Free Internal Audit Accounting Case Study

I. Introduction

A. Brief Overview of the Organization

[Your Company Name] is a globally recognized pharmaceutical company specializing in the research, development, and production of innovative healthcare solutions. With a presence in over 100 countries and a diverse product portfolio, [Your Company Name] plays a crucial role in improving global healthcare. This case study delves into the internal audit of [Your Company Name]'s financial processes and controls, aiming to enhance transparency, accuracy, and compliance.

B. Context and Background Information

In an industry characterized by rigorous regulatory standards and stringent financial reporting requirements, [Your Company Name] operates under high scrutiny. As a leader in pharmaceuticals, it is imperative to maintain robust financial controls and adherence to industry-specific regulations.

C. Purpose and Objectives of the Internal Audit Case Study

The primary purpose of this internal audit case study is to evaluate the effectiveness of [Your Company Name]'s financial processes and controls. Specific objectives include:

Assessing the accuracy and completeness of financial reporting.

Identifying internal control strengths and weaknesses.

Ensuring compliance with pharmaceutical industry regulations.

Recommending improvements to enhance financial transparency.

II. Case Scenario

A. Description of the Organization

[Your Company Name] operates in the pharmaceutical industry and is recognized for its commitment to research and development. With an annual revenue exceeding $10 billion, the organization employs over 20,000 people globally and manages a vast portfolio of patented drugs and healthcare products.

B. Overview of Key Financial Processes and Controls

Financial Processes:

PROCESS | DESCRIPTION |

|---|---|

Revenue Recognition | [Your Company Name] follows industry-specific principles for recognizing revenue from product sales, licenses, and royalties. The timing and accuracy of recognition are critical. |

Expense Management | Efficient cost control and allocation are essential in the pharmaceutical industry. Expense categories include R&D, manufacturing, marketing, and administrative costs. |

Inventory Control | Managing pharmaceutical inventory is complex. [Your Company Name] monitors raw materials, work-in-progress, and finished goods to meet demand while minimizing waste. |

Accounts Payable and Receivable | Timely payment of suppliers and efficient collection of receivables are crucial to maintain good relationships and cash flow. |

Internal Controls:

CONTROL AREAS | DESCRIPTION |

|---|---|

Segregation of Duties | [Your Company Name] enforces clear segregation of duties in financial processes, reducing the risk of fraud and errors. |

Authorization and Approval | Stringent authorization and approval processes are in place to control financial transactions and access to critical systems. |

Data Security and Access Control | Data is protected through access controls, encryption, and regular security assessments to safeguard sensitive financial information. |

Audit Trails and Monitoring | Comprehensive audit trails and real-time monitoring mechanisms ensure visibility into financial transactions and system access. |

C. Identification of Specific Issues, Challenges, or Scenarios for Analysis

The case study specifically examines the revenue recognition process, considering potential delays and compliance with industry regulations. It also addresses concerns related to inventory control, focusing on valuation consistency.

D. Presentation of Relevant Financial Data and Documentation

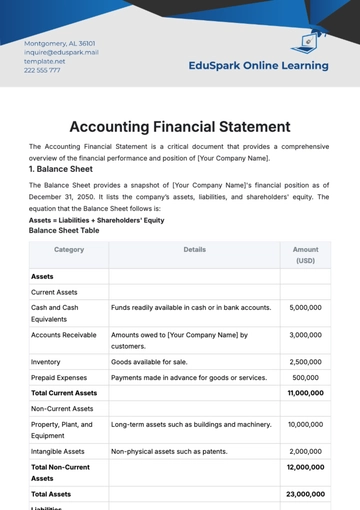

Financial Data:

Income Statements: Detailed income statements for the last three fiscal years.

Balance Sheets: Historical balance sheets showcasing the company's financial position.

Cash Flow Statements: Cash flow statements reflecting operating, investing, and financing activities.

Revenue Breakdown: A breakdown of revenue by product category and geographic region.

Documentation:

Financial Policies and Procedures Manual: A comprehensive manual outlining [Your Company Name]'s financial policies and procedures.

Internal Control Documentation: Documentation detailing the design and operation of internal controls.

Regulatory Guidelines: Relevant regulatory guidelines for revenue recognition in the pharmaceutical industry.

III. Audit Objectives

The audit objectives serve as a roadmap for the internal audit, outlining the specific goals and areas of focus that will guide the audit team throughout the process. In this case, the objectives are designed to ensure a comprehensive and thorough evaluation of [Your Company Name]'s financial processes and controls.

Objective 1: Accuracy of Financial Reporting

The primary objective of this internal audit is to assess the accuracy and completeness of financial reporting. This entails a meticulous examination of financial statements, including income statements, balance sheets, and cash flow statements, to ensure that they faithfully represent the company's financial performance and position. By scrutinizing financial data, the audit aims to identify any errors, misstatements, or omissions that may impact the reliability of the financial information presented to stakeholders.

Objective 2: Effectiveness of Internal Controls

Ensuring the effectiveness of internal controls is a fundamental aspect of this audit. Internal controls are the checks and balances within an organization that safeguard assets, ensure data integrity, and prevent fraud. The audit team will assess the design and operating effectiveness of these controls, evaluating their ability to mitigate risks and maintain the integrity of financial processes. This includes a thorough examination of segregation of duties, authorization and approval processes, data security measures, and audit trails.

Objective 3: Compliance with Industry Regulations

Given the pharmaceutical industry's strict regulatory environment, compliance with industry-specific regulations is a critical audit objective. The audit will focus on ensuring that [Your Company Name] adheres to pharmaceutical industry regulations, with a particular emphasis on areas such as revenue recognition and drug pricing. Any deviations or non-compliance issues will be documented and addressed, with the goal of aligning the company's practices with regulatory requirements.

Objective 4: Recommendations for Enhancing Transparency

In addition to identifying issues and weaknesses, the audit seeks to provide actionable recommendations for enhancing financial transparency within [Your Company Name]. These recommendations are not merely a response to problems but also a proactive approach to continuous improvement. By offering practical suggestions, the audit aims to empower the organization to strengthen its financial processes, controls, and reporting, ultimately enhancing transparency and mitigating risks.

IV. Audit Procedures

The audit procedures describe the methods and approaches that will be used to achieve the defined audit objectives. These procedures encompass a combination of substantive testing, analytical procedures, and control testing, each serving a specific purpose in the audit process.

Substantive Testing:

Substantive testing involves a detailed examination of account balances and transactions to verify their accuracy. In the context of this audit, substantive testing will be applied to financial data, including revenue transactions, expenses, and inventory balances. By selecting and testing samples of transactions and account balances, the audit team can gain confidence in the accuracy of financial information.

Analytical Procedures:

Analytical procedures involve the comparison of financial data across different periods and benchmarking against industry standards and expectations. In this audit, analytical procedures will be applied to assess the consistency and reasonableness of financial data. For example, comparing revenue trends over several years can reveal anomalies or significant deviations that require further investigation.

Control Testing:

Control testing focuses on the assessment of the design and operating effectiveness of internal controls. This entails a thorough review of control processes, documentation, and evidence to determine whether controls are functioning as intended. For example, the audit team will evaluate whether authorization and approval processes are consistently followed and whether data security measures effectively protect sensitive financial information.

Data Collection Methods and Sources:

The audit will collect data from various sources, including financial records, interviews with personnel, examination of inventory records, and consultation of regulatory guidelines. These diverse data sources provide a holistic view of [Your Company Name]'s financial processes, controls, and compliance efforts.

Testing Procedures and Sample Sizes:

Specific testing procedures will include sampling revenue transactions, evaluating inventory valuation methodologies, and conducting compliance testing related to industry regulations. The selection of samples and the determination of sample sizes will be based on statistical sampling principles and the significance of the items being tested.

Relevant Audit Standards and Regulations:

The audit will adhere to recognized audit standards, including Generally Accepted Auditing Standards (GAAS) and Generally Accepted Accounting Principles (GAAP). Additionally, it will consider pharmaceutical industry-specific regulations and guidelines governing revenue recognition and drug pricing to ensure compliance with industry-specific requirements.

V. Data Analysis

A. In-Depth Analysis of Financial Data, Transactions, and Account Balances

Financial data analysis involves a meticulous examination of [Your Company Name]'s financial information to ensure accuracy, completeness, and compliance. This includes:

Revenue Recognition Analysis: Scrutinizing revenue recognition processes and verifying that revenues are recognized in accordance with applicable accounting standards.

Expense Management Analysis: Reviewing the categorization and allocation of expenses to ensure consistency and adherence to GAAP.

Inventory Control Analysis: Analyzing inventory records, tracking systems, and valuation methodologies to identify any inconsistencies or issues.

Accounts Payable and Receivable Analysis: Assessing the timeliness of payments to suppliers and the effectiveness of collections.

B. Examination of Internal Controls, Policies, and Procedures

Internal controls play a pivotal role in financial accuracy and compliance. Therefore, the audit includes:

Segregation of Duties Assessment: Ensuring that responsibilities are appropriately segregated to prevent conflicts of interest and fraud.

Authorization and Approval Process Evaluation: Examining authorization and approval processes to validate their effectiveness and adherence to company policies.

Data Security and Access Control Review: Assessing the security measures in place to protect financial data and control access to sensitive systems.

Audit Trails and Monitoring Mechanism Analysis: Verifying the existence and adequacy of audit trails and real-time monitoring mechanisms that provide visibility into financial transactions and system access.

C. Identification of Anomalies, Discrepancies, and Potential Issues

The analysis phase focuses on:

Identifying Revenue Recognition Anomalies: Detecting any discrepancies or delays in recognizing revenue and their potential impact on financial accuracy.

Flagging Inventory Valuation Inconsistencies: Highlighting any inconsistencies or variations in inventory valuation methods across product categories.

Noting Minor Regulatory Deviations: Identifying minor deviations from industry-specific regulations related to drug pricing and revenue recognition.

Documenting Internal Control Weaknesses: Documenting any identified weaknesses or lapses in internal controls and their potential consequences.

VI. Findings and Observations

A. Presentation of Key Findings and Observations from the Audit

Key findings and observations include:

Delayed recognition of certain revenue streams, potentially impacting financial accuracy.

Variability in inventory valuation methods across product categories.

Minor deviations from industry-specific regulations related to drug pricing.

Strong internal controls in place, with some recommendations for improvement.

B. Documentation of Identified Weaknesses, Risks, and Non-Compliance Issues

Documented issues include:

Revenue recognition delays impacting financial reporting accuracy.

Inventory valuation inconsistencies posing risks.

Minor regulatory deviations necessitating attention.

Recommendations to strengthen internal controls.

C. Impact Analysis of Findings on the Organization's Financial Health

The findings may impact [Your Company Name] by:

Affecting the accuracy of financial reporting.

Influencing regulatory compliance and potential penalties.

Enhancing internal controls and reducing operational risks.

Guiding improvements to financial processes.

VII. Recommendations

A. Clear and Actionable Recommendations for Addressing the Identified Issues

Revenue Recognition:

Implement a robust revenue recognition monitoring system to ensure timely and accurate recognition.

Enhance training programs for finance personnel regarding revenue recognition principles and industry-specific guidelines.

Inventory Valuation:

Standardize inventory valuation methods across product categories for consistency and transparency.

Periodically review and adjust inventory valuation models to reflect market conditions accurately.

Regulatory Compliance:

Conduct regular audits to ensure compliance with pharmaceutical industry regulations and address any minor deviations promptly.

Establish a regulatory compliance task force to monitor evolving regulatory requirements.

Internal Controls:

Strengthen controls related to access to critical financial systems and data.

Enhance documentation of internal control processes and responsibilities.

B. Prioritization of Recommendations Based on Their Significance and Impact

Recommendations will be prioritized based on their potential impact on financial accuracy, regulatory compliance, and operational efficiency. Immediate attention will be given to those with higher significance and urgency, such as revenue recognition improvements and critical control enhancements.

C. Suggested Timelines for Implementing the Recommendations

Short-Term Recommendations (0-6 months):

Implement the revenue recognition monitoring system.

Enhance training programs for finance personnel.

Standardize inventory valuation methods.

Medium-Term Recommendations (6-12 months):

Review and adjust inventory valuation models.

Conduct regular audits for regulatory compliance.

Strengthen controls related to system access.

Long-Term Recommendations (12+ months):

Establish a regulatory compliance task force.

Enhance documentation of internal control processes.

VIII. Management Responses

A. Hypothetical Responses from the Organization's Management

Revenue Recognition:

Management acknowledges the significance of timely recognition and commits to implementing the monitoring system.

Plans are in place to enhance training programs for finance personnel.

Inventory Valuation:

Management agrees to standardize inventory valuation methods and commence the review process.

Regulatory Compliance:

Management acknowledges the need for regular compliance audits and will initiate the compliance task force.

Internal Controls:

Management recognizes the importance of strengthening controls and will work towards enhancing documentation and processes.

B. Discussion of How Management Plans to Address the Issues Identified

Management is committed to addressing the issues identified during the audit. Their responses demonstrate a proactive approach to improvement:

Revenue recognition monitoring system: Implementation plan includes selecting appropriate software, training personnel, and establishing monitoring criteria.

Training programs: Curriculum development, scheduling, and evaluation mechanisms are in progress.

Standardizing inventory valuation: A task force will be formed to review and standardize inventory valuation methods.

Compliance audits: A compliance audit schedule will be developed, and resources allocated to ensure ongoing compliance.

Internal control enhancements: Management intends to invest in technology upgrades, documentation enhancements, and personnel training.

IX. Conclusion

A. Summary of the Case Study and Key Takeaways

This comprehensive internal audit case study has provided a detailed evaluation of [Your Company Name]'s financial processes and controls. Key takeaways include:

The importance of accurate revenue recognition in financial reporting.

The need for consistent inventory valuation methods.

The significance of compliance with industry-specific regulations.

The role of internal controls in safeguarding assets and ensuring data integrity.

B. Emphasis on the Importance of Internal Audit

The case study underscores the pivotal role of internal audit functions in identifying areas for improvement. It serves as a reminder that internal audits contribute to the enhancement of financial transparency, accuracy, and compliance within complex industries like pharmaceuticals.

C. Closing Remarks and Lessons Learned

In conclusion, [Your Company Name] is poised to address the identified issues and strengthen its financial controls. This case study serves as a valuable resource for understanding the ongoing commitment required to maintain financial excellence within the pharmaceutical industry. It emphasizes that a proactive approach to financial management can lead to enhanced transparency, accuracy, and compliance, ultimately ensuring the organization's resilience and success.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Explore the Internal Audit Accounting Case Study Template from Template.net, a premier resource for in-depth audit analysis. This template, fully editable and customizable, offers professionals a structured format to document and examine audit findings, practices, and lessons learned. Ideal for educational and professional development, it can be edited using at Ai Editor Tool to help facilitate critical thinking and strategic insights into auditing challenges and solutions.