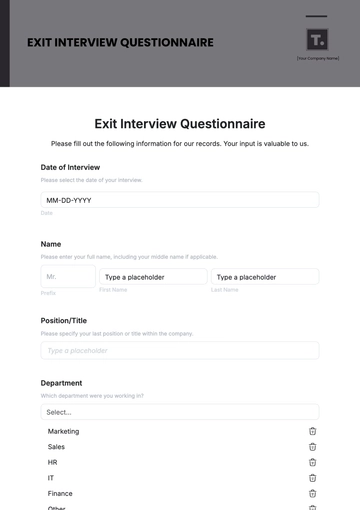

Free Accounting Internal Audit Questionnaire

This questionnaire is designed to assist our Internal Audit Department in understanding and evaluating the current state of accounting practices and internal controls within our organization. Your responses will provide valuable insights into areas that may require improvement or further investigation.

Instructions: Please answer all questions to the best of your knowledge and ability. If a question is not applicable, please mark it as N/A.

Section 1: General Accounting Practices

Are accounting policies and procedures documented and accessible to all relevant staff?

Have there been any significant changes to accounting policies or procedures in the last fiscal year?

How are new accounting policies communicated to the relevant departments?

Section 2: Revenue and Receivables

Describe the process for recognizing revenue. Are revenue recognition policies in compliance with applicable accounting standards?

How are receivables tracked and managed? Is there a periodic review of outstanding receivables?

What procedures are in place for handling overdue accounts?

Section 3: Expenses and Payables

Describe the process for recording expenses. How are expense approvals documented and reviewed?

Are there controls in place to ensure expenses are matched with the appropriate budget allocations?

How are payables managed and prioritized for payment?

Section 4: Payroll

What controls are in place to ensure accurate payroll processing?

How are employee timesheets verified and approved?

Describe the process for handling payroll discrepancies or adjustments.

Section 5: Inventory Management

How is inventory valued and recorded in the accounting system?

Are physical inventory counts performed regularly? If so, how often and by whom?

Describe the process for addressing discrepancies between physical inventory counts and recorded amounts.

Section 6: Fixed Assets

How are fixed assets recorded and tracked within the organization?

Describe the process for calculating and recording depreciation.

Are there procedures in place for the disposal or sale of fixed assets?

Section 7: Cash and Bank Reconciliations

Describe the process for performing bank reconciliations. How frequently are they done?

What controls are in place to ensure the accuracy of cash transactions?

How are discrepancies in cash or bank reconciliations addressed?

Section 8: Internal Controls and Risk Management

How are internal controls reviewed and updated?

Have there been any instances of fraud or significant errors in the past year? If so, how were they addressed?

What measures are in place to manage financial risks?

Section 9: Compliance

How does the organization ensure compliance with relevant laws, regulations, and accounting standards?

Are there any areas where compliance issues have been identified? If so, how are these being addressed?

Conclusion

Please provide any additional comments or information that you believe is relevant to our internal audit process.

Thank you for your cooperation and contribution to our internal audit process. Your insights are invaluable in helping us maintain the highest standards of accounting practices and internal controls.

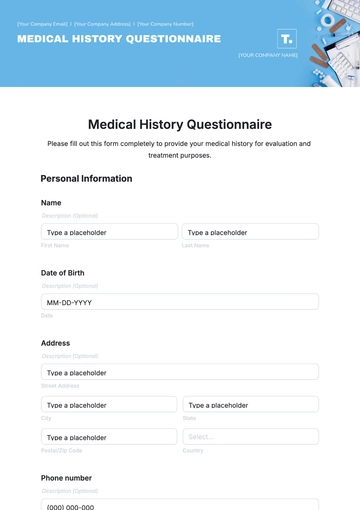

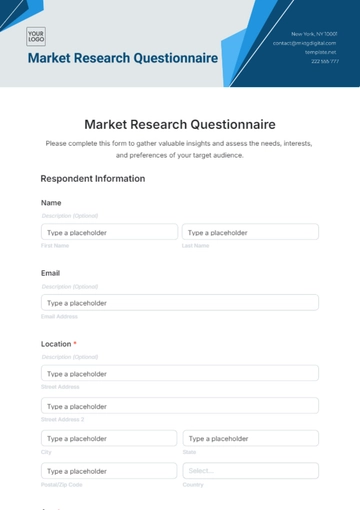

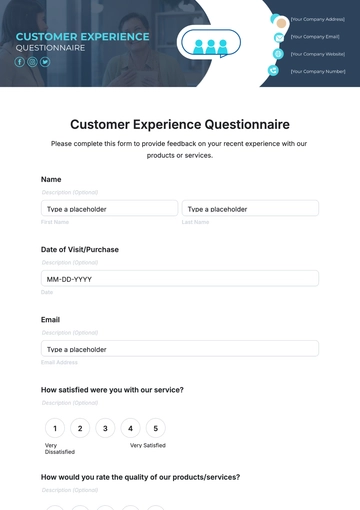

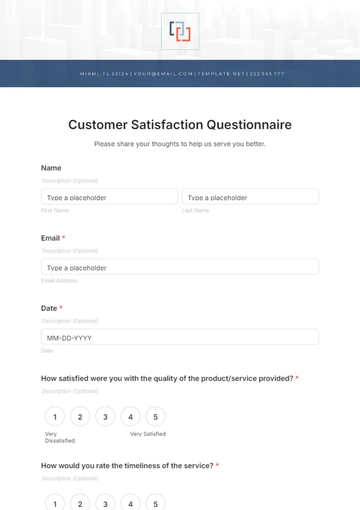

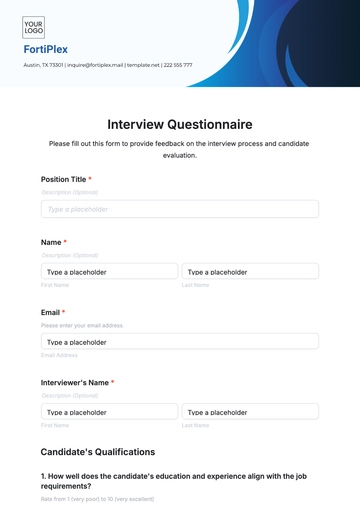

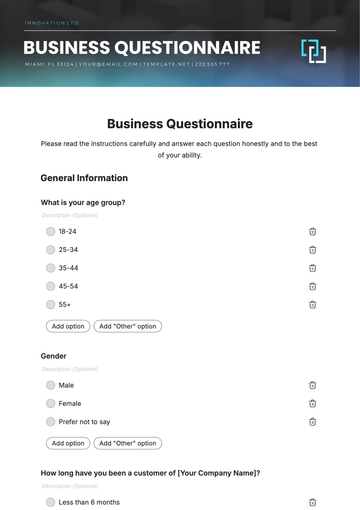

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Presenting the Accounting Internal Audit Questionnaire Template from Template.net, an essential tool for thorough audit assessments. This editable and customizable template simplifies the audit process, providing a comprehensive set of questions designed to uncover insights. Editable in our AI Editor tool, it allows for easy adjustments to suit your specific audit requirements.