Free Internal Audit Accounting System Feasibility Study

Introduction

[Your Company Name] has developed this Feasibility Study to underscore our dedication to providing an exhaustive evaluation of the feasibility of implementing an Internal Audit Accounting System within our organization. This study thoroughly examines various critical dimensions, including a detailed project description, an in-depth market analysis, pertinent legal considerations, financial viability, operational feasibility, potential risks, and strategic recommendations. Our objective is to ensure that stakeholders have a clear understanding of the project's scope, benefits, and challenges, facilitating informed decision-making.

Project Description

The primary aim of this project is to enhance the efficiency and reliability of our company's financial reporting and compliance processes through the introduction of an Internal Audit Accounting System. This initiative seeks to:

Streamline our internal audit procedures, ensuring they are more systematic and effective in identifying areas of risk and non-compliance within our financial operations.

Implement cutting-edge technology solutions that automate and optimize our auditing processes, thereby reducing manual effort and increasing accuracy in our financial reporting.

Ensure the system provides comprehensive support for adhering to current and future regulatory requirements. This includes automatic updates to compliance protocols in response to changes in laws and standards, thereby reducing the risk of non-compliance and associated penalties.

Leverage the system's capabilities to identify, assess, and manage financial and operational risks more effectively. By integrating real-time data analysis and risk assessment tools, the system should enable proactive risk management, allowing for timely interventions and mitigation strategies.

Utilize the system to foster a culture of transparency and accountability within the organization. This involves creating audit trails, facilitating clear reporting of audit findings, and ensuring that all financial transactions and processes are fully documented and accessible for review.

Empower management and decision-makers with accurate, timely, and relevant financial information. The system should provide insightful analytics and reporting tools that support strategic planning, budgeting, and resource allocation decisions.

By achieving these objectives, [Your Company Name] aims to fortify its financial integrity and operational efficiency, thus fostering a robust framework for sustained growth and compliance with regulatory standards.

Market Analysis

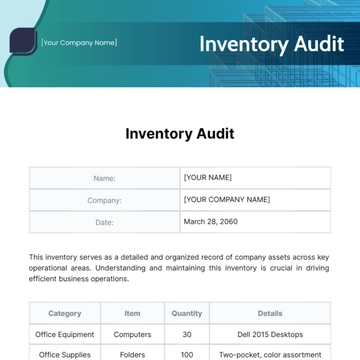

The Market Analysis section of this Feasibility Study delves into the current market trends, competitive market, and the demand for internal audit systems within our industry. This analysis is pivotal in understanding the potential market acceptance and the viability of implementing an Internal Audit Accounting System in our organization. It also explores the opportunities and challenges that may influence the project's success. To provide a comprehensive overview, the following table presents key market data that has been gathered and analyzed:

Market Segment | Estimated Size | Growth Rate | Key Competitors |

|---|---|---|---|

Internal Audit Software | $1,000,000,0000 | 15% annually | Competitor A |

This table highlights three critical segments within the market for internal audit and financial compliance systems. It outlines the size and growth rate of each segment, providing insight into the potential demand for an Internal Audit Accounting System. Furthermore, it identifies the key competitors within each segment, offering a view into the competitive dynamics our company might face upon entering this market. This analysis not only aids in assessing the feasibility of the project but also in strategizing our market entry to effectively compete and establish a strong market presence.

Financial Feasibility

The Financial Feasibility section of this Feasibility Study critically evaluates the economic viability of integrating an Internal Audit Accounting System within [Your Company Name]. This evaluation encompasses an analysis of the projected costs against the anticipated benefits, providing a comprehensive financial perspective on the investment. By assessing various financial metrics, including return on investment (ROI), payback period, and net present value (NPV), this section aims to ascertain the fiscal soundness of the project.

Initial Investment Analysis

The initial investment analysis outlines the upfront costs associated with implementing the Internal Audit Accounting System. These costs include software acquisition, system integration, training, and any necessary hardware upgrades.

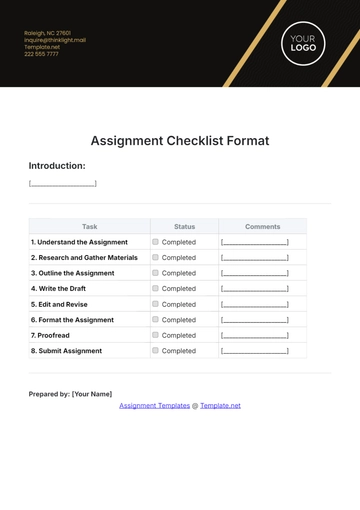

Cost Item | Description | Amount (USD) |

|---|---|---|

Software Acquisition | Cost of purchasing the audit software. | $800,000 |

Operational Cost and Benefit Analysis

This analysis provides a yearly projection of the operational costs and benefits associated with the new system, enabling an evaluation of its long-term financial sustainability.

Year | Operational Costs | Anticipated Benefits |

|---|---|---|

2050 | $85,000 | $90,000 |

Financial Metrics

Finally, key financial metrics are calculated to provide a quantitative foundation for the feasibility decision.

Metric | Description | Value |

|---|---|---|

Return on Investment (ROI) | The ratio of net profit to initial costs. | 35% |

The financial feasibility analysis demonstrates a structured approach to understanding the economic implications of adopting the Internal Audit Accounting System. By comparing the initial and operational costs to the projected benefits, [Your Company Name] can make an informed decision on proceeding with the implementation, ensuring the investment aligns with our financial goals and capabilities.

Legal Considerations

The Legal Considerations section of this Feasibility Study addresses the regulatory and compliance landscape that [Your Company Name] must navigate in the implementation of an Internal Audit Accounting System. This examination is crucial for ensuring that the deployment and operation of the system adhere to all relevant laws, regulations, and industry standards, thereby mitigating legal risks and safeguarding the company's reputation.

Key legal considerations include:

Data Privacy and Protection Laws: The system must comply with national and international data protection regulations, such as the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the United States. These laws dictate how personal and financial data should be collected, processed, stored, and shared, necessitating robust data protection measures within the system.

Financial Reporting Standards: The system must support compliance with applicable financial reporting standards, including Generally Accepted Accounting Principles (GAAP) in the United States and International Financial Reporting Standards (IFRS) globally. This ensures that the company's financial statements are accurate, reliable, and consistent with regulatory requirements.

Internal Audit Standards: The system should be designed to facilitate compliance with recognized internal audit standards, such as those issued by the Institute of Internal Auditors (IIA). Adhering to these standards enhances the quality and effectiveness of the audit process, contributing to the overall governance and risk management framework of the company.

Cybersecurity Regulations: With the increasing emphasis on cybersecurity, the system must align with relevant cybersecurity laws and regulations to protect sensitive data from unauthorized access and cyber threats. This includes implementing security measures in accordance with frameworks such as the National Institute of Standards and Technology (NIST) cybersecurity framework.

Industry-Specific Regulations: Depending on the nature of [Your Company Name]'s operations, additional industry-specific regulations may apply. For instance, companies in the financial sector might need to consider compliance with the Sarbanes-Oxley Act, while healthcare organizations must adhere to the Health Insurance Portability and Accountability Act (HIPAA).

By meticulously evaluating and addressing these legal considerations, [Your Company Name] can ensure that the Internal Audit Accounting System not only enhances operational efficiency and financial integrity but also aligns with the legal and regulatory framework. This proactive approach minimizes legal risks and fosters a culture of compliance and ethical business practices.

Operational Feasibility

The Operational Feasibility section of this Feasibility Study critically examines the practicality of integrating an Internal Audit Accounting System within [Your Company Name]'s existing operational framework. This assessment focuses on the system's compatibility with current business processes, the required changes to operational procedures, the impact on staff and workflow, and the overall readiness of the organization to adopt this new technology. Ensuring operational feasibility is paramount for the successful implementation and utilization of the system, aiming to optimize operational efficiency without disrupting ongoing business activities.

System Compatibility and Integration

A thorough analysis must be conducted to ensure that the proposed Internal Audit Accounting System is compatible with existing IT infrastructure and business software. This includes evaluating the system's requirements against current hardware capabilities, software environments, and data management systems. The goal is to identify any necessary upgrades or modifications to ensure seamless integration, thereby minimizing downtime and operational disruptions.

Process Re-engineering

Implementing the new system may necessitate re-engineering existing internal audit and financial reporting processes. This involves mapping out current workflows to identify inefficiencies or redundancies that the new system can address. The process re-engineering effort aims to align internal audit processes more closely with organizational goals, enhancing overall efficiency and effectiveness.

Staff Training and Change Management

The success of the system implementation heavily relies on the staff's ability to adapt to and embrace the new technology. A comprehensive training program should be developed to equip employees with the necessary skills and knowledge to operate the new system effectively. Additionally, a change management strategy must be in place to address potential resistance and ensure a smooth transition, fostering a culture of continuous improvement and innovation.

Impact on Workflow and Productivity

The anticipated impact of the new system on daily workflows and overall productivity must be evaluated. While the ultimate goal is to enhance efficiency and accuracy in internal audit processes, it is essential to assess short-term disruptions and develop strategies to mitigate them. This includes planning for phased implementation, if necessary, to allow employees to adjust without compromising ongoing operations.

Organizational Readiness

Finally, an assessment of the organization's overall readiness to adopt the new system is crucial. This encompasses evaluating the alignment of the project with strategic objectives, the availability of resources (financial, human, and technical) for implementation, and the commitment of leadership to support the initiative. Organizational readiness ensures that the company is well-positioned to embrace the new system and realize its full benefits.

By addressing these aspects of operational feasibility, [Your Company Name] can ensure that the implementation of the Internal Audit Accounting System is not only strategically beneficial but also practically viable. This comprehensive approach lays the foundation for a successful integration that enhances operational efficiency, compliance, and financial integrity.

Risks

The Risks section of this Feasibility Study identifies and evaluates potential challenges and uncertainties associated with the implementation and operation of an Internal Audit Accounting System within [Your Company Name]. Understanding these risks is crucial for developing effective mitigation strategies, ensuring the project's success, and safeguarding the organization's assets and reputation.

Technology Risks

System Integration Issues: There may be technical difficulties in integrating the new audit system with existing IT infrastructure, leading to potential data silos or compatibility issues.

Cybersecurity Vulnerabilities: Introducing new technology increases the risk of cyber-attacks. Ensuring robust cybersecurity measures are in place is essential to protect sensitive financial data.

Financial Risks

Cost Overruns: Initial cost estimates for implementing the system may prove to be undercalculated, leading to budget overruns and financial strain on the organization.

Lower-than-expected ROI: The benefits realized from the new system may not meet expectations, resulting in a lower return on investment.

Operational Risks

Disruption to Business Operations: The implementation process could temporarily disrupt existing business operations, affecting productivity and service delivery.

Resistance to Change: Employees may resist adopting the new system, hindering its effective utilization and the realization of intended benefits.

Compliance and Legal Risks

Regulatory Compliance Failures: Failure to comply with relevant laws and regulations, especially related to financial reporting and data protection, can result in legal penalties and damage to reputation.

Data Privacy Breaches: Mishandling of personal or sensitive information could lead to breaches of data privacy laws, resulting in legal action and loss of trust.

Project Management Risks

Inadequate Project Planning: Poorly defined project scope, timelines, or resources can lead to project delays, cost overruns, and failure to meet objectives.

Lack of Stakeholder Engagement: Failure to engage key stakeholders throughout the project can result in misaligned expectations and lack of support for the system.

Mitigation Strategies

To address these risks, [Your Company Name] should:

Conduct thorough due diligence during the system selection process to ensure compatibility and security features.

Establish a detailed project management plan with realistic budgets, timelines, and resource allocations.

Engage in comprehensive training and change management activities to ensure staff buy-in and effective system use.

Implement robust cybersecurity measures and data privacy protocols to protect against breaches and comply with legal requirements.

Regularly review and update compliance practices to align with evolving regulations and standards.

Foster ongoing communication with all stakeholders to ensure alignment and address concerns proactively.

Adopt a phased approach to the system implementation, starting with a pilot program in one department or function. This allows the organization to identify and address any technical or operational issues on a smaller scale before a full-scale rollout.

Create a dedicated support team responsible for addressing technical issues, user concerns, and training needs both during and after the implementation process. This team should include IT specialists, system users, and representatives from the system provider, ensuring a comprehensive support structure.

By identifying and proactively managing these risks, [Your Company Name] can enhance the likelihood of a successful implementation of the Internal Audit Accounting System, thereby achieving the desired improvements in efficiency, compliance, and financial integrity.

Conclusion and Recommendations

The Feasibility Study conducted by [Your Company Name] provides a comprehensive analysis of the viability of implementing an Internal Audit Accounting System within our organization. This study has meticulously examined various critical aspects, including market analysis, financial feasibility, legal considerations, operational feasibility, and potential risks. The findings indicate that while there are undeniable challenges and risks associated with the project, the potential benefits in terms of enhanced efficiency, compliance, and financial integrity offer a compelling case for moving forward.

Recommendations

Based on the insights gained from this study, the following recommendations are proposed to guide the decision-making process and implementation strategy:

Proceed with Implementation: Given the positive assessment of financial viability, market needs, and the strategic alignment with organizational goals, [Your Company Name] should proceed with the implementation of the Internal Audit Accounting System, while taking into account the identified risks and mitigation strategies.

Comprehensive Project Planning: Develop a detailed project plan that includes clear timelines, budget allocations, resource assignments, and milestones. This plan should also incorporate risk management strategies to address potential challenges identified in the study.

Stakeholder Engagement: Engage key stakeholders throughout the project to ensure alignment, address concerns, and foster support for the system's adoption. This includes regular updates and feedback loops with management, staff, and other relevant parties.

Invest in Training and Change Management: Allocate resources towards comprehensive training programs and change management initiatives to ensure that employees are well-prepared to utilize the new system effectively. This will facilitate a smoother transition and enhance the system's adoption rate.

Continuous Monitoring and Evaluation: After implementation, establish mechanisms for continuous monitoring and evaluation of the system's performance against expected outcomes. This should include periodic reviews of operational efficiency, compliance levels, and financial metrics to ensure the system delivers the intended benefits.

Adaptation and Improvement: Be prepared to make adjustments to the system and operational processes based on feedback and performance data. This adaptive approach will enable [Your Company Name] to maximize the benefits of the system and address any issues that arise post-implementation.

By following these recommendations, [Your Company Name] can confidently embark on the implementation of the Internal Audit Accounting System, secure in the knowledge that thorough analysis and planning have been undertaken. This strategic initiative is anticipated to significantly enhance our financial reporting accuracy, compliance with regulations, and overall operational efficiency, positioning our organization for sustained success in the competitive market.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

The Internal Audit Accounting System Feasibility Study Template from Template.net is a premium resource designed for meticulous analysis and planning. Fully editable and customizable, this template is tailored to meet your specific needs. With the ease of our Ai Editor Tool, you can effortlessly modify every aspect to align with your organizational objectives.