Free Payroll Summary Report

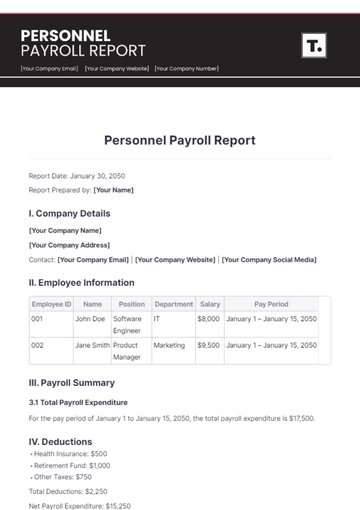

Prepared by: [Your Name]

Date: October 29, 2050

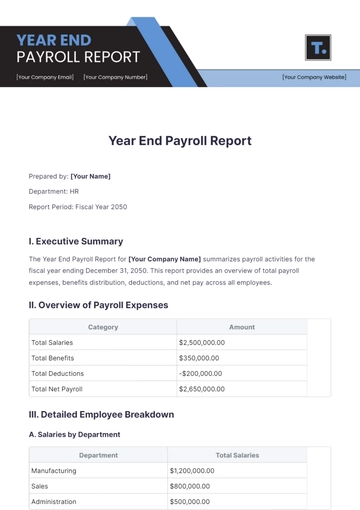

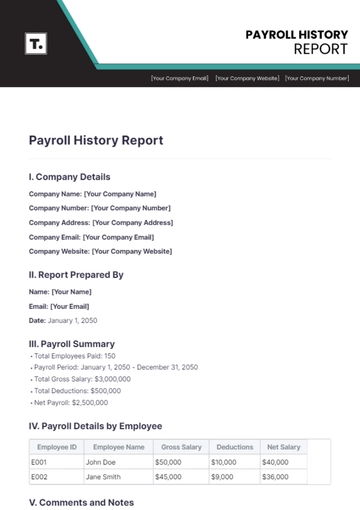

I. Executive Summary

This Payroll Summary Report provides an overview of the payroll expenses for [Your Company Name] for the month of October 2050. It outlines the total wages, benefits, deductions, and net pay distributed to employees. This report is essential for understanding the company’s financial obligations regarding employee compensation.

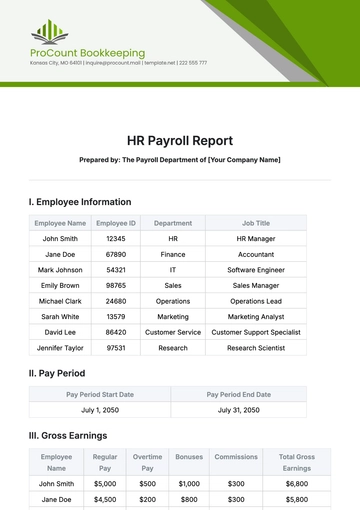

II. Payroll Overview

Total Payroll Costs

The following table summarizes the total payroll costs incurred by [Your Company Name] in October 2050.

Category | Amount ($) |

|---|---|

Gross Wages | 120,000 |

Employer Taxes | 15,000 |

Employee Benefits | 10,000 |

Total Payroll Cost | 145,000 |

Employee Distribution

A breakdown of employees by department and their corresponding salaries is provided below.

Department | Number of Employees | Total Salaries ($) |

|---|---|---|

Sales | 10 | 60,000 |

Marketing | 5 | 30,000 |

IT | 7 | 35,000 |

HR | 3 | 15,000 |

Total | 25 | 140,000 |

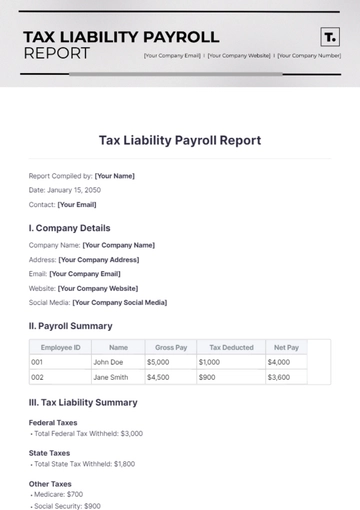

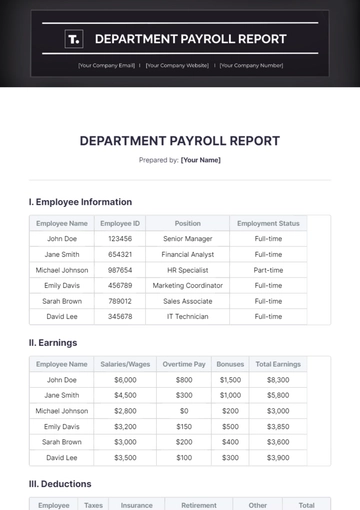

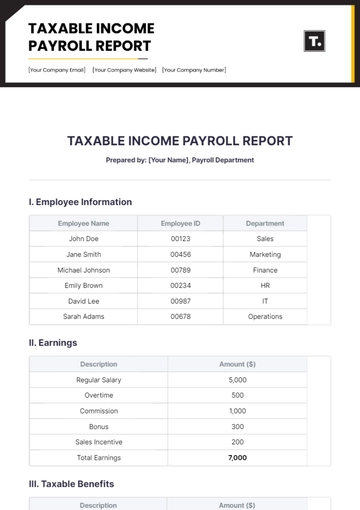

III. Deductions and Benefits

Employee Deductions

Employee deductions for October 2050 are detailed below:

Deduction Type | Amount ($) |

|---|---|

Federal Tax | 25,000 |

State Tax | 5,000 |

Health Insurance | 5,000 |

Retirement Savings | 5,000 |

Total Deductions | 40,000 |

Employee Benefits

Benefits offered to employees and their costs for October 2050 include:

Benefit Type | Cost ($) |

|---|---|

Health Insurance | 10,000 |

Retirement Plans | 8,000 |

Paid Time Off | 7,000 |

Total Benefits | 25,000 |

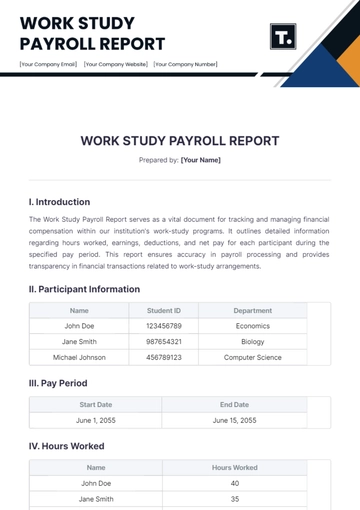

IV. Net Pay Calculation

The net pay calculation for employees for the month of October 2050 is summarized below:

Category | Amount ($) |

|---|---|

Gross Wages | 120,000 |

Total Deductions | 40,000 |

Net Pay | 80,000 |

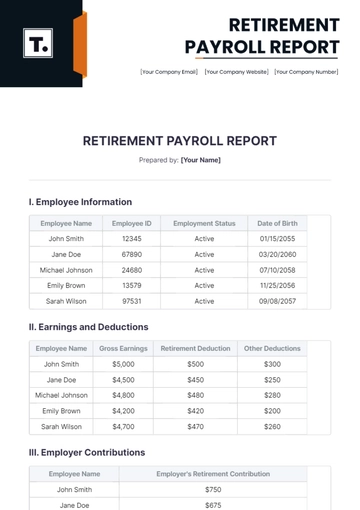

V. Conclusion

In conclusion, [Your Company Name] has successfully managed its payroll for the month of October 2050. The total payroll costs amounted to $145,000, with $80,000 distributed as net pay to employees after deductions. This report serves as a crucial tool for financial planning and ensures compliance with labor regulations.

For any inquiries regarding this report or payroll processes, please contact [Your Name] at [Your Email]. We encourage you to reach out for assistance or further clarification. For additional information about our company, you may also email [Your Company Email].

This Payroll Summary Report is designed to provide a comprehensive view of payroll operations and should be referenced for all payroll-related decisions moving forward.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the ultimate tool for streamlining your payroll process: the Payroll Summary Report Template from Template.net. This editable and customizable template is designed to meet your unique business needs. With seamless integration into our Ai Editor Tool, effortlessly manage payroll data with precision and efficiency like never before.

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report