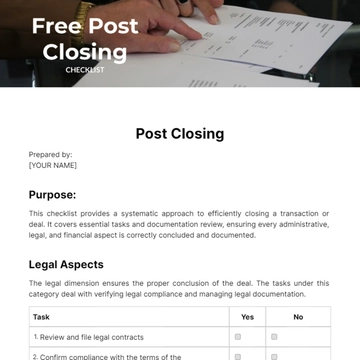

Free Accountant Payroll Accounting Checklist

Prepared by: [Your Name]

This Accountant Payroll Accounting Checklist aims to enable [Your Company Name] to systematically review and complete all necessary financial tasks. The intention is to ensure maximum accuracy and regulatory compliance in our accounting processes.

Objectives:

Improve the efficiency of our financial and accounting operations.

Minimize the risk of errors and financial discrepancies.

Ensure strict adherence to all financial regulations and statutory requirements.

Monthly Tasks:

Record and Document Transactions: Accurate documentation of every financial move is paramount for transparency and accountability. | |

Bank Account Reconciliation: Regularly reconcile bank accounts to identify discrepancies and maintain financial accuracy. | |

Generate Income and Expenditure Reports: Utilize financial reports to gauge the company's fiscal health and make informed decisions. | |

Execute Monthly Payroll: Timely payroll execution ensures employees are compensated accurately, maintaining workforce satisfaction. | |

Review Tax Obligations: Scrutinize monthly tax responsibilities to avoid penalties and ensure compliance with legal obligations. |

Quarterly Tasks:

Vendor and Supplier Reconciliation: Regularly review and reconcile vendor and supplier statements to foster healthy business relationships. | |

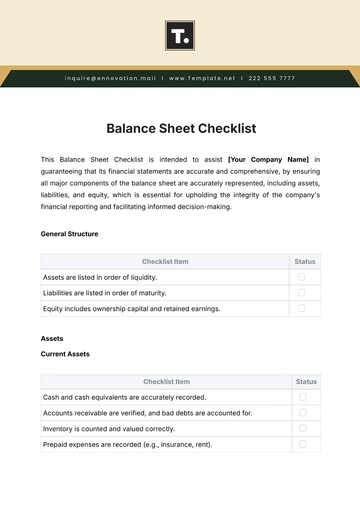

Prepare Financial Statements: Craft comprehensive quarterly financial statements to assess the company's financial standing. | |

Submit Quarterly Tax Returns: Adhere to regulatory timelines by submitting accurate quarterly tax returns, mitigating financial risks. | |

Update Budget Projections: Regularly revise budget projections to adapt to evolving market dynamics and business requirements. | |

Analyze Financial Performance: Conduct thorough internal reviews to assess financial performance, identifying areas for improvement. |

Annual Tasks:

Prepare Year-End Financial Statements: Compile exhaustive year-end financial statements for a holistic overview of the fiscal year. | |

Balance Reconciliation Statements: Ensure all reconciliation statements are balanced, providing a foundation for accurate financial assessments. | |

Audit Preparations: Facilitate a smooth annual audit process by preparing necessary documentation and collaborating with external auditors. | |

Submit Corporate Income Tax Return: Fulfill regulatory obligations by submitting accurate corporate income tax returns. | |

Assess Financial Performance: Summarize the year's financial performance, preparing an insightful annual report for stakeholders. |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Master payroll management through this Accountant Payroll Accounting Checklist Template. Designed for precision and ease, this meticulously crafted template is fully customizable and editable in our Ai Editor Tool. Streamline your payroll process, ensuring accuracy and efficiency in every pay period with this essential and user-friendly tool exclusively from Template.net.

You may also like

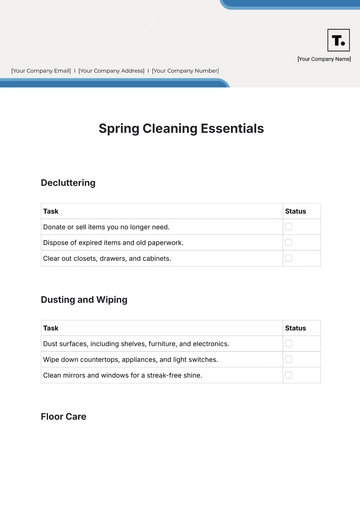

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

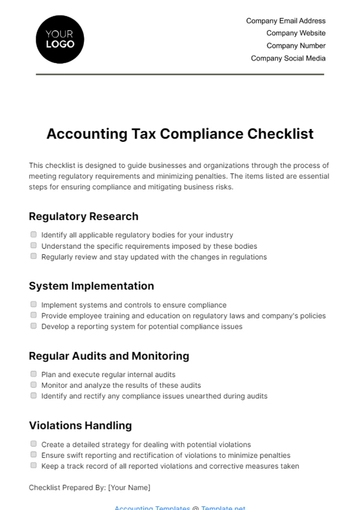

- Compliance Checklist

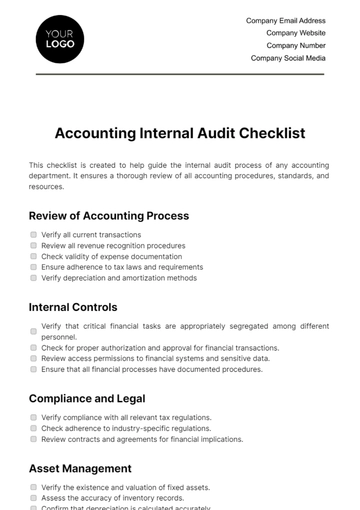

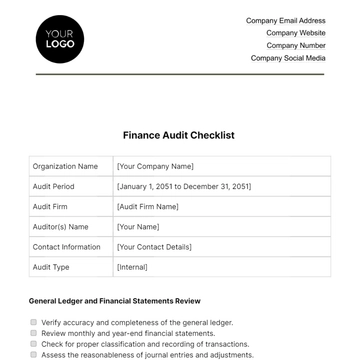

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

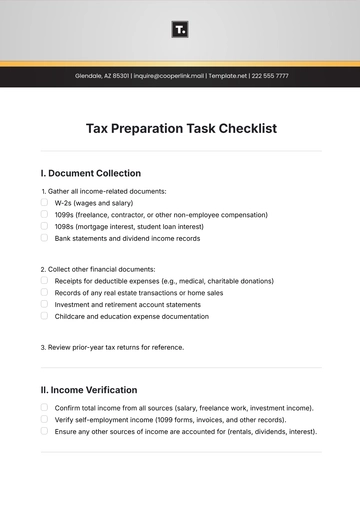

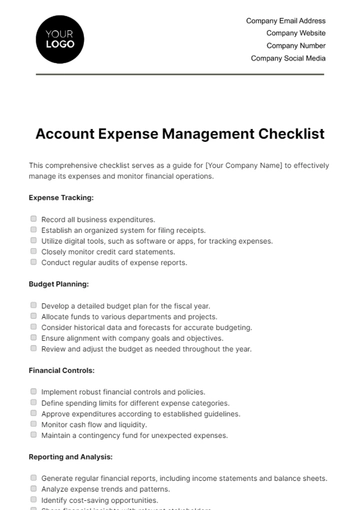

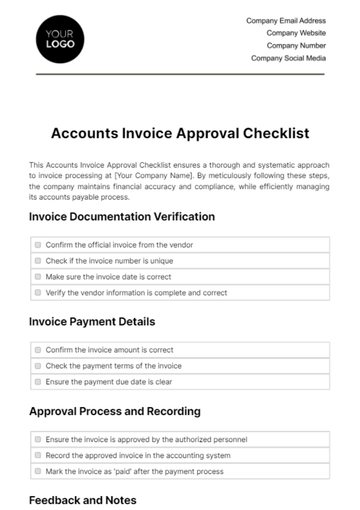

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

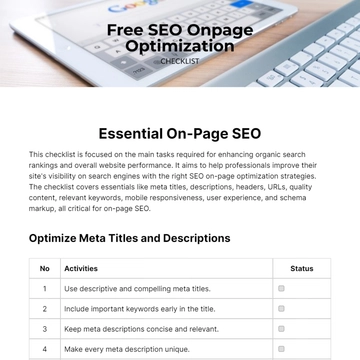

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

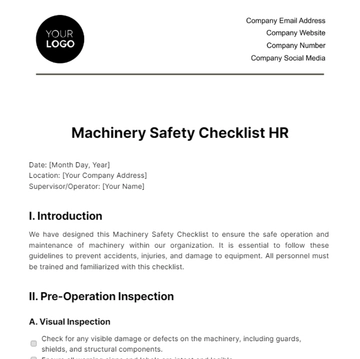

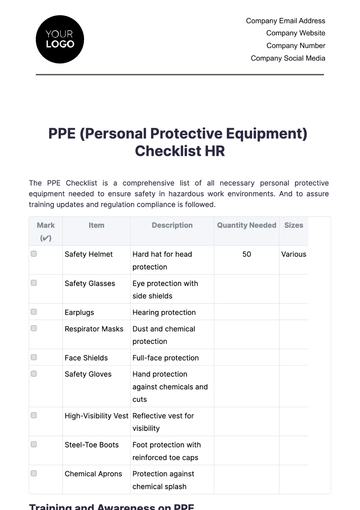

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist