payroll, ensures that we make informed decisions about technological investments. This approach fosters innovation, continuous improvement, and keeps our payroll processes aligned with the organization's evolving needs, contributing to overall operational excellence.

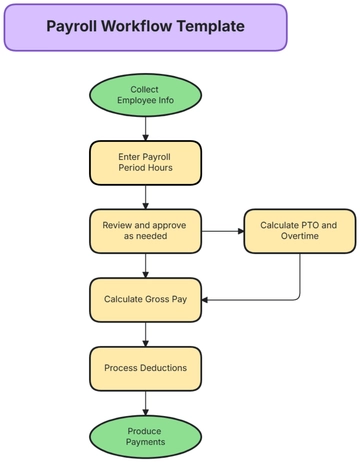

VI. Challenges and Issues

Effectively managing challenges within our payroll processes is pivotal for sustaining operational efficiency. This list below provides an in-depth exploration of specific areas presenting challenges, categorized into Internal Challenges and External Factors:

A. Internal Challenges

Compliance Complexity

Increased Risk of Errors and Legal Repercussions

The intricate nature of compliance requirements poses a substantial risk, heightening the likelihood of errors and potential legal consequences. Proactive measures are imperative to maintain accuracy and mitigate legal challenges.

Difficulty in Keeping up with Changing Labor Laws

The dynamic landscape of labor laws demands constant vigilance. The challenge lies in staying abreast of legislative changes, ensuring ongoing compliance, and adapting our processes accordingly.

Complexity in Ensuring Accurate Employee Classification

Accurate employee classification is pivotal for compliance. The complexity arises from nuanced criteria determining classifications, necessitating precision to avoid misclassifications.

Integration Hurdles

Hindered Seamless Collaboration Between Departments

Integration challenges impede smooth collaboration between different departments. Achieving a seamless flow of information is critical for accurate payroll processing and comprehensive workforce management.

Challenges in Merging Payroll Data with Other HR Systems

The integration of payroll data with other HR systems presents challenges. Ensuring data consistency and accuracy across diverse systems demands strategic planning and robust technological solutions.

Potential for Data Discrepancies Due to Lack of Integration

The absence of integration may lead to data discrepancies, affecting the overall integrity of payroll information. Integrating systems is vital to maintain a unified and accurate dataset.

B. External Factors

Market Fluctuations

Impact on Compensation Structures and Budgeting

External market fluctuations significantly impact compensation structures and budgeting. Adapting payroll practices to align with market trends and economic changes is essential for maintaining competitiveness.

Challenges in Adjusting Payroll Practices to Align with Market Trends

Navigating market trends and aligning payroll practices accordingly presents challenges. Flexibility and responsiveness are key to ensuring that our compensation strategies remain competitive.

Potential Disparities in Employee Expectations Due to Market Changes

Market changes may create disparities in employee expectations. Addressing these disparities requires proactive communication and strategic adjustments to align expectations with evolving market conditions.

Legislative and Regulatory Changes

Impact on Compliance Requirements

Evolving legislative and regulatory landscapes impact compliance requirements. Staying informed about changes is essential for adapting payroll processes to remain in accordance with updated standards.

Challenges in Navigating Multijurisdictional Compliance

Operating in multiple jurisdictions introduces complexity. Navigating diverse compliance requirements demands a comprehensive understanding of regional variations in labor laws and taxation.

Potential Legal Risks Due to Non-Compliance

Non-compliance with legislative changes poses legal risks. Effectively addressing these challenges through thorough audits and timely adjustments is essential to mitigate legal repercussions.

VII. Recommendations

Effective strategies are essential to overcome challenges and enhance the overall efficiency of our payroll processes. The following are the outlined below:

A. Internal Measures

Enhancing Compliance Protocols

Establishing a dedicated compliance team equipped to proactively monitor and swiftly communicate changes in labor laws fosters a proactive approach to regulatory adherence.

Introducing regular training sessions for employees not only imparts a comprehensive understanding of compliance intricacies but also instills a culture of continuous learning and adaptability.

Implementing automated auditing tools represents a technological leap, allowing for real-time identification and rectification of compliance gaps, bolstering our commitment to precision and legal adherence.

Streamlining Integration Processes

Investment in user-friendly integration tools designed to facilitate seamless collaboration between departments is pivotal for creating a synchronized and interconnected organizational ecosystem.

The formation of a centralized integration team underscores our commitment to oversight, ensuring the meticulous integration of payroll data with other HR systems, promoting coherence and accuracy.

Real-time validation checks constitute a proactive measure, addressing potential data discrepancies promptly and thereby fortifying the integrity of our centralized dataset.

Improving Data Accuracy

The introduction of data validation protocols serves as a proactive mechanism to minimize errors in payroll calculations, upholding a standard of precision and reliability.

Regular data cleansing procedures not only ensure accuracy and consistency in employee records but also underscore our commitment to maintaining a pristine and reliable database.

Specialized training sessions for employees, emphasizing the critical importance of accurate data entry, serve as a foundational pillar for cultivating a workforce adept at maintaining data integrity.

B. External Strategies

Adapting to Market Dynamics

The establishment of a dedicated market research team positions us strategically to proactively anticipate changes in compensation trends, aligning our practices with industry benchmarks.

Fostered open communication channels with employees, facilitated through regular surveys and feedback sessions, represent a commitment to inclusivity, ensuring employee expectations remain at the forefront of our compensation strategies.

The development of a flexible compensation structure exemplifies our agility, allowing us to swiftly adapt to market fluctuations, thereby maintaining competitiveness in a dynamic business landscape.

Navigating Legislative Changes

The formulation of a comprehensive compliance strategy for navigating multijurisdictional environments is emblematic of our commitment to legal diligence and adaptability.

Regular engagement with legal counsel exemplifies our commitment to staying abreast of potential legal risks, ensuring timely adjustments to align with evolving legislative landscapes.

The establishment of a legislative compliance calendar serves as a proactive tool, tracking key deadlines and updates, providing our organization with foresight and a proactive stance in the face of regulatory changes.

C. Technological Advancements

Leveraging Advanced Payroll Software

Exploration and investment in cutting-edge payroll software with enhanced automation capabilities signify our commitment to technological progress, streamlining processes for maximum efficiency.

Ensuring seamless integration of advanced software with other organizational systems represents a concerted effort to create a harmonized digital infrastructure, facilitating comprehensive data flow.

Providing training to staff on utilizing advanced features not only enhances operational capabilities but also empowers our workforce with the skills necessary to leverage the full potential of modern payroll technologies.

Implementing Data Security Measures

The enhancement of data security protocols underscores our commitment to safeguarding sensitive payroll information, fostering a culture of trust and reliability.

Regularly updating and testing security measures demonstrates our proactive approach to cybersecurity, ensuring resilience against potential threats and breaches.

The establishment of clear guidelines on data access and role-based permissions serves as a foundational pillar for maintaining the confidentiality and integrity of our payroll data.

D. Continuous Improvement Initiatives

Regular Process Audits

The conduct of periodic audits of payroll processes reflects our commitment to a culture of continuous improvement, providing insights into areas for refinement and enhancement.

Soliciting feedback from relevant stakeholders underscores our dedication to inclusivity, ensuring that diverse perspectives contribute to the refinement of our processes.

The implementation of a cross-functional audit team signifies a holistic approach, ensuring comprehensive assessments that consider various facets of our payroll management system.

Employee Training and Communication

The provision of ongoing training to employees on new payroll processes and technologies demonstrates our investment in empowering our workforce with evolving skills.

Establishing clear communication channels to address employee queries and concerns exemplifies our commitment to transparency, fostering an open dialogue between employees and management.

Conducting regular feedback sessions represents a two-way communication approach, creating an environment where employee insights contribute to the iterative refinement of our payroll practices.

E. Future Preparedness

Scenario Planning for Future Changes

The development of contingency plans to address unforeseen challenges in the payroll landscape positions us strategically to navigate uncertainties with resilience and adaptability.

Regular reassessment and updating of strategies showcase our commitment to staying ahead of evolving industry and economic trends, ensuring our payroll practices remain future-ready.

Fostering a forward-thinking approach to anticipate and prepare for future challenges underscores our proactive stance, aligning our organization with the dynamics of a rapidly evolving business environment.

Investing in Employee Well-being Programs

The consideration of implementing well-being programs to address potential disparities in employee expectations is a testament to our commitment to holistic employee care.

Collaborating with HR to ensure that compensation and benefits align with employee needs demonstrates our dedication to fostering a supportive work environment.

Monitoring employee satisfaction regularly and establishing well-being ambassadors serves as an ongoing initiative to create a workplace where employees feel valued and supported.

VIII. Conclusion

In conclusion, this study highlights the multifaceted challenges faced by our organization in maintaining an efficient and compliant payroll system. Through an in-depth exploration of internal challenges, such as compliance complexity and integration hurdles, and external factors like market fluctuations and legislative changes, we have gained valuable insights into the intricacies of our payroll processes. The recommendations provided across various dimensions, including internal measures, external strategies, technological advancements, continuous improvement initiatives, and future preparedness, serve as a strategic roadmap to enhance the overall effectiveness of our payroll management.

Moving forward, the organization is poised to implement these recommendations systematically, fostering a culture of adaptability and continuous improvement. By leveraging advanced technologies, streamlining integration processes, and proactively addressing market dynamics and legislative changes, we aim to fortify our payroll system against potential challenges. This case study not only identifies areas for enhancement but also lays the foundation for a resilient and future-ready payroll accounting system that aligns with industry best practices and positions our organization for sustained success.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Make your case study with precision with our Payroll Accounting Case Study Template, a customizable resource on Template.net! This fully editable case study allows seamless customization using our AI Editor Tool. Tailor the study to your specific payroll challenges, offering insights and solutions that align with your organizational needs today!