Free Payroll Accounting SWOT Analysis

TABLE OF CONTENTS

Introduction............................................................................................................3

Strengths................................................................................................................4

Weaknesses............................................................................................................5

Opportunities..........................................................................................................7

Threats....................................................................................................................9

Recommendations.................................................................................................10

Conclusion..............................................................................................................11

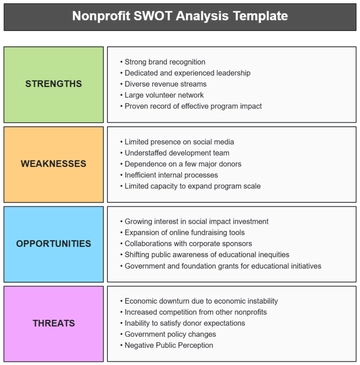

Introduction

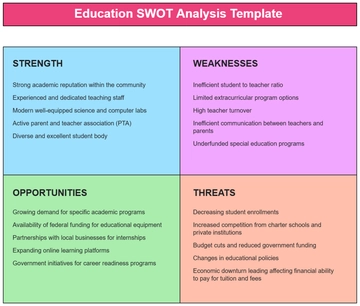

Payroll accounting, a critical component of our financial management, involves the process of calculating and distributing wages, taxes, and other deductions accurately and in compliance with legal standards. This SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis aims to offer a structured overview of our payroll accounting system. It seeks to identify internal factors (strengths and weaknesses) that influence our operations and external elements (opportunities and threats) that shape our strategic landscape. This analysis will serve as a cornerstone for strategic planning and operational improvement in our payroll management.

Strengths

The strengths of the payroll accounting system at [Your Company Name] are fundamental elements that ensure operational success and financial integrity. These strengths reflect the company's dedication to precision, efficiency, and employee well-being. Here, we detail the critical strengths that underscore the effectiveness of our payroll system.

Precision in Calculations and Legal Compliance: The payroll system at [Your Company Name] is characterized by its high level of accuracy in wage calculation. This precision is crucial in maintaining compliance with tax laws and other financial regulations, thereby reducing the risk of legal complications. The ability to consistently meet these complex regulatory requirements underlines the system's reliability and safeguards the company's reputation.

Efficient Processing Systems: Efficiency in payroll processing is a standout strength. The utilization of advanced software or methodologies streamlines payroll operations, significantly cutting down the time required to process payments. This efficiency not only reduces operational costs but also allows the HR and finance teams to focus on other critical tasks.

Positive Impact on Employee Morale: Timely and accurate payment processing is a key factor in maintaining high employee morale and trust. When employees consistently receive their wages without errors or delays, it fosters a sense of reliability and respect towards the company. This strength is vital in employee retention and satisfaction, contributing positively to the overall workplace atmosphere.

Data Management and Security: The payroll system at [Your Company Name] excels in managing sensitive employee data with utmost security. The implementation of robust data protection measures ensures that employee information is kept confidential and safe from any unauthorized access or breaches, which is crucial in today's digital age.

Adaptability to Changes: The payroll system demonstrates a remarkable capacity to adapt to changes, whether they are internal shifts in company policy or external changes in tax laws and regulations. This adaptability ensures that payroll processes remain uninterrupted and compliant under varying circumstances, showcasing the system's resilience and flexibility.

Advanced Reporting Capabilities: The payroll system at [Your Company Name] likely possesses advanced reporting functionalities. This feature enables the generation of in-depth financial reports and analytics, offering critical insights into payroll expenditures, taxation trends, and overall financial health. Such detailed reporting aids in strategic decision-making and financial planning.

Comprehensive Benefit Management: The payroll system might excel in the integrated management of various employee benefits, ranging from health insurance to retirement plans. This comprehensive approach simplifies administrative processes and enhances employee experience by providing a one-stop solution for benefit management, thereby boosting employee satisfaction and loyalty.

These strengths collectively contribute to the operational excellence and financial stability of [Your Company Name], playing a crucial role in the company's overall success and growth.

Weaknesses

Identifying and understanding the weaknesses in the payroll accounting system at [Your Company Name] is crucial for developing strategies to mitigate these challenges. These weaknesses, if not addressed, could lead to operational inefficiencies, financial discrepancies, and employee dissatisfaction. This section outlines the primary weaknesses in our payroll accounting system, providing a foundation for continuous improvement and risk management.

Complexity of Payroll Management: The complexity inherent in payroll accounting, especially in navigating various tax laws and employment regulations, stands as a significant weakness. This complexity requires specialized knowledge and often leads to a reliance on a few skilled individuals, which can be a risk if such expertise is not widely distributed within the team.

Resource Intensiveness: Operating an in-house payroll system can be resource-intensive, involving significant costs in terms of both finance and time. This includes expenses related to software maintenance, staff training, and updating systems to comply with new regulations, which can strain the company’s budget and resource allocation.

Risk of Errors in Manual Processes: If the payroll process involves manual inputs or calculations, it increases the risk of human error. These errors, ranging from incorrect tax withholdings to misreported hours, can lead to legal issues and financial losses, as well as negatively impact employee trust and satisfaction.

Vulnerability to Regulatory Changes: The payroll system may exhibit a vulnerability to frequent and sometimes abrupt regulatory changes. Staying updated with the latest tax laws and employment regulations requires constant vigilance and can be challenging, potentially leading to compliance issues.

Limited Scalability: The current payroll system may lack scalability, making it challenging to adapt efficiently to the changing size or structure of the company. As [Your Company Name] grows, the payroll system might struggle to handle an increased number of employees or varied employment agreements, leading to inefficiencies.

Data Security Concerns: While data management is a strength, there is always a concern for data security, particularly with sensitive employee information. The payroll system might be vulnerable to cyber threats or data breaches, which could have severe implications for privacy and trust.

Limited Customization Options: The current payroll system may face limitations in its ability to be customized to the specific and evolving needs of [Your Company Name]. This inflexibility could hinder the adaptation of the system to unique business models or specific employee requirements, potentially impacting operational efficiency.

Delayed System Updates: TThere may be notable delays in implementing updates or integrating new features into the payroll system. This lag can prevent the system from staying abreast of the latest technological advancements or regulatory changes, possibly affecting its efficiency and compliance with current standards.

Addressing these weaknesses is essential for enhancing the effectiveness and reliability of the payroll accounting system at [Your Company Name]. Recognizing these areas for improvement paves the way for strategic planning and the adoption of measures to bolster the overall payroll management process.

Opportunities

Exploring and capitalizing on opportunities within the payroll accounting system can significantly enhance [Your Company Name]'s operational efficiency and strategic positioning. Recognizing these opportunities is key to maintaining a competitive edge and ensuring long-term success. This section outlines potential opportunities that can be harnessed to improve our payroll accounting processes.

Technological Advancements: The process of payroll technology presents significant opportunities. Investing in state-of-the-art payroll software or cloud-based solutions can automate many processes, reduce manual errors, and enhance efficiency. This technology can also offer better data analytics capabilities, providing insightful metrics for decision-making.

Integration with HR Systems: There is an opportunity to integrate payroll accounting more closely with other HR systems. This integration can streamline data management, improve accuracy in employee records, and offer a more holistic view of HR functions, leading to better coordinated and strategic HR practices.

Outsourcing Payroll Functions: Outsourcing payroll functions to specialized firms can be a viable opportunity. This move can reduce operational costs, minimize errors, and allow the internal team to focus on core business strategies and other critical financial operations.

Employee Self-Service Platforms: Implementing employee self-service platforms for payroll-related tasks presents an opportunity to enhance employee engagement and reduce administrative burdens. These platforms can enable employees to view their pay stubs, manage tax information, and update personal details, fostering transparency and empowerment.

Adapting to Regulatory Changes: The ability to swiftly adapt to regulatory changes can be turned into a strategic opportunity. Staying ahead of legal requirements not only ensures compliance but can also position [Your Company Name] as a proactive and responsible employer.

Training and Development: Investing in training and development for payroll staff is an opportunity to enhance expertise and efficiency within the team. Continuous learning opportunities keep staff updated on best practices and new technologies, contributing to overall process improvement.

Sustainability Initiatives: Transitioning to paperless payroll systems is not only environmentally friendly but can also be cost-effective in the long run. Embracing sustainability in payroll processes can enhance the company's brand image and appeal to environmentally conscious stakeholders.

Global Expansion Compatibility: As [Your Company Name] considers expansion into international markets, adapting the payroll system to handle global payroll requirements emerges as a significant opportunity. This involves accommodating different currencies, tax laws, and employment regulations, thereby positioning the company for successful global operations.

Collaborations with Financial Technology Companies: Partnering with financial technology companies presents an opportunity to introduce cutting-edge payroll solutions. Such collaborations could lead to the adoption of innovative features like real-time wage access, enhanced financial planning tools for employees, and streamlined payment processes, setting [Your Company Name] apart in employee financial management.

By leveraging these opportunities, [Your Company Name] can refine its payroll accounting processes, align them with contemporary trends, and ensure that the payroll system supports the broader organizational goals. This proactive approach can lead to substantial benefits, including improved efficiency, cost savings, and enhanced employee satisfaction.

Threats

It is crucial for [Your Company Name] to be aware of potential threats that could impact its operations and financial stability. Identifying these threats is essential for proactive risk management and ensuring the resilience of our payroll system. This section outlines the key external challenges and risks that could pose threats to the effectiveness and security of our payroll accounting processes.

Regulatory Changes and Compliance Risks: The frequent changes in tax laws and employment regulations represent a significant threat. Staying compliant with these rules can be challenging, and non-compliance could lead to legal issues and financial penalties.

Technological Disruptions: Advancements in technology, while presenting opportunities, also pose threats such as obsolescence of current systems. The need to continuously update and maintain technological infrastructure to keep up with new trends can be both costly and resource-intensive.

Cybersecurity Vulnerabilities: As payroll systems increasingly rely on digital platforms, the threat of cyber attacks and data breaches becomes more pronounced. These security threats can compromise sensitive employee data, leading to loss of trust and potential legal ramifications.

Economic Fluctuations: Economic downturns or fluctuations can strain the financial resources of [Your Company Name], impacting the budget allocated for payroll operations. This could lead to constraints in updating systems, training staff, or maintaining efficient payroll processes.

Competitive Pressures: There is a constant threat from competitors offering more advanced, cost-effective payroll solutions. Keeping pace with industry standards and competitors’ offerings is essential to avoid losing market relevance.

Dependence on Third-Party Providers: If payroll functions are outsourced, there is a threat associated with over-reliance on third-party service providers. Issues such as service disruptions, changes in service agreements, or provider insolvency can directly impact the payroll process.

Employee Expectations and Satisfaction: The expectations of employees regarding payroll transparency, flexibility in benefits, and payment options can be a threat if not adequately addressed. Failure to meet these expectations may lead to decreased employee satisfaction and retention challenges.

Legal Risks Due to Misclassification: The risk of legal challenges due to the misclassification of employees or contractors in the payroll system is a significant concern. Misclassification can lead to incorrect wage calculations, improper tax withholdings, or benefits distribution, potentially resulting in legal disputes and financial penalties.

Evolving Employee Expectations: The dynamic nature of workforce demographics and changing employee expectations regarding transparency, flexibility, and benefits in payroll can pose a challenge. If the current system lacks the agility to adapt to these evolving needs, it could lead to decreased employee satisfaction and potential retention issues.

Recognizing and preparing for these threats is vital for [Your Company Name] to maintain a robust and secure payroll accounting system. Proactive strategies and contingency planning can mitigate these risks, ensuring the payroll process remains resilient and effective in supporting the company’s overall objectives.

Recommendations

Addressing the strengths, weaknesses, opportunities, and threats identified in the SWOT analysis is crucial for the continuous improvement of the payroll accounting system at [Your Company Name]. The following recommendations are designed to leverage strengths, mitigate weaknesses, capitalize on opportunities, and guard against potential threats. Implementing these recommendations will contribute to the efficiency, security, and compliance of the payroll process, aligning it with the company’s strategic goals.

Upgrade Technology Infrastructure: Invest in the latest payroll software or cloud-based solutions to automate and streamline payroll processes. This will not only enhance efficiency but also reduce the likelihood of errors and ensure compliance with regulatory changes.

Strengthen Data Security Measures: Given the sensitivity of payroll data, prioritize strengthening cybersecurity measures. Regular security audits, employee training on data safety, and investing in robust cybersecurity software can safeguard against data breaches.

Expand Training and Development: Conduct regular training sessions for the payroll team to keep them updated on the latest payroll practices, software, and regulatory changes. This will address the complexity of payroll management and reduce reliance on a few skilled individuals.

Consider Outsourcing Options: Evaluate the benefits and drawbacks of outsourcing payroll functions, especially for specialized tasks or during peak times. This can reduce the burden on internal resources and potentially offer cost savings.

Enhance Integration with HR Systems: Improve the integration of payroll with other HR systems to ensure seamless data flow and accuracy. This can lead to better workforce management and more strategic HR decisions.

Develop a Scalable Payroll System: Ensure that the payroll system is scalable to accommodate the growth of [Your Company Name]. This may involve modular software solutions that can be adapted or expanded as needed.

Implement Employee Self-Service Platforms: Adopt self-service platforms for employees to manage their payroll-related tasks. This will improve transparency, reduce administrative workload, and enhance employee satisfaction.

Stay Proactive with Regulatory Compliance: Establish a system for staying updated with regulatory changes, perhaps through a compliance officer or external consultancy. This proactive approach will prevent compliance-related issues.

Regular Review and Feedback Mechanisms: Set up regular reviews of the payroll process and establish feedback mechanisms with employees to understand their needs and expectations. This will help in making continuous improvements.

Crisis Management and Contingency Planning: Develop a comprehensive contingency plan to manage potential threats, such as economic downturns or cyber-attacks. This plan should include backup processes, emergency funds, and communication strategies.

Implementing these recommendations requires careful planning, resource allocation, and ongoing monitoring. It’s important to tailor these actions to the specific needs and context of [Your Company Name], ensuring they align with the company's overall strategy and operational capabilities.

Conclusion

The SWOT analysis for payroll accounting at [Your Company Name] has provided valuable insights into the internal strengths and weaknesses, as well as external opportunities and threats that shape our payroll processes. Key strengths like precision in calculations and efficiency in processing systems highlight the robustness of our current system. However, challenges such as the complexity of payroll management and vulnerability to regulatory changes underline areas for improvement.

The recommendations proposed aim to fortify our payroll system against these threats while capitalizing on available opportunities. By focusing on technology upgrades, employee training, regulatory compliance, and data security, [Your Company Name] can ensure a resilient and efficient payroll system. This SWOT analysis serves as a strategic tool, guiding [Your Company Name] towards operational excellence in payroll accounting and contributing to the overall success of the organization.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Boost your payroll accounting efficiency with Template.net's Payroll Accounting SWOT Analysis Template. It is a fully customizable and editable template, designed to maximize your strategic planning process. You can conveniently modify this tool in our Ai Editor Tool, tailoring it to your specific needs. Perfectly streamline your finances and leverage opportunities with this wonderful product!