Free Account Budget Compliance Analysis

I. Introduction

A. Significance of Budget Adherence

Effective budget adherence is foundational to the financial health of any organization. It extends beyond mere financial metrics, acting as a litmus test for the organization's fiscal responsibility and strategic alignment. A company's ability to adhere to its budgetary plans reflects its commitment to efficient resource allocation, cost management, and long-term sustainability. This adherence is a key indicator of operational efficiency, allowing for prudent decision-making and resource optimization. In essence, budget compliance is not just a numerical benchmark but a critical factor influencing the overall success and resilience of the organization.

B. Objectives

The primary objectives of the Account Budget Compliance Analysis are:

Assess Overall Budget Compliance

Conduct a comprehensive evaluation of the company's adherence to allocated budgets across various departments and accounts.

Identify Areas of Non-Compliance

Pinpoint departments or areas with notable deviations from budgetary expectations, shedding light on potential financial risks.

Analyze Reasons for Non-Compliance

Undertake a thorough examination of the underlying causes behind budgetary discrepancies, aiming to uncover common narratives and patterns.

Recommend Actionable Measures

Formulate practical and effective recommendations to address identified non-compliance issues and enhance overall budget management.

Provide Insights for Future Planning

Offer insights derived from the analysis to improve future budget planning, administration, and control, fostering a more robust financial strategy.

C. Scope

Thorough Financial Examination

Conduct a thorough examination of the company's financial health, with a focus on assessing the alignment of expenditures with allocated budgets. This comprehensive evaluation will provide insights into the overall fiscal well-being of the organization.

Departmental and Account Focus

Dive into individual departments and accounts to meticulously identify areas of both compliance and non-compliance. This focused approach allows for a granular understanding of budgetary dynamics within specific organizational units.

Variances Analysis

Systematically analyze budget variances to uncover the underlying reasons behind deviations, enabling a nuanced understanding of financial trends and potential areas for improvement.

Narrative Assessment

Delve into qualitative aspects by investigating common narratives within the company. This narrative analysis provides valuable insights into the non-numerical factors influencing budget compliance.

Sophisticated Budgeting Software Utilization

Leverage advanced budgeting software, complemented by manual validations, to ensure the precision and reliability of the findings. This dual approach enhances the accuracy of the analysis by combining automated tools with human expertise.

II. Methodology

The methodology employed in the analysis combined both quantitative and qualitative approaches, ensuring a thorough examination of the company's budget adherence. This dual-method strategy incorporated various techniques for data collection and analysis.

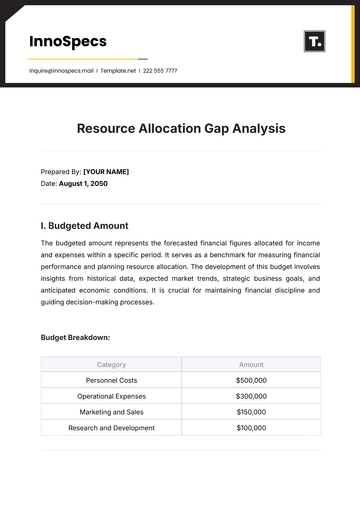

A. Quantitative Analysis

Financial Report Examination

Meticulously scrutinize individual company accounts through a comprehensive review of financial reports. This quantitative approach allows for the identification of significant variances from the expected budget, providing numerical insights into budget compliance.

Budgeting Software Utilization

Harness the power of sophisticated budgeting software to streamline the quantitative analysis. This tool not only enhances efficiency but also contributes to the accuracy of the findings by automating numerical computations.

Data Collection Methods

Employ systematic data collection methods, including the extraction of financial data from relevant databases and systems. This ensures the availability of accurate and up-to-date information for the quantitative analysis.

B. Qualitative Analysis

Audited Narrative Analysis

Conduct an audited analysis of narratives within the company to understand the qualitative aspects influencing budget compliance. This involves looking beyond numbers to uncover the stories and context behind budgetary decisions.

Root Cause Examination

Investigate the reasons behind discrepancies identified in the quantitative analysis. By exploring the root causes, the qualitative analysis adds depth to the understanding of budget non-compliance.

Interviews and Discussions

Engage in interviews and discussions with key stakeholders to gather qualitative insights. This method allows for a more nuanced understanding of the human and contextual factors influencing budgetary decisions.

III. Key Findings

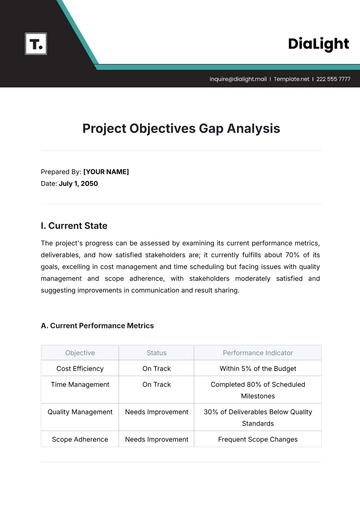

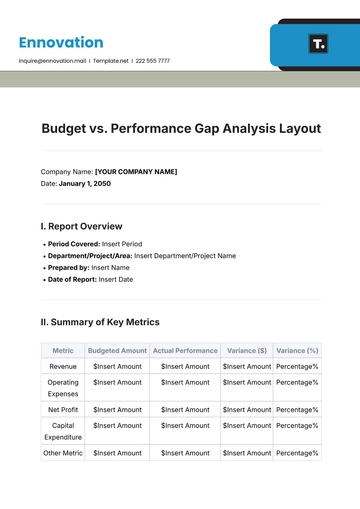

A. Overall Budget Compliance

The table below illustrates the overall budget compliance across various departments within the company:

Department | Budget Compliance |

|---|---|

Marketing | 80% |

Effectively assessing the overall budget compliance is crucial for maintaining the financial health and stability of the organization. By scrutinizing each department's adherence to budget allocations, companies can identify potential risks and opportunities for improvement. The Marketing Department demonstrates a budget compliance level of 80%, indicating a variance between projected and actual expenditures. This discrepancy might be attributed to factors such as unexpected campaign costs or shifts in marketing strategy. It raises the need for a detailed review of the department's spending patterns, ensuring that future budgets align more closely with operational realities. Analyzing the specific challenges faced by Marketing provides insights into potential areas of improvement, allowing for targeted adjustments and a more accurate forecasting process.

This comprehensive analysis serves as a strategic tool, enabling management to make informed decisions based on accurate financial data. It also enhances accountability across the organization, encouraging departments to align their spending with allocated budgets. Ultimately, a robust understanding of overall budget compliance lays the foundation for proactive financial management, fostering resilience and adaptability in a dynamic business landscape.

B. Factors Influencing Budget Deviation

The table below outlines key factors contributing to budget deviation within the organization:

Factors | Impact on Budget Compliance |

|---|---|

Unforeseen Project Expenses | High |

Unraveling these factors provides decision-makers with actionable insights to strengthen financial resilience. By comprehensively understanding the impact of unforeseen project expenses, the organization can implement measures to enhance budgetary flexibility. Proactive planning and risk management strategies can be tailored to address specific challenges highlighted in this analysis. Ultimately, this serves as a compass, guiding the organization toward more effective budget planning and fostering a culture of financial foresight.

Unforeseen Project Expenses, signifies a substantial impact on budget compliance within the organization. This factor underscores the challenges posed by unexpected costs arising during project execution. These unforeseen expenses can disrupt financial projections and strain allocated budgets, leading to deviations. Understanding the nature and magnitude of these expenses is critical for proactive financial planning. It necessitates the development of robust contingency measures and risk mitigation strategies to buffer against the financial implications of unexpected project costs.

C. Variances

Examining specific variances within each department offers insights into the unique challenges and opportunities that contribute to budget fluctuations.

Department | Variances |

|---|---|

Marketing | Marketing campaigns, promotional activities |

Examining departmental variances is essential for targeted interventions and strategic planning. It allows organizations to recognize the diverse nature of activities within each department, shaping budgetary requirements accordingly. By understanding the specific variances in Marketing and other departments, the organization can implement customized measures to optimize spending, enhance efficiency, and ensure greater alignment with overall budget goals. This level of granularity facilitates a more nuanced approach to budget management.

Marketing department variances are predominantly influenced by expenditures related to marketing campaigns and promotional activities. The dynamic nature of the marketing landscape, with ever-changing consumer trends and market dynamics, leads to fluctuations in campaign strategies and promotional events. These variances may stem from the need to adapt marketing approaches, invest in new channels, or respond to competitive pressures. Understanding the specific nature of marketing variances provides insights into the effectiveness of different promotional initiatives and helps align marketing strategies with budgetary considerations. By identifying the areas where variances occur, such as increased spending on particular campaigns or unexpected promotional events, the organization can refine its marketing budget to enhance overall cost-effectiveness.

IV. Actionable Recommendations

A. Strengthening Budget Tracking Systems

Implement Advanced Software Solutions

The introduction of cutting-edge budget tracking software stands as a cornerstone for transforming the company's financial landscape. This innovative technology provides real-time insights, enabling immediate corrective actions, fostering a more agile financial management approach.

Automate Reporting Processes

Automation, particularly in generating financial reports, represents a strategic move towards efficiency. The adoption of automated processes not only reduces the likelihood of manual errors but also streamlines operations, facilitating quicker responses to budgetary deviations.

Customization Features

The choice of budget tracking tools with customization features ensures that the software aligns precisely with the unique intricacies of the organization's budgeting structure. This tailored approach enhances the software's effectiveness and relevance.

Integration with Existing Systems

Seamless integration of the new software with existing systems is crucial for establishing a cohesive digital ecosystem. This integration fosters a unified approach to financial management, ensuring that all aspects of the organization operate in synergy.

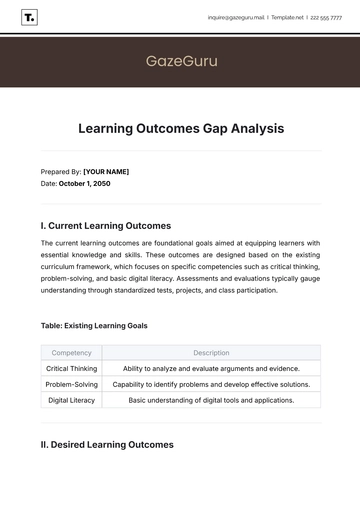

B. Enhancing Employee Awareness

Diversify Formats

A diverse approach, encompassing in-person workshops, webinars, and online courses, accommodates different learning preferences and schedules. This multifaceted training strategy ensures that every employee has access to relevant budget management education.

Certification Programs

The establishment of certification programs not only validates the skills acquired by employees but also serves as a motivating factor. Recognizing and certifying individuals for their proficiency in budget management can significantly boost morale and encourage continuous learning.

Feedback Mechanisms

Incorporating feedback mechanisms into training programs provides a valuable avenue for employees to share insights and suggestions. This iterative feedback loop contributes to continuous improvement in the quality and relevance of training initiatives.

Practical Case Studies

Integrating real-life case studies into training materials brings a practical dimension to the learning experience. Employees gain insights into the application of budget management skills in real-world scenarios, enhancing their understanding and proficiency.

Knowledge-sharing Platforms

Creating online platforms or forums dedicated to knowledge-sharing fosters a collaborative learning environment. These platforms allow employees to share experiences, ask questions, and provide insights, contributing to a collective pool of budget management knowledge.

C. Flexible Budgeting Methods

Scenario Planning Workshops

Conducting scenario planning workshops becomes a crucial strategy for simulating various financial scenarios. These workshops enable the organization to develop adaptive strategies for adjusting budgets in response to dynamic circumstances.

Dynamic Forecasting Models

Investment in dynamic forecasting models marks a significant step towards accurate financial predictions. These models dynamically adjust based on changing variables, providing a more precise estimation of future financial needs.

Continuous Monitoring

Implementing continuous monitoring mechanisms ensures real-time identification of budgetary discrepancies. This proactive approach facilitates swift corrective actions, preventing potential financial risks from escalating.

Regular Risk Assessments

Regular risk assessments contribute to proactive identification of potential financial risks that may impact budget compliance. By assessing risks systematically, the organization can develop strategies to mitigate and manage these challenges effectively.

Cross-functional Budget Committees

The establishment of cross-functional budget committees promotes collaborative decision-making. Inclusive of diverse perspectives, these committees contribute to the development of well-informed budgeting strategies that consider the needs of various departments.

D. Communication Strategies for Budget Changes

Transparent Reporting Practices

Emphasizing transparent reporting practices is integral to fostering trust and understanding among stakeholders. Clear and open communication about budget changes ensures that all stakeholders are well-informed, reducing the likelihood of misunderstandings.

Regular Town Hall Meetings

Regular town hall meetings or forums provide a direct channel for leadership to communicate budget changes to employees. These meetings offer a platform for addressing concerns, answering questions, and ensuring that employees feel heard and informed.

Feedback Channels

Creating open channels for feedback regarding budget communications is a proactive measure. These channels allow stakeholders to express their opinions, seek clarifications, and provide valuable input, contributing to continuous improvement in communication strategies.

Educational Campaigns

Launching educational campaigns is instrumental in raising awareness about the importance of budget changes. These campaigns not only inform stakeholders but also educate them about the broader organizational goals and the role of budget adjustments in achieving these objectives.

Visual Representation of Changes

The use of visual aids, such as charts or graphs, enhances the understanding of complex financial information. Visual representations of budget changes make information more accessible, enabling stakeholders to grasp the nuances of the changes and their implications.

E. Cross-Departmental Collaboration

Interdepartmental Workshops

Organizing workshops that bring together representatives from different departments facilitates cross-departmental collaboration. These workshops provide a platform for sharing insights, understanding diverse budgetary needs, and fostering a sense of unity among departments.

Shared Resources Strategy

Developing a strategy for shared resource utilization optimizes budget allocations. Identifying areas where departments can collaborate on expenses contributes to cost efficiency and promotes a culture of shared responsibility.

Regular Cross-functional Meetings

Scheduling regular cross-functional meetings ensures ongoing communication and collaboration. These meetings provide opportunities for departments to discuss budgetary concerns, share insights, and collectively address challenges.

Rotational Assignments

The implementation of rotational assignments promotes a deeper understanding of different departments' budgetary requirements. Employees gain valuable insights into the diverse financial aspects of the organization, fostering a holistic approach to budget management.

Recognition Programs

Introducing recognition programs for departments that demonstrate exemplary collaboration in achieving budgetary goals creates a positive incentive. Recognizing and rewarding collaborative efforts contribute to a culture of healthy competition and cooperation.

V. Conclusion

The analysis has revealed an overall positive adherence to set financial plans within the company with an estimated compliance level of 80%. Despite this, it is evident that certain departments like Marketing and Human Resources require additional focus to improve their budget compliance. Unforeseen expenses have emerged as a primary cause of budget deviation, emphasizing the need for flexible and adaptable budgeting systems. With the implementation of strict tracking mechanisms, enhanced capacity building, and more malleable budgeting methods, we believe the company can significantly boost its budget compliance and, by extension, its fiscal health. As always, ongoing analysis and dashboarding of financial operational data would ensure consistent and timely interventions when needed.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Make analysis stress-free with our editable Account Budget Compliance Analysis Template from Template.net! This comprehensive template, fully customizable, empowers you with standardized budget compliance analysis. Edit with the AI Editor Tool, ensuring an analysis that aligns with your specific budgeting policies. Guarantee standardized procedures and efficient operations by accessing now!