Free Account Budget System Feasibility Study

Executive Summary

The feasibility study conducted for [YOUR COMPANY NAME] explores the implementation of an Account Budget System (ABS), aiming to address the growing complexities in our financial operations. The proposed ABS is designed to modernize our budgetary framework, making it more efficient, transparent, and conducive to strategic decision-making. This initiative is expected not only to streamline financial processes but also to significantly contribute to our company's growth and competitiveness in the market.

Through an in-depth analysis, this study evaluates the project's viability across various dimensions: operational, legal, financial, and market potential, complemented by a thorough risk assessment. Operationally, the ABS is poised to offer a centralized platform for budget tracking, enhancing financial oversight and enabling more informed decisions. Legally, the study ensures that the system adheres to pertinent regulations, safeguarding data privacy and intellectual property. Financially, the analysis provides a detailed projection of the investment required, potential cost savings, revenue generation, and overall return on investment. The market analysis underscores the growing demand for advanced budgeting solutions, affirming the timeliness and relevance of introducing the ABS.

In summary, this feasibility study presents a compelling case for the adoption of the ABS, highlighting its potential to transform our financial management practices, reduce costs, and enhance operational efficiency, thereby positioning [YOUR COMPANY NAME] for sustained growth and success.

Project Description

The proposed Account Budget System (ABS) for [YOUR COMPANY NAME] is envisioned as a comprehensive solution designed to revolutionize our approach to budget management. The project is driven by three core objectives:

Enhanced Budget Tracking and Financial Management: The ABS will provide real-time access to budget data, facilitating better tracking and management of financial resources. By integrating financial data across various departments, the system will offer a unified view of the company's financial health, enabling more accurate forecasting and strategic planning.

Operational Cost Reduction and Productivity Increase: By automating and optimizing budgeting processes, the ABS will significantly reduce manual labor and associated costs. Improved efficiency will not only lead to direct cost savings but also free up valuable resources that can be redirected towards growth-oriented initiatives, thereby boosting overall productivity.

Improved Accountability and Financial Outcomes: The system will enforce financial discipline by providing detailed insights into spending patterns, budget variances, and performance metrics. Enhanced transparency and accountability will empower managers to make data-driven decisions, improving financial outcomes and organizational performance.

The ABS project encompasses the development, implementation, and ongoing support of the system, ensuring it is scalable, secure, and user-friendly. By meeting these objectives, the ABS will serve as a cornerstone for financial excellence at [YOUR COMPANY NAME], driving operational improvements and strategic growth.

Market Analysis

The market for budgeting and financial management systems is witnessing significant evolution, driven by the accelerating pace of digital transformation across industries. Our market analysis identifies the following key trends and target segments:

Target Market:

Corporates: Businesses of varying sizes are increasingly seeking sophisticated budgeting solutions to enhance financial transparency and efficiency. The ABS is particularly suited to organizations looking to leverage technology for better financial oversight and strategic planning.

Financial Institutions: These entities are in constant pursuit of advanced systems to manage their complex budgeting needs, making them prime candidates for the ABS. The system's ability to provide real-time financial insights and enhance decision-making aligns well with their requirements.

Government Institutions: Facing public accountability and stringent budgetary controls, government bodies can benefit significantly from the ABS, which offers improved budget management and operational efficiency.

Market Trends:

The digital transformation trend is leading to the rapid adoption of technology-driven solutions in budgeting and financial planning. Organizations are moving away from traditional, manual processes towards integrated, real-time systems that offer greater accuracy and control.

There is an increasing demand for real-time budget tracking systems that provide instant access to financial data, enabling proactive management of budgets and resources.

Efficiency and cost-effectiveness are becoming central to financial operations, with organizations looking for solutions that can streamline processes, reduce waste, and optimize spending.

Given these market dynamics, the introduction of the ABS by [YOUR COMPANY NAME] is timely and well-positioned to meet the growing needs of a diverse set of potential clients, offering them a competitive edge in financial management.

Financial Feasibility

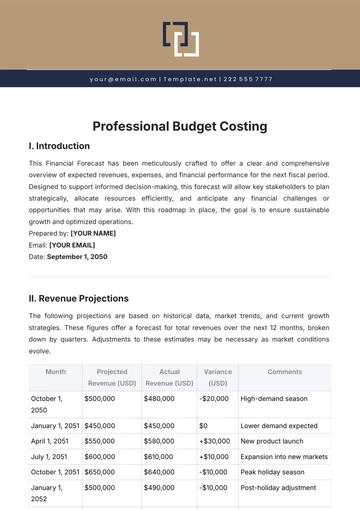

The financial feasibility section of the Account Budget System (ABS) study for [YOUR COMPANY NAME] is a critical component, providing a comprehensive analysis of the financial requirements and projections associated with the implementation of the ABS. This analysis covers the initial capital investment needed to launch the system, the estimated annual operational costs of maintaining the system, the expected annual revenue generated by the ABS, and a five-year profitability projection to assess the long-term viability of the project.

This financial assessment aims to ensure that the ABS not only meets the strategic and operational needs of [YOUR COMPANY NAME] but also represents a sound financial investment with a clear path to profitability. The following table details the financial aspects of the ABS project:

Initial Capital Investment | $1,500,000 |

|---|---|

Estimated Annual Operational Cost | $$$ |

Expected Annual Revenue | $$$ |

Profitability Projection (5 years) | $$$ |

The initial capital investment is substantial, reflecting the comprehensive nature of the system and the need for robust, secure, and scalable infrastructure. Operational costs are managed through efficient system design and the strategic use of resources, ensuring the system's sustainability.

Revenue projections are conservative, based on current market analysis and potential client base, with room for growth as the system gains traction and expands its reach. The five-year profitability projection is promising, indicating a strong return on investment and the financial viability of the ABS project.

This financial analysis underscores the potential of the ABS to not only enhance operational efficiency and decision-making at [YOUR COMPANY NAME] but also to contribute significantly to the company's financial health and growth trajectory over the long term.

Legal Considerations

When embarking on the development and implementation of an Account Budget System (ABS) for [YOUR COMPANY NAME], it's imperative to navigate a complex landscape of legal considerations to ensure full compliance and safeguard the organization's interests. These considerations are multifaceted, encompassing data privacy, intellectual property rights, and contractual obligations associated with software development and licensing.

Data Privacy and Compliance: In today's digital age, data is a critical asset but also a significant liability if not handled correctly. The ABS will manage sensitive financial data, necessitating strict adherence to local and international data protection laws, such as the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the United States. This involves implementing stringent data security measures, ensuring data is collected, stored, and processed in a manner that respects privacy rights and consent requirements, and providing clear policies on data usage and user rights.

Intellectual Property Rights: The creation of the ABS involves significant software development, which raises important intellectual property considerations. It is essential to clearly define ownership of the developed software, including source code, design documents, and any content created during the project. This may involve securing patents, copyrights, or trademarks as necessary, and ensuring that any third-party components used in the software are properly licensed and do not infringe on existing intellectual property rights.

Contractual Obligations and Software Licensing: The deployment of the ABS may involve entering into various contracts with software developers, vendors, and service providers. These contracts must be meticulously drafted to cover scope of work, deliverables, timelines, confidentiality, and liability clauses. Additionally, if the ABS incorporates third-party software or components, understanding and complying with those licensing agreements is crucial to avoid legal pitfalls.

Addressing these legal considerations requires a proactive approach, involving collaboration with legal experts to navigate the complexities of law and technology, ensuring that the ABS project is not only innovative but also legally sound.

Operational Feasibility

The operational feasibility of the Account Budget System (ABS) is a cornerstone of the project, ensuring that the proposed solution is not only technically viable but also aligns with the organization's operational capabilities and strategic goals. This involves examining the availability of necessary technology, the system's integration with existing infrastructure, and the availability of skilled professionals for implementation and ongoing support.

Technology Availability: The ABS project is predicated on the availability of advanced technology that can support the sophisticated functionalities required for effective budget management. This includes software platforms, database systems, and secure network infrastructure. The current technological landscape offers a wide range of solutions that can be tailored to meet the specific needs of the ABS, ensuring that the system is built on a robust and scalable technological foundation.

System Integration: A critical aspect of the ABS's operational feasibility is its ability to integrate seamlessly with [YOUR COMPANY NAME]'s existing systems, such as ERP (Enterprise Resource Planning), CRM (Customer Relationship Management), and other financial management tools. This integration is vital to ensure a cohesive ecosystem where data flows smoothly between systems, minimizing disruptions to existing workflows and maximizing the utility of the ABS. Strategic planning and the use of middleware or custom APIs (Application Programming Interfaces) can facilitate this integration, ensuring compatibility and interoperability between systems.

Professional Expertise: The successful setup and ongoing maintenance of the ABS require professionals with specialized skills in software development, system integration, and financial management. The current job market offers a pool of experienced individuals and consulting firms that specialize in ABS implementations, ensuring that the project can be staffed with the right talent. This includes project managers, software developers, system integrators, and financial analysts who can work collaboratively to bring the ABS to fruition.

By addressing these operational feasibility factors, [YOUR COMPANY NAME] can ensure that the ABS project is not only technically viable but also aligns with the organization's operational strategies and capabilities, paving the way for a successful implementation.

Risks

The implementation of an Account Budget System (ABS) carries inherent risks that could impact the project's success and the organization's operations if not properly managed. These risks range from technical challenges and data security concerns to organizational and compliance-related issues. A comprehensive risk management strategy is essential to identify, assess, and mitigate these risks effectively.

Data Security and Privacy Risks: As the ABS will handle sensitive financial data, there is a significant risk of data breaches and privacy violations. This could lead to financial loss, legal penalties, and damage to the company's reputation. To mitigate these risks, it is crucial to invest in advanced security technologies, including encryption, firewalls, and intrusion detection systems, and to establish strict data access controls and monitoring mechanisms.

Compliance Risks: Failure to comply with legal and regulatory requirements can result in fines, sanctions, and reputational damage. The ABS must be designed and operated in compliance with all relevant laws and regulations, including data protection and financial reporting standards. Regular compliance audits and consultations with legal experts can help ensure ongoing adherence to these requirements.

Organizational Risks: Implementing a new system like the ABS can encounter resistance from within the organization, particularly if it significantly changes existing processes or requires substantial learning and adaptation from staff. To address this, it is essential to engage in comprehensive change management practices, including stakeholder engagement, effective communication, training programs, and support structures to ease the transition and foster organizational buy-in.

Technical and Integration Risks: Technical issues, such as system failures, software bugs, or integration challenges with existing systems, can disrupt the implementation and operation of the ABS. Employing rigorous testing procedures, having contingency plans in place, and selecting reliable technology partners can help minimize these risks.

By proactively identifying and addressing these risks, [YOUR COMPANY NAME] can ensure the smooth implementation and operation of the ABS, safeguarding the organization's interests and maximizing the system's benefits.

Recommendations

Based on the comprehensive feasibility study conducted for the implementation of an Account Budget System (ABS) at [YOUR COMPANY NAME], it is evident that the project holds substantial promise for enhancing the company's financial management, operational efficiency, and strategic decision-making capabilities. The analysis across various dimensions—operational, financial, legal, and market feasibility—underscores the viability of the ABS. However, the success of this initiative is contingent upon meticulous planning, strategic execution, and proactive risk management. Herein, we outline our detailed recommendations for proceeding with the ABS implementation:

Strategic Planning and Stakeholder Engagement

Develop a Detailed Implementation Roadmap: Outline clear milestones, timelines, and responsibilities to guide the ABS project from inception to launch and beyond.

Engage Key Stakeholders: Ensure the involvement of all relevant parties, including senior management, financial teams, IT personnel, and end-users, to garner support and align the project with business objectives.

Technology and Infrastructure Investment

Select the Right Technology Platform: Choose a technology solution that is scalable, secure, and compatible with existing systems, ensuring it can support the company's current and future needs.

Invest in Robust Infrastructure: Prioritize investments in cybersecurity, data privacy, and system reliability to safeguard sensitive financial data and ensure uninterrupted system performance.

Legal Compliance and Intellectual Property Protection

Conduct a Comprehensive Legal Review: Collaborate with legal experts to navigate data protection laws, intellectual property rights, and contractual obligations, ensuring the ABS complies with all applicable regulations.

Implement Data Governance Policies: Establish clear policies for data handling, privacy, and security to protect company and customer information.

Operational Integration and Efficiency

Ensure Seamless System Integration: Work closely with IT specialists to integrate the ABS with existing financial and operational systems, minimizing disruptions and leveraging existing data and workflows.

Automate and Optimize Processes: Utilize the ABS to automate routine financial tasks, reduce manual errors, and optimize budgeting and reporting processes, freeing up resources for strategic initiatives.

Training and Change Management

Develop Comprehensive Training Programs: Equip employees with the necessary skills and knowledge to effectively use the ABS through targeted training sessions and support materials.

Implement Change Management Strategies: Address potential resistance through effective communication, demonstrating the system's benefits and providing ongoing support to ease the transition.

Risk Management and Quality Assurance

Establish a Risk Management Framework: Identify potential risks, assess their impact, and develop strategies to mitigate them, ensuring the project's success and the system's resilience.

Prioritize Quality Assurance and Testing: Conduct thorough testing of the ABS, including stress tests and scenario analyses, to identify and rectify any issues before system deployment.

Performance Monitoring and Continuous Improvement

Implement Performance Metrics: Track the ABS's performance against key objectives and metrics to assess its impact on financial management and operational efficiency.

Foster a Culture of Continuous Improvement: Encourage feedback from users and regularly review system performance to identify opportunities for enhancements and upgrades.

In conclusion, the successful implementation of the ABS at [YOUR COMPANY NAME] requires a strategic, well-coordinated approach that addresses technological, operational, legal, and cultural considerations. By adhering to these recommendations, the company can ensure the ABS not only meets its immediate financial management needs but also serves as a catalyst for long-term growth and innovation. The ABS project represents a significant investment in the company's future, promising to deliver substantial returns through improved efficiency, enhanced decision-making, and strengthened financial performance.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Template.net offers an exceptional Account Budget System Feasibility Study Template, fully editable and customizable with our cutting-edge AI editor tool. Simplify financial planning and analysis for your business with this comprehensive template. Dive into data, assess feasibility, and make informed decisions effortlessly. Unlock the potential of your budgeting process today with Template.net!

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising