Free Accounting Checklist

This Accounting Checklist serves as a strategic tool designed for [Your Company Name]. It aims to systematically review and complete the essential financial and compliance tasks integral to the accounting process.

Objectives:

Systematically track completion of finance tasks for comprehensive oversight.

Ensure utmost accuracy in accounting procedures, minimizing errors and discrepancies.

Bolster compliance by integrating best practices into every aspect of your financial processes.

Daily Accounting Tasks:

Review Cash Position: Monitor the daily cash flow to maintain liquidity and make informed financial decisions.

Record Transactions: Accurately document all financial transactions promptly for real-time tracking and reporting.

File Receipts and Invoices: Organize and retain physical and digital copies of receipts and invoices for audit trails.

Review Updated Financial Reports: Stay informed about the latest financial standings through regularly updated reports.

Review and Follow Up on Accounts Receivable: Actively manage accounts receivable to minimize outstanding payments and maintain healthy cash flow.

Weekly Accounting Tasks:

Analyze Billing Systems and Procedures: Assess the effectiveness of billing processes to streamline and improve revenue collection.

Run Payroll: Ensure timely and accurate payroll processing to meet employee compensation obligations.

Update Financial Data in Business Journal: Keep the financial journal current to reflect the most recent business transactions.

Review Unreconciled Transactions: Address and reconcile any discrepancies in financial records promptly.

Review Categorized Expenses: Analyze and categorize expenses for better budget management and cost control.

Monthly Accounting Tasks:

Reconciliation of Bank Accounts: Verify and reconcile bank statements to maintain accurate financial records.

Review Past Due Receivables: Investigate and address any overdue receivables to prevent cash flow disruptions.

Analyze Inventory Status: Assess inventory levels to optimize stocking and minimize carrying costs.

File Monthly Tax Requirements: Fulfill tax obligations by submitting required documents and payments on time.

Generate Month-End Financial Reports: Summarize key financial metrics for a comprehensive overview of monthly performance.

Annual Accounting Tasks:

Provide Information for Business Tax Return: Compile necessary data for an accurate and timely business tax return.

Prepare Year-End Financial Reports: Summarize the financial performance of the entire year for strategic planning.

Re-Evaluate Payroll System: Assess and update the payroll system to ensure compliance with regulations.

Prepare W-2 and 1099 Forms: Generate and distribute tax forms to employees and contractors as required.

Review Corporate Filings: Ensure all mandatory corporate filings are up-to-date for legal compliance.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Simplify your financial processes with the Accounting Checklist Template from Template.net. This editable and customizable tool is designed to organize and streamline your accounting tasks efficiently. Tailor your checklist with ease using our Ai Editor Tool, ensuring a precise fit for your unique accounting needs. Make accuracy standard with Template.net.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

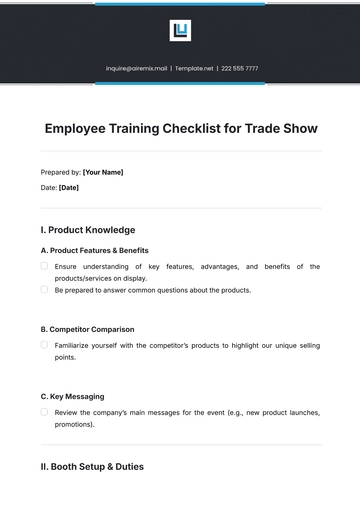

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

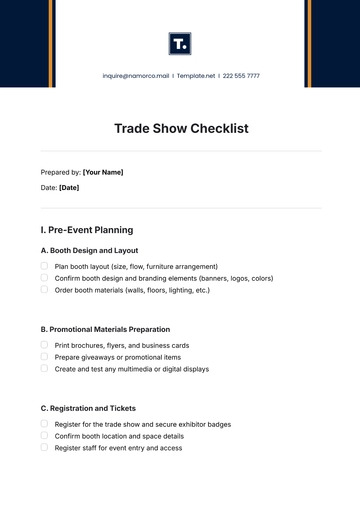

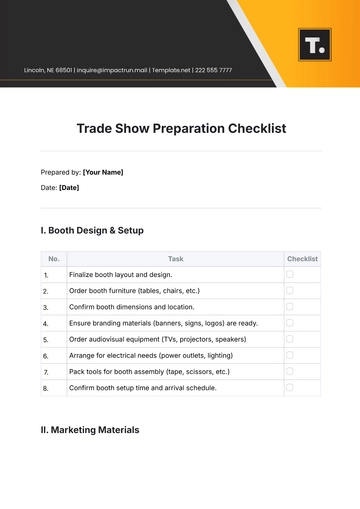

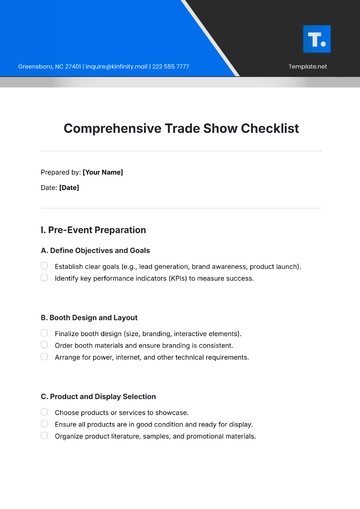

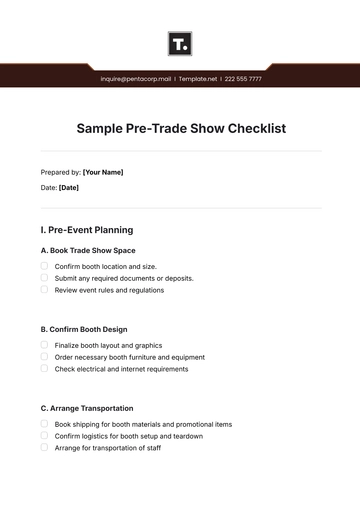

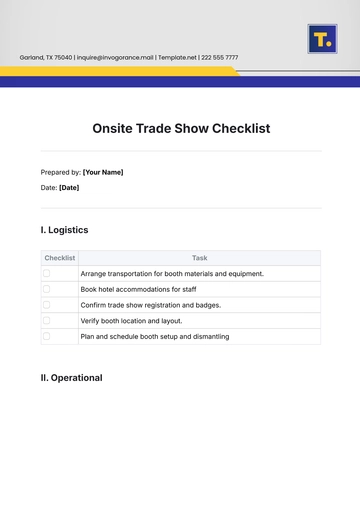

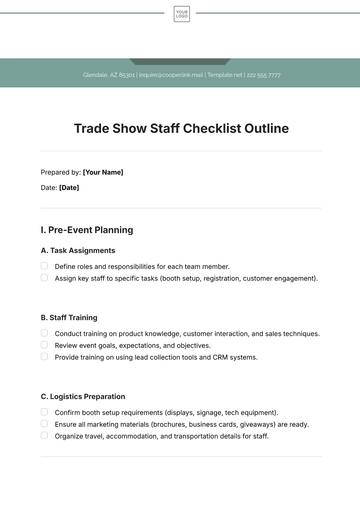

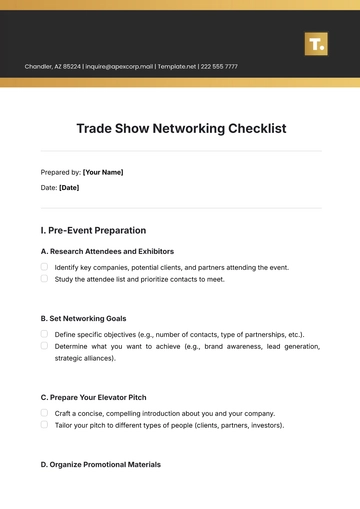

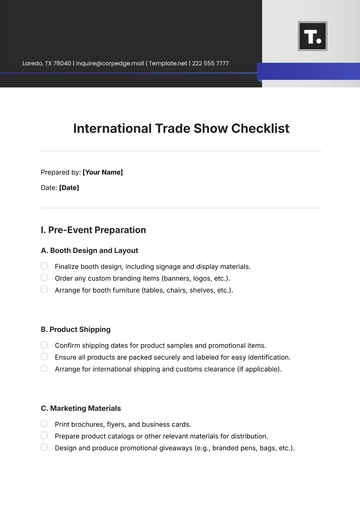

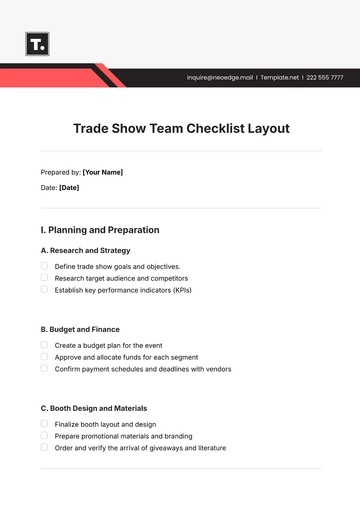

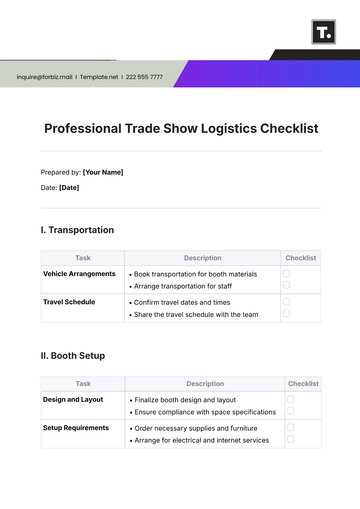

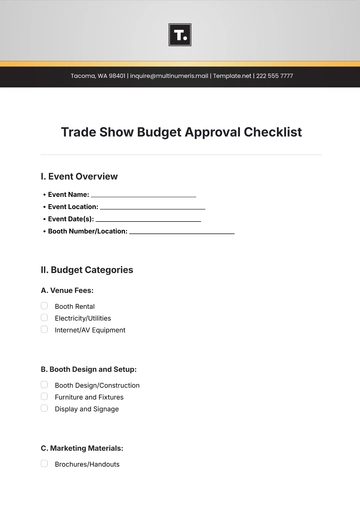

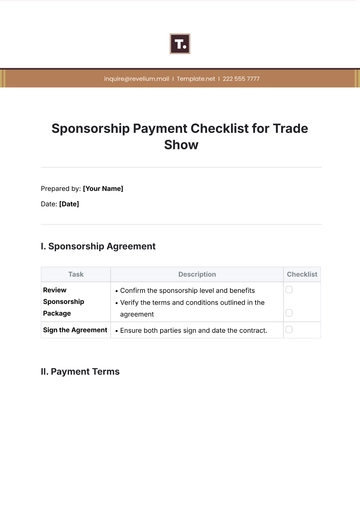

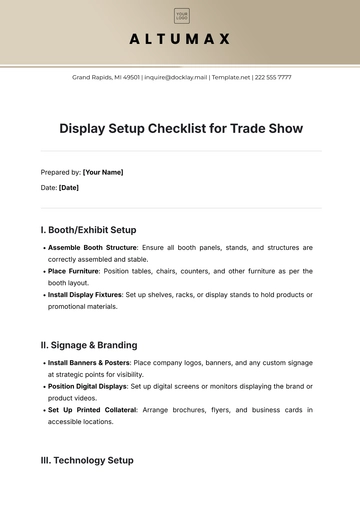

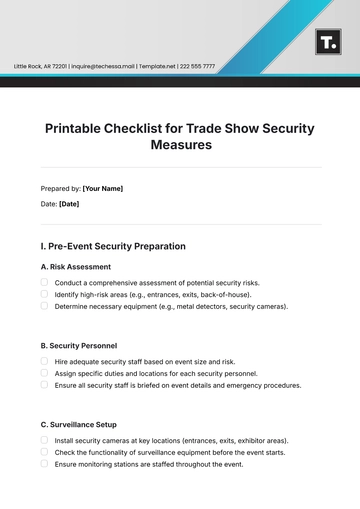

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist