Free Accounting Checklist for Small Business

This checklist is a useful tool developed to systematically assist individuals in reviewing and completing necessary financial tasks. The goal is to ensure accuracy and compliance throughout all stages of the accounting process.

Objectives:

To provide a systematic approach to accounting tasks.

To maintain accuracy throughout the accounting process.

To ensure compliance with financial regulations and standards.

To optimize the efficiency of the company's accounting process.

Financial and Accounting Procedures

Regularly assess market conditions and internal factors affecting your business to identify potential financial risks and opportunities.

Develop accurate financial forecasts to guide strategic decision-making and resource allocation.

Establish a robust financial plan outlining your business's long-term goals and strategies.

Conduct monthly, quarterly, and annual reviews of your budget to track and control expenses.

Analyze variations between budgeted and actual financial performance to understand and address discrepancies.

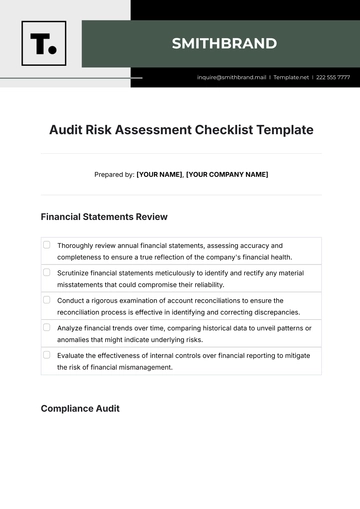

Auditing

Scrutinize financial statements to ensure accuracy and compliance with legal standards.

Regularly assess internal financial controls to detect and rectify discrepancies.

Keep abreast of changes in financial regulations and legislation to maintain compliance.

Document and communicate audit findings to facilitate necessary improvements.

Implement corrective actions based on audit findings to enhance financial practices.

Tax Preparation

Accurately calculate tax obligations based on the latest tax laws.

Scrutinize business expenses to maximize deductions and minimize tax liabilities.

Ensure timely and accurate filing of tax returns to avoid penalties.

Stay informed about evolving tax laws and regulations to maintain compliance.

Account Reconciliation

Regularly reconcile bank statements to ensure accurate representation of your financial transactions.

Align general ledger accounts with actual financial transactions to avoid discrepancies.

Promptly address any discrepancies to maintain accurate financial records.

Periodically review and verify account balances to ensure accuracy.

Payroll

Ensure timely and accurate salary payments to employees.

Accurately calculate and withhold deductions and contributions as per legal requirements.

Address and resolve any employee payroll-related queries promptly.

Keep accurate records of paid leave and sick time to comply with labor laws.

Stay informed about and adhere to payroll laws and standards to avoid legal issues.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your finances with this Accounting Checklist for Small Business Template. Perfectly tailored for efficiency, it's fully customizable and editable in our very own Ai Editor Tool. Keep your accounts precise and clear, ensuring a robust financial foundation for your business with this adaptable and essential template right from Template.net.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

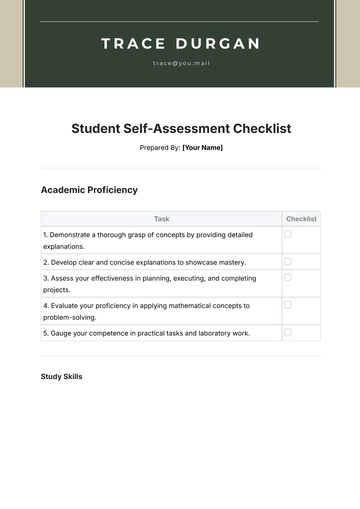

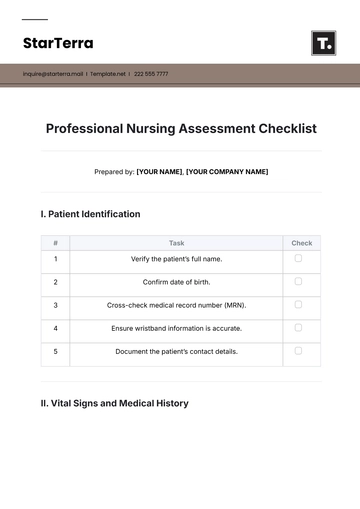

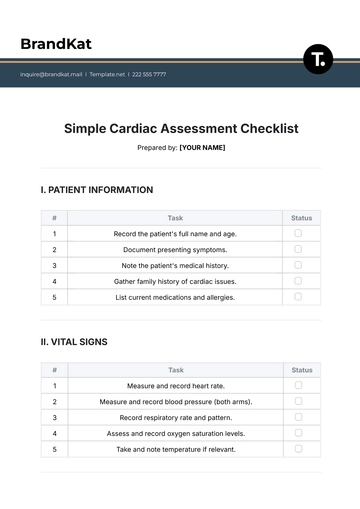

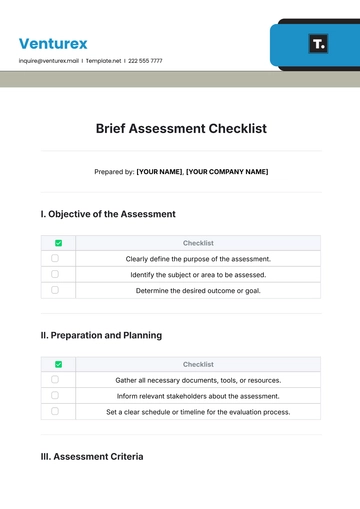

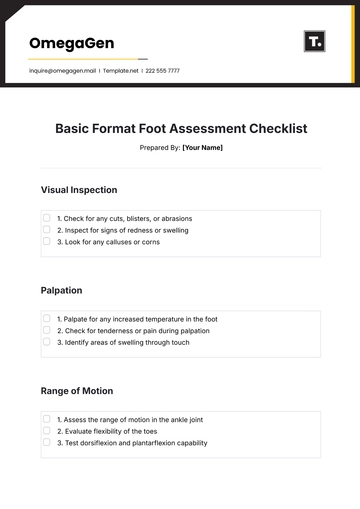

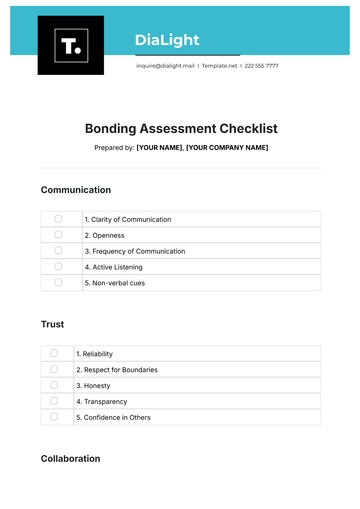

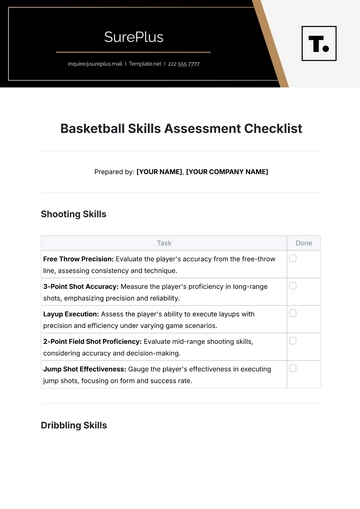

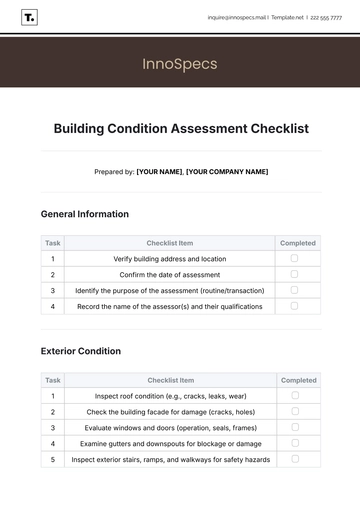

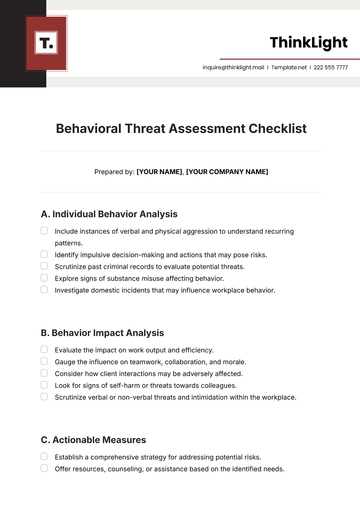

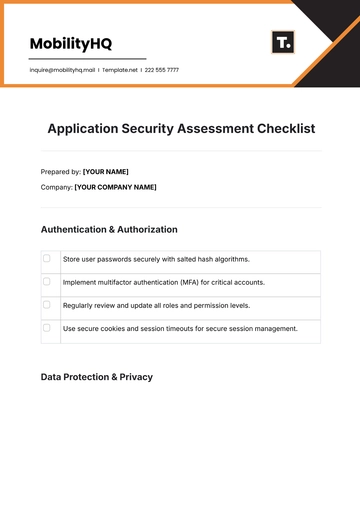

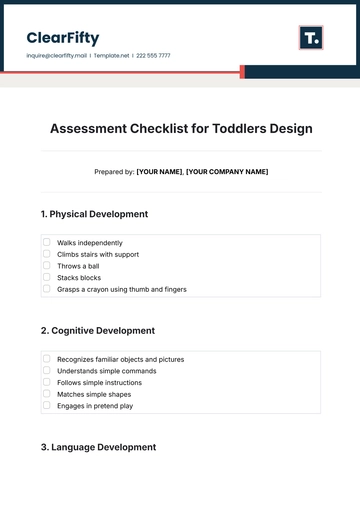

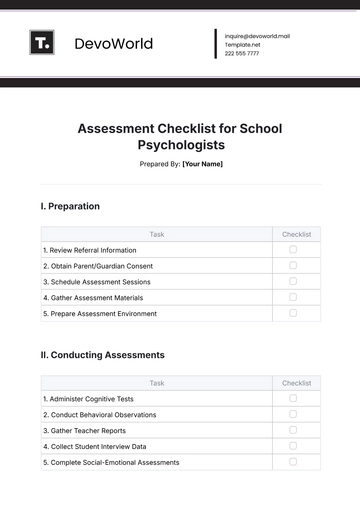

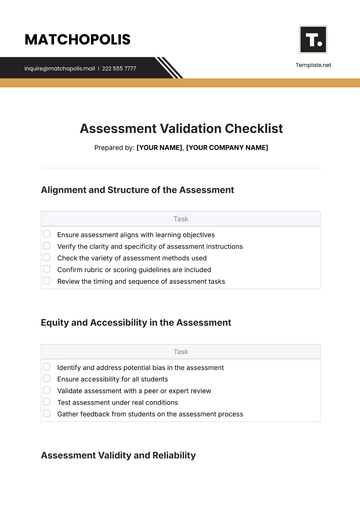

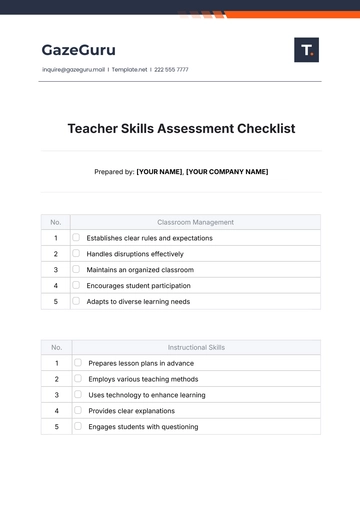

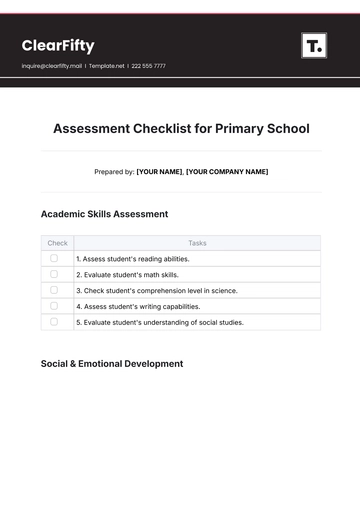

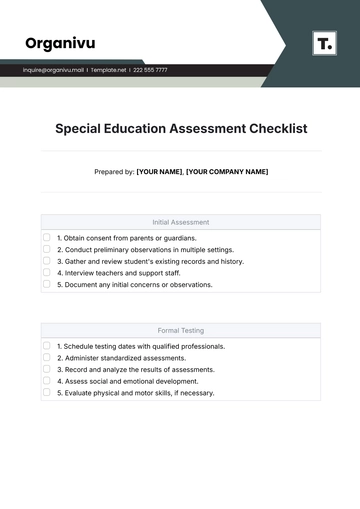

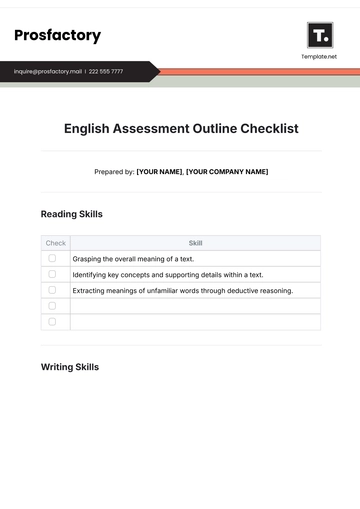

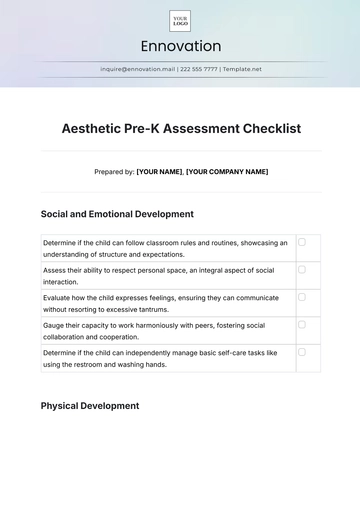

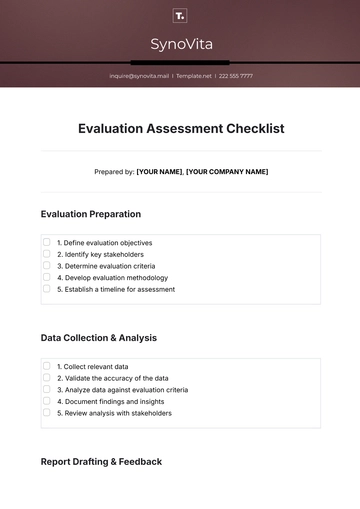

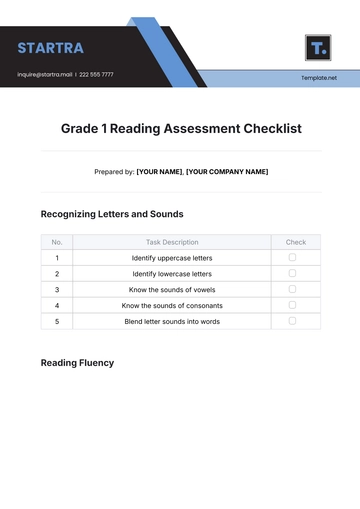

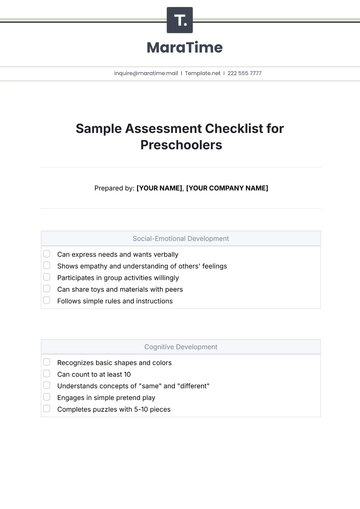

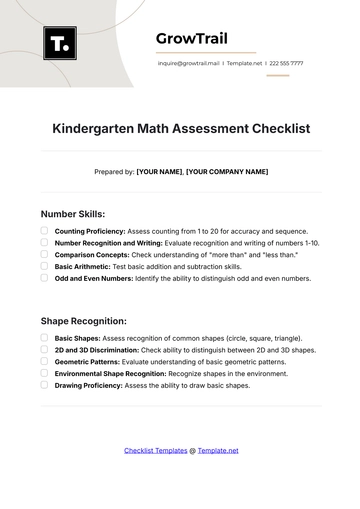

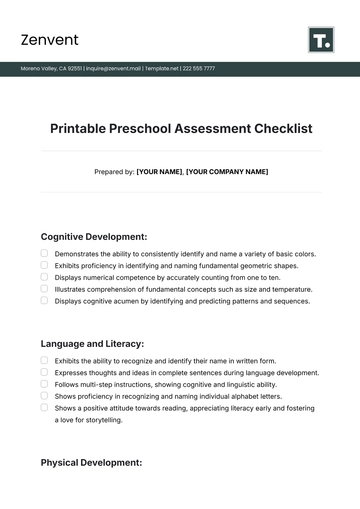

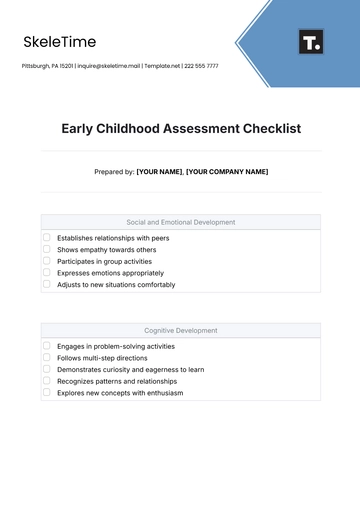

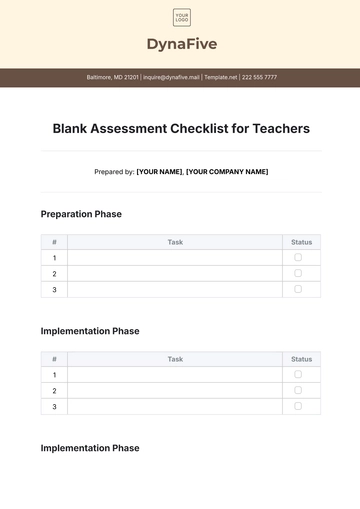

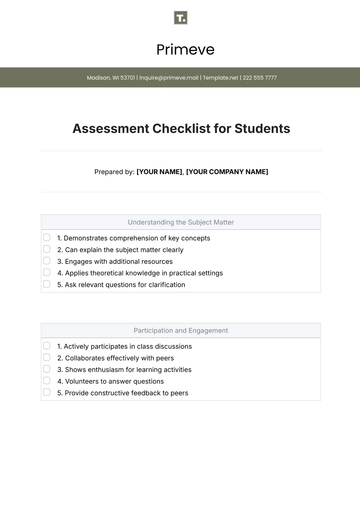

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist