Free Financial Control Plan

Prepared By: [Your Name]

Date: [Month, Day, Year]

Overview

The Financial Control Plan (FCP) provides detailed strategies to ensure regulatory compliance, effective budget management, and risk mitigation. This roadmap emphasizes maintaining the integrity of financial reporting, aligning costs with company goals, and assessing potential financial threats.

Regulatory Compliance

Regular audits will be carried out to ensure guidelines laid out by relevant financial authorities are strictly adhered to. Comprehensive training programs will help familiarize the team with essential regulations and standards. Plus, a robust reporting system will be put into place, making sure reports generated are transparent and unbiased.

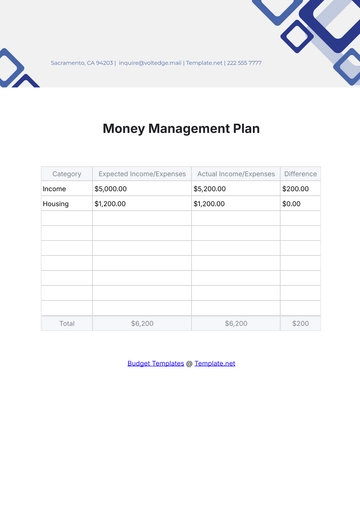

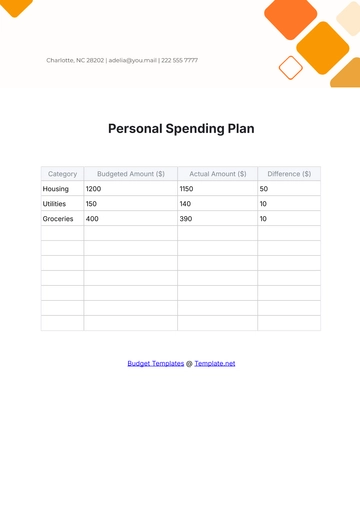

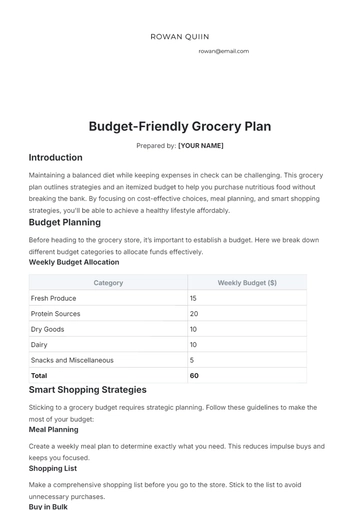

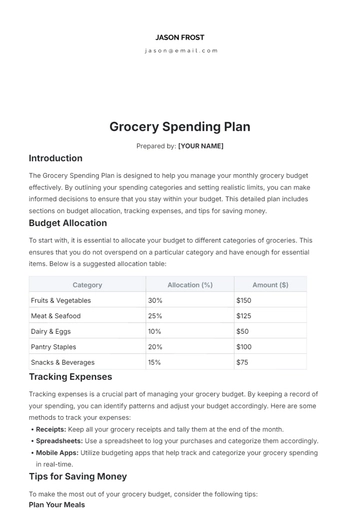

Budget Management

This section of the Financial Control Plan is dedicated to Budget Management, focusing on meticulous tracking and allocation of funds. It ensures efficient use of resources, aligns expenditures with strategic objectives, and promotes financial stability. Through this approach, we aim to optimize our financial performance and achieve our fiscal goals.

Category | Allocated Budget | Actual Spending | Variance | Remarks |

|---|---|---|---|---|

Personnel Costs | $500,000 | $480,000 | $20,000 | Under budget due to deferred hiring |

Operational Expenses | $300,000 | $320,000 | -$20,000 | Over budget, higher utility costs |

Marketing and Sales | $200,000 | $180,000 | $20,000 | Effective cost-saving in ad spending |

Cost Control

Departmental expenditures will be monitored closely to identify any existence of wasteful spending. Potential cost-saving opportunities will be actively sought, and cost-effective strategies will be applied. A special committee will be formed to raise red flags against unnecessary costs and promote economic efficiency.

Risk Assessment

Regular assessments will be conducted to identify potential risks that could harm the company's financial standing. Industry trends, market volatility, operational inefficiencies, and possible investment failures are examples of areas that will be investigated. These assessments will then form the basis of our risk management strategies.

Risk Mitigation

A risk prevention database will be generated following the identified threats during the risk assessment phase. Specific steps will be taken to minimize the risks. This proactive approach ensures the company's resilience against uncertainties, maintaining financial stability and safeguarding assets. We prioritize strategic actions to minimize risk impacts on our financial health.

Risk Identification

Risk Assessment

Prioritization

Development of Mitigation Strategies

Implementation of Mitigation Measures

Monitoring and Review

Continuous Improvement

Our financial control plan also aims at continuous improvement through regular revisions and updates to our strategies. Feedback from all stakeholders will be efficiently used for this purpose. Intensive scrutiny and evaluation to explore better alternatives will be a constant in our process.

Implementation and Execution

An effective road map will be designed to implement all sections of the Financial Control Plan. Carefully defined roles and accountabilities, implementation timelines, plan for ongoing communications, and requisite tools and resources will govern the execution process ensuring its effective implementation.

Monitoring and Evaluation

The last step in our plan involves setting up systems to monitor the application of the plan and evaluate its effectiveness. Key performance indicators (KPIs) will be defined, and regular reports will be made based on these indicators. This will provide a tangible measurement of our efforts and the way forward.

Conclusion

This Financial Control Plan is intended to ensure the highest standard of regulatory compliance, cost-effectiveness, and risk mitigation. With its rigorous implementation and constant monitoring, the company can uphold its financial integrity and succeed in its financial objectives.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

The Financial Control Plan Template from Template.net offers a comprehensive and customizable solution for streamlining your company's financial management. It's designed to enhance budget tracking, expense monitoring, and financial forecasting, ensuring compliance with US financial standards. Ideal for finance professionals seeking efficient and reliable financial planning tools.

You may also like

- Finance Plan

- Construction Plan

- Sales Plan

- Development Plan

- Career Plan

- Budget Plan

- HR Plan

- Education Plan

- Transition Plan

- Work Plan

- Training Plan

- Communication Plan

- Operation Plan

- Health And Safety Plan

- Strategy Plan

- Professional Development Plan

- Advertising Plan

- Risk Management Plan

- Restaurant Plan

- School Plan

- Nursing Home Patient Care Plan

- Nursing Care Plan

- Plan Event

- Startup Plan

- Social Media Plan

- Staffing Plan

- Annual Plan

- Content Plan

- Payment Plan

- Implementation Plan

- Hotel Plan

- Workout Plan

- Accounting Plan

- Campaign Plan

- Essay Plan

- 30 60 90 Day Plan

- Research Plan

- Recruitment Plan

- 90 Day Plan

- Quarterly Plan

- Emergency Plan

- 5 Year Plan

- Gym Plan

- Personal Plan

- IT and Software Plan

- Treatment Plan

- Real Estate Plan

- Law Firm Plan

- Healthcare Plan

- Improvement Plan

- Media Plan

- 5 Year Business Plan

- Learning Plan

- Marketing Campaign Plan

- Travel Agency Plan

- Cleaning Services Plan

- Interior Design Plan

- Performance Plan

- PR Plan

- Birth Plan

- Life Plan

- SEO Plan

- Disaster Recovery Plan

- Continuity Plan

- Launch Plan

- Legal Plan

- Behavior Plan

- Performance Improvement Plan

- Salon Plan

- Security Plan

- Security Management Plan

- Employee Development Plan

- Quality Plan

- Service Improvement Plan

- Growth Plan

- Incident Response Plan

- Basketball Plan

- Emergency Action Plan

- Product Launch Plan

- Spa Plan

- Employee Training Plan

- Data Analysis Plan

- Employee Action Plan

- Territory Plan

- Audit Plan

- Classroom Plan

- Activity Plan

- Parenting Plan

- Care Plan

- Project Execution Plan

- Exercise Plan

- Internship Plan

- Software Development Plan

- Continuous Improvement Plan

- Leave Plan

- 90 Day Sales Plan

- Advertising Agency Plan

- Employee Transition Plan

- Smart Action Plan

- Workplace Safety Plan

- Behavior Change Plan

- Contingency Plan

- Continuity of Operations Plan

- Health Plan

- Quality Control Plan

- Self Plan

- Sports Development Plan

- Change Management Plan

- Ecommerce Plan

- Personal Financial Plan

- Process Improvement Plan

- 30-60-90 Day Sales Plan

- Crisis Management Plan

- Engagement Plan

- Execution Plan

- Pandemic Plan

- Quality Assurance Plan

- Service Continuity Plan

- Agile Project Plan

- Fundraising Plan

- Job Transition Plan

- Asset Maintenance Plan

- Maintenance Plan

- Software Test Plan

- Staff Training and Development Plan

- 3 Year Plan

- Brand Activation Plan

- Release Plan

- Resource Plan

- Risk Mitigation Plan

- Teacher Plan

- 30 60 90 Day Plan for New Manager

- Food Safety Plan

- Food Truck Plan

- Hiring Plan

- Quality Management Plan

- Wellness Plan

- Behavior Intervention Plan

- Bonus Plan

- Investment Plan

- Maternity Leave Plan

- Pandemic Response Plan

- Succession Planning

- Coaching Plan

- Configuration Management Plan

- Remote Work Plan

- Self Care Plan

- Teaching Plan

- 100-Day Plan

- HACCP Plan

- Student Plan

- Sustainability Plan

- 30 60 90 Day Plan for Interview

- Access Plan

- Site Specific Safety Plan