Free Advertising Cash Management Protocol for Campaigns

I. Introduction

A. Purpose

The purpose of this Advertising Cash Management Protocol is to establish a comprehensive set of guidelines and procedures for managing the financial aspects of our advertising campaigns. This protocol is designed to ensure that every dollar allocated to advertising is spent judiciously, effectively, and in alignment with our strategic objectives.

B. Scope

This protocol covers all aspects of cash management for advertising campaigns, including budget allocation and approval, cash flow planning, expenditure tracking and control, payment procedures, and post-campaign financial analysis. It applies to all advertising campaigns conducted across various media channels, including digital, print, television, and radio.

C. Importance of Cash Management in Advertising

Effective cash management in advertising is crucial for maintaining financial stability and ensuring the success of our campaigns. By carefully managing our advertising budgets, we can maximize the impact of our campaigns, avoid overspending, and achieve a better return on investment. This discipline allows us to allocate resources more efficiently and adapt to changing market conditions or campaign needs swiftly.

II. Budget Allocation and Approval

A. Procedures

Setting and approving budgets for advertising campaigns involve a structured process to ensure alignment with our strategic goals and financial constraints:

Develop Preliminary Budgets: Begin with a draft budget based on campaign objectives, target audience, and expected outcomes.

Review and Adjust: Conduct a thorough review of preliminary budgets with key stakeholders to adjust allocations as necessary.

Obtain Approval: Submit final budget proposals to the designated approval authority within our organization.

Document and Communicate: Once approved, formally document the budgets and communicate allocations to relevant teams and departments.

Monitor and Update: Regularly monitor spending against the budget, allowing for adjustments in response to campaign performance or market changes.

B. Roles and Responsibilities

Effective budget management requires clear roles and responsibilities:

Role | Responsibilities |

Advertising Manager | Draft initial budget, oversee campaign planning and execution. |

Finance Department | Review budget proposals, provide financial oversight and guidance. |

Executive Leadership | Approve final budgets, ensure strategic alignment. |

Campaign Teams | Implement campaigns within budget, report on expenditure. |

C. Criteria for Adjustments

Adjustments to advertising budgets may be necessary to respond to various internal and external factors:

Shift funds based on campaign performance metrics and KPIs.

Adapt to changes in the market that impact cost or audience reach.

Reallocate budgets in response to changes in strategic direction or priorities.

Allow for the exploitation of unforeseen advertising opportunities.

Address and rectify any potential overspending in specific campaigns.

III. Cash Flow Planning

A. Forecasting Cash Requirements

Accurate forecasting of cash requirements is essential for ensuring that sufficient funds are available throughout the various stages of advertising campaigns. Forecasting helps in identifying the financial needs at each phase, from initial concept development to post-campaign analysis.

Campaign Stage | Cash Requirement |

Concept Development | $50,000 |

Creative Production | $200,000 |

Media Buying | $1,000,000 |

Campaign Execution | $500,000 |

Post-Campaign Analysis | $50,000 |

B. Scheduling of Expenditures

Efficient scheduling of expenditures ensures that payments are made timely and that cash flow is maintained throughout the campaign lifecycle:

Schedule payments close to revenue inflows to maintain a positive cash flow.

Ensure immediate payment for time-sensitive expenses to avoid delays.

Where possible, negotiate staggered payments to spread out cash outflows.

Regularly review and optimize payment terms with vendors.

C. Tools and Techniques

Effective cash flow management utilizes various tools and techniques to forecast, track, and analyze cash flows:

Tool | Best For |

Cash Flow Projections | Forecasting future cash requirements. |

Budgeting Software | Tracking expenditures against the budget. |

Financial Dashboards | Real-time monitoring of financial metrics. |

Scenario Analysis | Assessing impacts of different campaign strategies. |

IV. Expenditure Tracking and Control

A. Systems for Tracking

Our organization employs a comprehensive expenditure tracking system that integrates with our financial software. This system allows for real-time monitoring of campaign costs, ensuring that all expenditures are recorded and categorized accurately against the relevant campaign budgets.

B. Authorization Procedures

Effective control over advertising expenditures includes a clear authorization process:

Team members must submit detailed requests for expenditures.

The finance department reviews requests for compliance.

Expenditures exceeding thresholds require approval from management.

All approvals are documented and stored for auditing purposes.

C. Preventing Overspending

Preventing overspending is critical for maintaining financial discipline and ensuring the success of advertising campaigns:

Establish clear budget limits for each campaign and category.

Regularly review expenditure reports to address overspending in real-time.

Strictly enforce expenditure authorization procedures to control costs.

Periodically audit campaign expenditures to ensure adherence to budget.

V. Payment Procedures

A. Processing Payments

Efficient processing of payments to vendors and media partners is crucial to maintain good relationships and ensure the smooth execution of advertising campaigns:

Ensure all received invoices are reviewed for accuracy.

Obtain necessary approvals based on the authorization procedures.

Align payment schedules with cash flow planning.

Process payments through our financial system.

Confirm the receipt of payment with vendors and partners.

B. Timelines for Payment Cycles

Maintaining consistent payment cycles helps in managing cash flow effectively and ensures timely campaign execution:

Payment Type | Standard Timeline |

Vendor Payments | 30 days from invoice |

Media Buying | 45 days from booking |

Miscellaneous Expenses | As incurred, or within 15 days of expense |

C. Verification Processes

Verification of invoices and receipts is a critical step in maintaining the integrity of our financial operations:

Match invoices to purchase orders and campaign budgets.

Confirm that services or products were received prior to payment.

Maintain a clear audit trail of all payment documentation.

Quickly address any discrepancies or disputes with vendors.

VI. Monitoring and Reporting

A. Regular Reporting

Regular reporting on advertising expenditures and campaign performance is conducted monthly, providing stakeholders with up-to-date information on financial status, enabling timely decisions.

B. KPIs

Key Performance Indicators (KPIs) are essential for measuring the effectiveness of our advertising cash management against our goals:

KPI | Target Value |

Budget Variance | < 5% |

ROI | > 150% |

Payment Timeliness | 100% on-time |

Invoice Discrepancies | < 2% of transactions |

C. Addressing Discrepancies

Proactive measures are essential for addressing any financial discrepancies in advertising campaigns:

Immediately investigate the root causes of any discrepancies or variances.

Make adjustments to rectify any identified errors in transactions or records.

Inform relevant stakeholders of discrepancy and corrective actions taken.

Strengthen financial controls to prevent future occurrences.

VII. Training and Support

Ensuring that all team members involved in managing advertising cash are well-trained and supported is critical to the effective implementation of this protocol. Training programs are designed to enhance understanding, ensure compliance with processes, and foster best practices in financial management.

Program | Duration | Frequency |

Financial Management Basics | 2 days | Annually |

Advertising Budgeting | 1 day | Bi-annually |

Cash Flow Management Tools | Half-day | At least once a year |

Expenditure Tracking Systems | Half-day | Quarterly |

Regulatory Compliance | 1 day | Annually |

VIII. Revision and Update

This Advertising Cash Management Protocol will be reviewed and updated annually to ensure it remains relevant and effective in guiding our advertising financial practices. The review process will consider changes in regulatory requirements, advertising strategies, financial management technologies, and feedback from stakeholders. Any significant changes in our advertising operations or financial environment will trigger an immediate review to make necessary updates, ensuring our protocol always aligns with best practices and our organizational needs.

IX. Conclusion

The Advertising Cash Management Protocol is a foundational component of our commitment to fiscal responsibility and the effective management of our advertising resources. By adhering to this protocol, we ensure that our advertising campaigns are not only creative and impactful but also financially sustainable and aligned with our broader strategic objectives. Implementing these guidelines will enable us to maximize the return on our advertising investments, maintain financial integrity, and support the continued growth and success of our campaigns. Through ongoing training, regular reviews, and updates to this protocol, we are dedicated to maintaining the highest standards of advertising cash management.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your advertising campaign's financial operations with the Advertising Cash Management Protocol for Campaigns Template from Template.net. Designed to be both editable and customizable, this template, accessible in our AI Editor tool, lays out a clear, structured approach to managing cash flow, ensuring efficient and responsible handling of your advertising budget to maximize campaign effectiveness.

You may also like

- Marketing Google Slide

- Marketing Letter

- Marketing Quotation

- Marketing Report

- Marketing Strategic Plan

- Marketing Plan

- Marketing Proposal

- Marketing Flyer

- Marketing Presentation

- Real Estate Marketing Plan

- Marketing Contract

- Marketing Agreement

- Marketing Resume

- Marketing Checklist

- Marketing Brochure

- Marketing Banner

- Marketing Schedule

- Marketing Vector

- Marketing Logo

- Marketing Chart

- Marketing Campaign Plan

- Marketing Budget

- Marketing Postcard

- Marketing Poster

- Marketing Facebook Post

- Marketing Instagram Post

- Marketing Newsletter

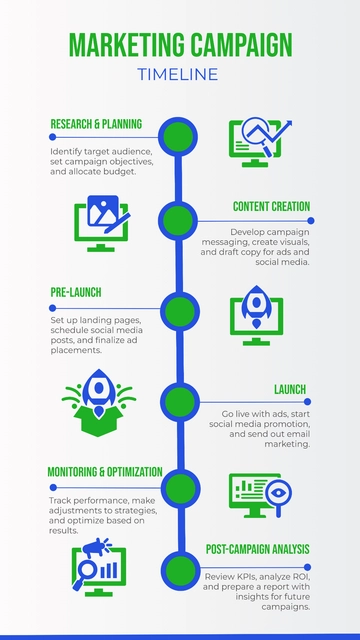

- Marketing Infographic