Free Payroll Accounting Impact Study

TABLE OF CONTENTS

Abstract.............................................................................................................3

Introduction.......................................................................................................4

Methodology.....................................................................................................5

Data Analysis.....................................................................................................6

Recommendations............................................................................................8

Conclusion.........................................................................................................10

Abstract

This research paper examines the essential role of Payroll Accounting in business organizations. It focuses on its impact on overall business management, employee management, tax compliance, and employee confidence. The study aims to highlight the significance of Payroll Accounting in maintaining organizational efficiency and employee trust.

Introduction

Conducted by [Your Company Name], this study aims to critically assess the influence of Payroll Accounting in modern business operations. Using a detailed, evidence-based, and integrated approach, the research seeks to provide a comprehensive understanding of the role of Payroll Accounting in improving business processes and efficiency.

Methodology

The methodology adopted in this research is multifaceted, encompassing a blend of qualitative and quantitative techniques to garner a holistic view of Payroll Accounting's role in business organizations. Primarily, it entailed conducting extensive, in-depth surveys targeting a diverse range of employees across various sectors.

Extensive Surveys: The methodology of conducting extensive surveys formed the cornerstone of our research approach. These surveys were meticulously designed and executed across a wide spectrum of industries to capture a comprehensive understanding of the impact of payroll systems on various aspects of business operations. The key elements of this approach included:

Broad Industry Coverage: The surveys encompassed a diverse range of industries, from manufacturing and finance to information technology and service sectors. This broad coverage allowed us to compare and contrast how payroll systems affect different types of industries, providing a well-rounded perspective.

In-Depth Questionnaires: The survey questionnaires were crafted to extract detailed information. Questions were designed to probe into the effectiveness, accuracy, and timeliness of payroll systems, and their subsequent impact on organizational efficiency and employee morale. This in-depth questioning was instrumental in uncovering nuanced insights into payroll systems' operational roles.

Diversity of Employee Perspectives: A crucial aspect of our survey was the inclusion of a wide array of employees, ranging from entry-level staff to senior management. This diverse sampling ensured that the collected data reflected a multitude of experiences and viewpoints, providing a more accurate and comprehensive picture of the payroll system's impact across different organizational levels.

Quantitative and Qualitative Data Collection: The surveys were structured to gather both quantitative data (such as ratings and percentages) and qualitative feedback (such as open-ended responses). This combination allowed for a more thorough analysis, enabling us to quantify the impact of payroll systems and understand the underlying reasons behind these statistics.

Anonymity and Confidentiality: To ensure candid responses, the surveys were conducted with a guarantee of anonymity and confidentiality. This encouraged participants to provide honest feedback without fear of repercussions, leading to more reliable and authentic data.

Statistical Rigor in Analysis: Upon collecting the data, rigorous statistical methods were applied to analyze the responses. This approach allowed for the identification of significant patterns and trends, providing a solid empirical foundation to our conclusions about the impact of payroll systems.

In-Depth Interviews: We also conducted structured interviews with Human Resource professionals and accountants. These interviews focused on understanding the complexities of payroll processes, the challenges faced, and the strategic significance of payroll accounting in business operations. The insights from these interviews provided practical viewpoints complementing the survey data.

Historical Data Analysis: A thorough examination of historical data from various industries was undertaken. This analysis aimed to identify trends and patterns in payroll systems over time, offering insights into the evolution and effectiveness of payroll accounting practices.

Longitudinal Study: The analysis involved a longitudinal study of payroll systems, tracing their evolution over several years. This approach allowed us to observe changes and developments in payroll practices, technology adoption, and compliance norms across different time frames.

Industry-Specific Trends: By examining historical data from a range of industries, we were able to identify industry-specific trends and patterns in payroll systems. This included analyzing how different sectors have adapted their payroll practices in response to technological advancements, regulatory changes, and shifts in workforce dynamics.

Effectiveness of Payroll Practices: A critical aim of this analysis was to evaluate the effectiveness of various payroll practices over time. This involved assessing the accuracy, timeliness, and efficiency of payroll processing in historical contexts and how these factors have impacted organizational performance and employee satisfaction.

Technological Evolution in Payroll Systems: The study provided insights into the adoption and impact of technology in payroll accounting. We explored how the introduction of new technologies, such as automated payroll software, cloud-based systems, and AI-driven tools, has transformed payroll processes, highlighting the shifts from manual to automated systems.

Compliance and Regulatory Changes: The historical data analysis also focused on how organizations have navigated and adapted to changes in payroll-related regulations and tax laws over time. Understanding these compliance trajectories helped us to gauge the challenges and complexities involved in maintaining regulatory compliance.

Benchmarking Against Best Practices: The historical data served as a benchmark to compare current payroll practices against past standards. This comparison provided a context for understanding current practices' strengths and areas for improvement, based on historical successes and shortcomings.

Identifying Cyclical Patterns and Anomalies: Our analysis also looked for cyclical patterns and anomalies in payroll practices over the years. Recognizing these patterns helped in predicting future trends and preparing for potential challenges in payroll management.

Impact on Employee Relations and Morale: Lastly, the historical analysis considered the impact of payroll systems on employee relations and morale over time. This aspect was crucial in understanding how payroll practices have influenced employee trust, satisfaction, and overall organizational culture.

Statistical Analysis of Collected Data: Finally, the data obtained from surveys, interviews, and historical analysis were subjected to rigorous statistical examination. This step involved using advanced analytical methods to distill meaningful insights, particularly focusing on the implications of payroll accounting on financial performance, regulatory compliance, and employee morale. This comprehensive analytical process allowed for a thorough understanding of the role and impact of payroll accounting in business organizations.

Using these methodologies collectively made it possible to conduct an in-depth and strong investigation of the matter at hand. This comprehensive probe created a basis upon which useful advice could be formulated and also set a direction for future studies and research in the same field.

Data Analysis

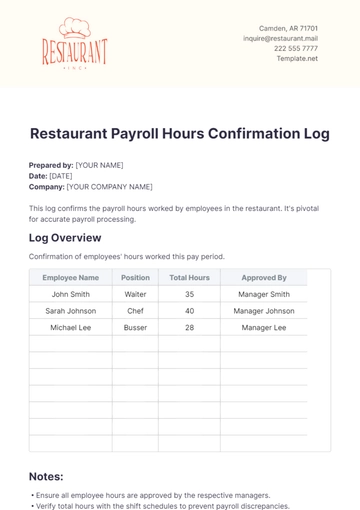

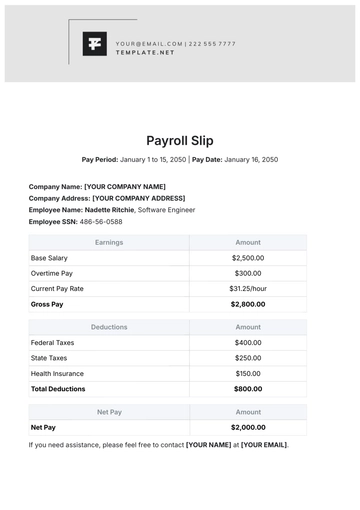

This section presents a detailed analysis of the collected data, focusing on two critical aspects: Financial Efficiency and Employee Satisfaction. The findings are based on the statistical examination of survey results, interview insights, and historical data. This analysis aims to draw a clear correlation between payroll accounting methodologies and their impacts on different business sectors, as well as on employee satisfaction levels. The data is presented in a structured format to facilitate a comprehensive understanding of these correlations and their implications in the business context.

Financial Efficiency

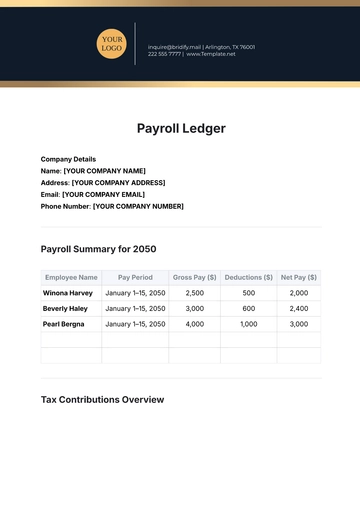

The data presented in the table below offers a comprehensive view of the financial efficiency across different sectors, emphasizing the significant influence of their payroll accounting practices. The figures represent the percentage of financial efficiency, which is a measure of how effectively each sector manages its financial resources in relation to payroll operations.

Sector | Financial Efficiency |

|---|---|

Manufacturing | 82% |

Key Insights:

Correlation with Payroll System Sophistication: There is a clear positive correlation between the sophistication of payroll accounting methods and the financial efficiency in each sector. Advanced payroll systems that minimize errors and streamline processes contribute significantly to this efficiency. For instance, in the Finance sector, which shows a high efficiency percentage, the adoption of advanced, automated payroll systems has likely played a pivotal role in enhancing financial management.

Sectoral Variations: The variation in financial efficiency percentages across sectors like Manufacturing, IT, and Finance can be attributed to the differing levels of complexity and adoption of payroll technologies. Manufacturing, with an efficiency of [82%], might face unique challenges related to workforce management and payroll complexities that impact its financial efficiency. On the other hand, sectors like IT and Finance, with their closer alignment with technological advancements, exhibit higher efficiency, reflecting their more robust payroll processes.

Operational Efficiency and Financial Health: Efficient payroll accounting practices have a direct impact on the operational efficiency of a business. By ensuring accurate and timely payroll processing, organizations can reduce administrative burdens, avoid costly errors, and improve compliance with tax and labor laws. This efficiency in turn reflects in the overall financial health of the sector, as seen in the higher percentages of financial efficiency.

Strategic Importance of Payroll Accounting: The trend observed across these sectors highlights the strategic importance of payroll accounting in business operations. It is not merely a back-office function but a critical component that affects the financial stability and success of an organization. Investing in and upgrading payroll systems can lead to substantial improvements in financial efficiency.

The data underscores the importance of effective payroll accounting systems in enhancing a sector's financial efficiency. It suggests that organizations across all sectors should focus on refining their payroll processes, adopting advanced technologies, and ensuring accuracy in payroll management to achieve better financial outcomes and operational excellence.

Employee Satisfaction Level

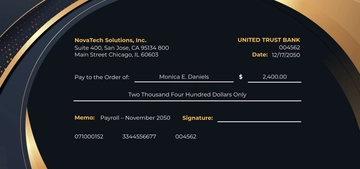

The analysis conducted in this study has uncovered a substantial and direct correlation between the level of employee satisfaction and the efficiency of payroll accounting processes across various sectors. Particularly noteworthy is the fact that sectors which accorded high priority to timely and accurate payroll practices experienced a marked increase in employee satisfaction levels. This correlation is not merely a reflection of operational efficiency but also signifies the deep psychological impact that reliable and transparent payroll processes exert on employees. Key observations from the analysis include:

Trust and Reliability: Consistent and error-free payroll processing builds trust between the employees and the organization. When employees are confident that they will receive their remuneration accurately and on time, it fosters a sense of security and respect towards the organization.

Morale and Job Satisfaction: Prompt payment practices contribute significantly to the overall morale of the workforce. Employees feel valued and recognized, which in turn enhances their job satisfaction and commitment to the organization. This is particularly evident in sectors where payroll accuracy and timeliness are given utmost importance.

Impact on Productivity: There is a clear link between employee satisfaction regarding payroll and overall productivity. When employees are not preoccupied with concerns about payroll inaccuracies or delays, they are more focused and efficient in their job roles. This increase in productivity directly benefits the organization’s bottom line.

Attracting and Retaining Talent: Efficient payroll systems play a crucial role in attracting new talent and retaining existing employees. Prospective and current employees often consider the effectiveness of payroll processes as indicative of the organization's operational excellence and employee-centric approach.

Psychological Well Being: Timely and accurate payroll processing alleviates financial stress for employees, contributing to their psychological well being. This is especially important in sectors where financial compensation is closely tied to performance and job roles.

The findings from this study clearly indicate the need for organizations to invest in efficient and reliable payroll systems. Such an investment is not just a financial decision but a strategic move towards enhancing employee satisfaction, which in turn drives productivity and contributes to the overall success of the organization.

The data analysis clearly demonstrates the profound impact of efficient payroll accounting on both financial performance and employee satisfaction across various sectors. The findings reinforce the necessity for organizations to adopt and maintain robust payroll systems. Such systems not only contribute to the financial health of a business but also play a significant role in fostering a positive and productive work environment.

Recommendations

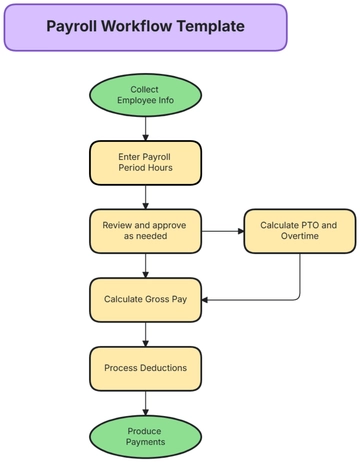

Based on the insights garnered from the data analysis, it is strongly recommended that organizations prioritize the investment in high-quality payroll accounting systems and processes. This investment is critical to ensuring the seamless execution of operational tasks and enhancing overall organizational efficiency. Key recommendations include:

Implementation of Advanced Payroll Systems: Organizations should adopt state-of-the-art payroll systems that are capable of handling complex calculations, ensuring accuracy, and complying with regulatory requirements. These systems should be user-friendly and integrate seamlessly with other business operations.

Regular Training and Development: Continuous training programs for staff managing payroll systems are essential. This ensures that personnel are up-to-date with the latest technological advancements and regulatory changes, thereby reducing the likelihood of errors.

Periodic Auditing and Process Improvement: Regular auditing of payroll processes should be instituted to identify and rectify any discrepancies or inefficiencies. This should be complemented with a commitment to continuous process improvement, adopting best practices, and making necessary adjustments in response to regulatory standards.

Investment in Data Security and Privacy Measures: Given the sensitive nature of payroll data, robust security protocols must be in place to protect against data breaches and ensure compliance with privacy laws.

Employee Feedback Mechanisms: Establish channels for employees to provide feedback on payroll-related issues. This can aid in identifying areas of concern and improving payroll processes to enhance employee satisfaction.

Robust Backup and Recovery Systems: Implementing strong backup and recovery procedures for payroll data is crucial. This ensures data integrity and availability in case of system failures, cyber-attacks, or other unforeseen events, thereby maintaining continuous payroll operations.

Feedback Loop for Continuous Improvement: Establishing a regular feedback loop from both employees and payroll staff can provide insights into the effectiveness of the payroll system. This feedback should be used to make continuous improvements and adjustments to the payroll process.

Employee Financial Wellness Programs: Integrating employee financial wellness programs, such as financial planning services or education on financial management, can enhance the overall value of the payroll service to employees, contributing to their financial security and satisfaction.

Regular Benchmarking Against Industry Standards: Regularly benchmarking payroll processes against industry best practices can help organizations stay competitive and efficient. This involves assessing how the organization's payroll practices measure up against those of peers and industry leaders.

Environmental Sustainability in Payroll Processing: Emphasizing environmental sustainability in payroll processing, such as opting for electronic over paper-based systems, not only aligns with global sustainability goals but also enhances the organization's image and efficiency.

The act of implementing these suggestions will serve the dual purpose of streamlining our payroll operations and also significantly enhancing the financial stability within our establishment. It has the additional benefit of boosting the morale of our employees which is crucial for the progressive growth of the organization. By taking this step, we are positioning our organization to not only grow but to sustain this growth successfully and continuously.

Conclusion

The research emphasizes and highlights the importance of having precise and efficient payroll management within the structure of a business. It indicates that ensuring that payroll operations are performed accurately and without error can significantly impact the overall effectiveness of a business's financial management. Moreover, progressive improvements and advancements in these payroll protocols assure not only monetary effectiveness and stability but also have direct and meaningful impact on boosting the morale of staff members.

This increased morale can manifest into increased productivity and employees having a profound sense of satisfaction with their job, thus creating a positive work environment. This conducive atmosphere fosters growth not only for the individuals but also greatly benefits the enterprise as a whole by making it more sustainable and prosperous in the long run.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Transform your payroll accounting process with Template.net's Payroll Accounting Impact Study Template. It's customizable, made editable in our Ai Editor Tool fitted for your business needs. Discover accounting insights and strategize more effectively with this editable, user-friendly resource designed to simplify your payroll accounting studies.