Free Payroll Accounting Compliance Analysis

Executive Summary

In the dynamic landscape of business operations, the integrity and compliance of payroll accounting systems are paramount, especially in light of evolving local and international standards. The "Payroll Accounting Compliance Analysis" report is crafted in response to the pressing need for rigorous adherence to these standards, prompted by recent regulatory changes and the intricate nature of modern payroll processes. Our comprehensive examination serves to ensure that the company's payroll accounting framework not only meets but exceeds the requisite compliance benchmarks.

The cornerstone of this analysis lies in a meticulous audit of the existing payroll systems. This pivotal action involves a deep dive into the mechanisms of payroll processing, identifying and rectifying any discrepancies that emerge, thereby fortifying the company against potential compliance pitfalls. A significant focus is also placed on tax compliance - a critical aspect that demands unwavering attention to detail and precision.

The culmination of this analysis is a set of targeted recommendations aimed at refining the performance and accuracy of the company's payroll accounting operations. These recommendations are not merely corrective but are designed to be proactive measures that enhance the efficiency of payroll processes, ensuring a seamless alignment with both current and future regulatory demands.

Objectives

Primary Goals

The overarching mission of this analysis is threefold, each aspect critical to the robustness and reliability of the company's payroll system:

Compliance Assessment: At the forefront is the comprehensive evaluation of the payroll system's compliance with the relevant legal and regulatory frameworks. This assessment is not limited to a surface-level review but delves into the intricate details of payroll processing, ensuring every facet of the system aligns with both local and international standards. This meticulous approach guarantees that the company remains on the right side of the law, thereby safeguarding its reputation and financial integrity.

Identification and Rectification of Non-Compliance: In the complex web of payroll accounting, discrepancies can often go unnoticed until they burgeon into significant compliance issues. This analysis places a high emphasis on the early detection of such anomalies. Through a systematic review process, areas of non-compliance are not only identified but are also subjected to a rigorous corrective protocol. This proactive measure ensures that potential risks are mitigated before they can escalate, maintaining the system's integrity.

Risk Minimization: Inherent in the realm of payroll accounting is a spectrum of risks, from financial penalties to reputational damage. The final pillar of our objectives is to implement strategies that substantially reduce these risks. By fortifying the payroll system against compliance breaches, the company is better positioned to navigate the complexities of payroll management with confidence. This strategic risk minimization is pivotal in cultivating a stable and secure payroll environment, ultimately contributing to the overall health and success of the business.

Through rigorous auditing, corrective measures, and strategic risk management, the analysis aims to foster a robust payroll framework that not only meets current compliance demands but is also resilient against future regulatory shifts.

Evaluation Methodology

The methodology employed to evaluate the payroll accounting compliance was both thorough and multifaceted, ensuring a comprehensive analysis of the company's payroll practices. Central to this evaluation was an in-depth review of the accounting records, which served as the primary source of truth for financial transactions related to payroll. This review was instrumental in verifying the accuracy of recorded payroll expenses, deductions, and contributions, thereby providing a clear picture of the payroll accounting landscape.

In addition to the financial records, the evaluation extended to the examination of system configurations. This aspect was critical, as the setup and parameters of the payroll system directly impact its ability to process transactions accurately and in compliance with regulatory requirements. By scrutinizing the system configurations, the evaluation aimed to uncover any potential settings or procedural lapses that could lead to non-compliance or inaccuracies in payroll processing.

Tax filings were another key component of the evaluation. Given the complexity and stringent requirements of tax regulations, the review of tax filings was essential to ensure that all payroll-related taxes were accurately calculated and remitted in a timely manner. This not only included income taxes but also payroll taxes, social security contributions, and any other statutory deductions applicable to the jurisdiction.

To augment the objectivity and robustness of the evaluation, sample-based testing was employed. This approach involved selecting random samples of payroll transactions and independently recalculating them to validate the accuracy of the payroll calculations performed by the system. This method provided an additional layer of assurance regarding the reliability of the payroll processes.

Furthermore, the evaluation process was enriched by incorporating feedback from a critical stakeholder group – the employees and the management team. Engaging with employees offered insights into their experiences and any concerns regarding payroll accuracy and timeliness. Similarly, management's perspective was invaluable in understanding the operational context and any challenges faced in maintaining payroll compliance.

By amalgamating these diverse sources of information and employing a rigorous testing approach, the evaluation methodology was designed to not only identify compliance gaps but also to provide actionable insights for enhancing the efficiency and reliability of the company's payroll accounting practices.

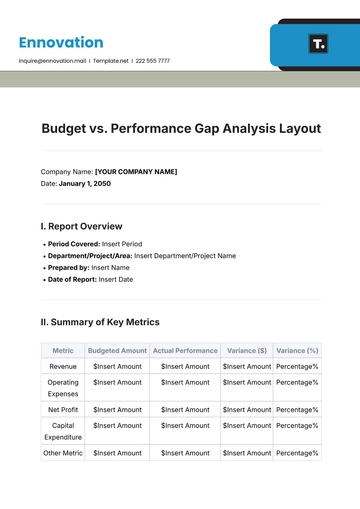

Analytical Tables

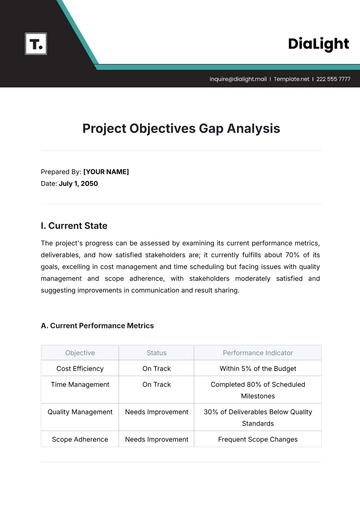

Several tables were used for the analysis, which include Payroll Compliance Analysis, Tax Filing Details, and Regulation Assessment among others.

Table Type | Description |

|---|---|

Payroll Compliance Analysis | Provides an overview of the payroll system's compliance with accounting standards and regulations |

Tax Filing Details | Details about filed and outstanding taxes |

Regulation Assessment | Details on the company's ability to comply with specific laws and regulations |

Following the detailed presentation of analytical tables, which serve as the backbone of the Payroll Accounting Compliance Analysis, it's essential to delve deeper into the implications of the findings and the strategic steps forward. These tables not only offer a snapshot of the current state of payroll compliance, tax obligations, and regulatory adherence but also set the stage for a more nuanced discussion on the actionable insights and strategic initiatives necessary to bolster the company's payroll system.

Insights and Strategic Initiatives

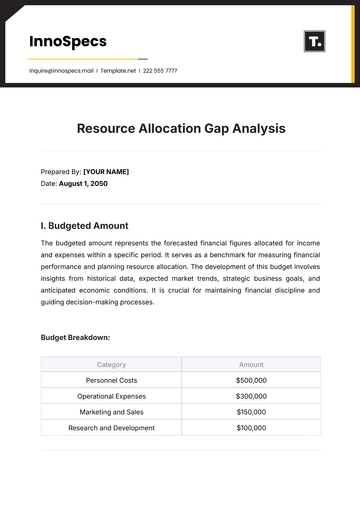

The insights derived from the Payroll Compliance Analysis table underscore the critical areas where the payroll system either excels or requires enhancements to meet the stringent accounting standards and regulations. This analysis provides a clear direction for prioritizing improvements in payroll processing accuracy, ensuring that all employees are compensated in accordance with their employment terms and applicable labor laws.

The Tax Filing Details table sheds light on the company's tax obligations, highlighting any discrepancies in filed taxes versus actual liabilities. This insight is pivotal in mitigating risks associated with tax non-compliance, including potential penalties and interest charges. The detailed scrutiny of tax filings emphasizes the need for a more streamlined and error-proof system for calculating and remitting payroll taxes.

Regulation Assessment offers a comprehensive view of the company's posture concerning specific legal and regulatory requirements. This assessment is instrumental in identifying gaps in compliance and understanding the nuances of various legal frameworks that the company must navigate. It serves as a foundation for developing robust compliance strategies that align with both current and emerging regulatory landscapes.

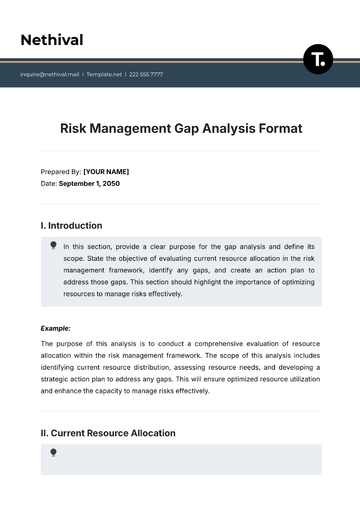

Action Plan

Building on the insights from these tables, a strategic action plan is essential to address the identified gaps and strengthen the payroll system. The plan should encompass:

Technology Upgrade: Implementing or upgrading payroll software to enhance accuracy in calculations and automate compliance checks.

Training and Development: Equipping the payroll team with the necessary knowledge and skills through targeted training sessions on the latest accounting standards, tax regulations, and compliance best practices.

Compliance Framework: Establishing a comprehensive compliance framework that includes regular audits, continuous monitoring, and updates to the payroll system in response to regulatory changes.

Stakeholder Engagement: Enhancing communication channels with employees and management to ensure transparency and address any concerns related to payroll processing.

The analytical tables serve as a critical tool in diagnosing the current state of payroll compliance and tax obligations. The subsequent insights and strategic initiatives outlined provide a roadmap for transforming these findings into tangible improvements, ensuring the company not only meets but exceeds compliance requirements, thereby fostering a culture of accuracy, transparency, and accountability in payroll accounting.

Findings

The comprehensive evaluation of the company's payroll system has unearthed several critical areas necessitating immediate intervention to uphold the integrity and compliance of payroll operations. Two primary concerns have emerged from the analysis: the punctuality of tax filings and the precision in payroll calculations.

1. Timely Filing of Taxes

The assessment disclosed instances where tax filings were not consistently submitted within the prescribed timelines. This delay in tax remittance not only exposes the company to the risk of financial penalties but also jeopardizes its standing with tax authorities. The reasons for these delays are multifaceted, ranging from gaps in internal processes to potential misunderstandings of tax deadlines or requirements. Such oversights underscore a pressing need for a more robust system that ensures adherence to all tax-related deadlines and obligations.

2. Accuracy in Payroll Calculations

The evaluation also highlighted discrepancies in payroll calculations, which could lead to significant issues such as underpayment or overpayment to employees, incorrect tax withholdings, and contributions to social security and other benefits. These inaccuracies can stem from various sources, including manual data entry errors, outdated payroll tables, or misinterpretation of complex compensation structures. The ramifications of these inaccuracies are far-reaching, affecting employee satisfaction, financial reporting, and compliance with labor laws.

Recommendations

In light of the findings, a series of targeted recommendations are proposed to address the identified issues and bolster the payroll system's overall efficiency and compliance.

1. Implementation of Automated Accounting Software

A pivotal recommendation is the adoption of advanced automated accounting software designed specifically for payroll processing. Such software can significantly reduce human errors associated with manual calculations and data entry. It ensures that payroll calculations are based on the latest tax tables and compliance requirements, automatically updates changes in regulations, and schedules tax filings to avoid late submissions. This technological intervention is crucial for enhancing the accuracy and reliability of payroll operations.

2. Engagement of a Payroll Management Specialist

Another key recommendation is to onboard a qualified professional specializing in payroll management. This specialist can bring a wealth of experience and knowledge in payroll processing, tax laws, and compliance management. Their expertise will be invaluable in auditing current practices, identifying gaps, and implementing best practices for payroll management. Moreover, they can serve as an intermediary between the company and tax authorities, ensuring that all communications and filings are handled professionally and promptly.

3. Regular System Reviews

To maintain and ensure ongoing compliance, it is recommended that regular reviews of the payroll system be conducted. These reviews should be comprehensive, covering all aspects of payroll processing, including the verification of system settings, the accuracy of tax calculations, and adherence to regulatory changes. Regular audits can help identify potential issues early on, allowing for timely corrections and updates to the system, thereby safeguarding against non-compliance and inaccuracies.

Conclusion

The detailed analysis of the company's payroll system has brought to light the commendable performance of basic payroll functions. However, it has also uncovered significant opportunities for enhancing compliance and operational efficiency. The essence of these improvements lies in their potential to not only avert financial penalties and compliance risks but also to elevate employee satisfaction by ensuring accurate and timely payroll processing.

The implementation of automated accounting software stands out as a transformative step towards achieving a more reliable and efficient payroll system. This, coupled with the expertise of a payroll management specialist, can significantly streamline payroll operations, ensuring accuracy and compliance. Regular system reviews will act as a safeguard, continuously monitoring the system's performance and compliance status.

In conclusion, while the foundation of the company's payroll accounting is solid, there is a clear pathway for advancement. The recommendations provided herein are not merely corrective measures but are strategic investments in the company's future. By embracing these recommendations, the company can look forward to a payroll system that is not only compliant with current regulations but is also adaptable to future changes, thereby supporting the company's growth and enhancing its reputation among employees and regulatory bodies alike. This proactive approach to payroll management will serve as a cornerstone for the company's operational excellence and financial integrity.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Unveil Template.net's Payroll Accounting Compliance Analysis Template – the ultimate solution for businesses! With our AI editor tool, easily customize this comprehensive template to suit your specific needs. Ensure payroll accuracy, meet compliance requirements, and streamline accounting processes effortlessly. Revolutionize your payroll management today with this user-friendly, editable template.