Free Annual Internal Audit Accounting Report

Executive Summary

This annual internal audit report for [Your Company Name] covers the period from [Month, Day, Year], to [Month, Day, Year]. The objective of this audit was to evaluate the company's adherence to financial reporting standards, compliance with applicable laws and regulations, the effectiveness of internal control systems, and the management of company assets. Through a comprehensive review and analysis process, the audit aimed to identify areas of risk, inefficiency, or non-compliance that could impact the company's financial health and operational integrity.

Key Findings:

The audit identified discrepancies in the financial reporting process, which, though not materially affecting the financial statements, indicate a need for improvement in internal controls.

Minor instances of non-compliance with federal tax regulations were observed, necessitating corrective actions.

The company's asset management practices were found to be generally effective, with some recommendations for enhancing physical asset security measures.

An evaluation of the revenue and expenditure cycles revealed areas for efficiency improvement, particularly in the procurement process.

Recommendations:

Enhance internal controls and training around financial reporting processes to prevent discrepancies.

Address the identified tax compliance issues promptly and review the compliance framework to prevent future occurrences.

Implement additional security measures for physical assets and conduct regular audits of asset management practices.

Streamline the procurement process to improve efficiency and reduce costs.

Overall, [Your Company Name] maintains a solid financial position and operational integrity. The audit team recommends prompt attention to the findings detailed in this report to ensure continued compliance and operational excellence.

Introduction

The internal audit of [Your Company Name] was conducted to assess the effectiveness of its financial reporting, compliance with laws and regulations, asset management, and internal control systems. By employing a combination of analytical reviews, tests of controls, and substantive testing, the audit aimed to provide assurance on the accuracy and reliability of financial information, the adequacy of internal controls, and the company's compliance status.

In undertaking this annual internal audit, the objective was not merely to assess [Your Company Name]'s compliance with financial reporting standards and regulatory requirements but also to take a holistic view of its operational health and efficiency. Recognizing the dynamic nature of the business environment in which [Your Company Name] operates, the audit was designed to be both comprehensive and flexible, allowing for an in-depth examination of practices, processes, and controls across various departments. This approach ensures that the audit findings and recommendations are not only relevant and actionable in the current fiscal year but also adaptable to future challenges and opportunities. By aligning audit objectives with strategic business goals, this exercise aims to contribute significantly to enhancing [Your Company Name]'s governance, risk management, and control processes, thereby supporting its mission to achieve excellence and sustainable growth in its industry.

Audit Methodology

The audit methodology was meticulously designed to ensure a thorough examination of [Your Company Name]'s financial and operational processes. This comprehensive approach included several key phases:

Planning: The initial phase involved detailed planning to identify the audit's objectives, scope, and key risk areas. This phase was critical for setting the direction and focus of the audit activities. The planning process also included the selection of departments and processes for review, based on their significance to the company's financial health and risk profile.

Risk Assessment: Before delving into the audit procedures, a risk assessment was conducted to identify and prioritize areas with the highest risk of material misstatement or non-compliance. This risk-based approach allowed the audit team to allocate resources efficiently and focus on areas of greatest concern.

Testing: The execution phase involved a mix of tests of controls and substantive testing procedures. Tests of controls were designed to assess the effectiveness of the company's internal control system in preventing or detecting errors and fraud. Substantive testing, on the other hand, aimed to directly verify the accuracy of financial records and transactions. The audit team used a variety of techniques, including sample testing, analytical procedures, and direct observation, to gather sufficient evidence for their findings.

Documentation: Throughout the audit process, detailed documentation was maintained to support the audit findings and conclusions. This documentation included work papers, interview notes, and evidence of testing procedures, which collectively provided a comprehensive record of the audit process and findings.

Reporting: The final phase of the audit methodology involved compiling the audit findings into a structured report. This report not only detailed the findings and observations but also included recommendations for improvement and risk mitigation. The reporting phase also provided an opportunity for management to respond to the audit findings and propose corrective actions.

Audit Findings and Observations

Financial Reporting

The audit revealed several discrepancies in the financial reporting process. While these did not materially misstate the financial statements, they raise concerns about the robustness of internal controls. Examples include minor errors in the recording of depreciation expenses and occasional lapses in accounts receivable aging analysis.

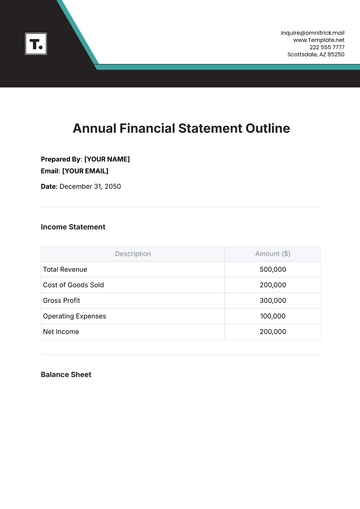

Table 1: Summary of Financial Reporting Discrepancies

Item | Description | Impact | Recommendation |

|---|---|---|---|

Depreciation Expenses | Incorrect application of depreciation rates on certain assets. | Understated expenses, overstated net income. | Review and adjust depreciation policies and procedures. |

Compliance with Laws and Regulations

The audit identified minor instances of non-compliance with federal tax regulations, specifically in the calculation and reporting of employment taxes. Immediate corrective action is advised to rectify these discrepancies and avoid potential penalties.

Table 2: Compliance Issues Identified

Area | Issue | Impact | Recommendation |

|---|---|---|---|

Employment Taxes | Incorrect calculation of employment taxes due to misclassification of certain expenses. | Potential penalties and interest. | Correct the misclassifications and review the tax filing process. |

Asset Management

The company's practices for managing its physical and intangible assets were found to be effective, with some areas for improvement in the security of physical assets. Regular audits and physical verification of assets are recommended to enhance asset security and accuracy of asset records.

Revenue and Expenditure Cycles

Review of the revenue and expenditure cycles highlighted opportunities for improving the efficiency of the procurement process. Implementing electronic procurement systems and vendor performance evaluations could yield significant cost savings and operational improvements.

Risk Assessment

The risk assessment process was a critical component of the audit methodology, enabling the audit team to identify areas of potential concern and allocate audit resources effectively. This process involved:

Identifying Risks: The first step was to identify potential risks that could impact the company's financial statements and operational efficiency. These risks were identified through a combination of industry analysis, review of previous audit findings, and discussions with management and staff.

Analyzing Risks: Each identified risk was then analyzed to assess its potential impact on the company's operations and financial reporting. This analysis considered the likelihood of the risk occurring and the magnitude of its potential impact.

Prioritizing Risks: Based on the risk analysis, risks were prioritized to focus the audit efforts on the most significant areas. High-priority risks were those that posed the greatest threat to the company's financial integrity and compliance with laws and regulations.

Developing Audit Procedures: For each high-priority risk, specific audit procedures were developed to test the effectiveness of controls in place to mitigate those risks. This targeted approach ensured that the audit efforts were focused on the areas of greatest concern.

Recommendations

The recommendations presented in this report are designed to address the findings of the audit and to strengthen [Your Company Name]'s financial and operational processes. These recommendations include:

Enhancing Internal Controls: For areas where discrepancies were noted, such as in financial reporting and compliance with tax regulations, it is recommended that the company enhances its internal control mechanisms. This may involve revising existing policies, improving documentation practices, and implementing additional checks and balances.

Training and Development: To address the errors in financial reporting and compliance, targeted training programs for staff involved in these areas are recommended. Training should focus on relevant accounting standards, tax laws, and internal procedures to ensure all team members are equipped with the necessary knowledge and skills.

Technology Improvements: Implementing or upgrading financial management software could streamline processes, improve accuracy in financial reporting, and enhance the efficiency of asset management and procurement processes. This recommendation includes conducting a thorough market analysis to identify suitable technological solutions that align with the company's needs and budget.

Regular Audits and Reviews: To continually assess and improve the effectiveness of internal controls and compliance efforts, regular internal audits and reviews should be scheduled. These audits can be targeted to specific areas of concern identified in this report and adjusted over time based on emerging risks and priorities.

Management Response

In response to the audit findings, [Your Company Name]'s management has expressed a commitment to taking decisive and timely action. Management has acknowledged the importance of addressing the identified issues and has outlined a comprehensive plan to implement the audit recommendations. This plan includes:

Immediate Corrective Actions: For issues requiring immediate attention, such as compliance with tax regulations, management has initiated corrective actions to rectify the discrepancies. This includes revising tax filings where necessary and enhancing oversight of tax reporting processes.

Long-Term Initiatives: Management has also committed to long-term initiatives aimed at strengthening the company's internal controls and operational processes. This includes investing in training and development, evaluating and adopting new technologies, and enhancing asset management practices.

Implementation Timeline: A detailed timeline has been developed for the implementation of each recommendation, with specific responsibilities assigned to ensure accountability. Management has also established a monitoring process to track the progress of these initiatives and to assess their effectiveness in addressing the audit findings.

Conclusion

The annual internal audit of [Your Company Name] has provided valuable insights into the company's financial reporting, compliance, and operational processes. While the audit identified areas for improvement, it also highlighted the company's strengths, including a solid financial position and a commitment to maintaining high standards of integrity and operational excellence.

The audit findings and recommendations offer a roadmap for enhancing [Your Company Name]'s internal controls, compliance efforts, and overall operational efficiency. Management's positive response and commitment to implementing the recommendations are commendable and indicative of the company's dedication to continuous improvement.

As [Your Company Name] moves forward with these initiatives, it is positioned to strengthen its financial and operational foundations, mitigate risks, and capitalize on opportunities for growth and success. The audit team looks forward to assessing the progress of these initiatives in future audits and continuing to support the company in achieving its objectives.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the Annual Internal Audit Accounting Report Template from Template.net, specifically designed for critical financial assessments. This template is fully editable and customizable, allowing for tailored audit reporting that meets specific organizational needs. It serves as an indispensable tool for auditors that is editable using an Ai Editor Tool, ensuring compliance, and highlighting financial insights for strategic decision-making.

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report