Free Law Firm Board Resolution Approving Declaration of Dividend & Loan

Company Name: [Your Company Name]

Date: [Date]

Resolution Number: [Resolution Number]

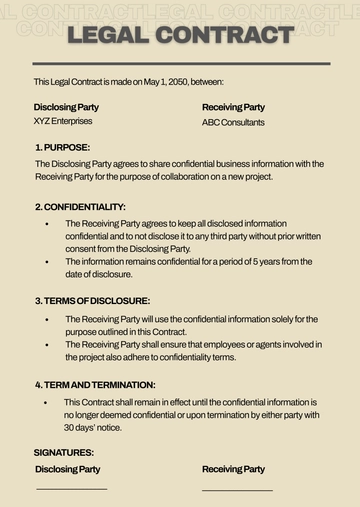

This Board Resolution is hereby enacted by the Board of Directors of [Your Company Name] (the "Board"). This resolution is intended to address and formalize the declaration of a dividend and the approval of a structured loan, reflecting the Board's commitment to enhancing shareholder value and supporting the firm's strategic growth initiatives.

WHEREAS, the firm has demonstrated sustained profitability and robust cash flow levels, enabling the responsible distribution of profits back to its shareholders;

WHEREAS, to support operational expansion and seize external growth opportunities, the firm considers it strategic to provide structured loans;

WHEREAS, it is imperative that these financial distributions are made in a manner that aligns with the firm's long-term growth strategy and rigorous fiscal policies;

WHEREAS, the Board has meticulously reviewed and confirmed compliance with all pertinent legal and financial regulations concerning the declaration of dividends and the approval of loans;

BE IT RESOLVED, that the Board of Directors of [Your Company Name] hereby approves the following:

Declaration of Dividend:

The Board approves the declaration of a dividend of [$ Amount] per share on the outstanding shares of the firm’s common stock.

The dividend shall be payable on [Payment Date] to shareholders of record as at [Record Date].

This dividend declaration is a testament to the firm's financial health and a commitment to delivering shareholder value.

Approval of Structured Loans:

Amount: [$Amount] to fund strategic growth initiatives and operational enhancements.

Interest Rate: [%Rate], competitively set to balance cost with market conditions.

Repayment Terms: The repayment terms for the approved loans are meticulously structured to ensure they are sustainable and aligned with the cash flow projections and overall financial planning of the firm. These terms typically include:

Initial Grace Period: Allowing a grace period of [number of months/years] before starting the repayment to provide the firm with flexibility to manage its cash flow without immediate repayment pressures.

Repayment Schedule: Regular payments are scheduled on a [monthly/quarterly/annual] basis, designed to correlate with the firm’s revenue cycles to avoid cash crunches.

Term Length: The loan is to be fully repaid over a period of [number of years], considering the projected cash inflows and financial commitments.

Early Repayment Options: Provision for early repayment without penalty to allow the firm flexibility in managing debt as financial conditions improve.

Collateral Required: To secure the loan, the firm will pledge assets that match or exceed the value of the loan amount, ensuring security and compliance with lending standards. Examples of such collateral include:

Real Estate: Office buildings or other commercial properties owned by the firm.

Equipment: Specialized equipment or machinery that is vital to the firm’s operations.

Intellectual Property: Patents or other intellectual property that hold significant value.

Receivables: Assigning a portion of the firm’s accounts receivable as collateral, based on the creditworthiness of the customers and the expected cash flow from these receivables.

Purpose: The strategic intent behind securing the loan includes detailed planning and targeted allocation of funds to support specific initiatives and growth opportunities. The purpose of the loan is described as follows:

Expansion Initiatives: Funding the expansion of operational facilities or opening new offices in strategic locations.

Technology Upgrades: Investing in advanced technology systems to enhance productivity, data security, and client service capabilities.

Mergers and Acquisitions: Providing capital for potential mergers or acquisitions that align with the firm’s strategic goals and expand its market presence.

Research and Development: Allocating funds towards research and development activities aimed at innovating new legal services or improving existing offerings.

Authorization to Implement:

The Chief Financial Officer (CFO) of [Your Company Name] is hereby authorized to implement these declarations and to ensure that all subsequent actions strictly adhere to the stipulations of this resolution.

Reporting and Oversight:

The CFO is required to report back to the Board in a timely manner on the execution and any significant developments concerning this resolution.

BE IT FINALLY RESOLVED, that this resolution shall take immediate effect upon its passage. The Secretary of the Board is directed to certify and preserve this resolution as part of the official records of the Board meetings.

Approved and Adopted by the Board of Directors of [Your Company Name] on this day [Date of Approval].

[Your Name]

Title: [Title]

[Your Company Name]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Ensure seamless board resolutions in your law firm with Template.net's editable and customizable Law Firm Board Resolution Approving Declaration of Dividend & Loan Template. Easily editable in our AI Editor Tool, our template aids in crafting professional documents, streamlining your firm's decision-making process. Experience efficiency and precision as you foster your firm's growth. Turn to Template.net, your trusted partner in cogent and professional document crafting.