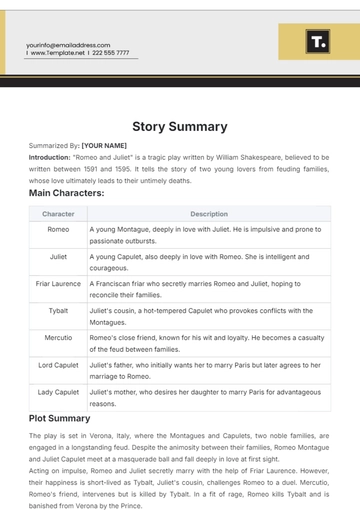

Free User Story For Transferring Money

I. Overview/Introduction

The transfer money feature aims to provide users on the [YOUR COMPANY NAME] digital banking platform with a seamless way to move funds between their accounts.

This specific User Story focuses on the process required for a user to transfer money from their checking account to their savings account, enhancing their ability to save for personal goals such as a vacation.

This feature targets users like [YOUR NAME], a dedicated professional looking for quick and accessible financial operations. Ensuring ease of use, security, and reliability in this feature will improve user satisfaction and foster financial planning amongst platform users.

II. User Persona/User Role

Persona Name: Mary Smith

Age: 30

Occupation: [your occupation]

Financial Goal: Wants to transfer $500 from his checking account to his savings account for saving towards a vacation.

Preference: Uses the digital banking app due to its convenience and quick accessibility.

Mary's scenario illustrates the typical user behavior targeted by the [YOUR COMPANY NAME] digital banking platform, helping shape the design approach to cater specifically to busy professionals who value efficiency and security in their banking transactions.

III. User Story/User Statement

User Story: As a user, I want to transfer $500 from my checking account to my savings account so that I can start saving for my vacation.

This user story indicates a clear action and goal, providing a focused scope for developing the required functionalities in the money transfer feature. Understanding the user’s intent helps in designing a user-centered product that efficiently solves the user’s needs.

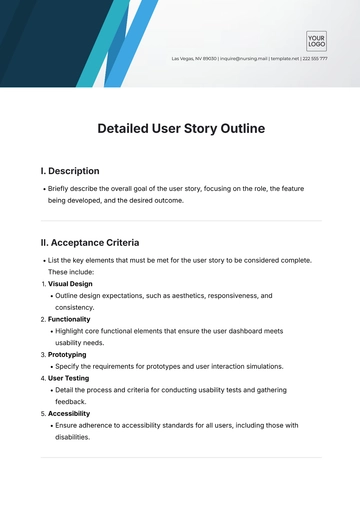

IV. Acceptance Criteria/Requirements

Initiate Transfer:

The user should easily navigate to the "Transfer Money" section of the digital banking platform.

"Transfer Funds" should display the user's checking account as the default source account.

Allow selection of the savings account as the transfer destination.

Enable entry of the amount with a pre-set suggestion of $500.

Validation:

Ensure the account balance of the checking account covers the transfer amount.

Confirm the validity of the destination savings account before processing the transfer.

Confirmation:

Show a detailed confirmation screen with transfer amount, source, destination, and fees.

Provide options to either confirm the transfer or cancel.

Transaction History:

Record the transfer in transaction history upon successful completion.

Display all relevant transfer details in the transaction history for user reference.

Error Handling:

Display an error message for insufficient funds and suggest adding funds or reducing the amount.

Present an appropriate error message for any other transfer errors, with guidance for resolution.

Security:

Ensure all data transferred during the process is fully encrypted.

Require user authentication at the start of the transfer process.

Each acceptance criterion focuses on particular aspects of the user interaction with the money transfer feature, specifying the necessary conditions for successful implementation and operation of this feature. By fulfilling these criteria, the digital banking platform ensures a secure, reliable, and user-friendly experience that aligns with [YOUR NAME]'s expectations and needs.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the ultimate solution for seamless money transfer scenarios with the User Story for Transferring Money Template from Template.net. Crafted with precision, this editable and customizable gem empowers you to tailor your narratives effortlessly. Harness the power of the AI Editable Tool to streamline your process, ensuring clarity and efficiency in every transaction story you tell.