Free Finance Mergers & Acquisitions Management Program

This Finance Mergers & Acquisitions Management Program is the result of our collective experience and best practices in the field of finance and M&A. It reflects our commitment to due diligence, strategic alignment, operational excellence, and compliance with legal standards. By following this program, we aim to maximize the value of our M&A activities, minimize risks, and ensure the smooth integration of acquired entities into our corporate family.

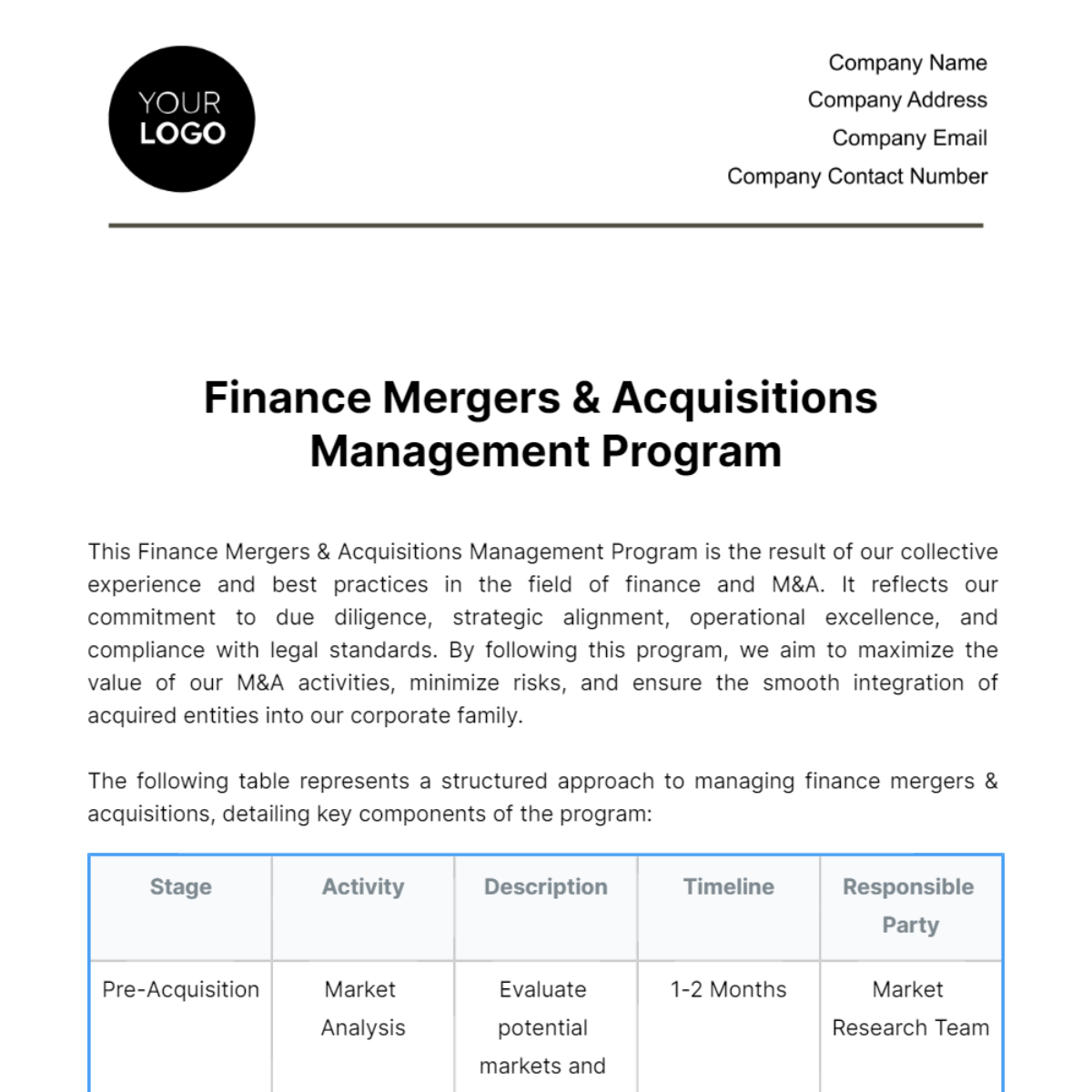

The following table represents a structured approach to managing finance mergers & acquisitions, detailing key components of the program:

Stage | Activity | Description | Timeline | Responsible Party |

|---|---|---|---|---|

Pre-Acquisition | Market Analysis | Evaluate potential markets and target companies for synergy. | 1-2 Months | Market Research Team |

Financial Due Diligence | Analyze financial health and stability of targets. | 1 Month | Finance Team | |

Acquisition Phase | Negotiation & Deal Structuring | Conduct negotiations and finalize deal terms. | 2-3 Months | M&A Negotiation Team |

Legal Compliance Check | Ensure all legal aspects of the deal are compliant. | Ongoing | Legal Department | |

Post-Acquisition | Integration Planning | Develop a plan for integrating operations and cultures. | 1-2 Months | Integration Team |

Operational Alignment | Align operational processes and systems. | 3-6 Months | Operations Team | |

Ongoing Management | Performance Monitoring | Regularly monitor the performance of the merged entities. | Ongoing | Management Team |

Risk Management and Mitigation | Identify and mitigate any arising risks. | Ongoing | Risk Management Team | |

Exit Strategy | Divestment/ Restructuring (if needed) | Plan and execute exit strategies for non-performing entities. | As needed | Strategic Planning Team |

Pre-Acquisition

During the Pre-Acquisition stage, our focus is on meticulous market analysis. Our Market Research Team will dedicate 1-2 months to evaluating potential markets and target companies, identifying those that offer the best synergies with our business. Concurrently, our Finance Team will engage in a thorough financial due diligence process over a month. This phase is critical for assessing the financial health and stability of potential acquisition targets, ensuring we make informed decisions that align with our strategic objectives.

Acquisition Phase

The Acquisition Phase is marked by intensive negotiations and deal structuring, led by our M&A Negotiation Team over 2-3 months. This phase involves finalizing the terms of the deal and ensuring they align with our strategic goals and financial parameters. Simultaneously, our Legal Department will conduct an ongoing compliance check to ensure all legal aspects of the deal adhere to regulatory standards and best practices. This dual approach ensures a robust and legally sound acquisition process.

Post-Acquisition

Once an acquisition is completed, our Integration Team steps in to develop a comprehensive plan for integrating operations, systems, and cultures over 1-2 months. This plan is critical to ensure a smooth transition and to leverage the synergies identified during the Pre-Acquisition stage. Following this, our Operations Team will take 3-6 months to align operational processes and systems, ensuring the newly acquired entity is effectively integrated into our existing operations.

Ongoing Management

In the Ongoing Management stage, our Management Team undertakes regular performance monitoring to assess the success of the merged entities. This involves continuously evaluating financial performance, operational efficiency, and strategic alignment. Additionally, our Risk Management Team plays a vital role in identifying and mitigating any risks that arise, ensuring the long-term success and stability of the merger or acquisition.

Exit Strategy

Finally, if necessary, our Strategic Planning Team is prepared to develop and execute exit strategies for non-performing entities. This could involve divestment or restructuring, depending on the specific circumstances and strategic fit of the entity within our broader business portfolio. This step is crucial for maintaining the overall health and efficiency of our organization post-acquisition.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your M&A strategy with the Finance Mergers & Acquisitions Management Program Template from Template.net. This template is fully editable and customizable, catering to the unique needs of your finance team. It guides you through every step of the M&A process, ensuring organized, efficient management of mergers and acquisitions. Essential for strategic financial planning.