Free Extensive Account Budget Research

Introduction

Background and Rationale

In an era of unprecedented economic volatility and technological advancements, the importance of robust financial management practices cannot be overstated. The inception of this Account Budget Research Document arises from the recognition that account budgeting serves as the linchpin in the financial architecture of organizations. Historical financial models are increasingly inadequate to navigate the complexities of the modern business landscape. The acceleration of globalization, digitalization, and a shifting regulatory environment necessitate a deep dive into account budgeting, aligning financial strategies with organizational objectives.

The rationale behind this document lies in providing a holistic resource that not only encapsulates traditional budgeting methodologies but also explores cutting-edge trends and technologies shaping the future of financial planning. As organizations strive for resilience and agility, understanding the intricacies of account budgeting becomes paramount. This research aims to equip financial professionals, executives, and researchers with insights and strategies to thrive in an environment where adaptability and foresight are key.

Objectives of Account Budget Research

The objectives of this research are multi-faceted. Firstly, it seeks to demystify the intricacies of account budgeting, making it accessible to a diverse audience. Secondly, it endeavors to provide practical insights and real-world applications, bridging the gap between theoretical knowledge and practical implementation. Furthermore, the research aims to explore the evolving nature of account budgeting, taking into account global perspectives, technological advancements, and emerging trends.

Beyond a mere exploration of concepts, the document aspires to serve as a guide for decision-makers, enabling them to make informed choices in the realm of financial planning. It also aims to contribute to academic discourse by offering a nuanced understanding of the challenges and opportunities in contemporary account budgeting practices.

Scope and Limitations

The scope of this research extends from the fundamentals of account budgeting to the forefront of technological innovations and global variations in practices. It encapsulates diverse industries and organizational sizes, recognizing that the principles of account budgeting are universally applicable but may require adaptation based on context.

However, it's essential to acknowledge the limitations inherent in any research endeavor. The dynamic nature of financial markets and business environments introduces an inherent challenge in capturing real-time dynamics comprehensively. Additionally, the applicability of certain practices may vary based on the industry, geographical location, or organizational structure. While efforts have been made to present a comprehensive overview, the document may not cover every nuance or specific contextual detail.

Significance of Account Budgeting

Role in Financial Planning

Account budgeting serves as the backbone of effective financial planning by providing a roadmap for allocating resources strategically. It goes beyond mere numbers, acting as a dynamic tool to align financial strategies with the overarching goals of the organization. For instance, a well-constructed budget facilitates the prioritization of projects, investments, and operational activities in line with the company's strategic vision.

Decision-Making and Resource Allocation

The significance of account budgeting becomes evident in its influence on decision-making processes. By offering a clear picture of anticipated revenues and expenditures, budgets empower decision-makers to allocate resources judiciously. Whether it's investing in new ventures, expanding operations, or optimizing costs, the budget serves as a compass guiding decision-makers through the complexities of choices that impact the financial health of the organization.

Impact on Organizational Performance

The impact of account budgeting extends beyond the finance department, permeating throughout the organization. A well-crafted budget not only ensures financial stability but also contributes to enhanced organizational performance. It fosters accountability, encourages efficiency, and enables proactive measures to address potential financial challenges. Ultimately, the effectiveness of account budgeting can be measured in the organization's ability to achieve its strategic goals and deliver sustainable growth.

Types of Budgets

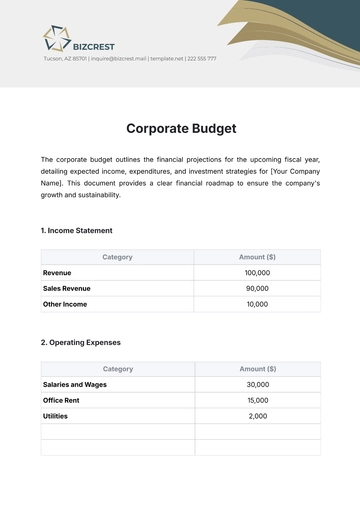

Budget Type | Description |

|---|---|

Operating Budgets | Financial plan detailing day-to-day operational expenses, including sales forecasts, production costs, labor expenses, and overheads. |

Capital Budgets | Focuses on significant, long-term investments such as equipment, facilities, or technological upgrades. Involves ROI analysis. |

Cash Budgets | Projects cash inflows and outflows over a specific period, ensuring liquidity for operational needs. |

Master Budgets | Comprehensive overview consolidating operating budgets, capital budgets, and cash budgets. Guides strategic decisions and aligns financial activities. |

Budgeting Process

Establishing Budgeting Goals

The budgeting process begins with clearly defined goals aligned with the organization's strategic objectives. These goals provide the foundation for the budget, guiding the allocation of resources and shaping financial priorities. For example, a technology company setting a goal to increase market share may allocate resources to research and development in its budget.

Involvement of Key Stakeholders

Effective budgeting involves the collaboration of key stakeholders across departments. Finance teams, department heads, and other relevant personnel should actively participate in the process. This collaborative approach ensures that diverse perspectives are considered, leading to a more accurate and realistic budget. For instance, involving sales teams in the budgeting process helps align revenue projections with market trends and sales strategies.

Data Collection and Analysis

Data collection involves gathering relevant information, including historical financial data, market trends, and internal performance metrics. Thorough analysis of this data is essential for making informed budgeting decisions. For instance, analyzing past sales performance and market conditions helps in projecting future revenues accurately.

Formulating Budget Plans

Based on the analysis, budget plans are formulated. These plans outline specific targets for revenues, expenses, and investments. Detailed budget plans provide a roadmap for financial activities during the budget period. For example, an organization may formulate a production budget outlining the quantity of products to be manufactured based on anticipated demand.

Review and Approval

The final step involves the review and approval of the budget plans. Key decision-makers assess the proposed budget against strategic goals and financial constraints. Adjustments may be made during this phase to ensure that the budget aligns with the organization's overarching objectives. Once approved, the budget serves as a guide for financial activities throughout the designated period.

Key Components of an Account Budget

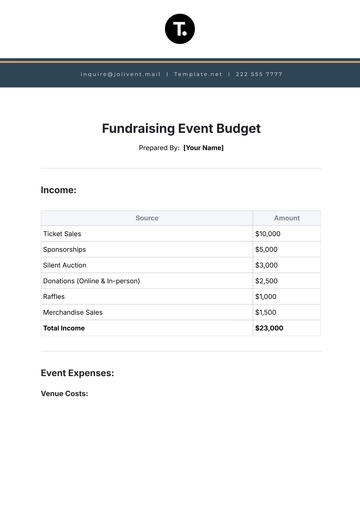

Revenue Budgeting

Revenue budgeting involves projecting and planning for the organization's incoming cash flows. This process encompasses detailed assessments of sales forecasts, pricing strategies, and market trends. For instance, in a technology company, revenue budgeting may involve forecasting product sales, subscription renewals, and service revenues. Additionally, it considers factors such as seasonality, market demand fluctuations, and potential impacts from competitors.

Expense Budgeting

Expense budgeting is a critical component that outlines the planned expenditures across various aspects of the organization. This includes operating costs, capital investments, and variable expenses. For example, in a manufacturing setting, expense budgeting may encompass raw material costs, labor expenses, equipment maintenance, and facility-related expenditures. Thorough analysis and categorization of expenses help organizations allocate resources efficiently and control costs.

Cash Flow Budgeting

Cash flow budgeting focuses on maintaining optimal liquidity by forecasting the organization's cash inflows and outflows. This involves a meticulous analysis of the timing of revenue receipts and expense payments. In a retail business, for instance, cash flow budgeting may involve predicting the cash impact of seasonal sales patterns, supplier payment terms, and inventory turnover. Accurate cash flow projections are crucial for ensuring that the organization has sufficient funds to meet its operational needs.

Budgeted Balance Sheet

The budgeted balance sheet provides a comprehensive snapshot of the organization's financial position based on budget projections. It includes assets, liabilities, and equity, reflecting the expected financial condition at a specific point in time. In the context of a financial services company, the budgeted balance sheet may detail projected investments, outstanding loans, and shareholder equity. This component ensures that the budget aligns with the overall financial health and stability of the organization.

Budgetary Control and Variance Analysis

Monitoring Actual Performance

Budgetary control involves actively monitoring the actual financial performance against the budgeted figures. This requires real-time tracking of revenue, expenses, and other financial metrics. In a hospitality business, for example, budgetary control may involve comparing actual guest bookings and revenue with the projected figures, allowing for immediate adjustments to operational plans.

Identifying Variances

Identifying variances is a crucial aspect of budgetary control. Variances represent the differences between the budgeted amounts and the actual results. In an e-commerce company, identifying a positive variance in sales might prompt further analysis to determine the factors contributing to the success, enabling the organization to replicate successful strategies.

Causes of Variances

Analyzing the causes of variances involves investigating the factors that contributed to deviations from the budget. In a healthcare organization, for instance, if there is a negative variance in operating expenses, it could be due to unexpected increases in medical supply costs or changes in patient volumes. Understanding these causes enables organizations to address underlying issues and refine future budgeting processes.

Corrective Actions

Implementing corrective actions is an essential step in response to identified variances. In a software development company, if there is a negative variance in project development costs, corrective actions may involve revisiting project timelines, negotiating vendor contracts, or optimizing resource allocation. Proactive corrective actions ensure that the organization remains on course to achieve its financial objectives.

Technology and Account Budgeting

Budgeting Software and Tools

The utilization of dedicated budgeting software and tools has become instrumental in streamlining the budgeting process. In a financial institution, adopting specialized software can automate data collection, facilitate collaborative budget creation, and enhance the accuracy of projections. This technology ensures that budgeting teams can focus on strategic decision-making rather than manual data entry.

Automation in Budgeting Processes

Automation in budgeting processes involves leveraging technology to automate routine and repetitive tasks associated with budget creation and maintenance. In a manufacturing environment, for example, automation may include using software to calculate production costs, track inventory levels, and automatically update budgetary figures based on real-time data. Automation increases efficiency and reduces the risk of errors in the budgeting process.

Integration with Accounting Systems

Integration with accounting systems is essential for ensuring seamless data flow between budgeting processes and financial reporting. For a retail chain, integrating budgeting with accounting systems enables real-time tracking of sales, expenses, and inventory levels. This integration enhances the accuracy of budget projections and facilitates a cohesive financial management ecosystem.

Challenges in Account Budgeting

Forecasting Accuracy

Achieving precise forecasting accuracy remains a perennial challenge in account budgeting due to the inherent complexity of predicting market trends, consumer behaviors, and external economic factors. External shocks, unexpected market fluctuations, and rapid technological advancements can introduce uncertainties that make accurate forecasting challenging. Organizations must adopt sophisticated predictive models, leverage big data analytics, and continuously refine forecasting methodologies to enhance accuracy and agility in responding to changes.

Dynamic Business Environments

The dynamic nature of business environments, marked by ever-changing market conditions, regulatory landscapes, and geopolitical influences, poses a significant challenge in account budgeting. Traditional static budgets may become quickly outdated, necessitating organizations to embrace flexible budgeting frameworks. Agile methodologies, scenario planning, and regular reassessment of assumptions are essential to navigate the dynamic nature of modern business environments successfully.

Communication and Collaboration

Effective communication and collaboration between departments are crucial challenges in account budgeting. Misalignment of goals between departments can lead to discrepancies in budget priorities. To overcome this challenge, organizations must foster a culture of transparency, encourage open communication channels, and establish cross-functional teams. Regular meetings and collaborative platforms help ensure that departmental budgeting efforts are aligned with the overall organizational strategy.

Resistance to Change

Resistance to change within an organization is a common challenge when implementing new budgeting processes or adopting technological solutions. Employees may be accustomed to traditional methods, and introducing new approaches may face resistance. Overcoming this challenge requires robust change management strategies, including comprehensive training programs, stakeholder engagement, and clearly communicated benefits of the proposed changes. Involving employees in the decision-making process can mitigate resistance and promote a smoother transition.

Best Practices in Account Budgeting

Continuous Monitoring and Adjustment

Continuous monitoring and adjustment involve establishing a dynamic budgeting process that doesn't end with the initial plan. Regularly tracking actual performance against the budget, identifying variances, and promptly adjusting the budget based on new information and changing circumstances are fundamental best practices. This ensures that the organization remains agile and can proactively respond to evolving conditions.

Cross-Functional Collaboration

Best practices in account budgeting emphasize the importance of cross-functional collaboration. Breaking down silos between departments promotes a holistic approach to budgeting, ensuring that all aspects of the organization are considered. Cross-functional teams can contribute diverse perspectives, aligning budgetary goals with broader organizational objectives and fostering a collaborative culture.

Scenario Planning

Scenario planning involves creating multiple budget scenarios to anticipate various potential outcomes. Rather than relying on a single static budget, organizations should develop alternative plans based on different market conditions, economic scenarios, or internal changes. This practice enhances strategic flexibility, enabling organizations to adapt quickly to unforeseen events and make informed decisions in dynamic environments.

Employee Training and Engagement

Employee training and engagement are critical components of successful account budgeting. Providing comprehensive training on budgeting processes, tools, and the importance of individual contributions to the overall financial health of the organization enhances employees' understanding and buy-in. Engaging employees in the budgeting process fosters a sense of ownership and accountability, aligning their efforts with organizational financial goals.

Future Trends in Account Budgeting

Artificial Intelligence and Predictive Analytics

The integration of artificial intelligence and predictive analytics into budgeting processes, enabling more accurate forecasting and proactive decision-making.

Real-Time Budgeting

The adoption of real-time budgeting, allowing organizations to adjust budgets dynamically based on current data and market conditions.

Environmental, Social, and Governance (ESG) Integration

The incorporation of ESG factors into budgeting practices, reflecting a growing emphasis on sustainability and responsible business practices.

Conclusion

In conclusion, this Extensive Account Budget Research Document serves as a comprehensive guide for navigating the complex landscape of account budgeting. It has explored the significance of account budgeting in financial planning, decision-making, and its impact on organizational performance.

The document covered various types of budgets, dissected the budgeting process, and highlighted the key components of an account budget. It addressed the critical aspects of budgetary control, variance analysis, and the integration of technology in account budgeting processes.

Challenges in account budgeting were discussed, accompanied by best practices to overcome these challenges. The importance of regulatory compliance and reporting was emphasized, considering the expectations of auditors.

This research document serves not only as a current reference for best practices but also as a forward-looking exploration of the evolving landscape of account budgeting, providing a solid foundation for informed decision-making and innovation in financial management.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Presenting Template.net's Extensive Account Budget Research Template, a customizable and editable solution for in-depth financial insights. Tailor it to your needs effortlessly using our AI Editor Tool. Unleash the power of adaptability, ensuring your account budgeting aligns seamlessly with your organizational goals. Streamline your financial planning with ease!

You may also like

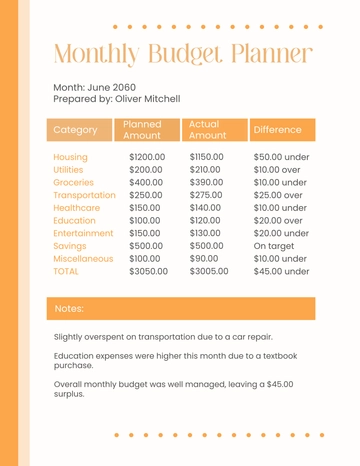

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

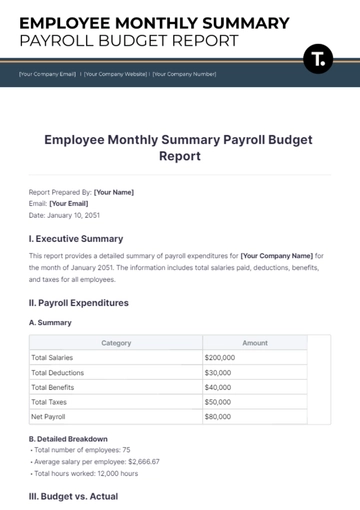

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising