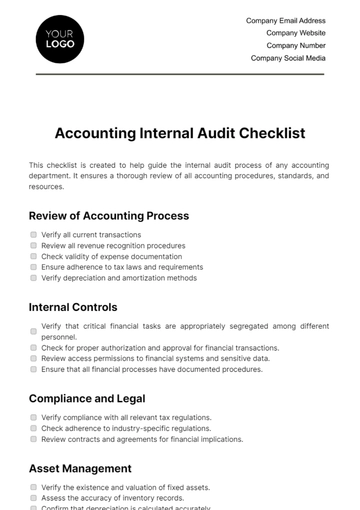

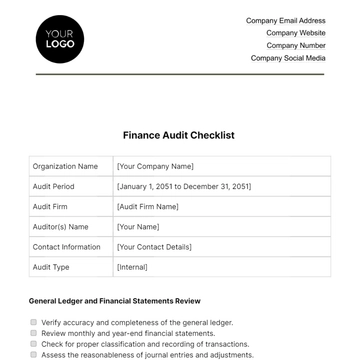

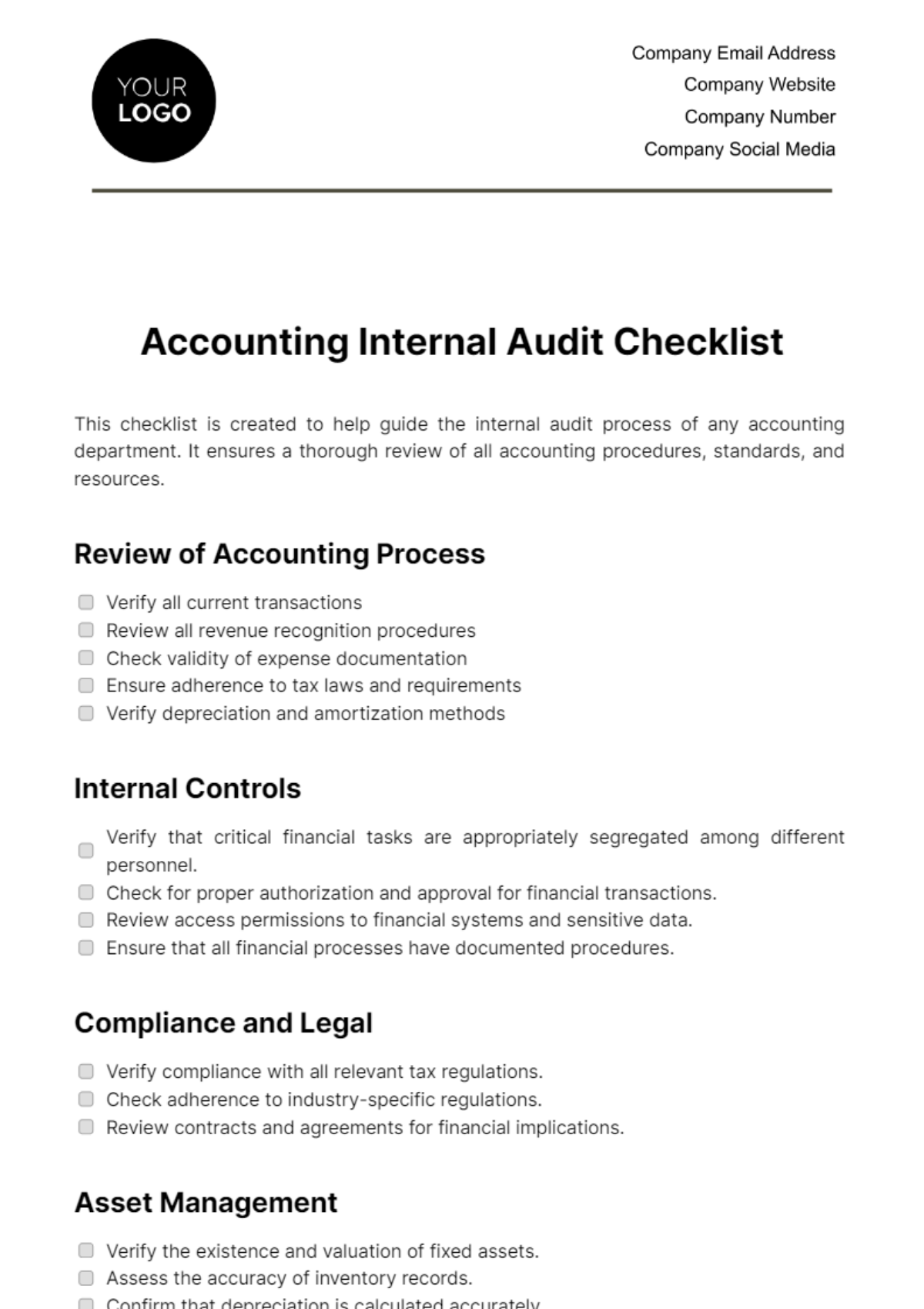

Free Accounting Internal Audit Checklist

This checklist is created to help guide the internal audit process of any accounting department. It ensures a thorough review of all accounting procedures, standards, and resources.

Review of Accounting Process

Verify all current transactions

Review all revenue recognition procedures

Check validity of expense documentation

Ensure adherence to tax laws and requirements

Verify depreciation and amortization methods

Internal Controls

Verify that critical financial tasks are appropriately segregated among different personnel.

Check for proper authorization and approval for financial transactions.

Review access permissions to financial systems and sensitive data.

Ensure that all financial processes have documented procedures.

Compliance and Legal

Verify compliance with all relevant tax regulations.

Check adherence to industry-specific regulations.

Review contracts and agreements for financial implications.

Asset Management

Verify the existence and valuation of fixed assets.

Assess the accuracy of inventory records.

Confirm that depreciation is calculated accurately.

Cash Management

Review procedures for cash receipts and disbursements.

Ensure timely and accurate bank reconciliations.

Verify the proper use and documentation of petty cash.

IT Systems and Data Security

Ensure proper backup and recovery procedures are in place.

Assess the security of financial data and systems.

Verify access controls for financial systems.

Internal Control Evaluation

Review financial statement controls

Inspect internal control systems for potential fraud risks

Examine IT systems and security

Ensure ethical conduct compliance

Review controls over business operations

Your diligence in completing this audit is instrumental in upholding financial transparency, minimizing risks, and fortifying the overall health of your organization's financial framework.

Prepared By: [YOUR NAME]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Optimize your audit procedures with the Accounting Internal Audit Checklist Template from Template.net. This editable and customizable checklist ensures thorough reviews tailored to your specifications. Effortlessly modify it using our Ai Editor Tool, adapting to evolving audit requirements. Stay in control of your processes, enhance accuracy, and streamline your internal audits with this versatile template.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist