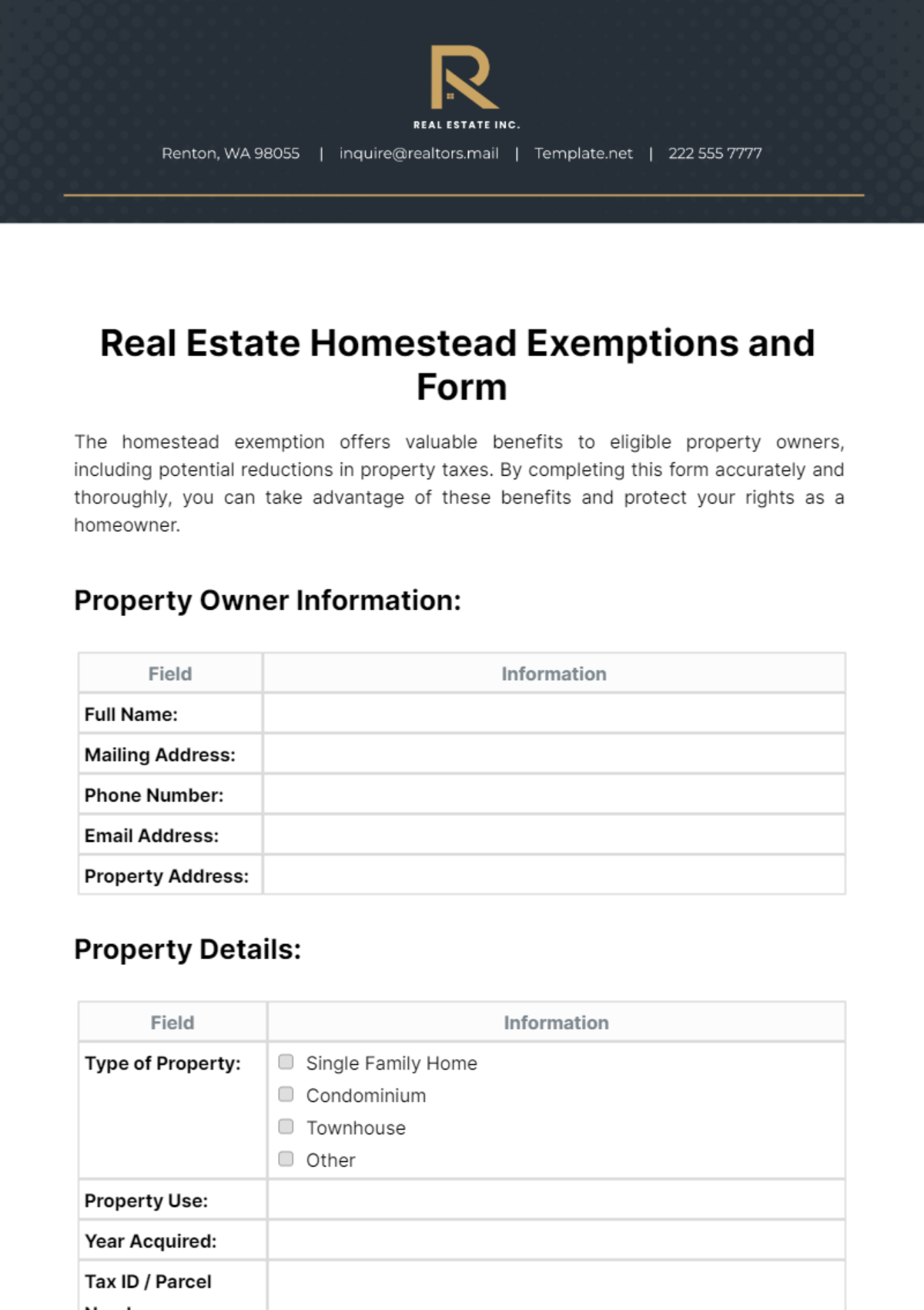

Free Real Estate Homestead Exemptions and Form

The homestead exemption offers valuable benefits to eligible property owners, including potential reductions in property taxes. By completing this form accurately and thoroughly, you can take advantage of these benefits and protect your rights as a homeowner.

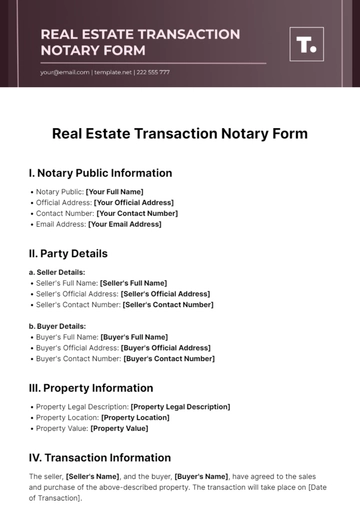

Property Owner Information:

Field | Information |

|---|---|

Full Name: | |

Mailing Address: | |

Phone Number: | |

Email Address: | |

Property Address: |

Property Details:

Field | Information |

|---|---|

Type of Property: |

|

Property Use: | |

Year Acquired: | |

Tax ID / Parcel Number: |

Homestead Exemption Information:

Field | Information |

|---|---|

Currently Receiving Exemption? |

|

Other Properties with Exemption? |

|

Co-owners of Property? |

|

Additional Exemptions Eligible? |

|

Co-owner Information (if applicable):

Field | Information |

|---|---|

Co-owner's Full Name: | |

Co-owner's Mailing Address: | |

Co-owner's Phone Number: | |

Co-owner's Email Address: |

Declaration:

I hereby declare that the information provided above is true and accurate to the best of my knowledge. I understand that providing false information may result in penalties.

Signature:

Date:

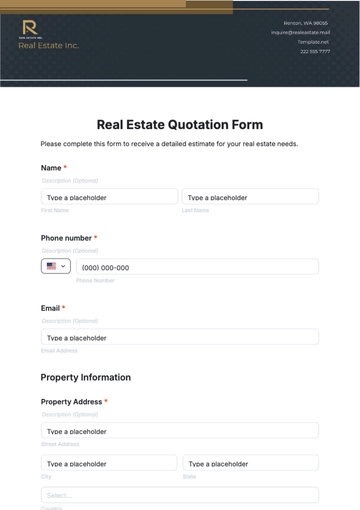

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Ensure eligibility for homestead exemptions with the Real Estate Homestead Exemptions and Form Template from Template.net. This editable and customizable form simplifies the application process, allowing homeowners to claim tax benefits. Tailor it effortlessly using our Ai Editor Tool for personalized submissions. Simplify tax filings and maximize savings with this essential template.