Free Liquidity Statement

Prepared by: [YOUR NAME]

Company: [YOUR COMPANY NAME]

I. Executive Summary

This Liquidity Statement provides a comprehensive overview of the financial health of [YOUR COMPANY NAME] concerning its ability to meet short-term liabilities. The insights derived from this analysis are vital for investors and creditors to assess the risk associated with financial support.

II. Current Financial Position

Analyzed on [DATE], this section details the current assets and liabilities of [YOUR COMPANY NAME] to provide a snapshot of its financial standings.

Total Current Assets: [TOTAL CURRENT ASSETS]

Total Current Liabilities: [TOTAL CURRENT LIABILITIES]

III. Analysis of Liquidity

This section evaluates the liquidity ratios and what they signify about the financial stability of [YOUR COMPANY NAME]. Each ratio provides insight into the different aspects of liquidity management:

Current Ratio: This ratio assesses the ability of [YOUR COMPANY NAME] to cover its current liabilities with its current assets. A higher current ratio indicates a better liquidity position, which suggests that the company can easily meet its short-term obligations.

Quick Ratio: Also known as the acid-test ratio, this measures the ability of the company to meet its short-term liabilities with its most liquid assets, excluding inventories. This is a stricter measure of liquidity because it does not consider inventory, which is not always readily convertible into cash.

Cash Ratio: The most conservative liquidity ratio, it assesses the ability of [YOUR COMPANY NAME] to cover its short-term liabilities using only cash and cash equivalents. This ratio indicates the company's immediate liquidity without relying on the sale of inventory or the collection of receivables.

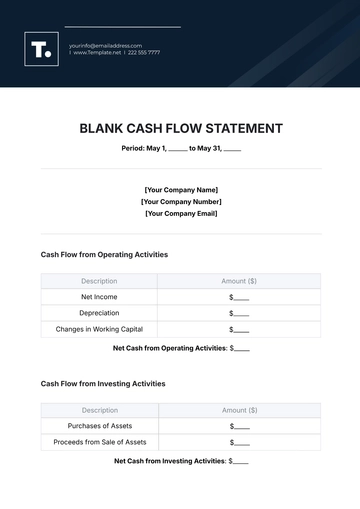

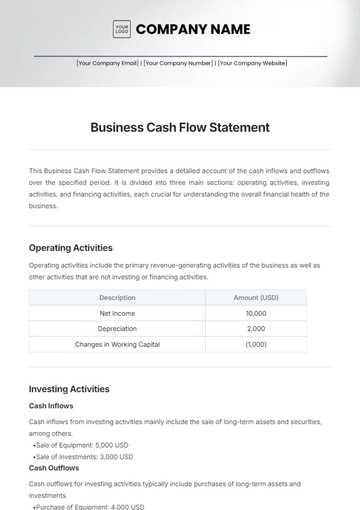

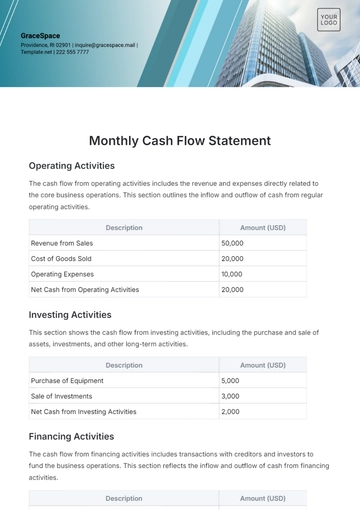

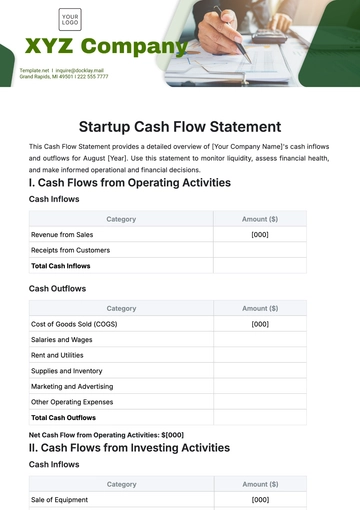

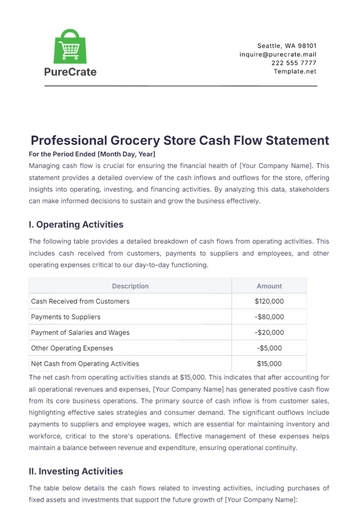

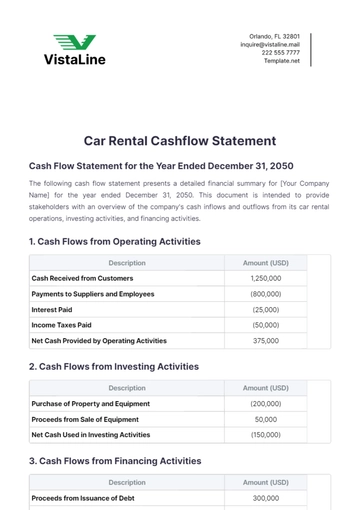

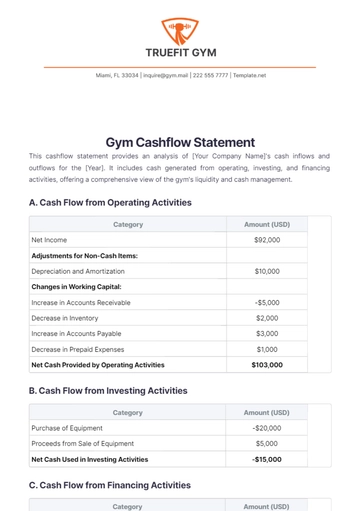

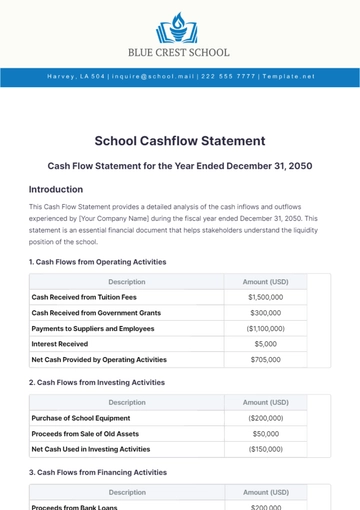

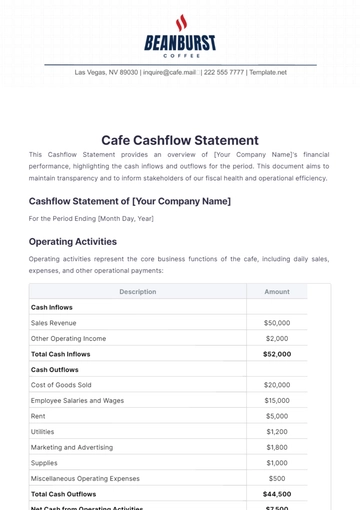

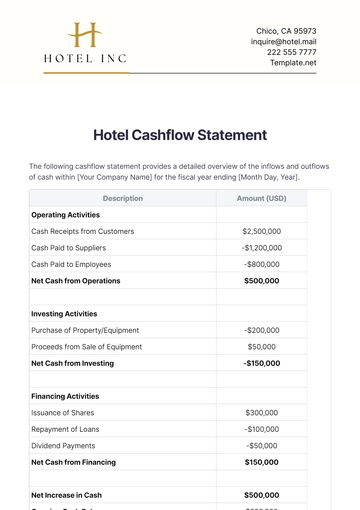

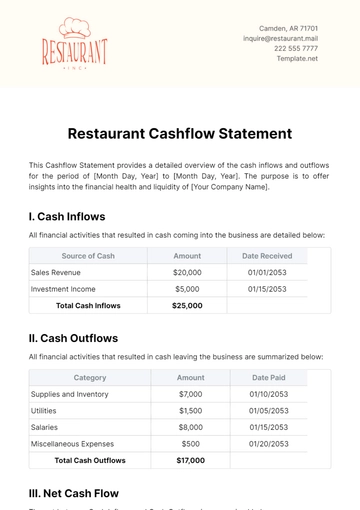

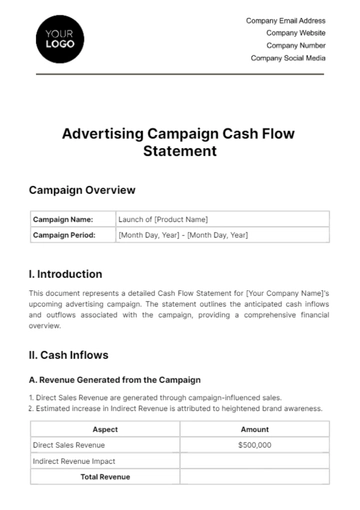

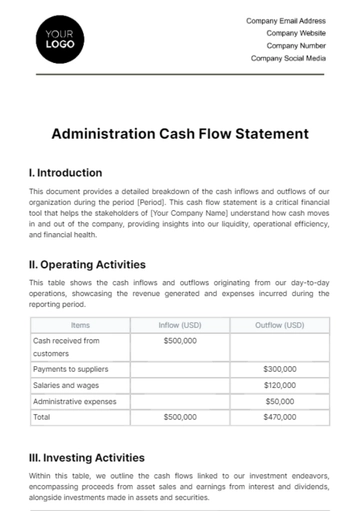

V. Cash Flow Analysis

In addition to the liquidity ratios, analyzing the cash flow statement is essential to understand the actual cash position of [YOUR COMPANY NAME]. This analysis will reveal the inflows and outflows of cash, highlighting the operational efficiency and its impact on liquidity:

Operating Cash Flow: This indicates the cash generated from core business operations, which is a key factor in maintaining sufficient liquidity.

Investing Cash Flow: This reflects the cash used for investments in long-term assets, which can affect the company’s liquidity by tying up funds that could otherwise be used to cover short-term obligations.

Financing Cash Flow: This indicates the cash flows associated with financing activities, including loans, repayments, and dividends. It affects the company's liquidity by showing how much cash is being raised from or returned to financiers.

VI. Conclusion and Recommendations

Based on the analysis conducted, [YOUR COMPANY NAME] exhibits a [strong/weak] liquidity position as of [DATE]. While the current and quick ratios suggest [positive/negative] insights, attention must also be given to the cash ratio and the trends observed in the cash flow statements.

Recommendations to improve liquidity may include:

Enhancing receivables collection to speed up cash inflows.

Better inventory management to reduce cash tied up in non-liquid assets.

Revising payment terms with suppliers to better manage cash outflows.

Considering financing options to better balance cash reserves.

This Liquidity Statement should be reviewed periodically to ensure that [YOUR COMPANY NAME] maintains adequate liquidity and to implement corrective measures timely, ensuring the company's ongoing financial health and stability.

Name: [Your Name]

Date: [Date Signed]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your financial analysis with the Liquidity Statement Template offered by Template.net. This customizable and downloadable tool is designed to enhance your business's financial reporting efficiency. Editable in our AI Editor Tool, it allows for seamless adjustments to fit your specific needs. Once tailored, easily print your personalized statement, ensuring your financial health is accurately documented and accessible.