Free Accounting Internal Audit Review

Scope and Objective of the Review

The comprehensive review of [Your Company Name]'s internal audit process is conducted to assess its efficiency, effectiveness, and compliance with both legal regulations and internal controls. This review aims to provide a thorough understanding of the audit practices within the organization and identify areas for improvement.

Methodology

To ensure the accuracy and reliability of the review, a multi-faceted methodology was employed. This included the examination of internal documents, conducting interviews with key employees involved in the audit process, and a detailed analysis of past audit reports. These methods allowed for the collection of recent and relevant data, facilitating an in-depth evaluation.

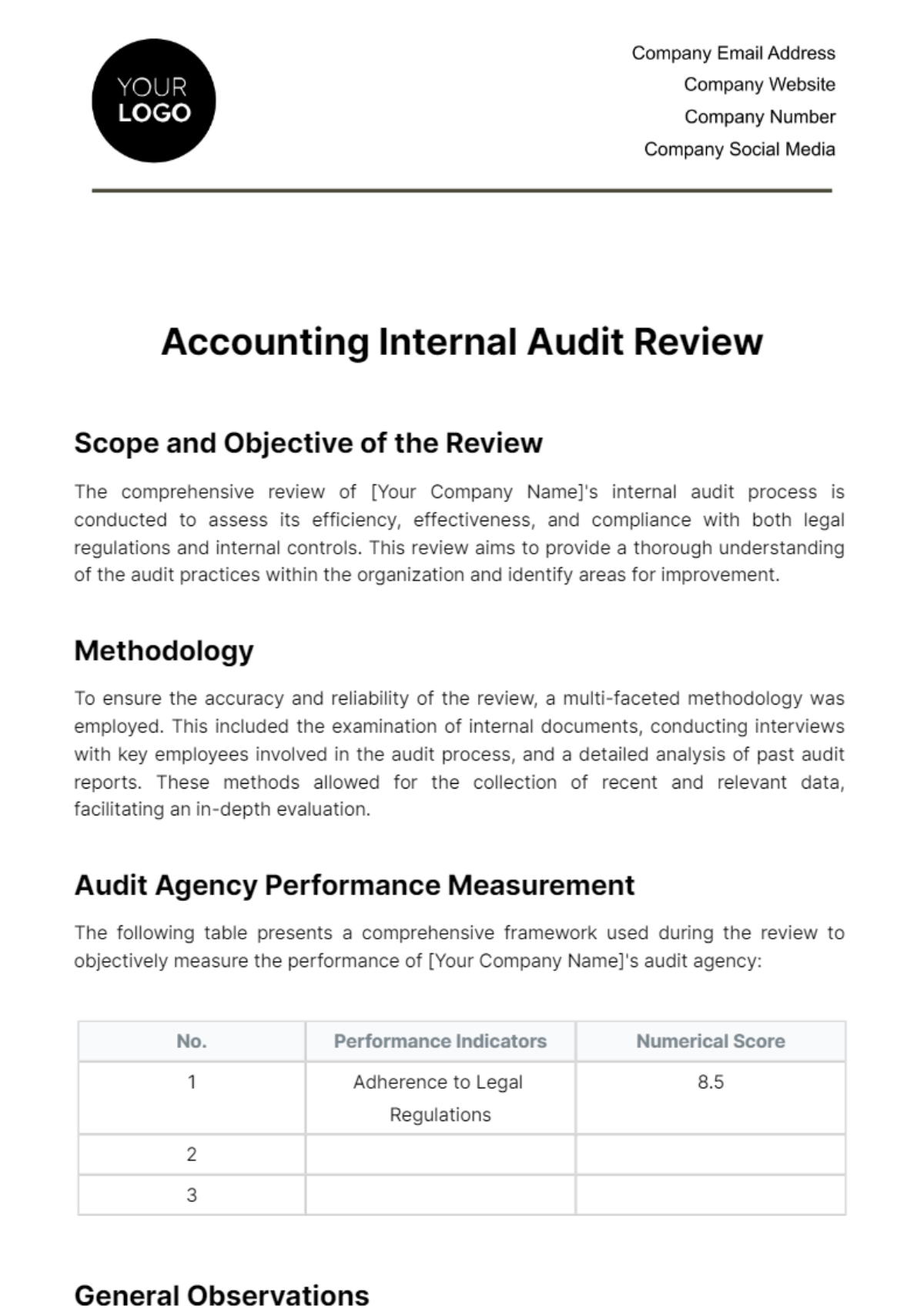

Audit Agency Performance Measurement

The following table presents a comprehensive framework used during the review to objectively measure the performance of [Your Company Name]'s audit agency:

No. | Performance Indicators | Numerical Score |

|---|---|---|

1 | Adherence to Legal Regulations | 8.5 |

2 | ||

3 |

General Observations

The review identified both strengths and areas for improvement within [Your Company Name]'s internal audit process. Notably, the audit agency demonstrates a high level of professionalism and consistency in their approach. However, there are areas where methods could be further streamlined to enhance overall efficiency and effectiveness.

Category | Strengths | Areas for Improvement |

|---|---|---|

Adherence to Legal Regulations | [Your Company Name]'s audit agency consistently adheres to legal regulations and compliance requirements, ensuring that all audits are conducted in accordance with the law. | While compliance is generally strong, there may be opportunities to further enhance awareness of evolving regulations and their implications on audits. |

Final Remarks and Recommendations

In conclusion, [Your Company Name]'s internal audit process demonstrates a commendable commitment to compliance with legal regulations and meets industry standards. The strengths observed in professionalism and consistency are noteworthy. However, to further enhance efficiency and effectiveness in the future, the following recommendations are proposed:

Continuous Monitoring of Legal Regulations: Stay vigilant and proactive in monitoring and implementing changes in legal regulations that may affect audit processes. Regular training and awareness programs can support this effort.

Proactive Risk Identification: Enhance procedures for identifying emerging risks and develop proactive strategies to mitigate them effectively.

Optimize Resource Allocation: Continuously evaluate and optimize resource allocation, incorporating advanced technological tools where feasible to improve audit efficiency.

Accelerate Reporting on High-Priority Issues: Implement expedited reporting procedures for high-priority issues and recommendations to enable faster corrective actions.

Transparent Reporting: Enhance transparency in reporting methodologies and ensure that audit findings are communicated clearly, promoting a deeper understanding among stakeholders.

Structured Employee Development: Develop a structured training and development program that focuses on skill enhancement and knowledge transfer, aligning with long-term organizational goals.

By implementing these recommendations, [Your Company Name] can further elevate its internal audit process, ensuring continued compliance, and achieving higher levels of efficiency and effectiveness in their audit activities.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Template.net offers a cutting-edge Accounting Internal Audit Review Template. Our editable and customizable template, empowered by our AI editor tool, streamlines the audit process. Efficiently evaluate financial data, ensure compliance, and enhance transparency. It's the ideal solution for businesses seeking precision and simplicity in their internal audit procedures. Upgrade your financial oversight with Template.net today.