Free Effective Account Budgeting Case Study

Introduction

Background of [Your Company Name]: Founded in [Year], the company stands as a prominent player in the [sector]. With a global presence and a diverse portfolio of innovative products, The company has consistently been at the forefront of technological advancements.

Industry Context: Operating in a dynamic industry, the company faces challenges inherent to rapid technological evolution and market volatility. The traditional budgeting practices in place struggled to keep pace with the industry's fast-paced changes, resulting in the need for a more adaptive and strategic approach to financial management.

Financial Management Challenges: Despite its success, the company encountered difficulties in accurately forecasting budgets and efficiently allocating financial resources. The lack of flexibility in the existing budgeting process posed challenges in responding to market shifts, necessitating a comprehensive overhaul of their financial management strategies.

Initial Budgeting Process

Historical Approach: [Your Company Name] historically relied on an annual budgeting process driven by past financial data and trends. While this method provided a baseline, it proved insufficient in addressing the increasingly dynamic nature of the technology industry.

Inflexibility and Challenges: The rigidity of the initial budgeting process became evident in the face of unforeseen market shifts and emerging opportunities. Fixed budget allocations struggled to accommodate the fluidity required for innovation and strategic investments, leading to frequent variances and suboptimal financial performance.

Need for Adaptability: Recognizing the shortcomings of the traditional approach, the company initiated a transformative journey to optimize its account budgeting. This case study delves into the specific challenges faced, the strategies implemented, and the outcomes achieved through a more adaptive and collaborative budgeting model.

Identification of Issues

Detailed Analysis of Budget Variances: Conducted an in-depth examination of budget variances to pinpoint specific areas where actual performance deviated from the planned budget. This involved scrutinizing line items, identifying patterns, and assessing the magnitude of discrepancies.

Contribution Analysis: Employed contribution analysis to understand the impact of each department or cost center on overall budget deviations. This analysis unveiled that marketing and research and development (R&D) were major contributors to the budget overruns, prompting a deeper investigation into these areas.

Root Cause Analysis: Applied root cause analysis methodologies to identify the underlying factors contributing to budget discrepancies. Uncovered issues such as underestimated project costs, unexpected market fluctuations, and inefficient resource allocation within certain departments.

Stakeholder Collaboration

Cross-Functional Workshops: Facilitated cross-functional workshops involving representatives from finance, marketing, and operations. These collaborative sessions fostered open communication, enabling stakeholders to share insights, challenges, and perspectives on budgeting.

Brainstorming and Idea Generation: Encouraged brainstorming sessions to generate innovative ideas for improving the budgeting process. Leveraged the collective intelligence of the team to identify potential solutions and address specific challenges faced by each department.

Goal Alignment: Ensured that the budgeting team's objectives were aligned with the broader organizational goals. This alignment helped create a sense of shared responsibility among stakeholders, enhancing their commitment to the budgeting process and its outcomes.

Training Initiatives: Recognizing the importance of a well-informed team, implemented training initiatives to enhance the financial literacy of stakeholders. This not only improved their understanding of budgeting processes but also empowered them to actively contribute to more accurate forecasting.

Establishment of Feedback Mechanisms: Instituted regular feedback mechanisms to gather input from stakeholders throughout the budgeting cycle. This iterative approach allowed for continuous improvement and adjustments based on real-time insights from those directly involved in day-to-day operations.

Increased Transparency: Emphasized the importance of transparency in sharing budgetary information and financial goals. The open exchange of information helped build trust among stakeholders, fostering a collaborative culture essential for effective budgeting.

Empowerment of Department Heads: Empowered department heads by involving them in decision-making processes related to budget allocation. This not only increased their ownership of the budget but also facilitated more accurate forecasting based on their departmental expertise.

Technology Integration

Software Selection Process: [Your Company Name] conducted a thorough evaluation of budgeting and financial management software options available in the market. The selection process involved assessing features, scalability, user-friendliness, and compatibility with existing systems to ensure seamless integration.

Automation of Data Processes: The company also implemented automation for data collection, analysis, and reporting. This streamlined previously manual processes, reducing the likelihood of errors and saving significant time during the budget preparation phase. Automation also allowed for real-time updates and adjustments.

Integration with Existing Systems: We ensured seamless integration of the selected software with existing organizational systems, such as enterprise resource planning (ERP) and accounting systems. This integration facilitated a more holistic view of financial data, enhancing the accuracy of budget forecasts.

User Training and Onboarding: We conducted comprehensive training programs to familiarize finance teams with the new software. This included hands-on sessions, user manuals, and ongoing support to ensure a smooth transition and optimal utilization of the technology.

Data-Driven Decision Making

Historical Data Analysis: [Your Company Name] utilized historical financial data to identify trends and patterns. This analysis provided valuable insights into past performance, enabling more accurate forecasting and budget allocation based on actual historical trends.

Real-Time Data Integration: The company also integrated real-time data sources to facilitate data-driven decision-making. This allowed the finance team to respond promptly to changing market conditions, ensuring that budget adjustments were based on the most up-to-date information.

Scenario Planning: We implemented scenario planning techniques to anticipate various market conditions and their potential impact on the budget. By creating multiple scenarios, the organization was better prepared to adapt to unforeseen challenges and make informed decisions in dynamic environments.

Data Literacy Training: Recognizing the importance of data literacy, the company conducted training sessions for finance teams to enhance their understanding of data analysis and interpretation. This empowered team members to confidently use data in decision-making processes.

Key Performance Indicators (KPIs): Established and monitored key performance indicators relevant to budgetary goals. This allowed for ongoing assessment of performance against predefined benchmarks, enabling the organization to proactively address deviations from budgeted targets.

Continuous Improvement: Fostered a culture of continuous improvement by regularly reviewing and refining data-driven processes. This involved gathering feedback from stakeholders, analyzing the effectiveness of data-driven strategies, and making iterative adjustments to enhance overall financial decision-making.

Data-Driven Decision Making

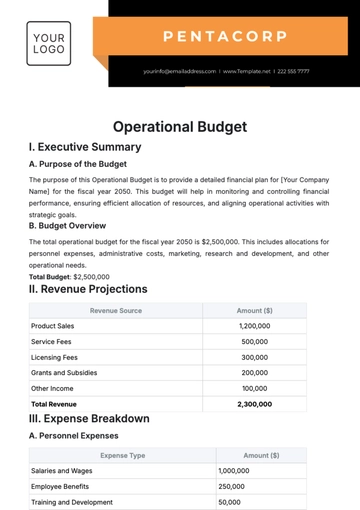

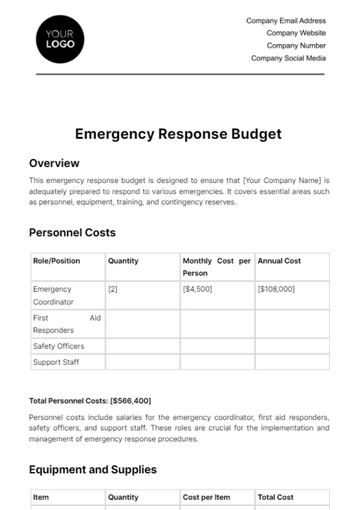

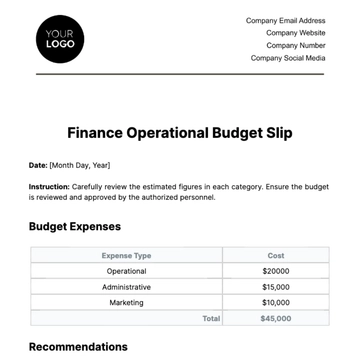

Aspect | Description |

|---|---|

Utilization of Historical Data | Leveraged five years of historical financial data to identify patterns and trends. |

Market Trends Integration | Incorporated market trends analysis to anticipate shifts in demand and pricing. |

Real-Time Data Integration | Integrated real-time financial data feeds for immediate decision-making insights. |

Employee Training and Development | Conducted quarterly training sessions to enhance data literacy among finance teams. |

Continuous Improvement | Established a feedback loop for continuous improvement based on data-driven insights. |

Flexible Budgeting Model

Aspect | Description |

|---|---|

Adoption of a Flexible Model | Adopted a rolling budget model allowing for adjustments based on quarterly performance. |

Scenario Planning | Implemented scenario planning for various market conditions, ensuring adaptability. |

Dynamic Adjustment Capability | Provided departments with the ability to dynamically adjust budget allocations as needed. |

Agility in Response to Challenges | Enhanced agility to respond quickly to unforeseen challenges and changing business dynamics. |

Continuous Monitoring and Analysis

At [Your Company Name], the journey towards optimizing account budgeting wasn't a one-time fix but a continuous process of vigilance and improvement. We recognized that implementing a comprehensive monitoring system was essential to keep our financial performance on track. Leveraging advanced analytics tools, we instituted a robust continuous monitoring framework that provided us with real-time insights into our budget performance.

Every week and month, our team gathered around real-time dashboards, analyzing the latest data to gauge our progress against budgetary targets. We didn't just stop at surface-level observations; we delved deep into the numbers, conducting thorough root cause analyses for any significant variances. This proactive approach allowed us to identify emerging issues promptly and take corrective actions before they escalated.

To ensure accountability and foster a sense of ownership, we established clear key performance indicators (KPIs) and proactive alerts to flag deviations from our budget forecasts. These alerts served as early warning signals, prompting us to investigate further and address any underlying issues swiftly.

Our monitoring efforts weren't just about reacting to problems; they were also about learning and improving. We encouraged all team members to actively participate in monitoring activities, soliciting their insights and feedback. By incorporating their perspectives, we were able to iterate and refine our budget forecasts, making them more accurate and reliable over time.

Improved Communication

Effective communication was at the heart of our efforts to optimize account budgeting at the company. We recognized that breaking down silos and fostering collaboration between departments was crucial for success. To achieve this, we implemented a series of initiatives aimed at enhancing communication channels and promoting transparency.

Regular cross-functional meetings became a cornerstone of our communication strategy, providing a forum for different departments to come together and align on budgetary goals. These meetings weren't just about sharing information; they were about fostering open dialogues and building a shared understanding of our financial objectives.

In addition to face-to-face interactions, we also invested in technology to facilitate communication. We introduced a centralized platform where stakeholders could access budgetary information in real-time, enabling greater transparency and accountability. This platform served as a hub for sharing updates, insights, and feedback, ensuring that everyone was on the same page.

Furthermore, we recognized the importance of equipping our teams with the necessary communication skills to effectively convey budget-related information. Through workshops and training sessions, we empowered our finance and non-finance teams alike to communicate with clarity and confidence.

Overall, our focus on improving communication not only enhanced collaboration within the organization but also strengthened our alignment with the overarching organizational strategy. By fostering a culture of openness and transparency, we laid the foundation for sustained success in optimizing our account budgeting processes.

Results and Impact

With effective account budgeting, the company:

Achieved a [x]% reduction in budget variances within the first fiscal year, resulting in more accurate financial forecasting and resource allocation.

Improved overall financial performance with a [x]% increase in net profit, attributed to better control over expenses and optimized revenue generation strategies.

Enhanced shareholder confidence and credibility in the financial management, leading to increased investor trust and potential for future growth opportunities.

Streamlined budgeting processes contributed to a more efficient use of resources, enabling the organization to invest in strategic initiatives and innovation projects.

Reduced financial risks associated with budget overruns, providing greater stability and resilience in a volatile market environment.

Lessons Learned

Additionally, throughout this case study, the company:

Emphasized the importance of adaptability and flexibility in budgeting strategies, as demonstrated by the success of the flexible budgeting model in responding to changing market conditions.

Acknowledged the value of continuous improvement and learning, underscoring the need for ongoing evaluation and refinement of budgeting processes to remain agile and competitive.

Recognized the importance of fostering a culture of innovation and collaboration, where employees are empowered to contribute ideas and solutions to improve financial management practices.

Highlighted the significance of leveraging technology as an enabler of efficiency and accuracy in budgeting processes, emphasizing the need for ongoing investment in digital tools and platforms.

Emphasized the role of effective communication and stakeholder engagement in driving successful budgeting outcomes, underscoring the importance of transparency and collaboration across departments.

Conclusion

The journey of transforming [Your Company Name]'s budgeting process serves as a testament to the organization's commitment to excellence and adaptability. What began as a recognition of challenges in traditional budgeting quickly evolved into a collaborative effort to innovate and improve financial management practices.

Through the concerted efforts of a cross-functional team and the integration of cutting-edge technology, the company overcame obstacles and embraced a more dynamic approach to budgeting. By harnessing the power of data-driven decision-making and fostering a culture of continuous monitoring and analysis, the organization achieved remarkable results.

The tangible impact of these efforts is evident in the significant reduction of budget variances and the marked improvement in overall financial performance. Shareholder confidence has been bolstered, and the company stands as a beacon of success in the competitive landscape of the software development industry.

As we reflect on this transformative journey, it is clear that the lessons learned are invaluable. The importance of adaptability, collaboration, and ongoing innovation cannot be overstated. Looking to the future, the company is poised to build upon its successes, embracing emerging technologies and best practices to maintain its position as a leader in financial management.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Unlock financial success with Template.net's Effective Account Budgeting Case Study Template. Customizable and editable, it empowers you to tailor your analysis to your organization's needs. Editable in our online AI Editor Tool, this template streamlines your budgeting process, offering flexibility and efficiency in optimizing financial strategies. Start now!

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising